Dear Valued Clients and Friends,

We are going to do something a little different today in the Dividend Cafe, or at least different from what I normally like to do. While “current conditions” are less interesting to me in the Dividend Cafe, various macro themes and long-term trends represent the focus of this weekly missive. That said, every now and then, the news cycle and state of affairs in financial markets warrant a little “refresher,” and that is what today’s Dividend Cafe will be.

Come for the debt ceiling talk; stay for the first principles. Perk up your ears around election talk; tune in (or out) on recession chatter. We have all the things today – even the things I hate talking about most. It’s a “lay of the land” Dividend Cafe … Jump on in!

|

Subscribe on |

All the things that matter

I really do try to give you “the lay of the land” each day in the DC Today. If a CPI number comes on a Tuesday, I cover it that day. If the Treasury Department were to announce plans to print a $1 trillion dollar bill, I would discuss that day. On those days that the market has a big sell-off (or rally), I usually give you the play-by-play that very day.

And I am almost always conflicted when I do so because I am essentially covering in real-time the various events (and often “noise”) that I assert have nothing – nothing – to do with your long-term financial success. Whatever the various things are that will impact your portfolio between now and the end of your life, and we do already know this: there will be things that impact your portfolio between now and the end of your life. My view is, and has always been, that what those exact things mean much less to your financial outcomes than how you respond to what those things may be. Responses driven by fear or greed are detrimental; responses rooted in poise and discipline win. Period. It’s really that simple. Now, this presupposes that the right plan is in place (the “right plan” is what we do at TBG), but yes, the right plan ought not to be altered by the noise of markets or the inevitable volatility of our temperament and emotions.

Not as hypocritical as it seems

So if no plan-altering portfolio adjustment is warranted by what Speaker McCarthy says one day or Elon Musk tweets another day, why cover it at all? If the Fed’s rate move last month is not going to change my life in 10 years, why mention it for three days in a row? Candidly, it’s a fair question.

I made a decision during the early moments of the Great Financial Crisis to communicate heavily with clients. First of all, that moment did feel quite existential (housing, credit, banks, government, the global financial system, etc.) – so all 20/20 hindsight and market recovery not withstanding, the week of September 16, 2008, when this weekly communique started was not exactly an “oh just turn off the TV and enjoy some Netflix” kind of week, you know? But I also observed something in a huge preponderance of the people in my profession in that period: They didn’t communicate with clients because they were as scared or more scared than their clients were, and they know no more or maybe less than their clients did about what the &*^% was going on.

I may believe that the most important variable for investor success is behavior and temperament, but I still have a point of view. Our entire firm has been built off of a strong worldview, and we root our activity (and inactivity) in a thoughtful perspective and foundation. I was so blown away by the lack of intellectual foundation in my “competitors” (colleagues and peers engaged in the business of financial advice) that I knew – knew to the core of my being – that I had to be different. I had to communicate early and often, and do so because I really did have a point of view, and I was not going to hide under my desk as I saw so many around me doing.

Week by week and day by day over these last fifteen years there have been meaningful things happened in economic history (TARP, QE, Euro crisis, 2011 sequester, China devaluation, Brexit, Trump tax cuts, trade war, COVID, Fed tightening, etc.) – but there have been a lot, and I mean a lot of things that no one has any memory of whatsoever, yet at the time were the be all and end all of the financial news cycles. Such is life. Separating news from noise sometimes takes time and always takes clear eyes and deep breaths. Always.

But the purpose in covering the day-by-day, knowing most of it is more noise than news – more drama than substance – is that I do not expect our clients to stick to their plans if they do not trust us – if they do not know that we stay engaged in the day to day reality of markets so they don’t have to. They can have as much daily or weekly engagement as they want, at varying degrees of cerebral interest and emotional attachment, and it is all okay. We have the wheel no matter what, but we lean into more information and perspective, not less, as long as it is never used to justify an activity that is counter-productive or even destructive.

Cutting to the chase

In 2040 I do not think anyone will remember the debt ceiling debate of 2023. To be honest, I am not totally sure anyone will remember it by the time the next episode of Top Chef comes out, but maybe that is an exaggeration (maybe). Yet right now, we have a number of things that linger which certainly matter for markets in the short term and which warrant our commentary – not because we are disrupting any plans any time soon – but because it all feeds our process, perspective, and strategy, and we prefer to share all of that early and often. And since our offices are all our own now, we no longer have to trip over people hiding under their desks to get to the “send” button.

So here are a few things to scratch the itches of the current lay of the land:

(1) The #1 financial markets story right now appears to me to be what happens in the tension between Fed policy and economic outcome.

One prediction is that the Fed breaks something, the economy goes into recession (or some form of contraction), and then the Fed starts easing. This is what seems to be priced into the yield curve and fed funds futures.

Another prediction is that the Fed does not break something, they do not ease monetary conditions, and rates stay high but without a recession for the foreseeable future.

And then the third major camp is that the Fed “sticks the landing” – they begin easing monetary policy, yet without a spike in unemployment or a credit/financial disaster that does great damage. You can call this the Goldilocks camp, and it has a growing number of proponents.

We at The Bahnsen Group believe it will either be option 1, 2, or 3 of these three options. =) (hey, having perspective does not mean you sacrifice humility)

(2) Debt ceiling drama. I think you know that my view is that the United States is not going to default on an interest or principal payment of its debt. I fully expect Presidential candidates to say dumb things along the way and for the political drama to be incoherent and frustrating. I also expect it to end. And then move on. One way or the other. In this case, I expect there will be concessions from the White House to the Republicans, but less than they have asked for, and that the debt ceiling will be extended to get everyone past the election. Eventually.

(3) Bank contagion. I believe the fundamentals of the still-standing regional banks are good enough that this saga can end, and I believe they are vulnerable enough that this thing can spread more. The nudge, one way or the other, is entirely driven by confidence. Fractional reserve banking is a self-fulfilling prophecy. My guess is one more bank does go down before this saga ends, but I wouldn’t take action around that guess. And my guess is that the next one will be the last one. This is all a question of will.

What to do?

In this environment, it is very important not to make an investment decision that depends on guessing an unguessable outcome. Anti-fragility means benefitting from difficult periods, and we believe various levels of market volatility (regardless of what causes it) benefit the cause and outcome of the dividend growth investor. We want to do smart due diligence on alternative and private market managers. We want to be well-positioned in the yield curve for bond portfolios. We want our growth enhancements to be more emerging markets and small-cap oriented than FAANG oriented. We want to acknowledge where expensive strategies have gotten more expensive and how much people are praying they get more expensive still (and avoid it). We want to refrain from ponzi-like investing (pursuit of returns that can only come if others believe). We want to have credit risk but not over-do it. And we want to be reasonably contrarian.

Dividend Growth contrarians make for good investors, whether or not they like reading our content.

What shall we cover next?

There are so many topics on my “to-do list” for Dividend Cafe these days I sometimes have a hard time getting started. I have a vision for a future Dividend Cafe on all these topics:

- U.S.-China relations, policy, and global economic implications

- The need for U.S. capex (capital expenditures) and what it means for the next phase of the economic cycle

- Venture capital – outlook and state of affairs

- A refresher on boom/bust cycles

- A vision for future U.S. energy policy (with special consideration for the China-Saudi alliance clearly forming)

- Onshoring/re-shoring/near-shoring and the future of trade and manufacturing

- The economic/market implications of artificial intelligence and automation

- More on the state of regional banking

- Is Japan investible?

For what it’s worth, I’m happy to hear your input on which topic(s) on that list (and others on your mind) most interest you at this juncture!

Chart of the Week

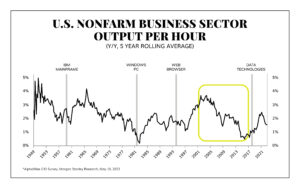

All of the talk about tech’s impact on productivity got me thinking. Is it really true that things like the mainframe, windows, the browser, and now AI are all catalysts for big increases in productivity? Well, this week’s chart would suggest that the answer is yes – at first. But what we clearly see in the data is that after technological catalysts, we see an increase in output, followed by a strong decrease. I have long-concluded that this is not because technology does not increase our capacity for productivity – it obviously does (intuitively and empirically, we know this to be true). However, I believe it evolves into a “do the same with more” mentality rather than a “do more with more” mentality. Put differently; tech productivity means people can work less for the same productivity. Some may celebrate this, actually. I don’t.

Quote of the Week

“Comparison is the thief of joy.”

~ Teddy Roosevelt

* * *

It is time to submit and get ready for a weekend of book-writing. I will be in the California office the first half of next week, then the New York office the second half of the week, then the Nashville office the week after that. Earnings season is complete, and markets are cursed with the boredom of being captivated by debt ceiling talks and regional bank failures – yawn! Well, even if it is more exciting than you want it to be, the fascinating tension between markets and the economy – between fears of “too hot” (high rates) and fears of “recession” (low rates) – is alive and well.

Our focus remains the same. Poise, discipline, and dividend growth. To these ends, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet