Dear Valued Clients and Friends,

Today I am going to do something an investment manager who writes about investing all the time ought to do more – I am going to talk about the market.

Now maybe you think I do that all the time, and you’d be right. But truth be told, my investment writing is very purposely peppered with the stuff I think most matters to investors – behavioral practices, monetary policy, evergreen principles, foundational truths. The markets are to be found in and through all of it, but in Dividend Cafe, I rarely am just saying, “Hey, here’s the skinny on the stock market.” I do plenty of that day by day in the DC Today (see below).

What I want to do in the Dividend Cafe today is just look at the overall stock market – why we feel the way we do about it, why most people offering a short-term point of view are totally full of it, and how we view the present environment. I believe you will find these insights counter-cultural, and that ought to pique your interest.

I want to make sure all of you reading Dividend Cafe (and enjoying it) are aware of our DC Today offering. At The DC Today, I write every Monday thru Thursday about that day in the markets, that day in the economy, key developments with public policy, housing, the Fed, and more. We keep those two lists (Dividend Cafe vs. The DC Today) separate from one another to respect the inboxes and wishes of subscribers. So if you are getting one and not the other, feel free to hit the subscription page here (click link and then hit this button):

Once you do, you will see this screen, and you can be signed up to one or both (I recommend) of the two offerings (the weekly Dividend Cafe and the daily DC Today) …

Just looking out for you!

Okay, let’s talk about the stock market, shall we?

What is your outlook for the stock market, Mr. Bahnsen?

When I first began getting invited to do financial media interviews six years ago, I was mystified by some of the questions. The general theme of each interview was either “what do you think about the market right now?” or else “what do you ‘like’ in the market right now?” The latter question had a certain cavalier feel to it – as if I might “like” a stock the way I “liked” Chinese food or USC football. And the former question was sort of a trap. Who would have their client capital and their own personal capital in a vehicle such as the stock market if they didn’t “like” it? But more importantly, didn’t “like” clearly apply a short-term view on a long-term asset in this context?

And in this point is the heart of the matter … My answer to this question is terrible television, but absolutely stellar fiduciary advice:

I don’t have a short-term view of the market, and neither should anyone else, and I don’t need one because I only want to use the stock market as a financial solution for long-term goals.

You can imagine how much the networks would like to unpack that one!

Now, plenty of people trade. Plenty of people have fun with this stuff. And if someone gets a one-week call right, they can make some money, and if someone gets a short-term call wrong, they can get hit. It’s fine. Have at it. But it is not what we do, it is not what we will ever do, and it really is not what any amateur investor does for long because eventually, the losses outpace the gains, and they throw in the towel. Is that because they lack talent? No. It is because they are trying to do something that cannot be done.

There is a cottage industry of mostly not-very-financially-comfortable people trying to tell you how much money you can make in short-term market speculation. There are two possibilities here … (1) They haven’t implemented their own wisdom very well, or (2) They have an intense desire to “serve” you, with the cost of a $39 DVD or subscription or some other ghastly atrocity against human intelligence.

The most successful of market investors have a market philosophy, and philosophies are not affirmed or disproven in short-term prognostication.

So buy and hold?

I have an apparently contradictory view on the “buy and hold” subject – but it is only apparently contradictory – not actually contradictory. I essentially agree with Warren Buffett’s dictum that the right time to sell a company is never. Yet we do sell companies (so does he!), and we do trim position sizes. So what do I mean that ideally, we wouldn’t ever sell?

First of all, we at The Bahnsen Group are referring to companies – not the stock market. A view of “the aggregate indexed price performance of 500+ publicly traded companies” is – BY DEFINITION – a view of (a) Price multiples (will they go higher or lower), and (b) Earnings. One can formulate a view of earnings across an entire index, but that is not too hard to do. What makes a market is one’s view of VALUATION. I have no interest in doing this. I can’t do it. No one can. And yet, having a view of the VALUATION (the P/E ratio – the amount investors are willing to pay for a claim on an earnings stream) is essentially what drives market returns in shorter horizons.

So let me make this simple for index investors and then bring it back to TBG’s philosophy on this stuff:

A long-term “buy and hold” index investor is placing an investment on growing earnings across a wide array of publicly traded companies over a long period of time. That strikes me as a good bet in a free society.

The return that long-term investor gets will mathematically be impacted (sometimes marginally, sometimes substantially) by the valuation they are paying when they enter the market.

But ultimately, a long-term buy-and-hold bet on growing profits is usually a good bet because companies are good at generating profits when allowed to innovate and do what mankind has done for many centuries.

But, when someone is not a long-term buy-and-hold investor, their “index” or “market” calls in shorter windows are more likely actions taken on valuation projections. They may not be aware this is what they are doing, but that is essentially what will determine the success or failure of the strategy – did they buy at 16x earnings and get out at 20x earnings, etc.

Our view is company-specific – it is not a “market call.” If we had a long-term market call (we do), it is that profits will grow over time. If we had a short-term market call (we don’t), it is that no one knows what will tick P/E ratios up or down in short windows of time. NO ONE.

But with individual companies, we are somewhat removed from the aggregate price action of 500+ companies. Now, if the profit levels of a whole index were collapsing, how likely is it that our 25-30 companies would see their profits soaring? Not super likely. And if P/E ratios are dropping across an index, they might be struggling with a more actively selected basket of individual stocks, too.

But that is not my point.

What we are buying

When we buy (and hold, or not) individual companies, we are looking to avoid over-paying for that company, but agnostic about the market’s multiple. We are focused on the company’s profit-making capacity but agnostic about overall market earnings in aggregate.

We want to buy a real company, with an underlying business we understand, with management we believe in, that has the financial metrics we care about (balance sheet, cash flows, debt profile, etc.).

And yes, we want companies with all those attractive fundamentals and then tack on to their well-run businesses a commitment to rewarding shareholders with cash. That dividend growth both reveals and creates a good investment for us.

But we can stay off of my dividend growth obsession for a moment (I only recommend doing this for a moment). My point is that having an outlook on a company is not the same as having an outlook on a market.

The latter is really about aggregated earnings and valuations. The former is really nuanced – really involved – really in-depth – and really important. Company investing makes you an equity shareholder in a business (and yes, that business will have up and down periods throughout time, like any business). Index/market investing makes you a participant in the broad multiple expansion of a whole market.

I bring this up not to make an argument for the knowledge and process that goes into company investing versus index investing, but rather to explain why one’s “opinion on the market” may be (and is for us) very irrelevant to how their portfolio is or should be positioned.

So why sell?

The reason I say the ideal time to sell a company is never is because, ideally, I would love all my companies to grow their earnings forever, grow their profit distributions forever, and never face impediments to this execution. But sometimes, companies face extrinsic enemies. Sometimes business models change. Sometimes a good CEO is replaced by a bad CEO. Sometimes the decision is made to lever your balance sheet to Mars to buy entertainment content that doesn’t serve your underlying telephone and broadband business. Sometimes you lever up your balance sheet with toxic mortgages and almost destroy your financial firm. Sometimes you have an oil spill in the Gulf of Mexico and face intense pressure from politicians to cut your dividend. Sometimes you face a year of mechanical pressures on your assembly line, and then the world enters a travel-free global pandemic. Sometimes your cash flow keeps growing, but your willingness to share it dissipates, raising the risk to shareholders.

I could go through every single stock we ever sold – the point is that all things being equal, we have a strong bias towards low turnover, and yet a willingness and need to act and change if the facts change.

So can you please, please take note of something I did not say? I did not say that we look to sell at a bad quarter. I did not say that we look to sell at each movement in a company’s P/E ratio. I did not say that we look to guess at what the stock price will do quarter by quarter. All of these things drive sale activity in the market for most people all the time. Not for us. Not ever. It’s insane. It’s pedestrian. It’s dangerous.

We buy companies with a thesis, and we sell when that thesis becomes severely challenged. That is our “buy and hold” strategy.

Back to the market

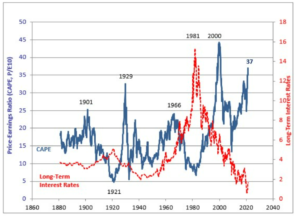

I think the Shiller PE is a pretty stupid valuation metric, all things considered. I think trying to cyclically adjust for a price-earnings ratio is fine, in theory. Still, in practice, it has led to the appearance of an over-valued market most of recorded history. That strikes me as unhelpful.

All that said, on a relative basis alone – meaning, comparing his own metric now to his own metric in past periods, it is now at the second-highest level in history.

*Shiller PE. Wealth of Common Sense, July 9, 2021

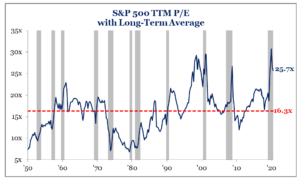

In more traditional and less controversial metrics, the numbers tell a very similar story. The TRAILING 12 months P/E ratio is over 25x right now, vs. a historical 16x level. Do I think that is expensive? Yes, of course. Do I think it is a useful timing vehicle? Not even a little bit.

*Strategas Research, Daily Macro Brief, July 7, 2021

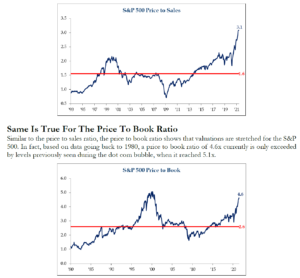

The price-to-sales ratios and price-to-book value ratios tell a similar story – a significant premium to historical valuations:

*Strategas Research, Daily Macro Brief, July 7, 2021

Demand

I do not know how long people will like stocks vs. other assets. I do not know how long risk appetite will stay high. I do not know how long the demand for stocks will drive or sustain prices.

I can only know the business execution and cash-generating capacity of my individual companies. That has to be our approach.

History and Logic

A really sincere long-term buy-and-hold investor right now who won’t be in a position to add new money to the portfolio in the future would be entering the “market” (the “index”) at elevated valuations right now. Over time, their investment in growing profits of 500+ diversified companies would probably see those profits grow. The valuation level starting high may impact the rate of return to sub-historical achievements, but it may not.

Telling it like it is

However, what someone is asking about right now is usually not “long-term” in focus. It is, “if I buy stocks now, will they be higher in a few months; because if not, why not just wait and buy when they are cheaper?”

That’s what people want to know.

I don’t know what to say. Consider the following:

(1) Bond yields are so, so, so, so low that it makes equities more attractive than bonds for many investors. But …

(2) Bond yields (and interest rates overall) are heavily impacted by the Fed. Those things can change. They can be distorted. There isn’t a great scale to measure one’s weight right now.

(3) Generally, bear markets come out of recession, and a post-COVID recession seems very unlikely right now. But “corrections” can come ANY TIME, and for ANY REASON.

(4) From a risk management standpoint, historically, if things got really bad (a bubble bursting, a recession, a terrorist attack, a global pandemic), the Fed became the nurse for markets and used the medicine of lowering rates and quantitative easing and other such things to treat the patient. If something bad happened now, what medicine does the nurse have in the medicine cabinet?

(5) The signs of a blow-off top coming where we have a real market implosion are simply not there right now, yet. Flows into equities are not extreme. Euphoria is present in pockets but absent in others. All of these things can change, and I certainly think there is more vulnerability in some spaces than others, but we don’t have that “my taxi driver told me to buy Pets.com” thing going on right now. Well, not totally.

Conclusion

There is plenty to wonder about in the short term. There is plenty that could surprise us and embarrass us as well. Upside. Downside. It can shock you either way. I would be adding money to equities right now, fully prepared for a correction and fully prepared for a rally. Either can happen.

But one does themselves a world of good when all of this becomes the horse manure that it really is in their investment practices. The purchase of good companies with growing free cash flow is not impacted by entry levels the way index timing is. The purchase of good companies that will give you more shares at the then-current price of their stock every quarter going forward allows your interests to benefit from market declines.

If only one can keep the temperament to allow this to happen.

How’s that for counter-cultural?

Chart of the Week

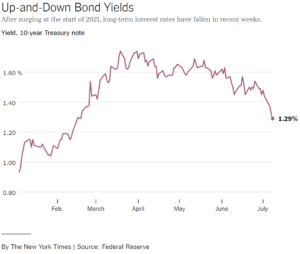

The 10-year bond yield hit 1.8% in March. It hit 1.25% this week. The message to me is not to worry or not to worry … it is to get right what you are worried and not worried about. For me, I am worried about low growth. I am not worried about inflation.

Quote of the Week

“People mock how much short-term thinking there is in the financial industry, and they should. But I also get it: The reason so many financial professionals stray towards short-termism is because it’s the only way to run a viable business when customers flee at the first sign of trouble. But the reason customers flee is because [investment advisors] have done such a poor job communicating how investing works, what their strategy is, what they should expect as an investor, and how to deal with inevitable volatility and cyclicality.”

~ Morgan Housel

* * *

Next week we will talk about the next generational opportunity. It isn’t a market call. It’s the reality of economics. I’ll leave you in suspense.

Stay dry. Stay cool. Stay comfortable. And stay in peace. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet