Dear Valued Clients and Friends,

Everybody is aware of the challenges that have surfaced in regional banks this year and the fears that such problems will become more contagious in other banks as well (other regionals, smaller banks, community banks, etc.). I am not sure that the reasons for the challenges are fully understood, and that is partially because, in the immediate aftermath of the Silicon Valley Bank failure, some may have been quick to find a simplistic explanation that confirmed their priors as opposed to the more nuanced and multi-faceted explanations that were probably more accurate and helpful.

Regardless of how the three bank failures of 2023 came to be and how people have thought about or processed those failures since they occurred, there are forward-looking questions that many are asking. The answers to these questions have ramifications for three different categories of economic actors. And those three categories around the future of banks, systemic risk, and general real estate investing in our country (amongst other things) are the subject of today’s Dividend Cafe.

If you aren’t tantalized yet, you will be. Jump on into the Dividend Cafe …

|

Subscribe on |

Banking 101

At the most basic of levels, banking as an industry and economic activity exists to capture a spread between borrowing short and lending long. Period. There are a whole bunch of reasons that are not fully true, but it is true enough for our purposes, and I want to unpack it all for you.

First of all, one could easily say, “No, that can’t be the purpose of banking because I need a bank and want a bank and use a bank and don’t care at all about borrowing money from the bank,” and that would mean the borrow short, lend long part is only half true for that banking customer (they are lending the bank money short term through their deposits but borrowing long term for a car loan or mortgage loan, etc.). But it is fully true for the bank, who is borrowing short from that depositor and lending long to others. This is basic fractional reserve banking in that the short borrowings are believed to be their long-term and are well-diversified, so some multiple of those deposits can be lent out to others without concern. And so if banks are borrowing with low or no interest expense (paying depositors X, which may be close to 0%), all the while lending out at 3% or 5% or whatever, that basic spread becomes the business model of banks to make a profit, and it becomes the societal tool for how credit is extended to borrowers, a vital component of economic growth.

Jimmy Stewart is on the line

But there is a risk for liquidity because some depositors may ask for their amounts of money back, and the bank has lent out more than the amount of dollars they have taken in. That is why banks are required to keep their own capital in the bank at a level that satisfies regulators. The idea is to have deposits that can be lent out (and then some) with a capital cushion in case an unusual level of deposit withdrawals happens or an unusual amount of defaults (on the loans the banks made) happens. The more risky loans a bank makes that might experience defaults, the more capital they will want to have on hand as a protective buffer for their depositors.

Of course, nothing is fool-proof, and some banks could experience a perfect storm of bad loans and/or deposit withdrawals, so Congress approved a Federal Deposit Insurance Commission (FDIC) to “insure” depositors so as to give banking customers the peace of mind that their bank will be there to make good should bad times come. That insurance is funded by premiums paid by banks, and the coverage is “capped” per depositor (250k, per bank, since 2008),

The general sequence that goes back to the famous Christmas classic, It’s a Wonderful Life, is that a bank does something with the money borrowed short (deposits) that impairs capital (bad loans, etc.). People get word of it and start demanding their money back, and if that panic metastasized, the “run on the bank” depletes the bank’s deposit base and eventually its capital, and voila, the bank fails.

The three things banks can do to never let that happen are:

(1) Not make bad loans

(2) Keep depositors from pulling too much money out

(3) Have abundant amounts of capital on hand as a cushion for additional funding

Easy, right?

There’s No Free Lunch

As a certain book that is selling very well in South Korea discusses, there are trade-offs in economics.

#1, 2, and 3 above are all solvable for every bank in the country, sort of.

No loans means no defaults and no bad loans means no credit risk. But no loans also means no profit, so that doesn’t work. And while we are about to talk about bad loans and credit risk, I would just point out that this is NOT what did in Silicon Valley Bank or First Republic Bank! But a bank can always turn the risk dial down by doing fewer loans and/or safer loans, and they can always turn the profit dial-up by doing more loans and riskier loans. It isn’t like this is a black-and-white proposition.

The deposit stability lever is a tad more complicated. In theory, a bank keeps depositors with great service, with a cool app, with mobile banking, with other services, by lending at favorable terms, by assuming inertia will stay strong, etc. In some cases, they can retain (or lure) deposits by paying out an attractive deposit rate, but of course, that cuts into profits as well.

And the third and final is the one regulators went to post-financial crisis – more capital. Banks now have to have certain levels of “tier one regulatory capital” to provide reasonable assurances that the bank has the capital if they face an economic downturn or credit impairment, etc. Are banks were very under-capitalized in 2008. Some are over-capitalized now. Nearly all are “adequately capitalized.”

But not those three that went under, you say. Well, actually, there’s more.

I did say there would be math

If a bank has $90 billion of loans it has extended, and $70 billion of deposits it has taken in, and $10 billion of its own capital invested in treasury bonds on this fictitious balance sheet, it has legit assets of $30 billion ($100 billion of assets it owns versus $70 billion of money it owes). Pretty good, right? But, if the market value of those $90 billion of loans goes down to $75 billion because they were given out at lower rates and market rates are now higher, and the $10 billion of their own capital goes to $8 billion because of the market value of their own assets, they now have $83 billion of assets and $70 billion of liabilities. Still solvent at $13 billion, but tighter. Now assume $15 billion of deposits are withdrawn because of this. Oops. It isn’t there.

BUT there is POSITIVE net worth!! (the assets would be $83 billion, and the liabilities would be $55 billion) – it is just that there is no liquidity to meet those withdrawals. Here comes the FDIC. Here comes CNBC on Sunday afternoon. And here comes the Congressional hearings on why it is all someone’s fault. Rinse and repeat.

But in this case, we had a LIQUIDITY crisis. The “value” was theoretically there, but the FUNDING was dependent on depositors, and in this hypothetical, a certain number pulled funds out, and it put the bank’s liquidity upside down.

So you can have more and more capital to handle, but then that bank becomes a worse and worse investment (so much capital getting tied up at a Return on Equity of what, 3%? 4%? 5%). No, thank you.

Depositor difficulties

How can you keep depositors happy and stable and non-vulnerable forever?

You can be so darn big that the level of withdrawals and the level of bank capital is just impenetrable.

You can be so good at banking that no one ever leaves you – loyalty, flirting with that local teller, a mobile app you are in love with, reward points on debit cards (oops – Dodd-Frank took that away), or whatever else bankers have done forever to keep relationships steady – but here’s the thing: you can’t really know for sure. You try, and the reason we basically have almost no bank failures in our country is that our deposit system IS loyal, it IS sticky, and our banks ARE capitalized. There are exceptions to the rule, but the rule has been pretty darn good here.

So what’s the problem?

The banks become more dependent on their depositors, who these days seem less dependable than ever when they have fewer loans providing their profits. And that includes less risky loans. Rock solid, safe loans at 3% are great, but a little juicier loan book with occasional but rare defaults at 6% is way, way better. But in a post-2008 world, what banks want this headache? Well, not many. Underwriting at banks is not done to take on real losses. Even foreclosed real estate is supposed to have recourse or protective equity that establishes the bank back to a zero position. Losses eat away at the capital base and become existential.

No real problems here post-2008 – banks are not doing risky lending that is blowing them up.

So how is the economy running?

If we achieved a more stable banking system since 2008 by having them get out of the business of risky loans, by having them do less loans, and by having them keep more capital on hand (hurting returns), how has anything gotten done at all? Our economy requires credit for businesses to borrow, for people to buy cars and houses, and for new inventions and inventories and ideas and expansions to take place. I am describing a banking situation where post-crisis, we needed less credit risk, and post-2023, we need fewer depositors (and interest rate risk) because we need banks not to fail. And yet, we also need credit to flow. So what do we do?

Risk and Liquidity and Door #3

Well, what if a whole bunch of loans were still being given, but they were funded by something other than depositors who MIGHT pull their money out? What if all of that liquidity risk went away? What if private investors funded borrowing needs and COULD NOT ask for their money back the way that John and Jane Doe presently can by hitting one button on their stupid app?

We have lent money to great borrowers who have built great buildings and are collecting great rents, and yet the money used to fund the loan was from depositors who can hit a button online and pull the funding. And then, the liquidity trap described above comes. It doesn’t look like Jimmy Stewart 1934, but the 2023 version is still a problem. LONG LOANS with SHORT FUNDING. It is a problem (systemically). As a financial system, we do not want banks failing (innocent people who took no risk being asked to take losses) and we do not want a phobia of credit and risk-taking.

We need to solve for the liquidity problem.

And I think we have it right in front of us.

Some Like it Private

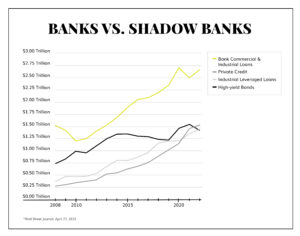

Trillions of dollars have been extended from non-bank lenders since the financial crisis began. The growth of direct lending (funded by investors) to middle markets borrowers has been substantial. The CMBS and RMBS marketplaces have become a huge part of mortgage lending in both commercial and residential lending (more to come below on this in the commercial real estate world).

Private credit assets have grown by +26% per year in the last five years. That is, money lent outside the banking system and outside of the bond market. Even companies with less than $50 million of EBITDA have grown their use of private credit by +9% per year for the last five years.

Banks have the largest amount of loans extended but the slowest growth of market share, by far. Each category of non-bank lending is outpacing bank loan growth by far. All of this is trending in the right direction if you buy what I am about to say.

It is already in motion

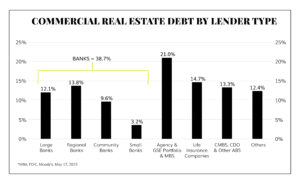

Note how commercial banks are already well less than half of commercial real estate lending in our country. And in fact, “big banks” are barely 10% of that market! About 27% is a combination of small/regional/community banks because there is a distinct advantage in “local” knowledge when it comes to “local” commercial projects. But even then, between the structured credit market, institutional investors such as insurance companies and CDO’s, and other private lenders, the need for banks to lend on the industrial, multi-family, office, retail, health care, storage, and hospitality projects of our economy is way, way down.

*Strategas Research, Daily Macro Brief, May 17, 2023

More lending without a need for liquidity is a good thing

Investors who invest in a loan fund do not need their money back right away or can be told they do not get their money back right away. Depositors can hit a button on their app and move from one bank to another. The more credit we have going from:

(a) Those who can’t demand their money back at any time, and

(b) Those who can (and should) absorb losses

… the better

How do commercial banks now pay their bills?

This is a pretty astute question. One thing I always admire when someone talks about how high of an interest rate they are getting paid on their deposit account or how low of an interest rate they are paying to borrow money is how easy it is in our banking system to not have to worry or care or think about how your bank stays in business. And truly, you don’t care. You care that they stay in business, but not how. That’s their problem, right? Of course, it is – I get it.

But here’s the thing – no one likes fees, no one likes low deposit rates paid to them, no one wants to borrow at a high rate, and everyone wants the very best apps, tech, services, and all the things. I get it.

But banks make money from some of these things until they don’t. We simply have a business model for banks right now that is not good for the banks but seems great for banking customers.

So sell the banks??

If the pure investment thesis for a publicly traded bank you own is the mere profit stream that comes with being a deposit-taking institution with a very modest/conservative loan book (likely in asset-secured residential lending with a small commercial lending practice as well), then yes, I wouldn’t say this will be the most exciting growth engine going forward. You either have the risk of a credit lending book that has not really been en vogue for fifteen years for banks, or the interest rate and depository risk of a regular bank, or you have those risks solved for but with just very little path to, you know, make money (or at least make it with a multiple that is remotely attractive in public markets).

But are there some banks that are not really banks – you know – that are actually well-run supermarkets that combine a lot of the capital markets fun, securities business, research and equities, insurance, credit cards, global trading, investment banking, and a host of other things that make it more of a Wall Street firm than a commercial bank (i.e., depository institution with a residential lending arm)? Well, there are. Now several of them, we think, were stripped of their great franchises and capacity for growth and attractive profits in their survival efforts of 2008. But there may be a major and a super-regional out there that buck the trend entirely of “boring banking.” Those rare cases are real apples to oranges, in what I am talking about here.

For the love of God, remember this!!!!

There will be credit losses in the world of non-bank lending. Whether it is structured credit or direct lending or what have you, businesses that are lent to, people that are lent to, buildings that are lent on, or whatever the case may be – backed as they may be by assets, or cash flows, or something – there will from time to time be losses. The history of various aspects of credit investing suggests that when excessive leverage is avoided, when there is good recovery even in defaults, and when there is some semblance of respectable underwriting – that losses in a diversified credit strategy can be quite minimal. But at some point, if losses materialize, it is absolutely crucial that no one ever, ever, ever, ever whisper the idea that this is a systemic risk. Because it is not. Investors (risk-takers) may lose money. They are trying to make 6-10% in a 3-4% world, so they have to accept the possibility of losses. That is how this deal works, my friends. So people who are willing and capable of absorbing losses get to make more money if things go well, and they get to absorb those losses when things don’t.

We don’t have that luxury as a society if credit extension is largely concentrated where Grandma’s retirement funds are, or the payroll account of the local YMCA is. We don’t have that luxury of knowing where the too-big-to-fail banks are. We don’t have that luxury where regular depositors are just trying to access their ATM machine for tip money for the valet. To my libertarian friends screaming, “No! let them all eat losses, too!” – I get it. That sounds lovely. But just one thing – it. will. never. happen. so, just. stop. They are never, ever, ever going to let systemic, societal risk spread like contagion. The nature of financial panics is too costly socially, economically, societally, and, yes, politically.

Let investors take risk. Let competent asset managers extend credit. Let losses be absorbed by those who can bear them. And let profits come to those who know they might take losses. And let banks hold deposits and receive their net interest margin with the Fed, with a conservative loan book, with less leverage, and with strong service. (And to be honest, let them charge a few fees here and there for the work they do).

All or nothing?

I am not suggesting all banks get out of the lending business. I am suggesting that a greater market share of lending moving to non-bank lenders (investor-driven) makes the banks safer (but less profitable) and makes for more opportunity (not less) in credit. I believe a less robust loan book for banks is inevitable, even if not great for banks, as the credit (2008) and liquidity (2023) reality of the banking model has issues. We need profitable banks because we need depository institutions, and yes, some bank lending is a good thing. We do not have a systemic bank collapse problem. But if we are going to keep fractional reserve banking in our country, which I assure you we are, I think “leaning in” to more credit from more private lenders will be a good thing. And more banks doing more local customer service with more relationship building and, unfortunately, fewer profits will prove to be a new business reality. Not “no lending” – but less. That is my guess. And yet, the solution is right in front of us.

Conclusion

The really fascinating (and verbose) Matt Levine of Bloomberg has begun writing about this idea of private credit being the market-based solution to an assets/liabilities mismatch at commercial banks. I have, of course, had this theme for many years in the context of credit (commercial banks don’t, can’t, and shouldn’t have the credit profile to lend at the level our credit-driven society requires). From liquidity mismatch to credit risk, we basically have two glaring reasons why non-banks are going to be the bigger lenders in our economy going forward (versus the banks), and I say that as a good thing. What I didn’t say is that there would no longer be losses. There will be, or at least I hope there will be. If there are no losses, there was no risk and if an economy without risk is an economy without growth. It is a society that dies a slow, painful death. We want risk. We need risk.

We just want risk-takers to take the pain when things are bad. And then we better stop getting mad at risk-takers who reap the rewards when things are good.

Somewhere in all of this is the right solution for fractional reserve banking, for regional banks, for credit needs, for investors, and more. Unfortunately, the question is how much work will be done by some to try and screw it all up.

Quote of the Week

“A committee moves at the speed of its least informed member, and is a way to share irresponsibility.”

~ Ralph Cordiner

* * *

I am in New York City working away and in our Nashville office all of next week. May your weekends be sunny, bright, warm, and lovely. And reach out with questions any time. We love answering them, and hopefully, through this dialogue, bringing about more trust and more confidence towards the better achievement of more objectives. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet