Dear Valued Clients and Friends,

Some important and timely comments and updates about the last 96 hours of insanity around the fall of Silicon Valley Bank!!

I had to wait until Monday morning to write this despite reading hundreds of articles, dozens of conversations with government officials and Wall Street analysts, and a plethora of media rumors and media reports over the weekend. The news was updating so fast and so frequently that to try and pen a piece like this Sunday was futile if I were to avoid something obsolete by the time I hit “save and submit.” Even now, the risk is still there that something else has developed in this story by the time you are reading this. I hope this piece will prove succinct and useful.

First the causes …

I think this piece at National Review is useful in unpacking the causation more thoroughly, but in a nutshell, you likely know by now that Silicon Valley Bank was taken over by the FDIC on Friday. Essentially, upon hearing that Moody’s was about to downgrade their credit rating, SVB went on a mission to raise equity capital to solidify their financial position after word got out (from footnotes in a financial report, no less) of large mark-to-market losses in their bond portfolio). The word that they were trying to raise capital caused depositors to pull funds. And the word that depositors were trying to pull funds caused their efforts to raise capital to fail. The vicious cycle moved quickly, and by Friday morning, FDIC regulators determined that there were now fewer assets than there were liabilities (in this case, the liabilities are a reference to the uninsured deposits), and they took over the bank,

How did the bank have mark-to-market losses in their own capital that served as the assets of their balance sheet? Because they bought long-maturity bonds with $80 billion of their assets, $68 billion in residential mortgage-backed securities and $14 billion in commercial mortgage-backed. They had zero defaults or impairments in these assets; but they held them on their books as “held to maturity” assets (par value), and in fact, their mark-to-market value based on interest rate movements had worked quite a bit against them.

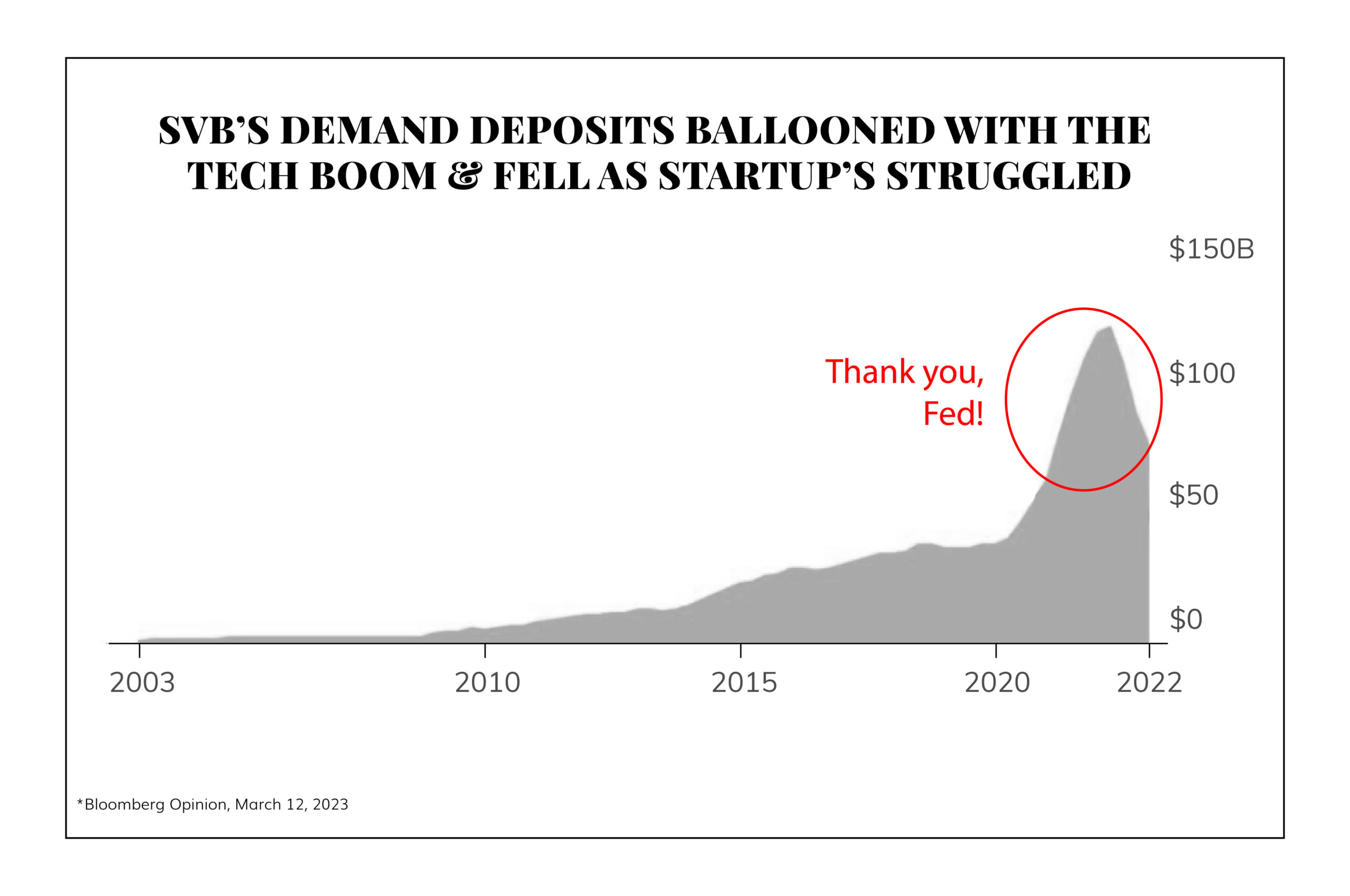

How did the bank suffer a large amount of depositor withdrawals in just a 24-hour period merely because of a Moody’s downgrade threat and word of valuation trouble on their bond portfolio? Because the bank almost entirely banks start-up tech companies funded by venture capital, the venture capital sponsors started screaming to withdraw funds. It was a classic run on the bank. And this deposit base was, shall we say, not the epitome of stability and sensibility. IPO proceeds from non-profitable tech companies. SPAC money. Crypto companies. This was a walking who’s who of shiny objects. It was like if the Shiny Object Club got together and picked a bank, this was their bank. And the bubble of the deposit base is clearly visible here, and then the run on that deposit base by those same shiny depositors.

It looks like the era of 0% interest rates was really good for venture capital raises and, therefore, really good for Silicon Valley Bank. Deposits flew, until they didn’t. Bubble charts often look like a mountain with one line up and then another line down (like the chart above), but usually, they chart the value of a stock or a market cap, not a depositor cash level.

Bottom line – a good-sized bank found itself with a NEGATIVE $958 million cash balance on Friday, and the FDIC took over. And then the weekend began.

What are policymakers now doing?

Last night the FDIC, Federal Reserve, and Treasury Department issued a joint statement that uninsured depositors at both Silicon Valley Bank and Signature Bank of NY will be fully backstopped, citing a systemic risk exception. If you have the same definition of “systemic” that I do, it is essentially a quasi-lift on all FDIC limits for the time being as a means of signaling depositor protection across the U.S. banking system. Shareholders and unsecured bondholders will not be protected as market forces play out there, but depositors will be.

They further announced the creation of a Bank Term Funding Program (BTFP) – yes, when new acronyms start getting created in financial news moments, you know the Fed is nearby. The Fed is offering loans of up to one year in maturity valued at par when any asset is posted as collateral regardless of maturity. So, let’s say a bank has $100 million of 10-year mortgage bonds and treasuries that are only worth $90 million right now, they can access loans for the whole $100 million as a way of maintaining liquidity.

Make no mistake about it. Someone is paying for this backstop, insuring the uninsured deposits. Yes, technically, the funds are not coming from taxpayers to pay for uninsured depositor protections, but higher premiums for FDIC coverage are paid by banks, who then recoup the costs either with lower deposit rates or higher costs, expenses, and fees. And even beyond that, the guarantee is, indeed, backstopped by the Treasury Department, which is funded by, well, taxpayers. This is not a comment on the propriety or impropriety of this decision. Everyone can have their own opinion there, and it is a complex subject, to say the least. I am merely pointing out that, regardless of what one believes about it, it is not true that fairy dust is paying for it.

I referred above to the “quasi-lift” of the $250,000 limit on FDIC coverage. This is at risk of being a very problematic deal because, on one hand, it satisfies all depositor needs today and lends a helping hand to depositors (mostly tech and crypto start-ups) at these two broken banks, but on the other hand, it leaves unsettled if FDIC limits still really apply or not. If they do not, there is still the risk of depositors at even very well-run smaller banks to say, “yeah, I’m not so sure about this,” and pulling funds in favor of a larger bank. This clarification is needed, and I would think quickly needed.

Before this step was announced late Sunday, the FDIC did hold an auction to allow for large financial institutions to bid on the Silicon Valley Bank business, but no one participated. I intend to write an article this week on how the actions of state attorney generals in the aftermath of the financial crisis against those entities who did buy failing financial institutions took away the appetite for anyone to ever play this game again.

Though no one showed up to buy all of Silicon Valley Bank, there are reportedly four financial institutions involved in discussions for the various silos of their business outside the commercial bank (which is now under the control of the FDIC). Their private markets business, capital markets business and securities business are separate from the bank and may very well catch a bid today or this week. Two of our portfolio companies are involved in these discussions.

What does it mean for you?

There is no way this will all shake out with significant market volatility. That began in earnest last Thursday and Friday, and I have no reason to believe (or fear) it continuing this week. Last night futures were up over +300 points, and this morning they were down over -100 points, and there will likely remain a bit of uncertain skittishness for a while. As I submit this, the Dow had been down -175 points and has now gone positive. It is a completely and totally irrelevant reality to your portfolio. It should take very little imagination to understand why markets would be all over the place in the immediate aftermath of all this. Noise, not substance.

In the meantime, bonds are rallying ferociously. The two-year Treasury yield has gone from 5.06% to 4.07% in three days. I have never, ever seen such a quick rally in bonds, especially at the short end of the curve. Even the 10-year is back to a 3.45% yield. It is a sight to behold.

Goldman Sachs is now predicting the Fed will not raise rates at all next week. The odds in the fed funds future market of a half-point rate hike went from 70% to 0%. The odds of a quarter point are back to 89%. And there is now an 11% chance in the futures market of no rate hike at all.

Those who believe the Fed capitulating here may inflame the inflation fire are wrongly presuming that the Fed was the cause of the inflation before and wrongly assuming they were the solution for the [supply-induced] inflation. They were neither.

I do not know what the Fed will or will not do next week, but I have said since the Fed tightening period began that I believed they would stop when they break something. I think they broke something.

Oh, and as for quantitative tightening, I think it is dead. Bank reserves were being challenged by QT and now are really being challenged by SVB. I simply don’t believe the Fed can go much further here without bringing reserves-to-liabilities to a place they do not want to go. The Fed’s tightening party may finally have seen the police show up at the front door.

I expect that after the immediate reaction to all that has transpired and will play out in the hours and days to come, we do face yet another intensification of banking sector regulation. Some, of course, may say, “good – after this incident, it is clear we need more!” Of course, a counter to that may be, “after this incident, shouldn’t we ask what good it has been, to begin with?” But as for implications to us as investors, I have a long-held view that regulation is a subsidy to the big and a penalty to the small. When you look at the size of the banking institutions in our portfolio, you will see why I believe this development will, for reasons I actually hate and detest, accrue to their benefit over time.

I believe where there will likely be more pain and scrutiny and trouble – not of the emotional or temperamental type like we see playing out in “noise” today – but in real fundamental erosion of solvency – is in any financial institution heavily linked to the crypto space. The amount of fraud, grift, corruption and just general lunacy adjacent to this shiny object seems to be bottomless thus far, and I do not think we are in the final innings of this implosion.

California’s tax revenue is another adjacent story to all of this. My friend, Louis Gave, a first-class economist and contrarian market thinker, pointed out that California’s tax base has been shrinking anyways. Seeing the implosion of one of its most distinctive banks and the massive ecosystem of mostly CA-based companies attached to it cannot be good for the CA-specific economy. Stay tuned for more commentary here.

To quote Rene Aninao of Corbu in his morning research report. With COVID, “the shock to markets was not the pandemic itself but rather the policy response.” Remember that line when you think about Silicon Valley Bank.

* * *

In a nutshell, while there is very little that has directly impacted us or any of our clients, the peripheral dynamics at play are all noteworthy: Enhanced equity volatility, potential buying opportunities in select financial names, a bond market rally, an anticipated hastening of the Fed’s inevitable policy pivot, a regulatory spigot that may be problematic, more crypto pain, and adjacent trouble for the state of California. I am sure there are more ramifications I could focus on, but I think this covers it for now.

If you have any particular questions or concerns, do not hesitate to reach out to your Private Wealth Advisor, and if any of you (including non-clients) have broad questions you’d like addressed, fire away here. I assure you that I am on the case as things continue to develop here, and we intend to stay in heavy communication throughout this bizarre chain of events. To that end, we work – communicating through the bizarre. This is the life I chose.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet