Dear Valued Clients and Friends,

The month of January has launched 2023 in a very different direction than 2022 thus far. I do not mean because markets are up thus far, whereas they were down in 2022 (though technically, both of those things are true). But beyond the mere directional change in markets (which could reverse at the drop of a hat), the themes and factors influencing markets – in other words, the stuff that matters – has changed. Moving way down the totem pole has been what the Fed is doing or is expected to do, and moving way up in priority (to the very top) is what will happen in the economy as a result of what the Fed has already done.

I am going to elaborate on what that means in today’s Dividend Cafe, and, more importantly, make the case for and against a 2023 recession. And I hope that after reading my case you will decide I have made the perfect call …

Let’s jump into the Dividend Cafe.

|

Subscribe on |

Action vs. Reaction

We know that the Fed spent the second half of 2022 tightening monetary policy, and we know that some additional rate hikes are coming (one quarter-point hike at least, two quarter-point hikes is the most consensus view, and some believe that “Volcker-Powell” has a hundred or more basis points left in him). We know that some modest quantitative tightening has happened, with $400 billion coming off the Fed’s nearly $9 trillion balance sheet. The Fed has tightened. And the Fed is more or less close to being done with such. And all that is about as much as we know.

Many (most) believe a recession is coming, with plenty of support and logic for their decision. Some merely predict one will come, and others root for it to come, believing that a contraction in employment and wages is the antidote to inflation. Figures of speech become accepted commonplace that may or may not make actual sense in real life (“the economy is too hot and needs to cool down”). Regardless of my critique of perpetual ambiguity in economic vocabulary, the narrative is in effect. A recession either is coming, or should come, or both.

Optimism in markets these days comes from the so-called “soft landing” thesis – the idea that – maybe, just maybe – the Fed will stop tightening, the economy will not suffer significant recessionary impact, and besides a few people being fired at Twitter, all will go back to normal. Okay, maybe it would be a little worse than that in the “soft landing” scenario, but my point is that it would not feel like a deep recession, and nothing would have to “break” in financial markets. It is a minority view, but not a fringe one.

And I want to look at the entire recession conversation today.

Putting odds on things

My friend, Jason Trennert, CEO of Strategas Research, told the crowd in a panel I was a part of yesterday in New York City that he believed there was a 50% chance of a bad recession, a 40% chance of a soft landing, and a 10% chance of no recession. I am not sure I can place odds with quantifiable rationale on any particular outlook, but I can make a qualitative case for the major camps. We will start with the arguments for a recession.

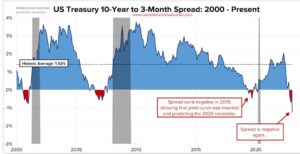

Yes to recession #1 – Inverted Yield Curve

I mean, seriously? Not only is the curve inverted by 65-70 basis points (4.2% for a two-year treasury vs. 3.5% for a 10-year), but the inversion has now lasted for six months and counting.

As of January 26, 2023

Is it foolproof? Maybe not. History has had false positives and false negatives. But not like this. Not this severe. Not this long. And not this obvious. An inverted yield curve does not create a recession – it predicts one. And this is a screaming obscenity of a recession call, period.

*Current Market Valuation, January 2023

First of all, I want to say that the box above in the chart is absurd when it comes to 2019. That inverted yield curve was a FALSE positive unless one actually wants to say that the 2019 yield curve was the bond market predicting a COVID virus no one had heard of and a 2020 government-imposed lockdown no one on earth imagined. Yes, we had a COVID lockdown recession in 2020, but obviously, the inverted yield curve in 2019 did not know that, and few economists believe the economy was headed to a 2020 recession without that.

But the 2000 and 2006 yield curve inversions did prove prescient, though with a long lag before the actual recessionary onset in the case of the latter. And I would point out that this chart does not reflect the 1998 inversion that proved to be a false positive or the several times in history we had a recession without a preceding yield curve inversion.

But this is a screaming warning sign, and it is #1 on the “recession is coming” list.

Yes to recession #2 – Purchasing Managers’ Index

Business activity has been slowing for about nine months, and whether it be manufacturing or services, this slowdown is indicative of downward pressure on productivity and growth.

*Miller Howard Investments, Q4 2022 Summary, p. 2

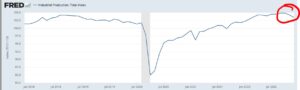

Yes to recession #3 – Industrial Production

You may have heard that I am a supply-sider, and value production and output as the driver of economic well-being and quality of life. I have spent the bulk of my economic and financial career scoffing at the idea that retail sales and consumer appetite dictates economic growth, mostly because I have no doubt that people like spending money, and because I see consumption as something that can only happen after two parts of production (that of the spender, and that of the maker of the thing the spender is producing). An imperfect index of measuring industrial output across mining, manufacturing, and utilities is called Industrial Production. It had been holding strongly post-COVID, until all of a sudden, a substantial decline this month.

*St. Louis FRED, Industrial Production, Dec. 2022

The one-armed economist

Harry Truman famously said he needed a one-armed economist because he was so tired of hearing “on one hand …” this and “on the other hand …” that. Presenting conflicting data or data sets that do not all conveniently intertwine is not a cop-out; it is not the act of those who lack conviction; it is sometimes the duty of the objective and intellectually reliable. So allow me to present some counterfactuals before presenting the perfect call of a conclusion.

No to recession #1 – Labor markets, for now

The unemployment rate is 3.5% (tied for the lowest of all time). Median wages are up. There are 10.4 million open jobs. Weekly jobless claims are quite low, and have come LOWER as the Fed has tightened! This all cannot be said enough – sure, maybe it changes, and yeah, a lot of technology people appear to be being laid off in response to that sector’s over-hiring of 2020-21 (bubbles permeate), but this stuff is, right now, not not not recessionary.

Now, for those desperate to find some negativity here. Average hours worked MIGHT be inching down, and that MIGHT be foreshadowing weakness in labor markets that leads to layoffs. So we’ll watch all data and keep you posted.

*Bloomberg, Weekly Hours Worked, Dec. 2022

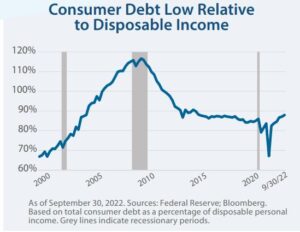

No to recession #2 – Household debt is less

Household debt was 115% of income going into the last recession; it is 90% now. There is simply different particulars in household leverage. Now, I still think this is too high, but it is somewhat recession-buffering (or at least soft-landing-ish), if one is looking to a household-led recession.

No to recession #3 – Housing is different

This housing slowdown is not the same thing as recent housing-adjacent slowdowns. Rising rates do hurt new homebuyers in terms of monthly cost (which prices will inevitably adjust for), but not current ones, as adjustable rate mortgages have gone from 35% of the market to just 6%! And, of course, as I have repeatedly pointed out, equity is abundant – the defining difference.

New construction is vulnerable, yes, BUT construction is less than 1% of GDP. A general correction to affordability is healthy. Look, other knock-on effects are more potentially problematic, but the general housing slowdown is less contagious than is believed.

Stuck in the middle with you

Corporate debt is high, but interest expense as a percentage of operating income has stayed quite low as (a) Good rates have been locked in for many borrowers, and (b) Operating income has been phenomenal. Eventually, the impact of floating rates becomes a factor. Eventually, operating income can come down. But corporate debt is hard to call a 2023 benefit or a 2023 liability. It is ambiguous. Sound familiar?

The Perfect Call

As much as I would love to tell you exactly when the recession is coming, long it will last, and how severe it will be, I believe the perfect call in January 2023 is that no one knows what will happen, or when, or how much of it. And I mean, NO ONE. I strongly suspect a technical recession is in the cards, and I anecdotally suspect it will prove to be a mild one. I cannot formulate my perspective on this from people who always, always, always believe bad things are about to rain down. Nor can I formulate my opinion from hope, or from what I believe SHOULD be the case (i.e. the policy conditions that I think would be better for economic prosperity). Rather, the perfect call is to not make one and have a portfolio that does not undermine financial goals if one does happen. To that end, we work.

Chart of the Week

A dependence on P/E expansion is the problem of the financial repression era. A relationship to growing cash flow is the antidote.

*Miller Howard Investments, Q4 2022 Summary, p. 7

Quote of the Week

“Between stimulus and response there is a space. In that space is our power to choose our response. In our response lies our growth and our freedom.”

~ Victor E. Frankl

* * *

I fly back from New York City tonight after a wonderful but packed week and look forward to a productive week in the Newport Beach office next week.

Recession or no recession, may we all enjoy our weekends, stay epistemically humble, and know that the right portfolio is never programmed around a recession call. Ever.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet