Dear Valued Clients and Friends,

I wrote an awful lot of stuff over the weekend for this special mid-week Dividend Cafe. I wrote about the bizarre reality that with three days last week that the market was down nearly 1,000 points (Friday’s was intra-day, but it did come back at the end of the day), the market was actually up 450 points last week. I wrote about various peripheral economic and market realities that I thought useful in the fuller context of the current state of affairs. And then Monday happened, and I have spent the 3 am – 6 am hours of Tuesday morning re-writing the entire thing.

I hesitate to even mention that as I type, the market futures are pointing to a 650+ point jump in the market (it had been a lot more). First of all, that is just a small part of yesterday’s collapse, and secondly, by the time I am done typing this paragraph, let alone by the time you are done reading it, the possibility of reversal or adjustment is extremely high. These are the times in which we find ourselves.

You should have received my bulletin last night on the 11th worst market day in history that was Monday (and the worst day since the financial crisis). I stand behind every word written yesterday afternoon and will be reiterating much of it in this Dividend Cafe. But I really want to dive deeper into the oil saga playing out with Saudi and Russia, and I really want to unpack more of the economic ramifications of the present hysteria. That is what this Dividend Cafe will be devoted to – a bit more meat on the bone, none of which is meant to take away from the fundamental behavioral lessons I am desperately trying to reaffirm in all communications right now.

So jump on into this special Dividend Cafe …

Contrarian hope

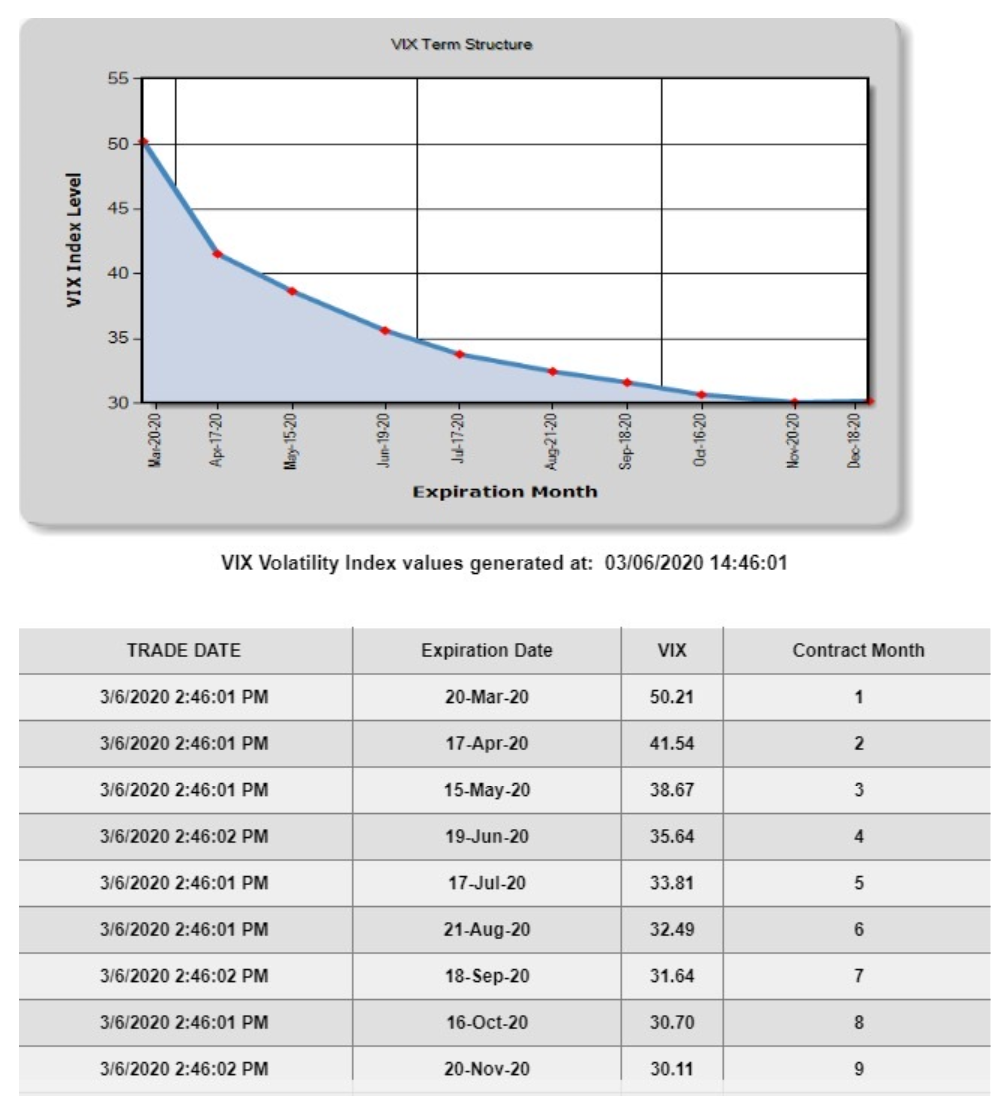

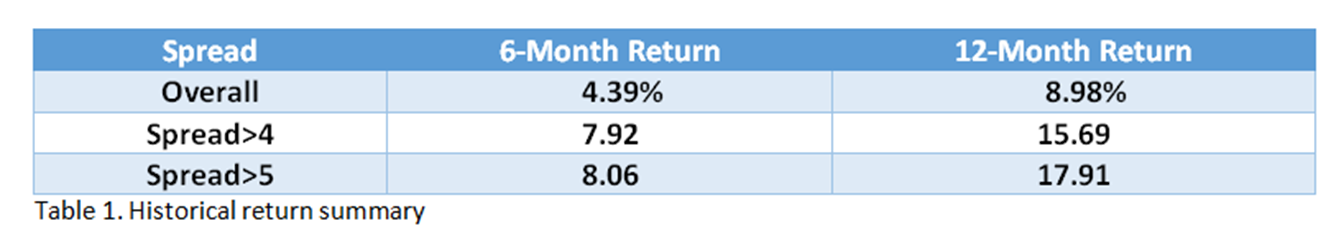

Hope here is not a reach – these are real facts that have real historical meaning. First, the put-call ratio hit its highest point since December 2018 yesterday (the indicator of bearishness in the options market reflected by how many “puts” are being bought vs. “calls” – or bearish bets vs. bullish ones). And equally significant – the VIX curve is as inverted as it has been since the financial crisis. What this means is just that people are paying way, way more money for protection on the S&P 500 for thirty days than they are for protection on the S&P 500 for nine months. Of course, this is completely counter-intuitive, as the more time one has, the more risk there is of some unknown negative event. Yet when risk markets enter the world of chaos and irrationality, short term-ism takes over. Both of these indicators have always been heavily correlated with market capitulation that were early indicators of a significant market recovery.

* FactSet Research Systems, March 6, 2020

The average returns after the VIX have reached these levels is +18% in the market a year out. The range can be much higher. And there are no incidents of it being lower.

* Cumberland Advisors, VIX Spread, Dr. Leo Chen, March 9, 2020

Economic optimism and anxiety rolled together

273,000 jobs created in February, as I mentioned in Friday’s Dividend Cafe. Leisure and hospitality were strong, and we know they are about to show significant weakness. The forward momentum coming into this shock certainly helps, but it can’t offset it entirely. Events are being canceled around the country, and airlines and hotels have announced hiring freezes. There is far more risk in the economy from the hysterical response to COVID-19 than the epidemic itself, but economically that may very well be a distinction without a difference.

That there will be a hit to economic growth is not up for debate. But the extent of how bad it gets will depend on how long the coronavirus anxiety lasts and how far it spreads.

The weeds

China’s GDP growth is certainly going to contract on the quarter. Domestically, the biggest impact will be in transportation and supply chain sensitive sectors/businesses. The $8 billion spending bill Congress passed is intended to be more virus/medical-targeted that economic-stimulus targeted. We know the Fed has begun their response, and will soon (we expect) be doing a lot more – but we question the impact of monetary policy in addressing this moment.

I expect most economic metrics to begin looking down in March, with Q2 being the real peak evidence of negative impact (consumer, employment, GDP growth, etc.). My own best guess is that the market has reasonably priced in the negativity for Q2, but not yet an extension into Q3. The difference between this being a 1-3 month economic impact event, vs. a 4-6 month one is substantial.

Is the market that cheap now???

Here’s the thing that may really bother some people. It actually isn’t. Some select areas are in extreme under-valuation, and certainly, all market segments are much cheaper than they were just 2-3 weeks ago. But candidly, the market’s multiple has dropped a couple of points, from a little rich to something more normal – not dirt cheap – and not at all cheap if we were going to go into a recession (which is certainly not our call at this time). The premium market multiple was warranted to some degree entering the year with the expectation of 10-12% earnings growth. But you now have a multiple that required re-pricing, and earnings growth expectations adjusting lower (in some sectors more than others).

I say this to set the table for the broad market reality of where we are. The market multiple should be (and will be) higher when we are on the other side of this coronavirus incident, and equities get priced up against this [yet again] “new” era of monetary accommodation. But in the meantime, we have no belief that S&P levels have found a bottom, or should be considered “cheap.”

Monetary Perspective

I expect stealth QE (“non-QE, QE”) or whatever else anyone wants to call it to (a) Escalate substantially in the weeks and months ahead, and (b) Be entirely focused on hyper-short term bills (treasury bills of 0-90 days in maturity, so as to un-invert the yield curve, and bring back some slope and carry to the rates market. This will bring money markets, CD’s, and savings accounts back to near 0% – brutal for savers. But it will provide profitability to banks to lend. A tangled web, indeed.

One reason I sort of expect the Fed to take some action that the market is not expecting is because the Fed is so aware that their actions don’t really move the needle unless the market was not already expecting them (last week’s rate cuts as case-in-point).

A post-COVID19 world will eventually come and the Fed will have left us with 100 basis points of lower discount rates for risk assets to be priced by. But in the meantime, the questions are all around psychological liquidity concerns not becoming real credit problems. The oil war and the Fed’s actions will have a lot to say about all of this in the days ahead.

Italian lockdown

After 9,000 cases of coronavirus and about a 5% mortality response to those, the 60 million population country of Italy has gone into full lock-down. Travel is all but banned (besides certain required needs). Public gatherings are out. Schools, universities, and museums are closed. They are targeting a 21-day timeline for this draconian measure.

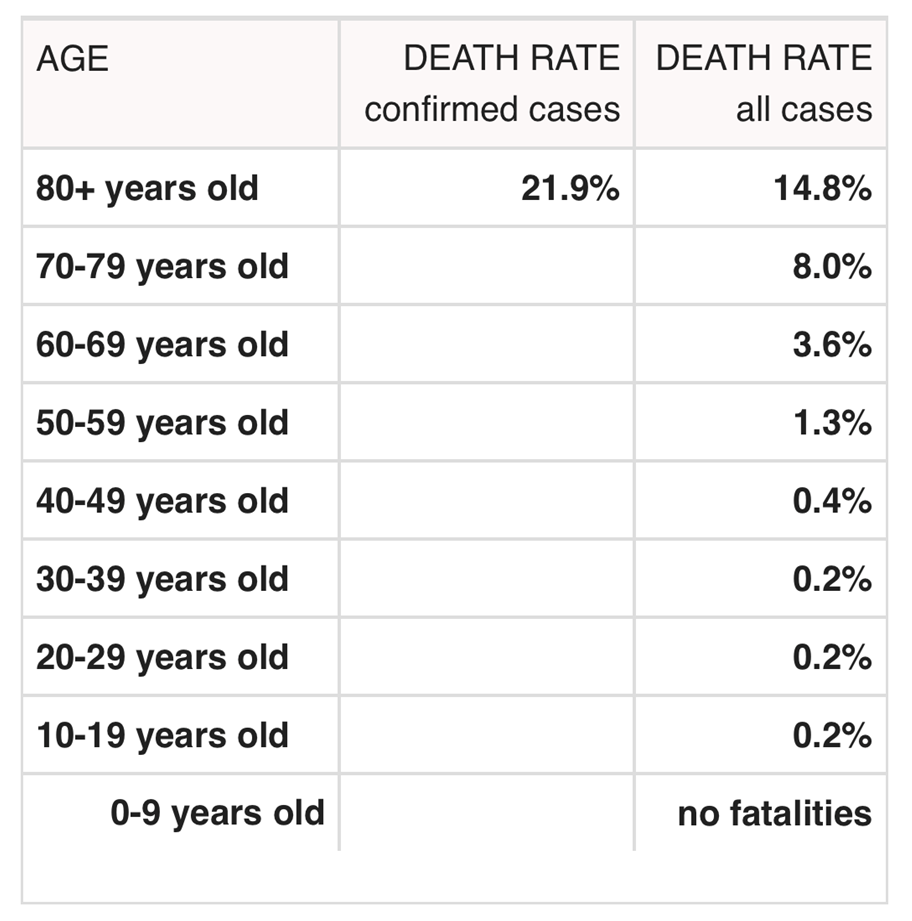

Mortality Factoids

Some data across the globe from the World Health Organization.

* https://www.worldometers.info/coronavirus/coronavirus-age-sex-demographics/

Oil prices and the U.S. Economy

Oil prices dropped 30% overnight Sunday, the largest single-day move since the Gulf War in 1991. The upstream (producers) and midstream (transporters) sectors were pummeled Monday as expected. To what extent is this good for the U.S. economy? To what extent is this bad for the U.S. economy? And, what does it really mean geopolitically?

First, the “good.” Should oil prices stay low, there is an argument that it serves as tax relief on American consumers. With 142 billion gallons of motor vehicle gas consumed per year in America, the EIA believes that every penny reduction in the cost of gasoline amounts to $1.4 billion of savings to American consumers. If gas prices really do decline $0.30-70 cents per gallon in the aftermath of this, we could be looking at $50 billion or more of “stimulus” to American consumers.

But of course, it is not that simple. The reality is that this “good” is offset (and then some) by the economic impact of what such a move would mean to capital expenditures and business activity in America (not to mention the consumers who work in that space, or some second or third order of that industry). There are marginal producers who would either go out of business from prolonged declines in oil price margins, or who would at least face financial pressures related to their debt and leverage levels.

Saudi/Russia

So if you believe news reports and leaks from the involved parties, Russia told OPEC they would not agree to curtail production with “OPEC+” in the face of current challenges to support prices, so Saudi said they would flood the world with oil, so Russia said they would destroy American shale, etc., etc. I have learned the hard way the impossibility of using perceived geopolitical agendas to forecast oil supply/demand realities.

I do happen to believe that Saudi will blink, and that Russia will stand down with them, with the expected amount of face-saving posturing to go along with all of this. Neither side can really afford this price war themselves, and the idea that American shale will be destroyed is dubious, as recent lessons taught us.

The shale industry is massively profitable. But there are small producers with highly leveraged balance sheets who have a high cost of capital and a large bogey to hit for marginal profits. The 2015 attempts to “kill” shale ignored the reality of capital – it may “kill” weak players, but in doing so, it just simply transfers the wealth to stronger hands who have the balance sheets to withstand the pain. Behemoth integrated energy companies, not to mention America’s private equity industry, are really quite happy to see low oil prices take out C+ credit players while they pick up the pieces. There can and will be a macro effect on capex, which has a tail effect in manufacturing and industrial production activity at-large, and there will be targeted ramifications for certain lenders, bondholders, and even banks. But the 2015 experiment to destroy shale blew up in the Saudis face because of their underestimation of American capital markets (which are stronger now than then). And Putin is no dummy. I can, therefore, only assume he has a different agenda than we understand.

I am not convinced that politicians are master strategists playing out three moves in advance of what we all can see and understand. I am even more dubious of this when it comes to Middle Eastern autocrats.

I don’t want to over-think this, but …

Oil prices were smashed yesterday. Equities are down 16% in just weeks. Bond yields have collapsed. We know how much demand is being taken out of the economy by this hysteria (travel, etc.). And yet …

Copper prices are stable and even positive? I am not drawing a conclusion, but I am watching it. Closely.

* Commodities Exchange Center, March 10, 2020

Tuesday bounce

The 650 point recovery we are currently seeing in the futures market (it was 1,000 points earlier) as of press time comes as the White House readies a payroll tax cut proposal for Congress as a means of providing economic relief to middle-class taxpayers impacted by the state of affairs. There is no assurance it will receive Congressional approval, and other legislative elements are likely to come with it (more unemployment insurance protections, school lunch assistance programs, coronavirus testing, etc.). The politics will probably be ugly.

The markets could also be going up because they just got done going down so much – period.

Payroll tax cuts do not have a historical record of being stimulative when people know they are temporary (see Milton Friedman’s “permanent income” hypothesis). There also is the risk of it creating more panic and hysteria. Other measures being discussed include loans to small businesses and targeted relief for airline and hotel industries.

We’ll know more details later Tuesday.

Encouraged and happy? Or … ?

Assuming the market holds this opening upside move in effect as of press time (it was over 1,000 points to the upside) but is now just 650, should we view this as the possibility that Monday was a bottom in this traumatic sell-off? Unfortunately, no. It certainly could be that Monday was a bottom, and it certainly feels better to see +650 points to the upside than downside, but I want to shoot very straight with everyone right now – we cannot read too much into any move in any direction when markets get this chaotic. Big violent moves up do happen even in bear markets. Ultimately, markets are not trading on known bad news when they collapse these days, and unfortunately, they are not trading on known good news when they rally either … There are so many unknown and fear and greed vacillate as people try to find their footing.

How bad will it get?

By now, many people are familiar with the viral video of Brian Williams at MSNBC,and a New York Times reporter claim that Michael Bloomberg’s $550 million campaign spending could have given $1 million to every person in America (with our population of 330 million). Hint: the actual number is $1.53 per person, not $1 million, so just off by $999,998.47.

But even with the impact of coronavirus, there is a problem with the basic math, even where there may or may not be a problem with the basics of the scientific and medical forecasting.

A leading macro research firm recently reported that, per Brookings Institute, 10% of the U.S. population was likely to get the coronarvirus. They then went on to say that 1% of those would likely die, so there would be 30,000 deaths. But of course, 10% of the American population is 33 million people, and 1% of that is 330,000. I guess my point is: It is very hard to assess the qualitative part of one’s research when the quantitative part is so off.

Our market view right now cannot be based on other’s speculation of what exposure and fatality count may be. We do take great human optimism out of the very high cure rate we presently see, and the very low mortality rate presently in evidence. But we take no comfort at all from the fact that no one talking about what will happen, could happen, or might happen, as any flipping idea what they are talking about. The estimates are all over the map, but if one “expert” says deaths may be limited to a hundred people in the U.S., and another says the deaths could reach 80 million people, you basically have received no estimates or forecasts at all – just non-scientific jibberish with zeroes and commas.

We cannot assume the worst out of where this may go, and we cannot assume the very best. We follow the facts as they come in, and adjust medical and economic understandings accordingly. We don’t seek to time what cannot be timed, or price what cannot be priced. We can only respond to what is known, not speculated, and center investment policy around core and timeless principles.

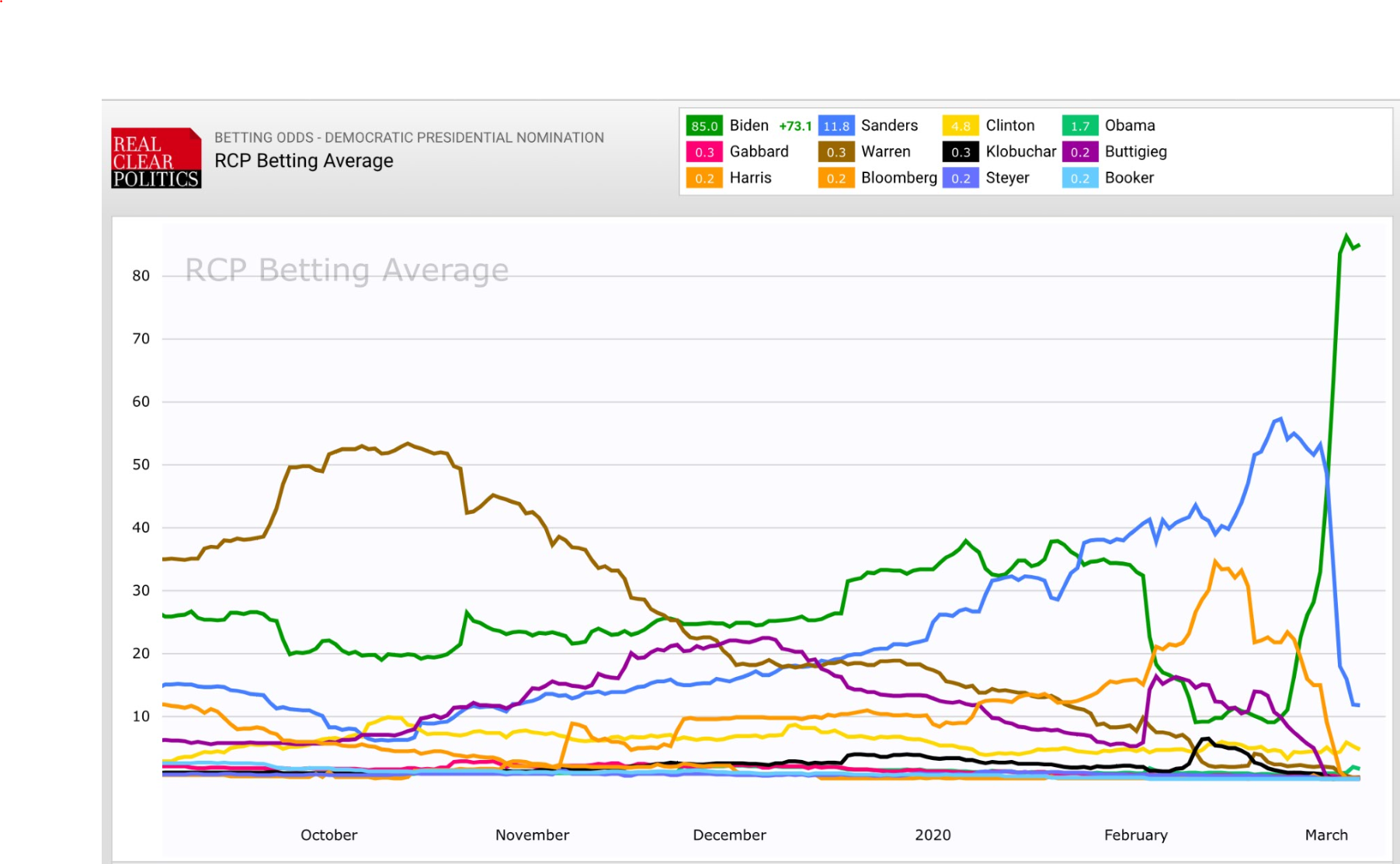

Politics & Money: Beltway Bulls and Bears

- How do you illustrate the most remarkable political comeback in recent memory? Look at the betting odds of Joe Biden securing the Democratic nomination (green line below). From the stunning collapse of Elizabeth Warren (brown line) to the violent drop down after Iowa/New Hampshire of Biden and then the straight line to the top, it has been one bizarre run through this primary.

* RealClearPolitics, Betting Odds averages, March 7, 2020

- The efforts we are already seeing but will see in dramatic, and I mean dramatic, fashion in the days, weeks, and months to come to portray the COVID-19 event (22 fatalities thus far) as a “Katrina” event for the current administration will be staggering. I have always had my own opinions about the President, positively and negatively, and I have my own opinions about what we are witnessing right now in the media and national stage regarding this coronavirus event. I am sure you all do, too. I bring this up, though, not to share my views – but rather to share the rather obvious fact that politically, the development of a Katrina-effect for POTUS is a top priority for many. Do with that what you will.

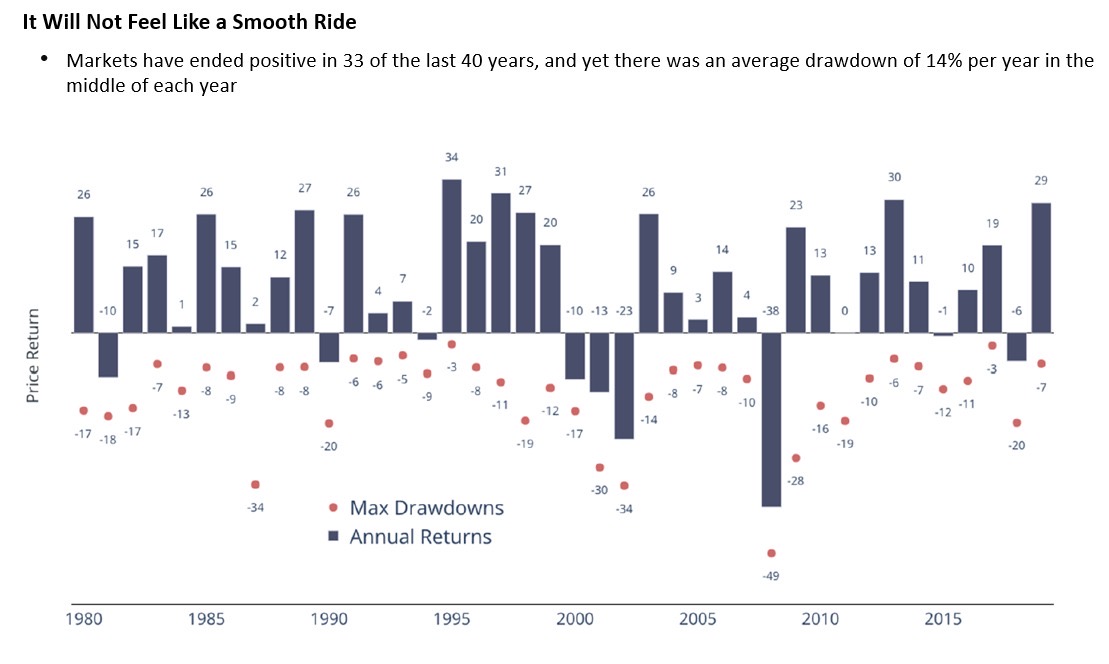

Chart of the Week

One of my favorite charts has always been J.P. Morgan’s historical portrayal of average market draw-downs up against annual returns. In other words, it shows how draw-downs have worked in the middle of the year, even in years that proved to be positive return years in the market, which is most years. I have absolutely no view as to how the totality of 2020 will play out in the market, but I do know that a 13-14% drawdown from a peak level is not an outlier but the average. This historical and mathematical perspective is important.

* J.P. Morgan, Quarterly Markets Overview, January 2020

Quote of the Week

“In the short run, the market is a voting machine. In the long run, it is a weighing machine.”

~ Benjamin Graham

* * *

My plan is to continue doing two weekly Dividend Cafe communiques per week until market conditions settle. I am hoping this one, and all of these attempts, see enough market cooperation that they not be obsolete by the time they hit your inbox.

But I promise you this – if a new news update comes that alters these commentaries, or when market pricing adjusts beyond what I have written, there are principles that will not ever be obsolete in the Dividend Cafe:

- History has been merciless to those who panicked out at the bottom

- Bonds and Alternatives are an effective diversifying force from the occasional bouts of violence in equity markets

- Timing one’s way in and out of volatile markets cannot be done, and it risks extraordinary damage to one’s portfolio (first, by exiting in advance of some recovery; then, from the regret that follows)

- Dividends accumulate more shares at lower prices during market distress – our emphatic goal

- Dividends continue coming in, and growing, for those needing income, even during market distress – our other emphatic goal

Working towards all our ends – our mission – our telos …

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet