Dear Valued Clients and Friends,

As of press time markets are down on the week, but the focus of this week’s Dividend Cafe is not on the market’s day to day moves this week (where volatility was on the rise). With so much focus on the short-term vulnerabilities in the economy that every breathing person is aware of, I thought I would spend our efforts this week looking at other catalysts that may not be so obvious. More importantly, I want to begin the inevitable discussions of long-term ramifications now. The coverage this week of these things is not meant to be exhaustive, but rather introductory.

I spend a lot of time looking at the state of the economy, the risks in the market short-term, and particularly various longer-term ramifications of a post-COVID life. I am trying to take this very seriously, and it requires a lot of study because frankly most of the analysis out there is so pedestrian, so unsatisfying, and possibly so dangerous.

The basic analysis I read on most days of “life after COVID” is some version of … “people are going to do video chat a lot more … people may not go back to their gyms … companies may not make their employees come to work anymore… people will not sit next to each other anymore… streaming is the new big thing [is it new?] … etc. etc.” The majority of it is flat-out wrong, as time will eventually prove in forceful ways. But even where various societal changes may surface, 100% of people all talking about the exact same thing means one thing for investors: “It. Is. Not. Investable.”

How’s that for a risk/reward trade-off? Most of what people are saying is probably wrong, and where it may be loosely right, it is not invest-able.

What I want to do, starting in this week’s Dividend Cafe, but really in the weeks and months to come, is to examine the truly significant macroeconomic forces that are relevant to investors, and to explore investment solutions that match the moment. I do not believe advisors and investors can consider solutions intelligently if they have not considered what they are trying to solve intelligently. So to that end, we work. Join us, in this week’s Dividend Cafe.

The toughest thing to write

I wrote last week of how much I want to see the economy re-opened, not merely for the needed economic output, but for the existential purpose, work brings to workers. I meant every word of it.

And this week I have to say something that I fear will sound crude and heartless, and it is incumbent upon me to not let that impression be delivered. I am very specifically writing in my next paragraph as an economist, as a financial analyst, as an investment manager. I very much understand that these comments feel at odds with a sense of compassion or empathy. I only ask you to take my comments in the context that they are very intentionally delivered.

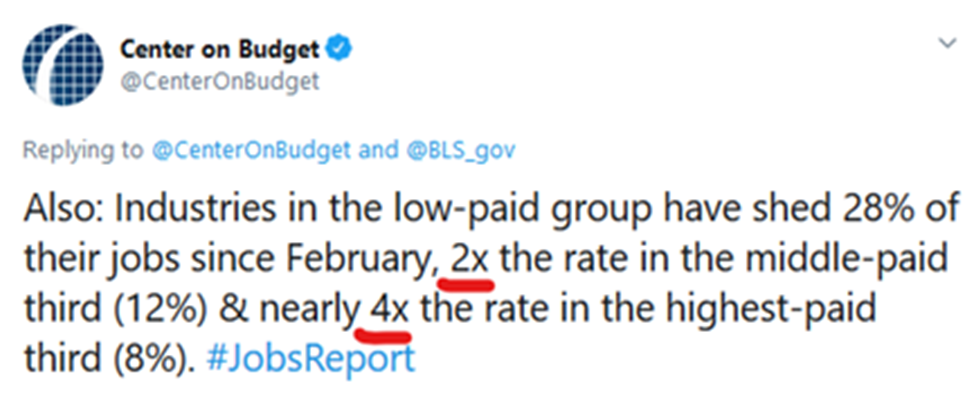

The economic data is getting clearer and clearer to me that the majority of economic pain being felt is in the lowest income brackets, which often means the lowest segment of economic productivity. An increase in monthly wages in a month where more jobs are lost than any month since the depression can only mean one thing – the job losses were in low-income segments. Benign numbers in new home purchases when the economy is locked down can only mean one thing – the people most suffering economically right now are not those who were most likely to be purchasing a home even apart from COVID.

So it goes without saying that this is immaterial to the human tragedy and the financial anxiety it creates for those in the epicenter of impact and suffering. I pray for those suffering daily. I think about the right personal and the right policy solutions for anyone suffering daily. Really, I do.

But the point I want to make for readers of this investment commentary as it pertains to markets and the economy is that we should not be surprised to see this development increase margins on the other side. Companies will be able to get more done with less for a time because that is the cycle of productivity. The decrease in overhead will be greater than the impact on revenue once revenue picks back up, which will drive higher margins and even higher productivity. That is a big part of the reason markets have been resilient to the pains in the labor market … It is a reason companies with legacy strength benefit in times like this.

Margins expanded post-crisis for a long time as a lot of slack was cut out of the labor force, and companies did more with less. Through time conditional improvements necessitated more hires and more hiring, and cyclically margins become pressured even as business is improving. But the optimal spot at a point in time from the vantage point of corporate profitability and maximized productivity is when revenues normalize but expenses do not.

I am more convinced than ever that that is what much of corporate America faces – a boost to productivity and boost to margins at the initial recovery phase of this post-COVID experience, paradoxically driven by the tragedy of current cost reductions – namely, reduced labor costs.

I believe financial assets will not feel the same distributional impact from COVID that the lowest-income groups will feel. It is my job to analyze that as an investment professional. It is not something I have to like as a human.

P.S. – this tweet (data: BLS) captures the essence of what I am getting at: Least pain in the most productive silo of labor; most pain in the least compensated/productive silo of labor …

What will economic recovery look like?

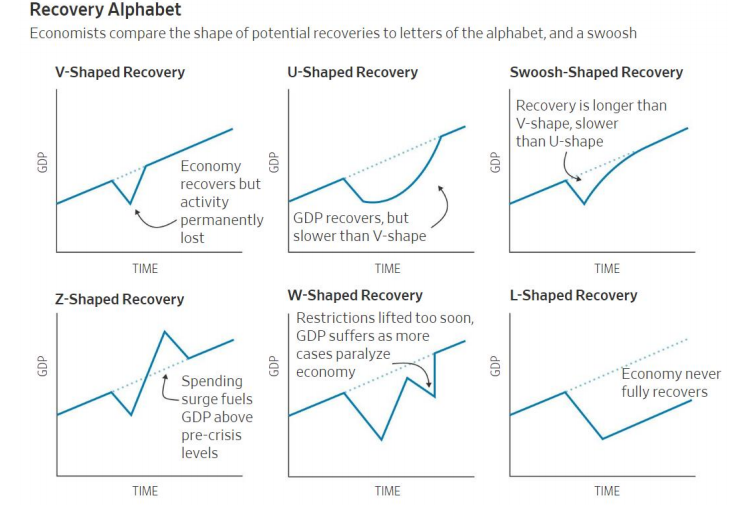

The length of time the economic shut-down has lasted has moved most people who in February/early March thought we faced a V-shaped recovery on the other side of this to now anticipate some different shape of the recovery. The charts below summarize most of the prevalent viewpoints in circulation:

* Wall Street Journal, May 12, 2020

My view is that some sectors will have a V-shape recovery, and other sectors a more complicated recovery. The shutdown lasted longer than I ever dreamed possible, and the re-opening is happening in such a staged and gradual manner (geographically, and substantively) that I really believe there will be pieces of “all the above” evident in the economy. And by the way, that is much more relevant to investors than what the aggregate economy’s shape recovery is! You can not buy a stock called “GDP” – the aggregate level of activity in the economy is not investible, anyways. So the disparate impact across the various aspects of the economy (and market) will be what matters.

Where is the market vulnerable?

Let’s assume the COVID economic pain does move into the economic recovery that many market actors assume, hope, and believe is coming. Outside of the obvious issues that linger in the economy, what are market vulnerabilities – perhaps less obvious ones – that many are simply not talking about? A few thoughts on potential catalysts to market challenges outside of COVID economic recovery:

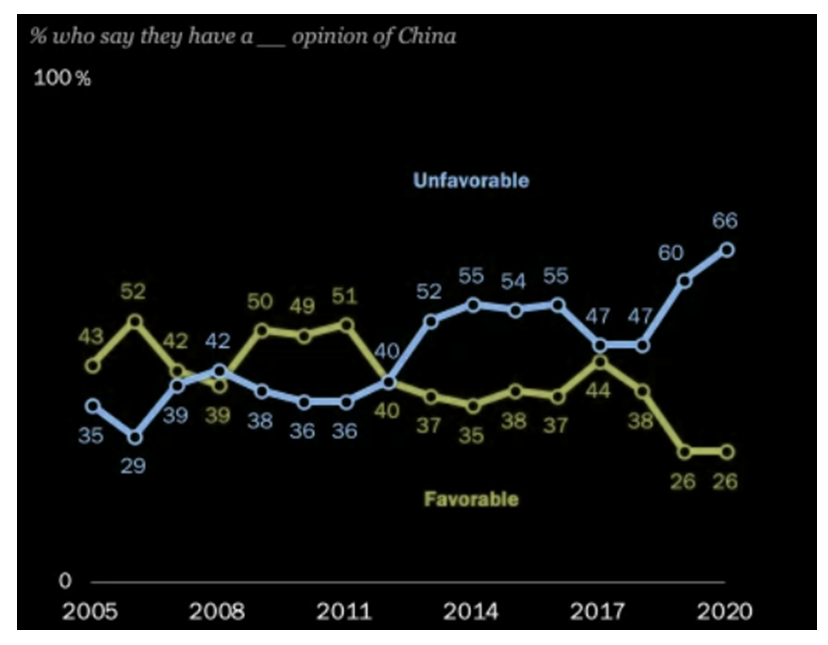

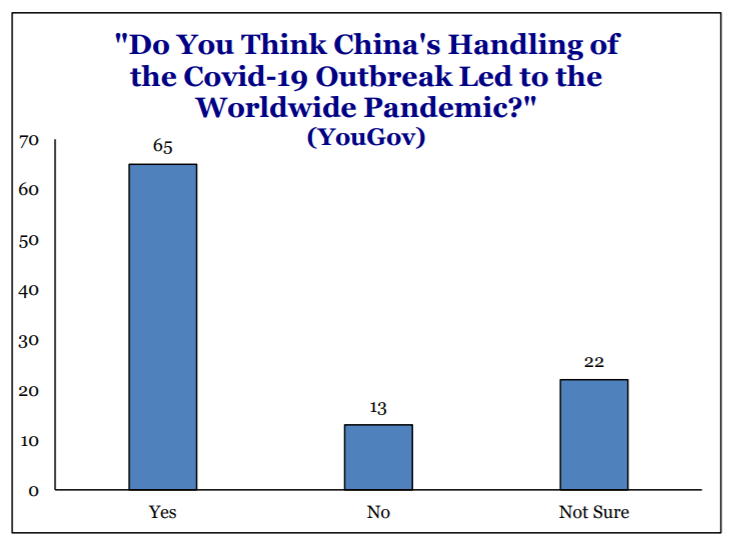

(1) A surprise negative development in U.S.-China trade. I am taking for granted that a politically popular tension with China could surface in the months ahead (or even after the election). I simply believe that the soil has never been more fertile for some push-back of China (in various forms) from the vantage point of U.S policy.

* Pew Research, Jones Institutional Trading LLC, May 14, 2020

* Strategas Research, YouGov, Policy Outlook, May 14, 2020

I would have said that where risk exists not priced into markets is in trade tensions escalating. That risk seemed elevated early last week but had essentially subsided by the end of the week. I believe the President’s top policy advisors believe we are best off staying in the present trade deal (okay, I know they believe this). But this week we saw a significant escalation in the talk around removing Chinese companies from various market indexes. And then the issue of the U.S. federal government employee pension plan potentially divesting of Chinese equities got a lot of play this week … The topic of Chinese companies that trade on U.S. exchanges but do not follow U.S. accounting rules has become a hot button.

There is plenty of room here for these things to boil into some short term market-disruptive noise. I do not expect this boil in the next few weeks, but should the administration achieve desired clarity around FOMC intentions, stimulus 4.0, COVID economic damage, etc., they may very well have the green light and political hall pass to pursue escalation. And with Congress driving some of the anti-China bills, it enables the White House to sit back and watch how some of this plays out politically, and then decide to escalate or de-escalate from there.

None of these comments speak to what may or may not happen as good or not good; it just simply refers to the existence of potential short-term market vulnerability.

(2) This is probably a given, but political noise around Stimulus 4.0 may create elevated volatility in the weeks/months ahead, not so much because markets will be surprised by political noise, but to the extent, some outcome gets “baked in” then whipsawed around.

(3) The yield curve is hardly bullish or “steep,” but the 2/10 at 50 basis points is steeper than it was a few weeks ago, which is better than flat or inverted. However, some additional flattening of the curve, or God forbid, the whole curve going negative, could have horrific effects throughout financial markets.

(4) Finally, political risk may become more of a fact as the months go by, to the extent that the prospects of a Democratic sweep (take-over of Senate and White House) potentially become more probable.

But what about long-term risks?

The preceding section is admittedly about short-term issues that are more headline-oriented but nonetheless could interrupt good vibrations in risk assets (one or more of them). I think there are more macro issues that linger over the world and the global economy that represent bigger picture issues, many of which will never materialize, some of which may materialize but end up having a different impact than feared, and some which do represent issues for long-term economic health.

My preference is to deal with each one, exhaustively, independent of the others. I have probably given the most attention over the last few years to the reality of debt-deflationary spirals and what excessive sovereign spending means to a developed economy. But what other macroeconomic issues do I see surfacing, perhaps out of COVID, or perhaps unrelated to COVID, that warrant the attention of a thoughtful asset allocator?

(1) The failed Euro experiment is something I wrote about last week (and the growing awareness in Europe of it). I do not believe that an abandonment of the Euro would be a bad thing (I would be overwhelmingly in favor of it), and I do not say that it absolutely will happen (some very large and powerful forces are quite vested in it not happening). But any financial professional not considering the possibility of a failed Euro in the years ahead is committing malpractice. This topic will warrant significant attention from these pages in the months and years ahead.

(2) A collapse in the relationship between the U.S. and Saudi Arabia. Once again I have not had time to complete my thoughts on this subject and really believe it deserves a better crystallization in these pages than just the mere mention or observation that the Saudi/U.S. relationship could be facing a 75-year old geopolitical transformation. I want to unpack all pieces here – what Saudi’s decision to flood the world with oil in March and April may mean to our view of a defense alliance with them; what our potential decision to perhaps impose tariffs on Saudi oil imports may mean to the U.S. shale industry; what a re-alignment of Middle East priorities may mean for Iranian interests in the Arabian peninsula; could the Saudi-peg to the U.S. dollar be in jeopardy; etc. In other words, there is a lot at play here and I am committed to unpacking it more.

(3) We simply must consider Changes in Globalization, and much of this is a post-COVID consideration. I would separate this from my prior above comments about China, which I think more have to do with short term noise around that disintegrating relationship (index removal and soybean tariffs are small-ball things in the grand scheme of it all; U.S. companies substantially on-shoring their supply chains is a big, big deal). I do not see all of this as necessarily a negative. It has a cost. It invites uncertainty. But if the world woke up tomorrow with all vital U.S. pharmaceutical and national security production on U.S. soil, I don’t think too many people would lose sleep over it. The long term risk is the transition and uncertainty about the what, when, where, why, and who. Other than that, it’s all clear as mud.

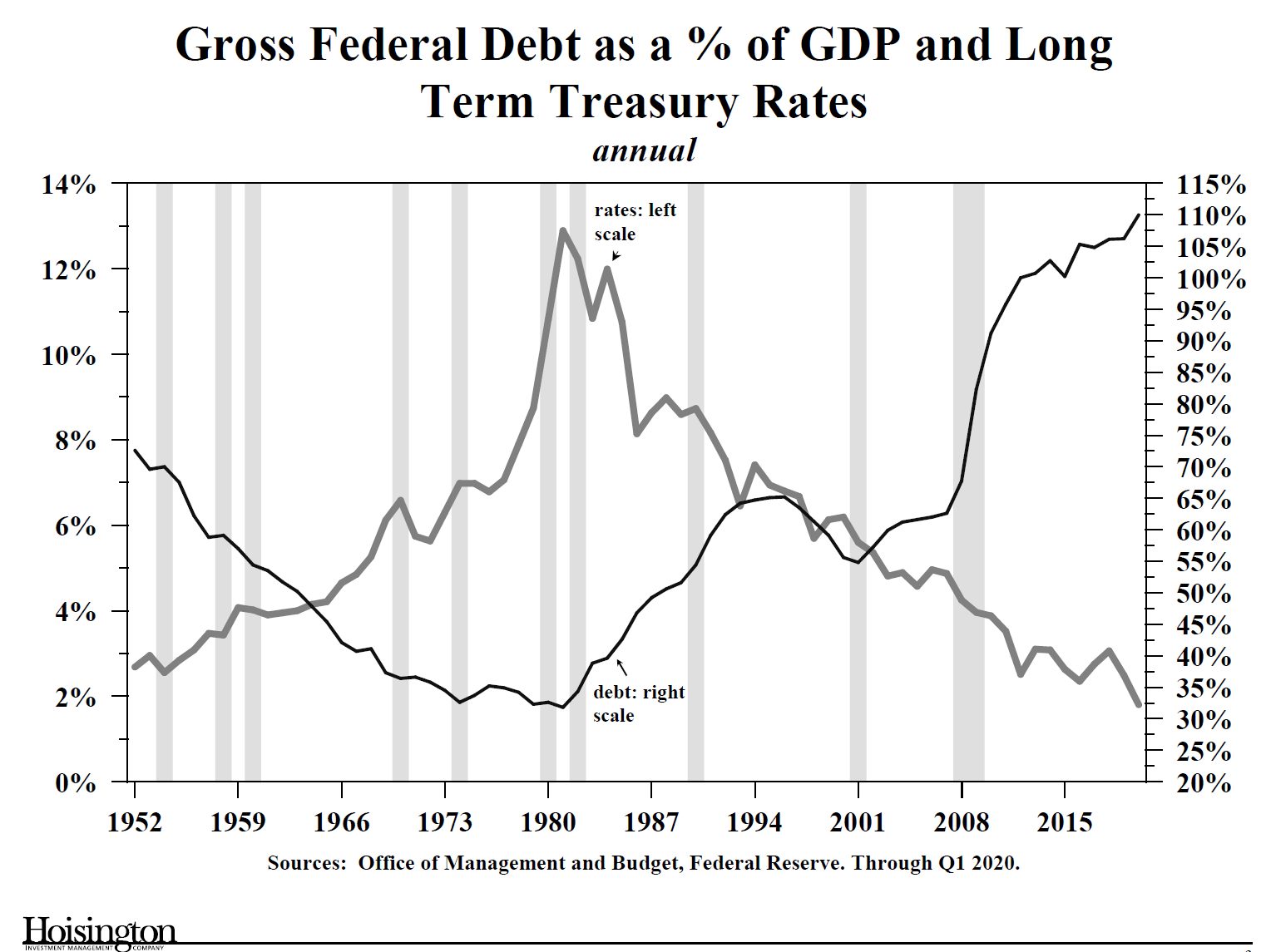

(4) Long-term deflationary pressures from excessive government debt leading to generationally compressed interest rates. This is something I plan to obsess on for months and months to come. Allow me to state two obvious facts that may warrant a reminder:

(a) Government debt was excessive before COVID

(b) Monetary policy was highly accommodative before COVID

Debt-deflation pressures, low-interest rates, and a Japanification phenomena were all at play and was all the economic story of this era, even before COVID. So, it stands to reason that this issue has just been put on steroids with the stupefying addition to national debt in this COVID era (and that is just based on the $3 trillion of fiscal stimulus we have spent so far; not the $2-4 trillion still to come in phase 4.0 and 5.0). Add in the impact of monetary stimuli (present – QE, ZIRP; future – Yield Curve Control?; NIRP?) – and again, this will be the defining economic challenge of the next 10-20 years.

The implications to interest rates, bond opportunities, growth expectations, and equity valuations are all significant. Frankly, the impact public debt has on private sector leverage is hugely under-appreciated. There is a lot to do here. It is my top priority.

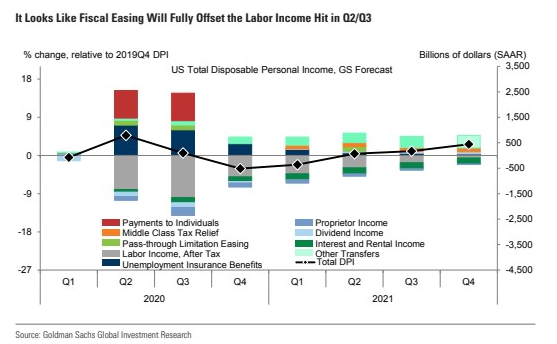

Income is getting hit, or is it?

The economic effects of our collapsing labor market are horrific, and as I pointed out in last week’s Dividend Café, the teleological effects are even worse. But in evaluating the macroeconomic impact, there is yet again a fiscal reality holding the bears at bay – disposable income may very well reflect as positive in Q2 and Q3 because of the size of the fiscal bazooka. This does not speak to the ultimate sufficiency of the current stimulus size, and it does not speak to all aspects of its distributions and efficiencies. But to the extent, one is wondering how such a substantial extraction of income can take place from the economy and some still postulate that Q2 and Q3 will not reflect that economic distress (again, on a macro level), it is simply the unknown of how this massive fiscal stimulus will end up impacting the economy. It is very hard to bet against something so large.

Speaking of income …

With interest rates so low, the impact to savers is the most-ignored topic in economics. I made this little two-minute video to discuss this reality.

A fascinating market tidbit, and a crucial market lesson

I am pretty sure everyone knows how much tech has outperformed energy as far as sector performance goes in recent years. Since 2014 technology (led by FANG) has been the best performing sector, and energy (after the initial golden five years of the shale revolution) has since been bruised and battered and performed at the very bottom of the S&P sector list. But did you know that since 2000, Energy and Technology are actually tied with each other? Energy outperformed Tech so significantly from 2000-2014 (+385% vs. +29%) that even with the big reversion since then they are tied with each other over the last twenty years (h/t Ben Carlson).

Yes, the timing of this does coincide with the Nasdaq bubble burst at the beginning of 2000. But my point is this:

Leadership changes within the stock market (sector and company leadership) are not the exception, they are the rule.

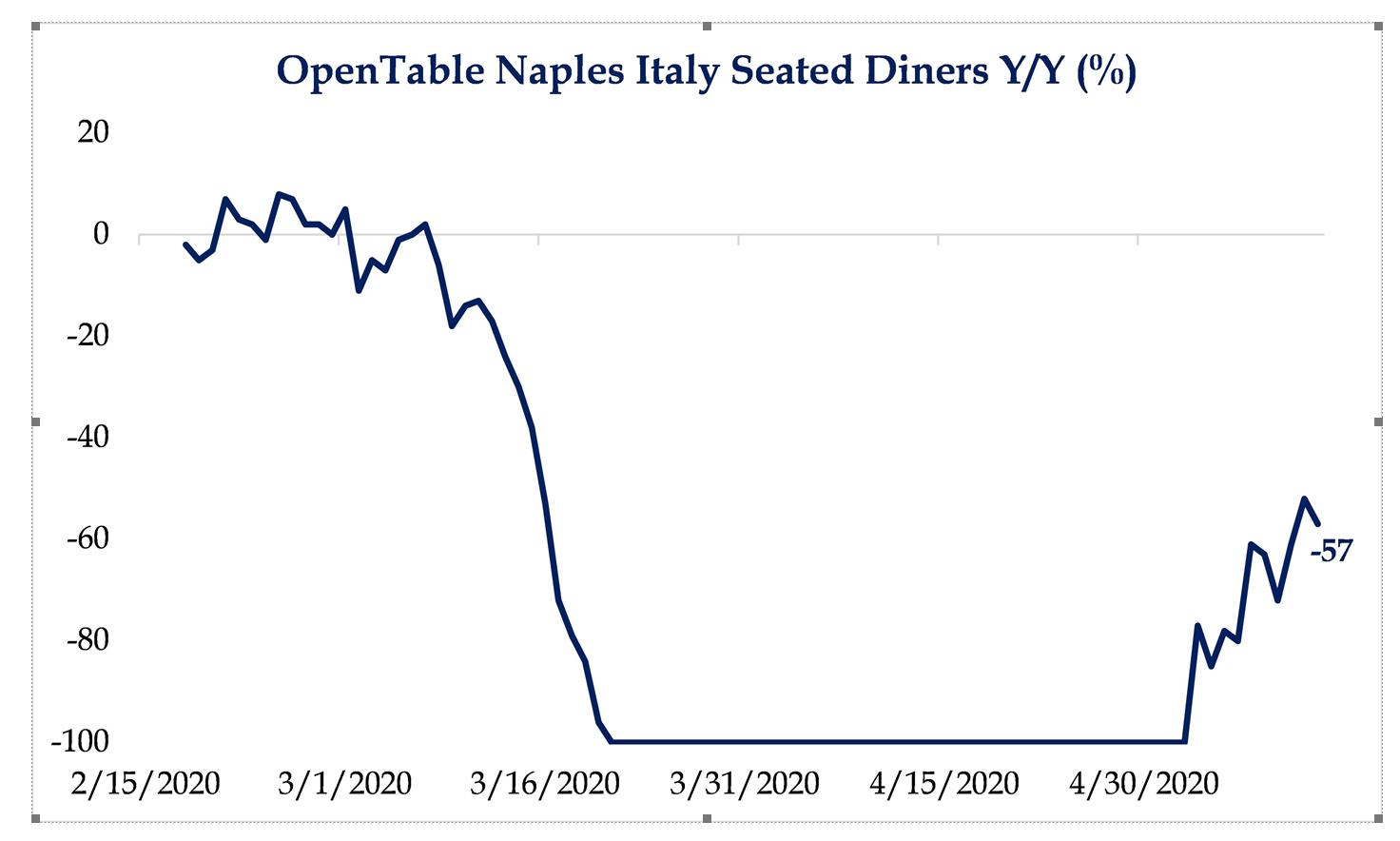

Some green shoots (perhaps Marinara?)

In prior market commentaries, I showed Open Table dinner reservation reports in the height of America’s shutdown that had unsurprisingly showed -100% activity for reservations (since every restaurant was closed, reservations were down 100% from the month prior). With Italy having just begun to re-open restaurants at the beginning of the month, I thought this Open Table report for Naples, Italy showed some encouraging and expected data.

* Strategas Research, Daily Macro Brief, May 15, 2020

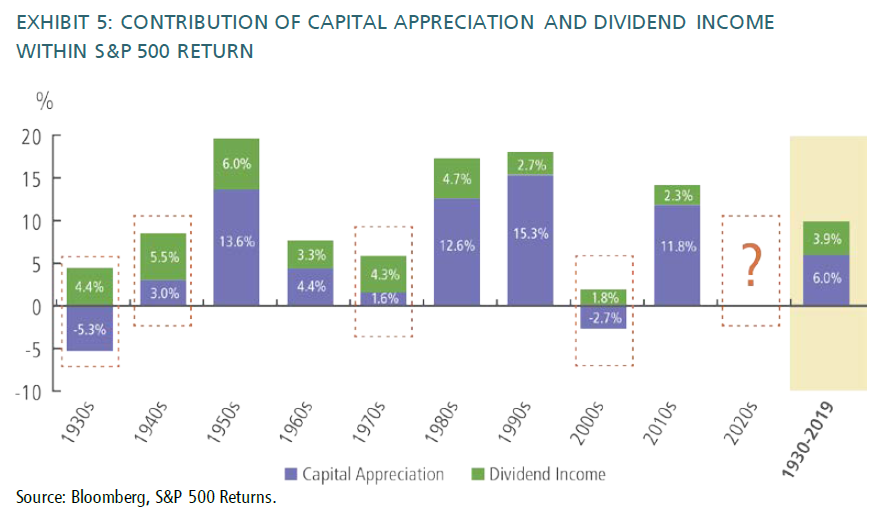

Dividends as Defense

Our philosophy around dividends and dividend growth is not seasonal. We believe in companies inclined to grow their dividends and that at purchase already have an above-average dividend yield. We do believe companies that are able to sustainably grow their capital distributions over time prove to be better-run companies with better total return prospects … but we also believe that in times of choppiness and volatility dividends become very important for a very different reason. In challenging periods (see the decades circled below) dividends become a much higher percentage of the total return. It is screaming and easy bull markets where that gets forgotten. In normalcy, good and bad, dividends are paramount.

Stock buyback pain as dividend gain?

I did not want to put it as a “long term risk” out of COVID, because I can say it becoming a benefit to dividend investors in a lot of ways … but I would say that the political intensity against stock buybacks appears to be more entrenched since COVID, and more and more bipartisan. Obviously we can expect increasing opposition to companies who partake of government aid partaking in share repurchases, but I believe it is possible we will see more and more hostility towards the practice even apart from companies that feed at the government trough. Besides the questions about a free country dictating what a company can do with their own capital, it likely would further boost the practice of dividend payments, even as it would adjust the accounting around “earnings per share” (earnings would not change, but share count would). My view? A restriction on share buybacks may not come, but more pressure against the practice will … Dividend payments are more transparent, more consistent, and more advantageous to shareholders.

Politics & Money: Beltway Bulls and Bears

- The surprise win in the CA-25 district special election by a Republican challenger in a Democrat district have some wondering if things are not teed up as badly for Republicans as some may have thought. CNN had polls this week that had POTUS trailing nationally to Joe Biden, but in a lead across the major battleground states. My own view on special elections is the same whether it looks like they portend one thing, or the opposite thing: They are not normative – they cannot be relied upon to dictate trends – they are “special” for a lot of reasons. As for polling, battleground states, approval ratings, and everything else related to predicting the November 2020 Presidential outcome … I would not recommend placing any bets one way or the other. Heads or Tails – best predictive tool we are likely to get any time soon.

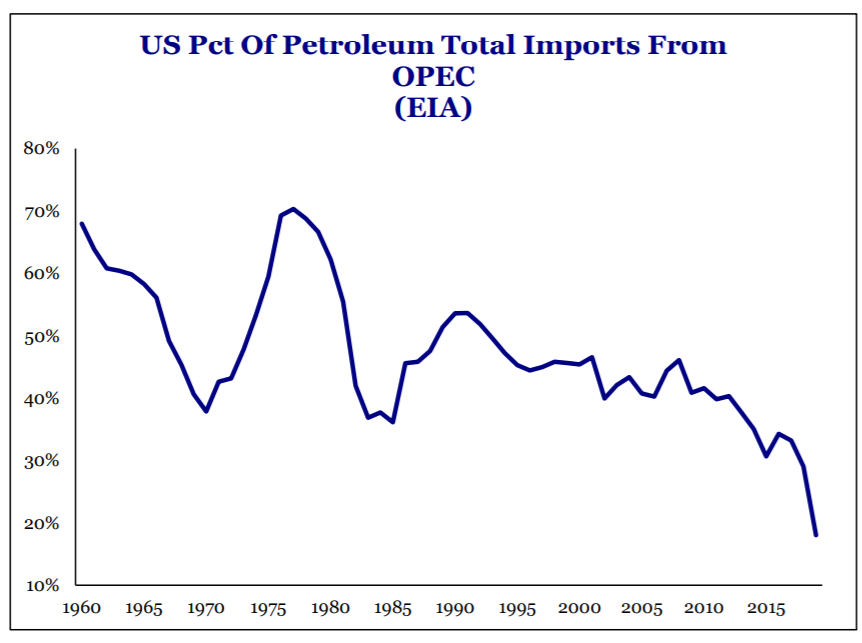

Chart of the Week

I am not just in love with this chart because I am in love with the U.S. energy independence story, but I believe it single-handedly tells the story of why the U.S. has the geopolitical and economic options it has right now as we sort through this demand evaporation in oil. WTI is very close to $30 as I get ready for press time here …

* Strategas Research, Policy Outlook, May 13, 2020, p. 4

Quote of the Week

“The two most powerful warriors are Patience and Time.”

~ Leo Tolstoy

* * *

I am already excited for next week’s Dividend Cafe. That is how much I love this weekly writing endeavor. In the meantime, may you enjoy a weekend of peace, family, friends, and hopefully, some outdoor time, social interaction, and maybe, just maybe, actual economic activity. Oh, how I long to sit in a restaurant and order from a menu with my wife. It’s coming, friends. To that end, we await. =)

Join us Monday at 11:00 am for our bi-weekly national video call.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet