Dear Valued Clients and Friends,

We received the April jobs report this morning from the Bureau of Labor Statistics, and 20.5 million jobs were lost in the month of April. The unemployment rate is officially 14.7%, the highest since the Great Depression. For our purposes, I will refrain from pointing out that these numbers were well, well known to be coming (and in fact, most projections were that they could be potentially worse). As true as all that is, these numbers capture the tragedy of the COVID moment – that in the aftermath of this economic shutdown, millions of people are suffering – economically, and otherwise.

This week’s Dividend Cafe will do all it generally sets out to do. We will look at the overall economy, and I even close with something I don’t often do: A summary of our short term, medium-term, and long term outlooks. There is quite a deep dive into the jobs data, the economic picture, the state of the U.S. energy industry, some post-COVID economic realities, and much, much more. But there also is a sober assessment of something else – the human toll of non-productivity – the impact on joy and fulfillment when people are cut off from productive activity. It is the heart of our tragic moment.

So grab your coffee and get ready for a deep and wide read this morning. May your time be fulfilling, in this week’s … Dividend Cafe …

The Truth in the Jobs Picture the Data Could Never Capture

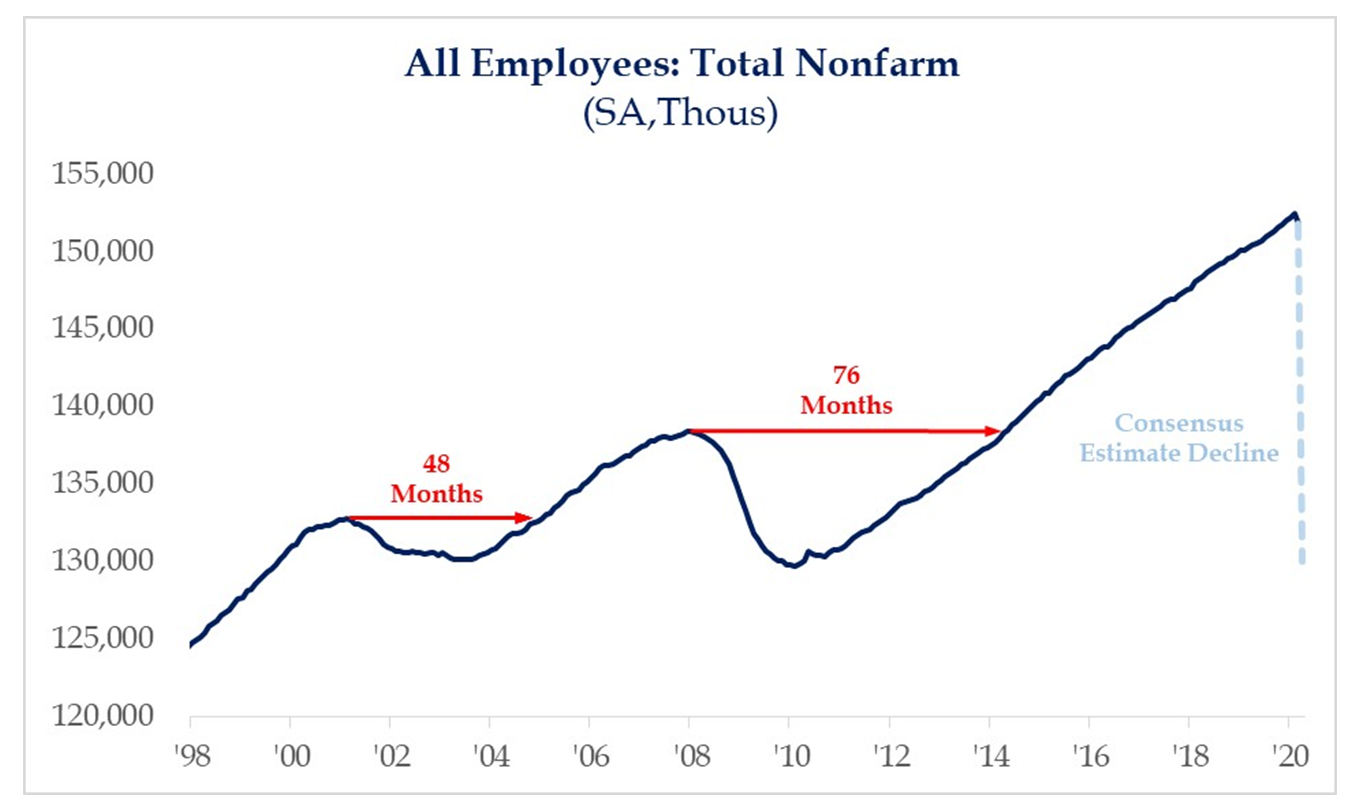

The unemployment data today (20.5 million jobs lost in April, a 14.7% unemployment rate) reflects the economic tragedy that is taking place in our country right now. Yes, this news was well known. And yes, markets were not surprised by it today as markets are “discounting mechanisms” that look forward, not backward. But I have something else to say about the jobs picture in our country that goes beyond the data of this chart here:

* Strategas Research, Daily Macro Brief, May 8, 2020

Economically, we know that re-capturing lost jobs can take a long time. Part of the reason is that our safety net (for good or for bad, I am just speaking descriptively here) often incentivizes staying unemployed in that benefits received offset the economic burden of not having a paycheck. That was particularly true post-financial crisis where unemployment benefits were extended multiple times. But we also know that many jobs lost in an economic correction don’t come back, as businesses adjust and use the downturn to learn how to get by without a given position. The more “structural” a downturn is and less “transitory” it is, the more true that would be. Both recessions we have had in the new millennium were far more structural than transitory so that time frame to restore jobs took much longer (see chart above). We all pray this COVID downturn will prove more transitory than secular or structural, and enable a quicker recovery of lost jobs.

But beyond the economic impact of lost jobs and the economic outlook around it all, there is a human toll that cannot be calculated. Economic data can try its best to capture wage declines, a contraction in aggregate demand, and other such econometric indicators of suffering. That data does not reflect the existential suffering done when people are not work – when people are not being productive. All social and cultural commentary aside about people who perhaps are not as motivated to work as others, there is one thing I believe almost more than anything else I believe in the world: Human beings were made to be productive.

The entire point of this whole thing – markets, investment success, free enterprise, productivity – is human flourishing. We want the human person to thrive, to be alive, free, and happy. There is simply no sociological study worth the paper on which it is printed that does not validate my thesis here … Human beings most flourish, are most fulfilled, when they are most productive. Every challenge I have ever gone through in my life was overcome through the sheer joy of the pursuit of productivity. The fulfillment people find when they work, when they perform, when they deliver goods and services to others – it is not a mere economic function. it is an entirely existential function.

And I pray for a return to work for all as soon as is possible, not merely to “see the economy turning” again but to see the cause of human flourishing advanced. I swear to you from the bottom of my heart, more than anything else I obsess over, it is to this end that I work. Free enterprise offers the most virtuous cycle ever devised – fulfillment that comes from productivity, which in turn allows others to be fulfilled by their own productivity, etc. It is a contagious process of growth, service, and usefulness. And in the human endeavor that is work, we can sow the seeds for human flourishing.

Back to econometrics: Unpacking the jobs data

I am entirely focused (economically) on one data point this morning: 78% of the 20 million unemployed people in today’s data categorized their layoff as temporary. 78%. Now, perhaps a lot of these people (employees) have a more optimistic view than their employers do. What I do believe is that over 50% of these unemployed will be back to work by July, and hopefully sooner. Ultimately, though, what percentage of this ghastly unemployed number ends up being back at work depends on how much of this economic tsunami remains temporary vs. structural. The scale tilts more towards the latter with each day parts of the economy remain closed.

And frankly, a huge unknown to everyone – optimists and pessimists – is how effective things like the PPP program will prove to be. The unemployment is substantially more evident at companies with less than 500 employees. Will the stimulus program be effective in protecting payrolls for these smaller companies? One can be optimistic (I am) without being certain (I am not). But the efficacy of this program will likely be the key determinant of labor data in the months ahead.

5.5 million of the newly unemployed are in restaurants and bars. 2.1 million were in retail. Manufacturing was 1.4 million and government workers were 1 million. Lower paid workers were almost the entirety of the layoffs in March and April. This whole situation is just unspeakably sad.

What to do at a “Market Leg Down” ?

There is a 50% chance that the market will go lower again before it goes higher again. Why do I say 50%? Because there is always a 50% chance that the market will go lower before it goes higher. I will let you look at the chart of the market long-term to determine what the odds are of it going higher, after it gets done either going lower or not going lower.

But apart from the historical, mathematical, and logical facts of market movements and short term directions in the midst of its long-term trend, I would like to offer a few more useful and practical reminders and perspectives that may be useful in the midst of additional market corrections …

(1) We are not focused on the stock price of the companies we own. We are focused on the long-term value of the actual companies. We believe those two things are, most of the time, very, very different.

(2) We are not invested in the companies we own right now for what their stock prices will do in the coming weeks or months or quarters, but rather for the cash flow they will generate for our client’s financial goals for years and decades to come.

(3) If your investment time frame is measured by weeks or months or quarters, you ought not to have money in stocks.

(4) If you are accumulating long-term wealth and future cash flow, the reinvested dividends at periods of market distress are making you wealthier. If you are living off of current cash flow, your dividends are still paying even in market distress and are, in fact, growing.

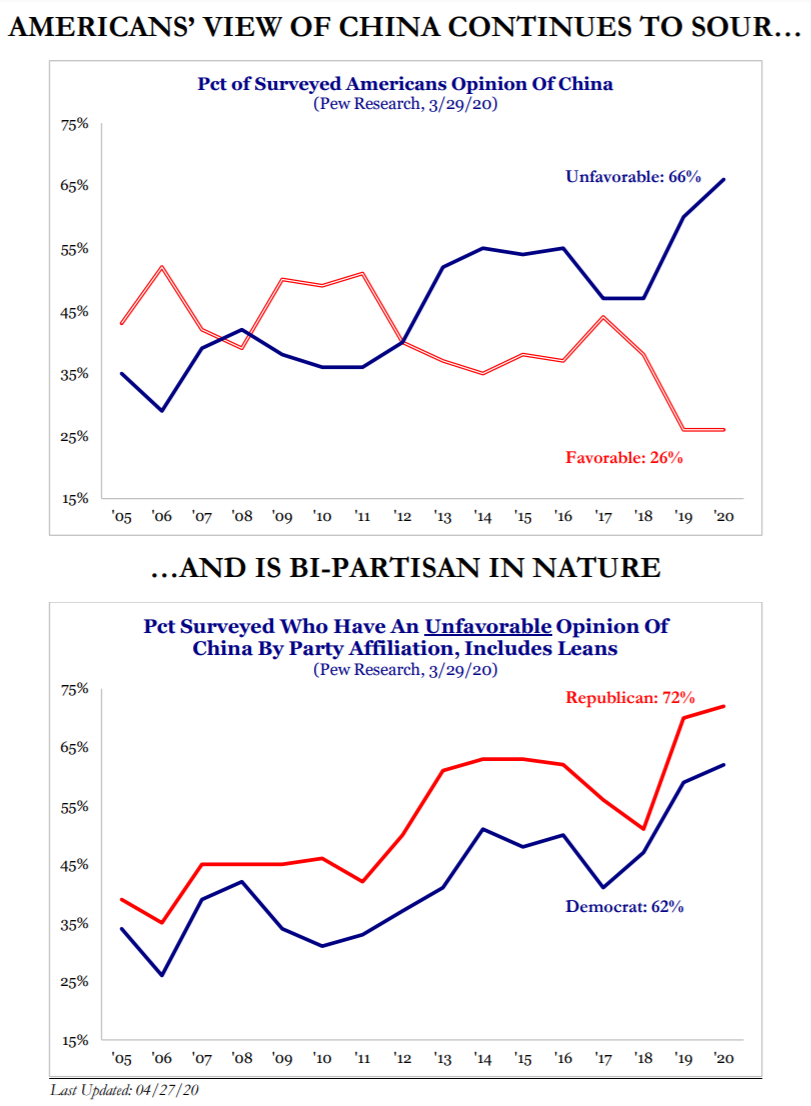

Post-COVID Changes – #26

Maybe I have skipped numbers 1-25, but since we hear more talk about changes coming post-COVID than almost anything else, here is one I would recommend we begin thinking about sooner than later. It is not protectionist and it is not mercantilist – it is just a rank political observation: The economic relationship the U.S. wants to have and the economic relationship the U.S. will have with China is going to change, bigly. There are a number of ways this may manifest itself, but the public sentiment expressed below makes it extremely clear that changes are coming (economically, geopolitically, etc.).

* Strategas Research, Investment Strategy Report, May 1, 2020

One more thing on Post-COVID life

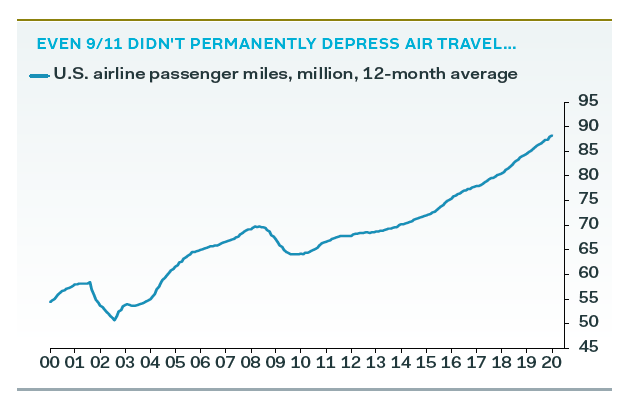

I may be talking my own book here because I travel hundreds of thousands of miles a year on business, and have every intention of continuing to do so post-COVID. But I think the historical lesson of air travel post-9/11 is useful.

* Weekly U.S. Economic Monitor, Pantheon Macroeconomics, May 4, 2020, p. 1

So we can debate how long Americans may resume air travel, and the historical precedent of 9/11 is either helpful or it isn’t. We do know some major global amusement parks are set to re-open in three days. Tickets are currently gone (sold out in minutes).

It’s the end of the world, like 2016?

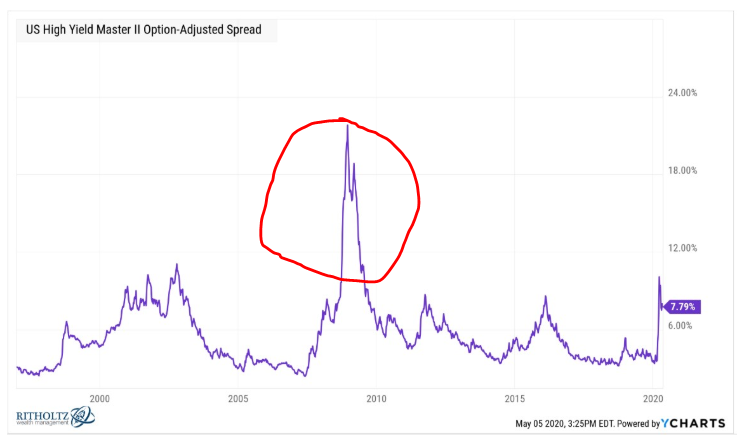

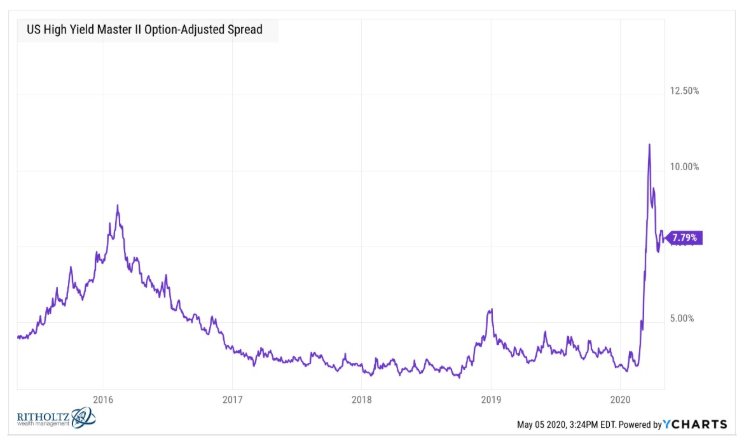

Here is what happened to high yield bond spreads during the Great Financial Crisis – spreads blew out like never before in the history of high yield credit, essentially pricing in Armageddon.

And here is where things stand now in the high yield credit spread world:

Note – spreads right now are less than they were in 2016. And they are one-third of what they were during the financial crisis. How could this be with the economy shut down, and the fact that we supposedly entered COVID with so much more leverage in corporate America than we had before?

(1) The Fed’s planned intervention into corporate debt this time is, indeed, a game-changer

(2) The consumer discretionary and energy sectors face some existential crises, but in 2008, everything faced an existential crisis!

(3) The debt markets are telling you they believe this economic pain will be transitory, not permanent

Good News vs. Bad News

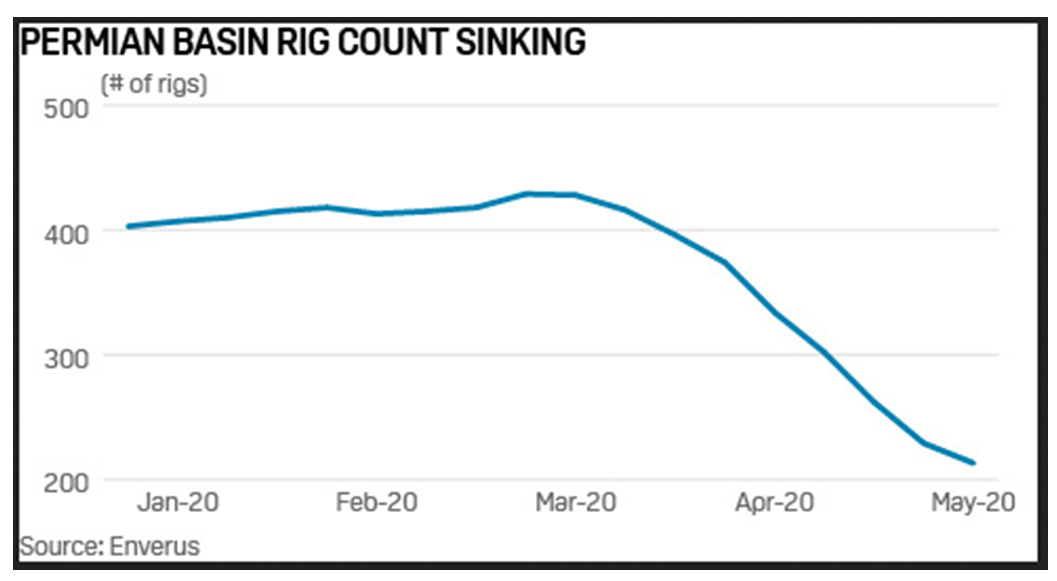

For those who care about the shale industry and U.S. energy independence, the recent solidification in WTI oil prices may be encouraging (effectively, up to ~$25 from ~$12 in the last two weeks). But what has largely helped bid up crude oil prices is the problem, and that is the collapse of U.S. production (i.e. 1.7 million barrels per day out of production by the end of June).

* Enverus, Jones Institutional, May 8, 2020

Timing is everything

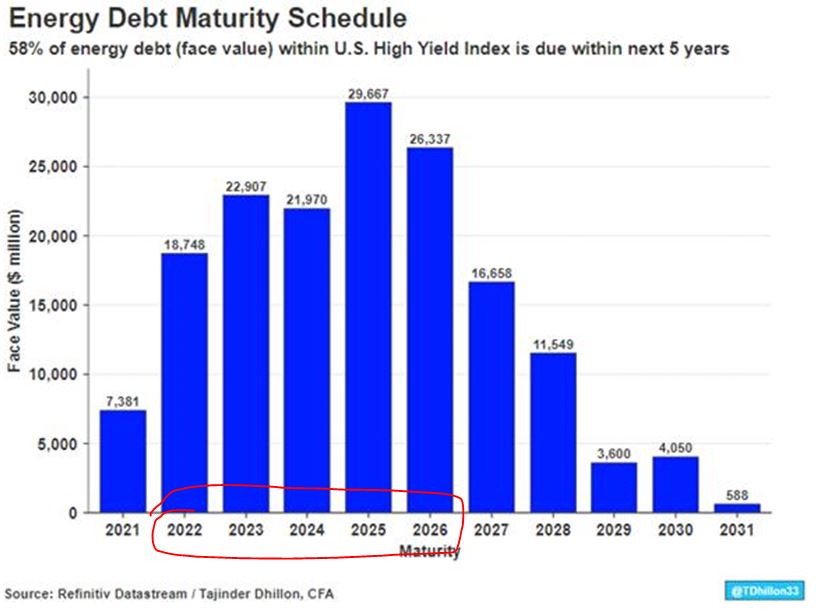

A big part of me believes it is the term structure of the shale sector‘s debt that is driving policy right now. Various short-term liquidity facilities (the Fed’s Main Street facility, for example) may be enough to keep the sector’s lights on through 2020 and 2021. It is 2022-2026 where the debt maturities start to loom large. Liquidity through this down-cycle keeps their assets in place for the other side of this cycle, and then they face their real debt walls with full strength and firepower (as opposed to having to sell off assets and enter this phase of capital responsibilities hampered). Keeping the smaller shale players alive protects the banks that have lent to them, protects the jobs of that manufacturing and industrial production base, provides a floor in capex, and very possibly has a happy ending when the cycle changes. If 2022-26′ maturities were 2020-21’ maturities, I wouldn’t be writing this paragraph. But to me, there is a path here that will look less extreme than I previously thought.

Hold on a little bit longer

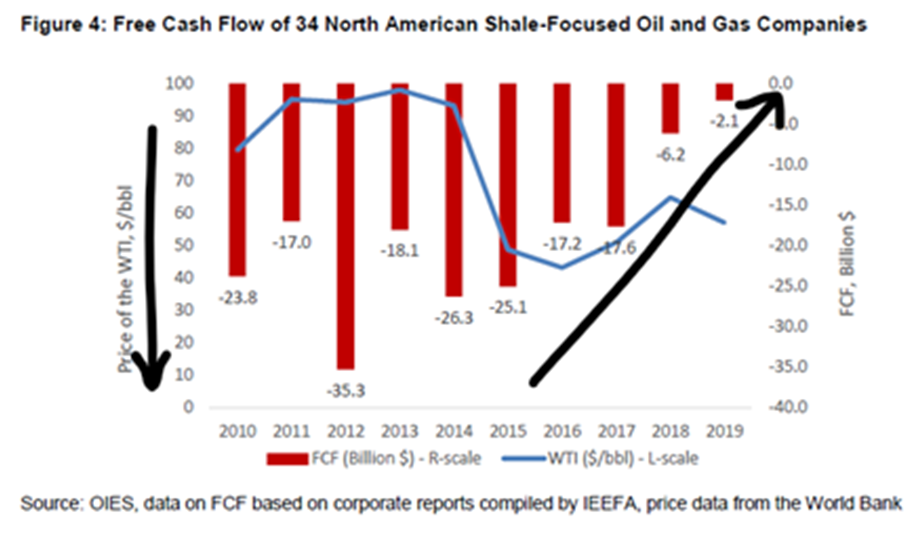

The irony of the recent pain that evaporating demand has created in the production side of the American energy sector is that it happened just as the sector was, after a decade of heavy infrastructure investment, set to go cash-flow positive. For all of the discussion about the debt in the space and heavy capex requirement, and partial correlation to the commodity price, the free cash flow of the shale sector (upstream) was set to go positive in 2020 after years of investment.

Both true at once?

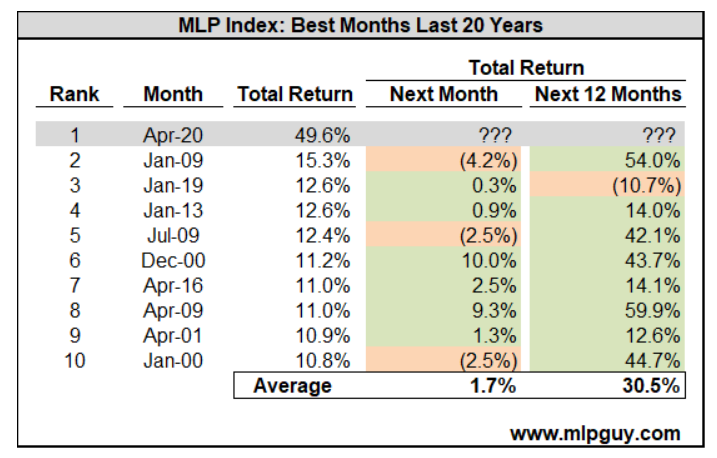

The midstream energy sector (oil and gas pipelines, storage, etc.) had its biggest month in history in April (up 50%) yet also has had its worst four-month start to a year ever (down 36%). The results in the short term (next month) after such a huge month are a bit scattered and unreliable. The results a year later have been interesting.

When the bad news becomes the good news

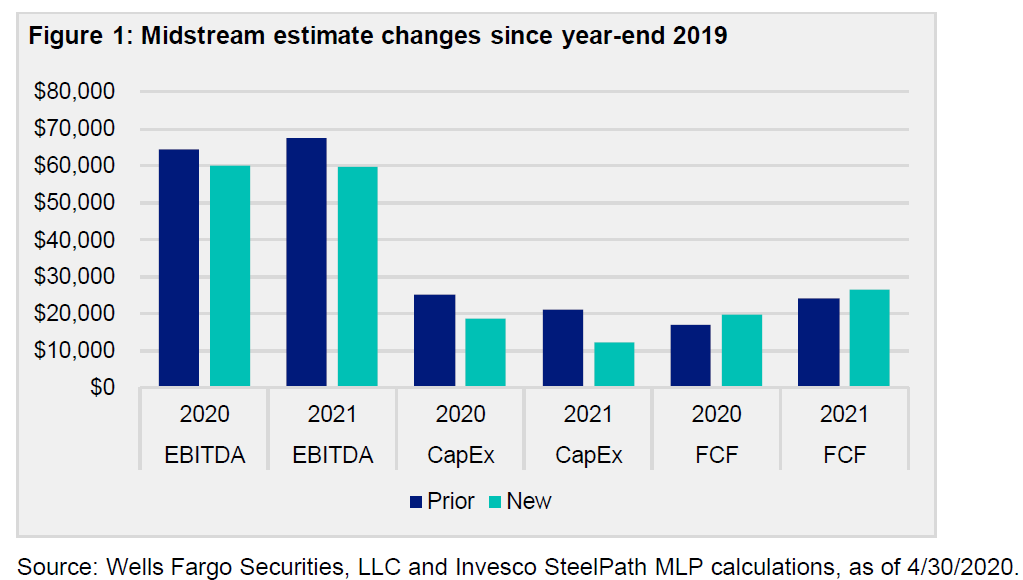

Keeping the midstream energy sector discussion alive, I thought this chart today really illustrated the irony of what has transpired in the midstream sector due to the collapse of so much in the energy production world … Expected volumes dropped, and re-negotiated rates and takeaways are assumed. Therefore, earnings estimates dropped. So in response to declining earnings and business conditions, capex plans were dropped. So, at the end of the day, Free Cash Flow estimates are now actually higher (because of reduced capex). Higher free cash flow provides better protection to dividend distributions. And so here we are.

European sideshow

The ruling of the German court this week calling into question the legitimacy of European Central Bank bond purchases did not end up rattling markets much, and barely registered in U.S. financial media. And I admit that I doubt this actual suit will break up the Euro or permanently alter the direction of European Union monetary policy. However, I do think it speaks to the real heart of what is an unavoidable and catastrophic problem – and that is, a European Union that does not allow for the mutualization of each other’s debts, and that calls for each nation to maintain its own independence, and yet, calls for a common currency and common monetary arrangement that inevitably crosses into each other’s debts and each other’s independence.

Short / Medium / Long

I would be curious to hear from readers if this breakdown is considered useful, and I certainly acknowledge it is necessarily simplistic. But sometimes a simplistic summary may be useful, and frankly, these distinctions can be important. The caveat I offer is that we are investing for client’s long-term goals, so if you are wondering which of these three categories we spend most of our time thinking about, I hope the question answers itself.

Our outlook:

Short-term: High volatility in markets as uncertainty around structural economic damage and post-COVID life persists

Medium-term: Moderately bullish as post-COVID resilience proves higher than expected and post-COVID normalcy proves more normal than expected. Additionally, it will be the medium-term where the pure marination of fiscal and monetary stimulus most flavors the economic meat, enhancing risk asset valuations and pushing up cash flows.

Long-term: Economically concerned about deflationary effects of excessive government spending and monetary interventions. Selectively bullish on the ability of incumbent assets/producers to manage, yet concerned for the lack of “risk-free” asset possibilities we are setting ourselves up for (i.e. Japanification)

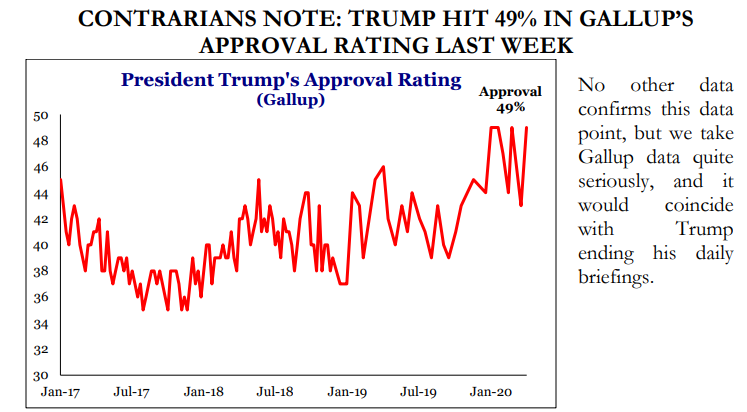

Politics & Money: Beltway Bulls and Bears

- It is hard to take polls too seriously this early, and I assure you the Democrats know that to be true (regarding polls that look good for them) and the Republicans know it to be true (whether polls look good or not). I share this fluctuating result of the approval rating for POTUS to reflect the volatility of all this.

* Strategas Research, Policy Outlook, May 4, 2020, p. 7

- If the public policy elements of the COVID affair are of interest to you, check-in daily to COVID and Markets, where I offer daily updates on the public policy realm. Future adjustments to PPP are likely coming. A new stimulus program is almost certainly coming, though with significant political fighting before it does. All of this is eventually going to become an impact in the November narratives (general election).

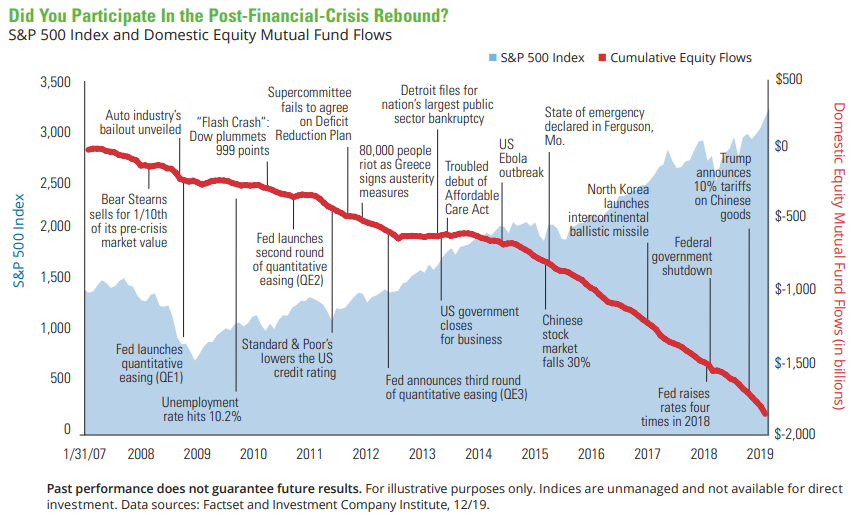

Chart of the Week

There are two profound messages in this week’s Chart of the Week … First, you see the post-financial crisis direction of the market in the face of repeated news events and headline risks that threatened to undermine it. It is fair to say that none of those events proved to be of the magnitude of an economic shutdown like we have seen in this COVID affair, but they speak loudly and clearly to the ability of markets to perform in the face of relative adversity. But secondly is the message of that big red line, the dirty little secret of the 450% post-crisis market rally … that so, so, so many retail investors did not participate in it.

Quote of the Week

“The two most powerful warriors are Patience and Time.”

~ Leo Tolstoy

* * *

Will you consider doing me a favor? Shoot me a quick email if you feel strongly one way or the other that either (a) These longer weekly Dividend Cafes are too much, and harder to absorb, or (b) Really like them longer and meatier. If you don’t have a strong feeling, either way, I’ll leave it to your discretion whether or not to email me feedback. My overall impression is that if you made it to this part of Dividend Cafe you probably like the longer versions, but I truly do want to hear from you as to what is most useful for you out of Dividend Cafe. This weekly writing labor is a passion of mine, and I am trying to use the quarantine experience of COVID to make it the best offering I can for my clients.

And so to that end I work and thank you all for your trust and confidence. May those out of work, find work. May those of us who are still blessed with work do our part to see this economy and the activities of our free society re-opened. And may we all be safe, well, and free.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet