Dear Valued Clients and Friends,

So as I hit “submit” mid-way through this Friday market trading session, the roller coaster ride of this week continues. The markets were down over 800 points early, but right at this moment are down 450 points. I have no doubt markets will move from here, and I have no idea which direction. Big moves, in either direction, are the daily expectation right now.

This week’s Dividend Cafe offers as much information, guidance, and reality as we are able to muster. We absolutely encourage you to read the Wednesday special edition Dividend Cafe of just two days ago, and we encourage you to listen to my newest podcast/video. But in this Dividend Cafe, find the very latest perspective we have for this highly volatile time in the markets.

First things, first.

I closed the Wednesday Dividend Cafe with this:

*********

Declining share prices allow accumulators to pick up more shares when dividends are being reinvested.

Declining share prices do not effect withdrawers at all when the dividend stream they withdraw from is steady and even growing, not impacted by the natural movement of the stock market.

Every client is one of those two buckets. Every client should feel great encouragement from it.

*********

I opened the Dividend Cafe with it today and will continue doing so for the foreseeable future, to allow first things to be the first thing.

Our goal in equity management is the sustainable and uninterrupted growth of superior dividend income. Our objectives in good times and bad times are unrelated to the randomness of external sentiment and valuations. We are now in the lowest interest-rate environment in human history, and our investment philosophy is to get clients the cash flow they need. And if a client doesn’t need cash flow, it is compound their capital with the power of reinvested dividends at lower prices – a compounding and accumulation miracle. What we do need to do is see that that income be sustained, and even grow, regardless of market environment.

That is my only goal as an equity manager, because it is what I can do through our work, research, selection, and effort. What moves stock prices themselves day by day (the sentiment of other people) is outside my control (and everyone else’s), and therefore a rather silly goal for investors.

This has permeated our philosophy for years and years and years. Some may disagree, or find it unhelpful, but we will not stray from what we know to be best. These last few paragraphs drive us each and every day, and we hope they will be paramount in your mind through this period.

As far as the economy …

273,000 jobs were created in February per today’s report. And yes, March is going to see a big reversal, and there will be a big set of data points reflecting the uncertainty (and irrational behavior) of many. Yes, economic weakness is coming. Others can decide if the weakness coming rationalizes a 4,000 point move in the Dow. But, and this is very important – a shock to the system that is people’s response to this story is very different when it hits an economy creating 80,000 jobs per month, or negative jobs per month, versus one creating 273,000 jobs per month. I hope this is clear to everyone.

Medical stuff

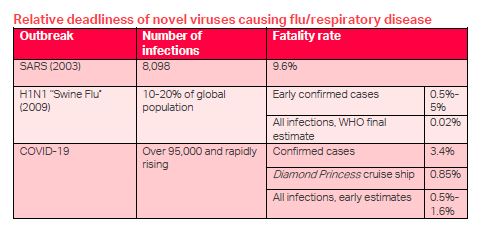

I have no intention of turning Dividend Cafe into a medical report. But I don’t believe it is possible to do proper economic and market forecasting without a real understanding of some of these medical realities.

Source: CDC

Source: CDC

You have a dozen fatalities in the United States. Twelve. And I mourn the loss of each of those twelve for their families and loved ones.

“And more than half of coronavirus patients worldwide have become better, according to the Johns Hopkins Center for Systems Science and Engineering. Of 96,988 cases around the globe, 53,638 have recovered.”

Not my words – NBCNews.com reporting Johns Hopkins data.

Fed and all that

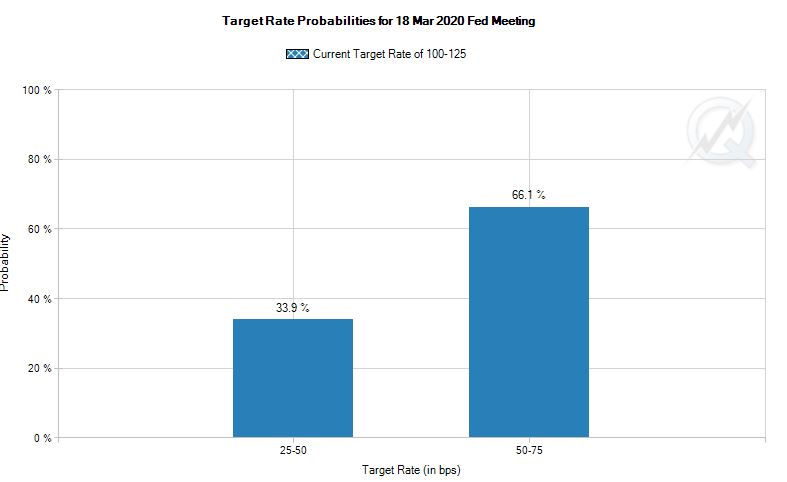

They are now being told by the market to cut rates at least another half-point in the March meeting, with even a 34% implied probability of .75% more (which would bring their rate down to .25-.50%. Our forecast is that they are headed to the “zero bound” – perhaps sooner, but certainly by the end of the year. And once there, we think you will see that Japanification effect in place for a long, long time.

* CME, Federal Funds Rate, March 6, 2020

A little cheating

I have no interest in “forecasting” what cannot be forecasted, but my mind is in two places right now – (a) The present conditions of the market insanity and (b) What to expect when there is some normalcy on the other side of this. So allow me to forecast on “b” since I have no forecast on “a” at all.

I expect yielding instruments to be “bid up” substantially, as investors grapple with the reality of low interest rates. Where there is yield spread – REIT’s, Utilities, MLP’s, great dividend stocks – there will be an appetite before there is an appetite across all cyclicals. This is fundamentally fair and expected, but it also is the historical lesson of market behaviors around manipulated interest rates.

So I can’t make a call on when markets normalize, and all risk assets suffer to some degree until they do, but I am firmly convinced that the environment in front of us favors cash flow premium instruments.

To this end, we work.

But the financials?

Yes, BANKS, even good dividend payers/growers, would not be in that “yield spread” category above if interest rates are compressed like this, as their incentive to lend money is decimated by the inferior opportunity of doing such.

If financials find a bottom, and of course when oil finds a bottom, you will very likely see daylight in the normalization of markets.

Days? Weeks? Months? We do not know.

Politics & Money: Beltway Bulls and Bears

- The Joe Biden story of the last week or two is one for the history books, and has re-framed the Presidential race. More on the political ramifications of coronavirus and the Bernie/Biden brawl-to-come next week!

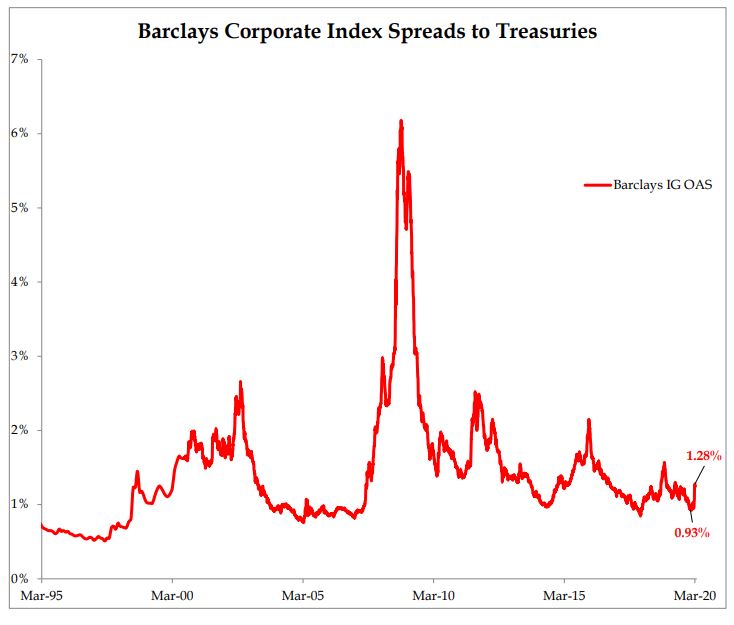

Chart of the Week

There has been panic in equity markets the last two weeks (with two days of 1,000+ points rallies). There remains panic in the VIX as people pay extreme levels to buy protection on the S&P. And most unbelievable – a ten-year government bond at 0.75% as we talked about previously. BUT, shouldn’t spreads (the money people expect for the risk of corporate bonds vs. safety of Treasuries) be blowing out wider? Look, they have widened, but in nowhere near the proportion to movement in these other indicators. High yield spreads reflect equity market conditions; high quality bonds (high rated) reflect credit market realities in real-time. We see no evidence of tightening financial conditions.

Quote of the Week

“The sea changes color, but the sea does not change.”

~ Stevie Nicks

* * *

I will close out this Friday’s Dividend Cafe to similar sentiments as last week. The day-to-day market volatility, the exploding VIX, and collapsing bond yields – these are indicators of irrationality, not fundamental deterioration; they are indicative of emotional selling, not rational selling; they are indicative of transitory events, not fundamental ones.

I do not know when this era of market volatility will end, and I do not have a reason to assume it will be over any time soon. I feel most comfortable assuming it will take some period of time.

But I do know that I will work vigilantly through this entire period to do what is best for our clients. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet