Dear Valued Clients and Friends,

I have always had a sort of unfair pet peeve with people talking about time moving either too fast or too slow. I think what I hate is the thoughtlessness of it – the sort of expected cliche when someone says, “Wow, this year has flown by.” For one thing, it can’t possibly feel that way for everybody, yet it seems like everybody says it. Plus, it oftentimes is just patently false – what people say they feel is the opposite of how I feel, and therefore I assume they must be wrong. I know, I know, but I already said it was unfair.

The first half of 2021 did not “zoom by” and it also has not “dragged on” – for me. There are moments I can look back on and say “that feels like it was years ago” and there are other moments (perhaps more of these) that I do feel came and went quickly. At the end of the day, the holidays and the turn of the year were about six months ago. That much I know is true.

As I do every year, I wrote a lengthy white paper between Christmas and the New Year to recap last year and to lay out our themes and perspectives for this year ahead. I prefer to wait for the next six months to do a deeper dive there, but I will check in this week on some of those perspectives.

But primarily what I want to do in this week’s Dividend Cafe is give you a look at what has transpired so far this calendar year, and why. Accurately knowing what happened in financial markets is useful – and not to be taken for granted (remember, “what you know that just ain’t so” can be dangerous stuff). But I really want to explain today why things have played out how they have, and from there offer up a viewpoint on the future.

It’s an actionable and practical Dividend Cafe this week, and just the perfect reading you need to launch your holiday weekend. And not just any holiday – the one that gave birth to this great nation. Our nation not only is the greatest nation on God’s green earth, but we remain home to the most robust capital markets in the history of the world.

May that never change.

Jump on into the Dividend Cafe …

Markets Recap

So here is what we know for the first half of 2021:

The S&P 500 was up +15% for the six-month period, the Dow was up nearly 14%, the Nasdaq was up nearly 13%, and the small-cap Russell 2000 was up over 17%.

Pretty big returns across equity markets, yes?

Some other noteworthy results:

Energy was the top-performing sector of the first half of 2021 (up over 45%). As oil was up over 53% this makes sense. But even midstream energy which is not as correlated to underlying commodity prices was up 42%. Financials were in second place up 26%. The worst performing sector was Utilities, which were up 2.4%, meaning all 11 sectors of the S&P 500 were positive for the six-month period.

The 10-year bond saw its yield go up 75 basis points YTD but was down 30 basis points in Q2.

International indices lagged U.S. markets with the developed EAFE index up 11% and the Emerging Markets index up 7%.

Going back to a year ago (June 2020), the last four quarters don’t look like a recession chart, do they?

*Strategas Research, Quarter in Charts, July 1, 2021, p. 3

Solid but not Historical

The +15% in the S&P 500 for the first half of the year was the 13th best of all time, impressive and respectable, but not barn-burning (I am not going to lie; I do not know where the expression “barnburner” came from, or why it applies here). 34 new closing highs in the market this year make it (a) An impressive demonstration of momentum and (b) Really sad for those people who on 33 prior occasions thought that an “all-time high” meant something bad.

Unpacking why markets have done so well

The three circumstances that have driven markets higher this year are reasonably simple, but nevertheless warrant reiteration:

(1) The vaccines (plural) came earlier than expected, they were more effective than expected, they stopped the spread of COVID dead in its tracks, they made child’s play of the so-called variants, and our distribution of the vaccine was a smashing success (relative to other countries, but also on an absolute basis). Bottom line – the markets knew last year COVID was less fatal than feared and had a more narrow vulnerable population than feared, but markets did not know when “it would all be over.” The vaccines (plural) accelerated that and therefore generated re-opening across the economy in a way that markets have loved.

(2) Accommodative monetary policy has created a combined effect of (a) re-accelerating earnings, during a (b) high valuation period for risk assets (as QE and ZIRP give substantial boost to market multiples).

And then (3) Profits … Impacted by #1 and #2, but on a stand-alone basis, profit expectations have risen, and with that, so have market prices.

Mother’s Milk of Markets

At the beginning of the year, profit expectations were for full-year profit growth of +23.3% (pretty huge). After two-quarters of profits beating expectations and guidance moving higher, full-year profit growth is now tracking to be +36.9%. This is the story of 2021 in stock prices.

*Strategas Research, Daily Macro Brief, July 1, 2021

This does move 2022’s profit growth expectations down – with early year expectations (and January 1, 2021 expectations for full-year 2022 profits were always going to be highly fallible) being +16.7%, but now are in the +12% vicinity. Earnings have grown at about +6% for seventy years, so this kind of compound annual growth is unfathomably bullish. Profit growth above historical levels usually will mean stock price growth above historical levels. That part is all pretty simple.

Historical Comparisons

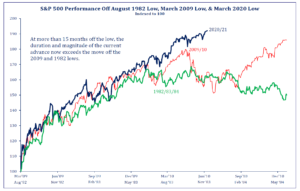

Historically speaking, this rally since the COVID bottom has now become superior to past recoveries. History never has to repeat itself exactly, and nothing about past corrections/recoveries speaks to this particular correction/recovery. But I will say this – one ought not enter the second half of this year believing an equity correction at some point is unlikely, let alone impossible.

*Strategas Research, Technical Strategy Report, July 1, 2021

Growth-Value Cage Match

Overall 2021 has been a year for value, but Q2 and particularly June were heavily tilted for growth – it’s just value had that much of a head start entering Q2. The Nasdaq’s +5.5% return in the last four weeks doubled its return for the whole year, providing a lot of catch-up for big tech and growth sectors of the market.

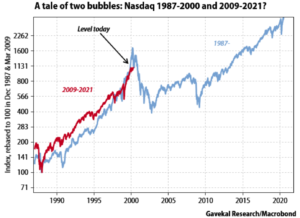

The problem with over-valued assets is that you never, ever, ever have the ability to say when over-valued assets will stop getting even more over-valued. One can believe (as I do) and be right (as I believe I am) that excesses eventually get priced away, that worthless assets eventually go to zero, and that reversion to the mean is a law of nature. But along the way, things happen. Such is life.

Inflation is coming!

Since the peak in bond yields:

- Bitcoin is down 40.6%

- Utilities are flat

- Consumer staples are only up 2%

- Growth outperformed value

Look, prices have moved higher in 2021. If that is all we needed to say, there would be no dispute. The problem is that things are not that simple. 2021 has presented a complicated picture around inflation realities.

(1) Many prices were hyper-distressed around the shutdown COVID realities of 2020 (base effect). so prices had to move higher as the economy began its inevitable (and robust) recovery

(2) This all has happened with a slew of supply disruptions around the globe as various parts of the supply chain have broken, experienced delays, run into transportation or storage or geopolitical problems, and of course, the whole semiconductor debacle which has had a profound trickle-down impact.

(3) It has also coincided with the third COVID “stimulus” bill that brought total government outlays in this arena to over $5 trillion. This spending onslaught and corresponding easy monetary policy has resulted in substantial additions to money supply and of course to national debt.

(4) And then, there are the inconvenient problems around bond yields … Namely, a ten-year yield that lingers around 1.45%.

The economy is going to grow 6-8% this year depending on who you ask in the snapback economic recovery that the vaccine and removal of COVID lockdowns have wrought. The ten-year moved to 1.8% back in March and many mysteriously took that as a sign of pending inflation. It has since retreated to below 1.5%. Well, I didn’t think a 1.8% yield was remotely indicative of inflation, so I certainly can’t see a (declining) yield of 1.45% as inflationary. But what do we make of all the above contrary indicators?

Inflation ad nauseum

The thoughtful argument for inflation is easy; the thoughtless arguments should be dismissed. We do not have inflation or see signs of huge inflation because of wild swings in certain commodity prices like lumber or increases in used car prices. Some of the people saying these things mean inflation know it isn’t true; some of them are just clueless. But those circumstances are extremely idiosyncratic and not useful in assessing broad inflation dynamics.

Rather, the thoughtful argument is that while many price signals now speak to “base effect” considerations and supply-chain disruptions, after these things do run their course ANCHORING will be in place and prices will remain sticky.

Now, that is NOT my view and I will attempt to dissuade you of it now, but it is absolutely a thoughtful and earnest argument.

Deflation ad nauseum

Why do I not believe prices will anchor to these higher levels that various circumstances have created?

Fundamentally, I do not believe excess government spending is inflationary; I believe it is deflationary. On this disagreement is the crux of the matter.

Look, a budget deficit that is 19% of GDP is downright frightening, and just a whisker away from the 20% deficits we ran in World War 2!! But after World War 2 – like, immediately after, we brought that down to 7%, and then 4%. So I ask you – who believes we will get our budget deficit from 19% of GDP to 6% of GDP with COVID gone?

I didn’t think so.

The reason I do not believe inflationary prices will “stick” is because I believe the long-term structural factors around our debt (and the monetary medicine we use to treat those factors) are deflationary.

We have had four debt bubbles in U.S. history pre-COVID and all four were deflationary or disinflationary (1838, 1873, 1929, and 2008). It is, of course, possible to believe that government debt creates more productivity, more business investment, and more growth. That is not my view. Therefore, the downward pressure of excessive debt on growth and productivity stifles reflationary efforts.

You add to that the impotence of monetary policy when interest rates are already at the zero bound (the critical price variable has been removed from the table), and inflation becomes harder for policymakers to create.

As the great Lacy Hunt has taught us, loans-to-deposits have collapsed in these conditions, and that has led to an all time low in the velocity of money, the primary ingredient necessary for inflation. Why has loan demand collapsed even with excess bank reserves through the roof? The good borrowers are already levered. Borrowers will not pay through the risk premium.

I want to be wrong. I want to see greater net national savings. You cannot get new investment without savings (investment is the savings that come from income). To get an improved standard of living you must have sustained growth of investment. How do you get growth of investment if you do not have an increase in national savings? You do not. How do you get an increase in national savings if government spending is eroding such? You do not.

What we now have is an asymmetric Fed monetary policy, where if they want to slow economic activity by tightening monetary policy, they can do so. But if they want to accelerate economic activity by loosening monetary policy, they cannot.

This is my deflationary case as we come out of the idiosyncratic moments of the day.

I have to stop doing that

I intended to write a few sentences about the inflation/deflation discussion and the next thing I know it is ten paragraphs. I can’t help it. It is the great debate of our day, and while I see it as a 2020’s matter (ten years), not a 2021 matter (one year), the reality is that so much of what happened in 2021 so far was based on expectations of structural inflation being priced into certain risk assets, and in my mind, this was done unwisely.

It’s the Yield Curve, Stupid

Much of the market action for stocks and bonds in 2H 2021 will come down to the yield curve. If the curve flattens further, I would expect a negative impact to stocks. If the curve widens back towards 150 basis points or higher (the spread between the two-year and the ten-year), that is likely bullish for financials, for cyclicals, and for the economy.

P.S. – No one is stupid for not knowing this. I just haven’t done a play on James Carville’s “it’s the economy, stupid” in a long time and it felt due.

Credit Warning

Investment Grade corporate bond spreads are 80 basis points above treasuries, pre-COVID lows. High yield spreads are only 300 basis points or so. Investors are being pushed out the risk curve to find yield, and while I see no surprise hitting here in 2H of 2021 (necessarily), this is always and forever a building risk that eventually does not end well. Credit investors must be selective.

*Strategas Research, Daily Macro Brief, July 2, 2021

Conclusions for the second half of the year:

(1) The pockets of excess and speculation that circle markets right now will see chickens come home to roost, in my opinion. Can I say that this will happen in 2H of 2021? I cannot. Can I say it will not? I definitely cannot. What I can say is that the world where fundamentals are laughed off as a relic, where valuations are said not to matter, where logic and reason and math are most lacking, these areas are not part of the investible universe at The Bahnsen Group. Would I include so-called meme stocks, the crypto world, speculative tech plays, and so forth and so on in this description? I would. It may run higher – I have seen a roulette wheel land on black 17 times in a row – but it is not what we will do as part of our stewardship of client capital.

I also have studied the 1989 Japanese bubble, the 2000 dot-com bubble, and the 2008 housing/credit bubble, immensely. Two of them I invested through, and all three I have studied vigorously. Two things I will say: All three were in a bubble for a long, long time before the bubble burst; and all three saw the bubble burst.

(2) The risk-reward trade-offs favor Value over Growth, but in different sectors than Q1 saw (i.e. consumer staples now versus energy then, etc.)

(3) The political risk has been so perversely over-stated for so long, it may take a lot for it to actually matter. But I do think unlike the bloviations of Q1 and Q2, some clarity on forward fiscal policy will work its way through the market in the second half of the year.

Chart of the Week

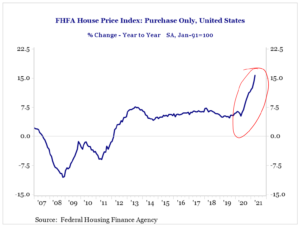

We spend so much time talking about stocks and bonds and financial assets, I’d hate to ignore one of the most significant dynamics playing out in markets today: Housing prices. Led by a real problem of under-supply and a real low cost of capital, the most levered asset on earth – one’s primary residence – has seen a rate of growth explosion in the last year.

We had extremely high birth rates ~30 years ago and so you expect high first-time homebuyers now. Demand being high and supply being low is creating a real upward price pressure that is killing affordability. In 2006 we built two million homes and only had 900,000 household formations (h/t Barry Habib). That over-supply then led to a ten-year+ hangover where new supply was under-built to deal with past excess. Now, household formations are higher (demographically), and supply is under-prepared.

The disconnection of prices from income growth is the stuff bubbles are made of. It has no impact for one simply buying a primary residence to live in with ample protective equity if things get dicey. Today, 87% of homeowners have a loan-to-value of 80% or less. In 2009, 26% of homeowners had a loan-to-value of greater than 100%. Equity. Always and forever, equity.

It’s where speculation comes in that one can start raising eyebrows. I haven’t seen a ton of spec excess – yet. But we will.

Quote of the Week

“We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness. That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed. “

~ Declaration of Independence, July 4, 1776

* * *

I do wish you and yours a very Happy Fourth of July weekend. I love this holiday, love my country, love our nation’s founding, love the experiment our founders have unleashed on civilization, and love the very practice of liberty.

These things ought to animate all of us. Happy Independence Day!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet