Dear Valued Clients and Friends,

Everything is about the Fed, bond yields, and inflation right now. Sometimes I mean that as if I am describing what really does matter, and other times I am just describing what “all the rage” is about. “Everything is about” may mean what “everything is about,” or it may mean what “everyone is talking about.” In this case, we have the weirdest of circumstances where “everyone” is talking about the right thing, but doing so in the wrong way. Allow me to break through some of the ambiguity.

On a daily basis you will find media reports expressing shock and awe about a 10-year Treasury bond at 1.5%, and it’s fair enough to note the speed with which yields have moved in recent days. But the coverage really has an implicit message in it that I believe needs to be shunned. And as is always the case it seems, getting to my destination requires a few detours along the way.

Let the journey begin, in the Dividend Cafe …

Setting the table

The general lay of the land out there looks something like this right now (media treatment of a conflation of topics, and maybe even a consensus view outside a remnant of thinkers) …

(1) The Fed moved to hyper low rates because of the extreme circumstances of the COVID moment

(2) The economy still needs help, and the Fed wants to give it

(3) But bond yields are moving higher because of fear of inflation, leaving the Fed in the tough position of having to decide if they want to let inflation overheat while they fix the economy, or taking actions to control inflation that may damage economic recovery before it is complete.

Implicit in these points are the following beliefs:

(1) The only reason for accommodative monetary policy from the Fed is the challenge of the COVID moment.

(2) That the economy needs help

(3) That the Fed can help the economy

(4) That bond yields are moving higher because of inflation fears instead of natural growth expectations

(5) That growth equals overheating

(6) That the Fed has knobs to turn to decrease inflation

(7) That the Fed has knobs to turn to increase inflation

(8) That the knobs the Fed has to do #3, #6, and #7 are all a matter of human wisdom and power (mainly, Fed wisdom and Fed power)

The reason why my view of the “lay of the land” above is different than that which is captured in those three points is that I find all eight of the “implicit beliefs” that underlie them to be either wrong, incomplete, or misunderstood.

Okay. Now we are going to have fun.

What in the world is money?

How can anyone understand what creates inflation (an excess of money relative to goods and services) if they do not know what money is to begin? The belief that money is paper currency circulated by the Fed into the financial system substantially misunderstands everything. The view that the Fed can just snap their fingers and create inflation comes from a belief that the Fed prints money, drops it in the lap of people, who then deposit the funds in the bank, giving the bank more money to lend. Rinse and repeat, then, inflation.

But that is NOT how it works, and when you understand the machinations of money creation in the modern economy you will begin to understand the failed premises in the beliefs I laid out above.

Money creation comes from bank lending. Step one is not a person depositing cash in a bank so that the bank can lend it. Step one is, rather, a bank lending. People don’t create deposits, they create loan demand; the bank’s loan becomes a deposit somewhere else – generally at a company or household. What is done with the deposit of money from the loan the bank extended is the nature of money creation. If a debt is paid off with the money lent out, there is less money in the financial system. The “stock” of money has been reduced. That is the essence of disinflationary activity. Money deposited and held at a bank does not increase the money base; if it had been spent it would have been deposited somewhere else; new money comes only when new money is lent out.

Yes, on the margins, the Fed would love to put their thumb on the scale of seeing money lent out. They can create as many “reserves” as they want ex nihilo by purchasing assets, but they cannot make the banks lend the money out, and they cannot make companies and households borrow money, and they cannot control what borrowers do with the money when they get it. The Fed has plenty of tools to intervene in various steps of this process (primarily by controlling the price of bank reserves – i.e. interest rates). But all of this is always and forever a story of loan demand, and loan demand comes down to the supply side of the economy – that is, the productive and rational activity of economic actors.

If lending is money, can the Fed create anti-money?

When I was in my young 20’s, I coined the term “anti-money” to refer to what my friends and I had in our pockets after a night of gambling in Las Vegas. More often than not, our chips were gone, our cash was gone, and all that was left was the ATM slips for our withdrawals, or credit line markets, or credit card advances, etc. The casino didn’t give us money – it gave us “anti-money.” We thought it was a funny way to cope with the wealth destruction we had subjected ourselves to.

Is the Fed creating anti-money?

The Fed has become the major buyer of U.S. government Treasuries. This is what we call Quantitative Easing. There should be an abundance of Treasury Bonds out there. After all, the government has to issue a ton of debt to fund massive deficits. But the Fed has purchased about $5 trillion of these bonds (and another $2 trillion of Fannie/Freddie to boot). What is the problem? The Fed is helping keeping rates down by purchasing these assets, and even helping to fund this government debt, all the while providing excess reserves to banks that they pay interest on, providing abundant liquidity to an economy that needs it, right?

The problem is that the Fed has taken so much of that good collateral out of the system – Treasury bonds, etc. – that the massive credit markets that fund the bulk of economic activity in our society have less stable, high quality collateral available. Now, this is all well and good now – the Treasury Department had to issue $2 trillion of excess debt last year, and that meant more issuance of good collateral – exactly what credit markets needed to get rolling again. (I assure you this was not the intent of that borrowing, but it worked).

But none of this changes the underlying point – the Fed’s QE program takes good collateral out of the economy. Anti-money. They have a reason to do it (trying to loosen financial conditions and lower rates), but it adds to the instability in the financial system at the moment stability is needed, because less “good” assets are available.

Impugning motive

Why did the Fed take the actions they took? Were they unaware of the long-term ramifications of some of these policy decisions, particularly what the dependency on QE would mean for the financial economy?

The majority of the issues we face come from one of the oldest dynamics in the universe – decisions made for short-term gain without regard for long-term pain. The brilliant economist, William White, points out that this is not all together unnatural – survival is the first imperative. If one believes survival is needed, short term decisions don’t have the luxury of considering long term ramifications. The post-2008 crisis actions of the Fed were entirely driven by this mentality. So were the March 2020 COVID decisions. One may disagree that short term survival was actually at stake, but I find it implausible that the Fed decision makers themselves did not sincerely believe so.

Our challenge is that:

(A) Short term survival decisions become embedded long term policies, compounding the long term risks, AND marginalizing future short term tools.

(B) There is little or no consideration of the long term impact, partially because of poor incentives; partially because it’s hard to be long term focused.

Inflation: What me, worry?

One thing I find fascinating through all of the current hand-wringing about inflation: Inflation expectations were actually HIGHER in late 2019 than they are now. Yes, before $5 trillion of stimulus, a new regime of the zero-bound, and QE Infinity, the market measurement of inflation expectations (TIP spreads to Treasury yields, adjusted for liquidity) was HIGHER 14 months ago than it is now.

Bond yields: What me, worry?

Are bond yields actually set to meaningfully move higher?

I understand the argument that expectations for higher nominal GDP growth ought to push bond yields higher, and I don’t disagree with that argument as far as theoreticals go. But if one wanted a counter-argument, they could do worse than mentioning the $13 trillion of negative yielding debt worldwide (yes, I believe that all serves as an anchor on U.S. bond yields I don’t want to ignore). Being the world’s reserve currency is potentially relevant, as well.

Inflationary questions

If I could say anything on the general topic of the day, I would say these three things:

(1) The Fed cannot create inflation as easily as you are being told they can, or else they would do so.

(2) There are few arguments for the surge-in-inflation risk that are not rooted in the same logic and thinking that wrongly predicted such out of the Great Financial Crisis

(3) This is different than saying inflation cannot surface.

Unpack that last one?

My view is essentially that there has not been, and will not be, adequate velocity on the money that has been added to money supply for those in the inflationary doom-and-gloom camp to be proven correct.

Back to our prior lesson on the nature of money creation – new money (i.e. new loans in the system) that is used to pay off old loans (i.e. much of the corporate bond issuance, for example) is not new money; the money stock is not higher through that process. The better example in 2020/21 is home re-financings – record amount of loan issuance, almost entirely “replacing” other loans – no new money involved.

However, I do recognize that initially out of 2008, the attempts to use credit growth to reflate the economy were never going to be inflationary (even as inflationistas missed this point entirely) because that new credit issuance was being offset by one of the fastest and most violent deleveraging cycles in history. From the regulatory environment to the business demands of the moment, the forces of de-leveraging make credit growth more like running on a treadmill than a track. But it must be said – equity levels are high now, so debt (leverage) can grow a lot relative to equity without feeling excessive (in the aftermath of 2008 the opposite was true; capital structures had to deleverage in the reality of re-priced equity).

So in a nutshell – to see inflation in this environment when we didn’t post-crisis – one has to believe that this time it’s different – and the difference would be that private sector credit growth is not offset by deleveraging this time.

It’s not my forecast. And I think that corporate balance sheets are already plenty leveraged. But if you believe leverage rates are going to rise further, that would be your logic for assuming current activity becomes inflationary. I don’t see it, not in a meaningful way, but it is the area which will receive the bulk of my attention for quite some time.

Taper Tantrum Sequel?

Bond yields flew higher (briefly) in mid-2013 when the Fed announced that they would begin “tapering” off of QE3. It lasted only four months, but it was significant (a 10-year that went from 1.6% to 3%). In that time period, Industrials, Financials, Materials, and Health Care stocks did very, very well. REIT’s and Utilities did very poorly. And the overall market was, wait for it, up!

But remember, that was the Fed telling you they were going to reverse policy accommodation. Right now, we have the exact opposite – the Fed telling you they are not. Now, you can think they are lying. Or you can think they will change their mind. Or you can think the market will force them to change their mind. All of those things are one version or another of “fighting the Fed.”

In my 25 years in this game I have yet to come across a time that the mantra, “don’t fight the Fed” proved to be wrong for investors.

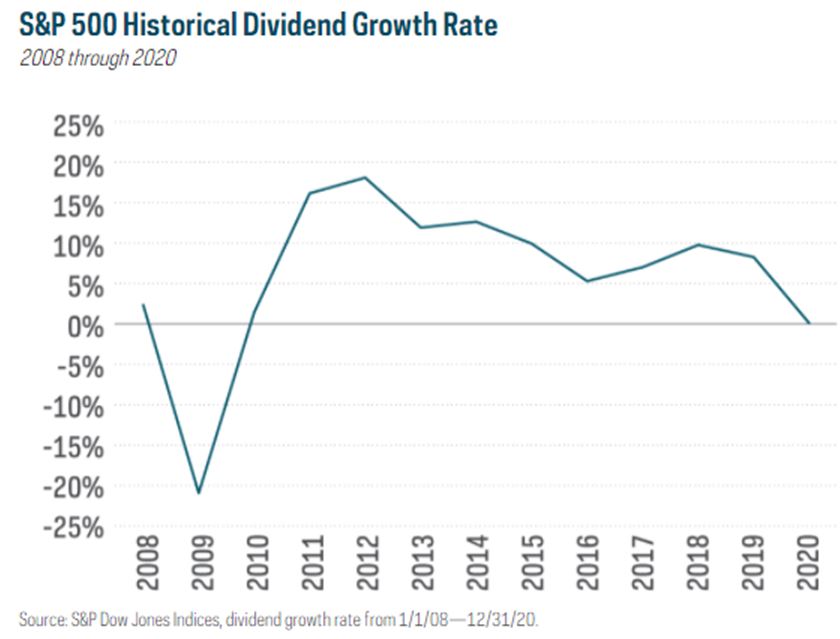

Chart of the Week

It is true that COVID brought the less-dividend committed or less-dividend capable companies in the stock market to a point of reckoning, with roughly 70 cuts/suspensions last year across the index, and no growth in aggregate on the year! The fact of the matter is, the dividend reductions in the S&P last year proved pretty shallow and pretty short-lived (especially relative to the Great Financial Crisis). But even apart from COVID, the rate of growth of index income has been declining little by little for a decade. It takes a strategy of active and intentional dividend growth to avoid this fate.

Quote of the Week

“We cannot absolutely prove that those are in error who say society has reached a turning point – that we have seen our best days. But so said all who came before us and with just as much apparent reason. On what principle is it that with nothing but improvement behind us, we are to expect nothing but deterioration before us?”

~ Thomas Babington Macaulay

* * *

I am not sure if I ended this Dividend Cafe at the right place or not. I truthfully could do another 10,000 words here, no problem. I will re-read this weekend and see what other “tangentials” need coverage next week. In the meantime, don’t fight the Fed, understand the nature of money, and enjoy your weekend!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet