Dear Valued Clients and Friends –

I did something a little different this week in the Dividend Cafe. As many of you know, for most of the last 12+ years I have been doing this weekly commentary I have sort of written all over the place – just covering a potpourri of topics that either came up throughout that week or were otherwise on my mind when I sat down to write. I liked the “multi-topic” approach, and I think it covered all the bases of investment and economic topics.

When I put the daily COVID and Markets missive to bed a few months ago, I transitioned to a different daily missive – hopefully, one you all are receiving (and reading) – The DC Today. The intent has been (and will continue to be) to use that daily communique to report on that “potpourri” of investment topics, with a special focus on daily events in the market, the news cycle, and the beltway. Yes, I use a loosely pre-formed template of topics each day (Markets, News, Economic Metrics, COVID, the Fed, Housing, Oil, and “On Deck”) – but I can go anywhere want within those topics, and really that outline is just to constrain me from my bad habits of red herrings and deep dives. After all, you wouldn’t want me veering into a granular analysis of the hysteresis risk in labor markets and where the Fed’s policy inertia in reaction function regarding realized inflation carries structural implications for the economy (I see you, Rene!).

But I digress.

So when I launched The DC Today, it freed me up to use Dividend Cafe to be more “singular topic” focused, and I really do believe that makes for a better commentary. I have mostly not used this weekly commentary for “ad hoc” market discussion or current events, and I think this approach has enabled me to go a little deeper into topics that I believe are essential in their relevance. I plan to continue this approach until I get inspired otherwise (or overwhelmed with hate mail, whichever comes first).

This week, though, I do a little bit of both. The “singular topic” is a really important one – and that is seeking a better understanding of what really drives asset prices over time. There is a need for improved knowledge here, not just amongst mom and pop investors but apparently amongst the professional class as well. But I have been in New York City away from my family all week, which means one thing about my evenings back at my apartment – instead of hanging out with my wife and kids, I am just sitting there, unrepentantly (and some would say pathetically) reading more and more research. And this leads to one thing – more fodder and inspiration for the Dividend Cafe. Ergo, I cover a few “odds and ends” this week as well.

Whether it is the discussion of market forces or the tidbits covering a healthy array of other topics, I truly hope you will enjoy today’s edition of the Dividend Cafe. Let’s dive in …

“It’s a Policy Driven Market” ????

This headline stuck out like a lightning bolt, “It’s a Policy Driven Market.” I had just gotten done reading seven research papers, including a primer on money creation from some former central bankers, a white paper outlook on inflation, an update on structured credit from a boutique hedge fund, a “lay of the global economic land” from the former economic advisor to the Bank for International Settlements, and a bond manager’s take on where crypto fits in the future toolbox of the Fed. I was overly stimulated, having drunk heavily from a firehose of research and analysis, and yet something about this headline grabbed me.

I spend much of my time analyzing policy. I recently retained a highly regarded economist who is himself an alumnus of two White House administrations because I believe public policy matters so much to our work.

I wrote 150 missives or so in 150 days or so last year on COVID and Markets, generally around the policy response and impact to what was happening with the pandemic.

We named our daily market commentary The DC Today because of its double-meaning with “DC,” an abbreviation for our nation’s capital (politics), and the Dividend Cafe weekly market writing. In each daily bulletin, I address both public policy and monetary policy, sometimes quite extensively.

And specific to monetary policy, I have long-espoused the belief (and still do now) that the great debate of our day is the inflation/deflation challenges largely embedded in central bank responses to the issue. My view has been carefully chronicled – that at a macro level, we have a policy of high government spending, high monetary accommodation, high fiscal and monetary interventions when aforementioned policies lead to disruptions, which then leads to more fiscal and monetary dependency as a result of those interventions themselves. Rinse and repeat.

It is not just that I make the case these things matter. I make the case that this is the primary macroeconomic issue of the next thirty years (even as the subject involves “tentacles” to the subject itself).

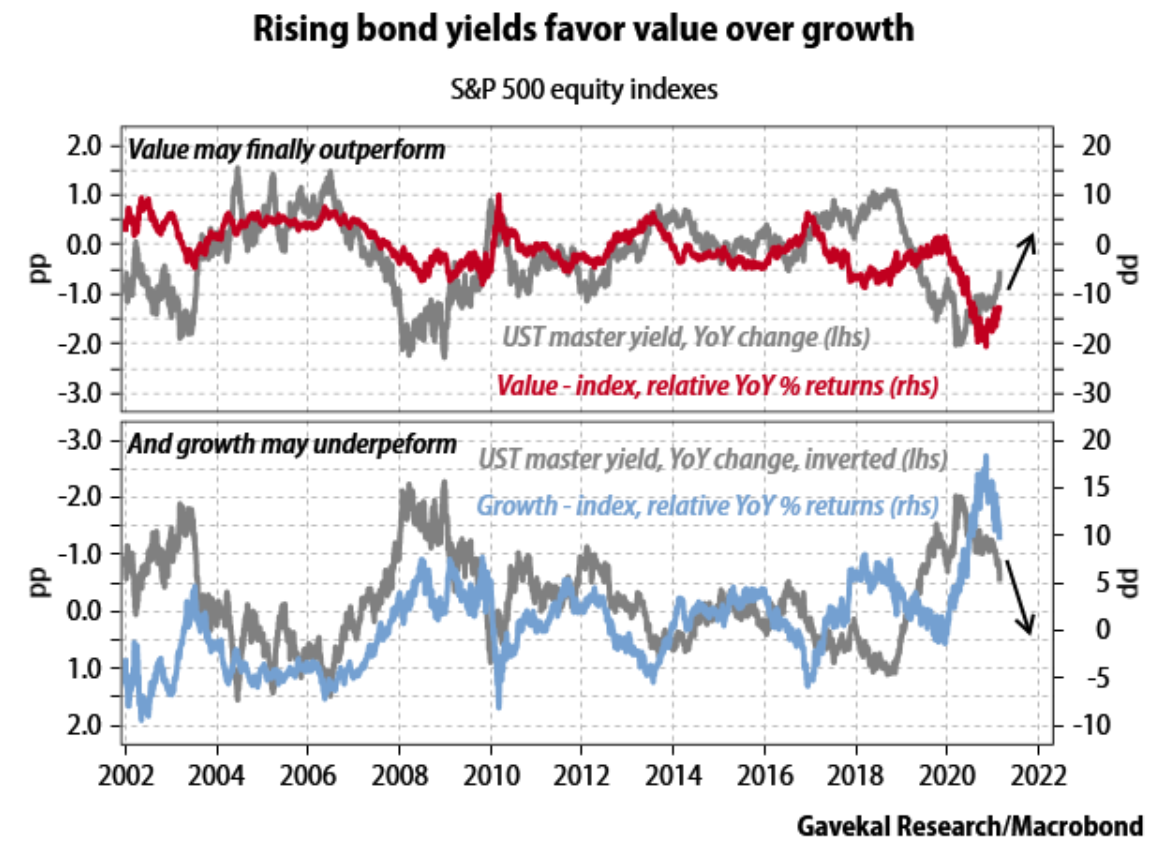

And yet, there is something that really troubles me about the statement, “It’s a Policy-Driven Market.” The piece was actually very good, and to the extent, one sees vaccine roll-out as a “policy” matter (I’d argue it’s a hybrid), the essential point was that right now, bond yields are responding to “policy” realities (fiscal, monetary, and vaccine), and stocks are responding to bond yields. Value stocks did better because bond yields rose, growth stocks did worse because bond yields rose, and bond yields rose because of more stimulus spending, vaccine success, and general economic expectations.

All close enough, and certainly in the context of a very limited period of time, a reasonable analysis. That there are certainly correlations around bond yields and the whole value/growth discussion is indisputable, and that policy inputs influence bond yields is also indisputable.

So what is the problem? Why did the headline bother me, or what about it do I think is potentially unhelpful in how investors think about their portfolios?

Because profits will trump all of this stuff – all of it.

Now, I just want to get the easy and obvious stuff out of the way right upfront. Profits do not exist in a vacuum; they are theoretically impacted by some policy decisions. I will give examples in a moment. And Valuations certainly do not exist in a vacuum; they are absolutely impacted by monetary policy decisions – and therefore, the prices that come out of aforementioned profits are somewhat policy-related. I get it. I concur. But none of this is actually my point.

Fundamentally, the macroeconomic paradigm impacts is a “universal” reality. It is not like the varied milieu of policy and macro realities that impact some semiconductor company are all of a sudden different policy and macro realities for an Industrials company. And since chief amongst all of these “policy” things we discuss is monetary policy, the “rate environment” is, by definition, the same across sectors and companies.

So, where can they differentiate? In their own execution, their own business strategy, their own performance. In short, their own profit creation.

But wait, there’s more …

I freely admit that the Fed sets the Fed Funds rate (the ultra-short-term rate), and I freely admit that bond yields impact risk asset values. However, is it true that the 10-year bond yield is “controlled” by the Federal Reserve? I am not talking about (yet) radical Yield Curve Control, or the Japanese Central Bank becoming the entire Japanese bond market. Maybe we go there. But is the 10-year moving right now because the Fed wants it to, or despite the fact that the Fed doesn’t want it to? I sympathize with those who want to believe there is some puppeteer here on earth controlling all the affairs of the globe, but is it possible that we vastly overestimate the ability of the Fed to control certain things (chief amongst these, the long end of the yield curve)?

The European Central Bank and the Federal Reserve have spent 12+ years throwing the kitchen sink at trying to create inflation. They have not met their target once. Not once. The most powerful economic bodies on earth and have been swinging and missing, through no fault of their own, for years and years. Why? Because some things are just not in their control. I assure you that I would LOVE – love – to beat Lebron James in one on one. It would not be a lack of will or desire that would keep that from happening (I think we all know it is because I am eleven years older than he is; if we were the same age, he’d be in trouble!).

Do you see my point? Congress and the White House can “influence” the economy with fiscal policy decisions. The Fed can influence the long bond. And I would argue, the less “influence,” the better, to the extent I have pretty high confidence in free exchange and human action to generate good results in a society of ordered liberty.

But my problem with operating as if “policy” drives everything else is that we misunderstand what fundamentally drives asset prices. We want to own XYZ stock because we believe in the profit-making capability of that company. And along the way, (monetary) policy will impact the valuation of that company, and (fiscal) policy may impact the operational realities of that company.

But hear this: If we ever believed in a company enough to invest in it, to begin with, then you should infer from that we believe in that company’s ability to modify strategy, to overcome policy adversity, to react to new policy realities, and to generally compete in the paradigms of the moment, as they are.

Does that mean we will always get that right? No. Does it mean companies will always overcome and succeed? No. But what will drive a company’s success (long-term) is always and forever their successful formation and execution of a strategy, and that strategy has to be centered around the creation of the profits that come from doing what they do (yes, this means providing goods or services to those who want to pay for such).

This is cart-before-the-horse stuff. No company can be immune from the transitory volatility and noise that comes from a stimulus check here, a bond yield change there, or whatnot. But good companies, by definition, persist through all seasons, and the fact of the matter is, there is a season for all policies. I believe we are in a secular season of easy monetary policy (this strikes me as a fair conclusion). I further believe that there will be periods of cyclical inflationary spurts along the way.

But to the extent the driving force of a portfolio’s success, and by that, I mean its ability to help facilitate a successful financial outcome, is anything other than the blessed, organic, real, sustainable growth of profits, that portfolio is missing the mark.

Next week, I am going to dive deep into some realities of money. The questions around inflation, bond yields, and policy aren’t going away, and some economic primer work will help a lot in our understanding. But this interest and study is always and forever subservient to the first rule of risk asset investing … Profits.

Some odds and ends

Cost of Debt in Context

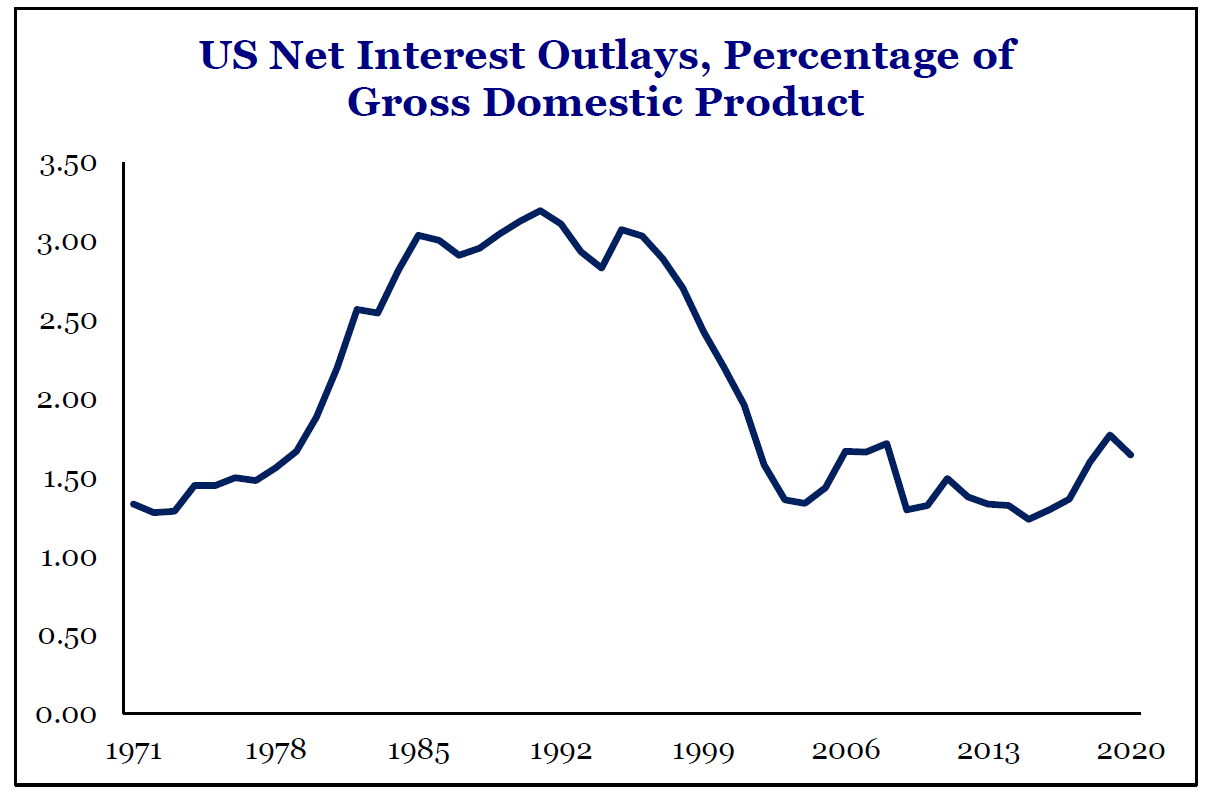

I showed last week the percentages that different silos of government expense represents as a percentage of total expenditures. As you recall, the interest expense on the debt is actually quite small despite the large increase in absolute debt level, primarily because of rock-bottom low-interest rates, but also because of the increase in percentage in other key categories, primarily entitlement costs.

Here you see the interest expense as a percentage of our total GDP. Here you see how low the number is now, despite a 25x increase in the amount of debt since that peak level. Again, the primary reason is the collapsing cost of debt as a result of collapsing interest rates. This chart is all at once encouraging (the cost of debt is not breaking us) and daunting (they simply cannot let rates normalize, or the cost will be monumental to GDP).

*Strategas Research, Policy Outlook, Feb. 21, 2021, p. 5

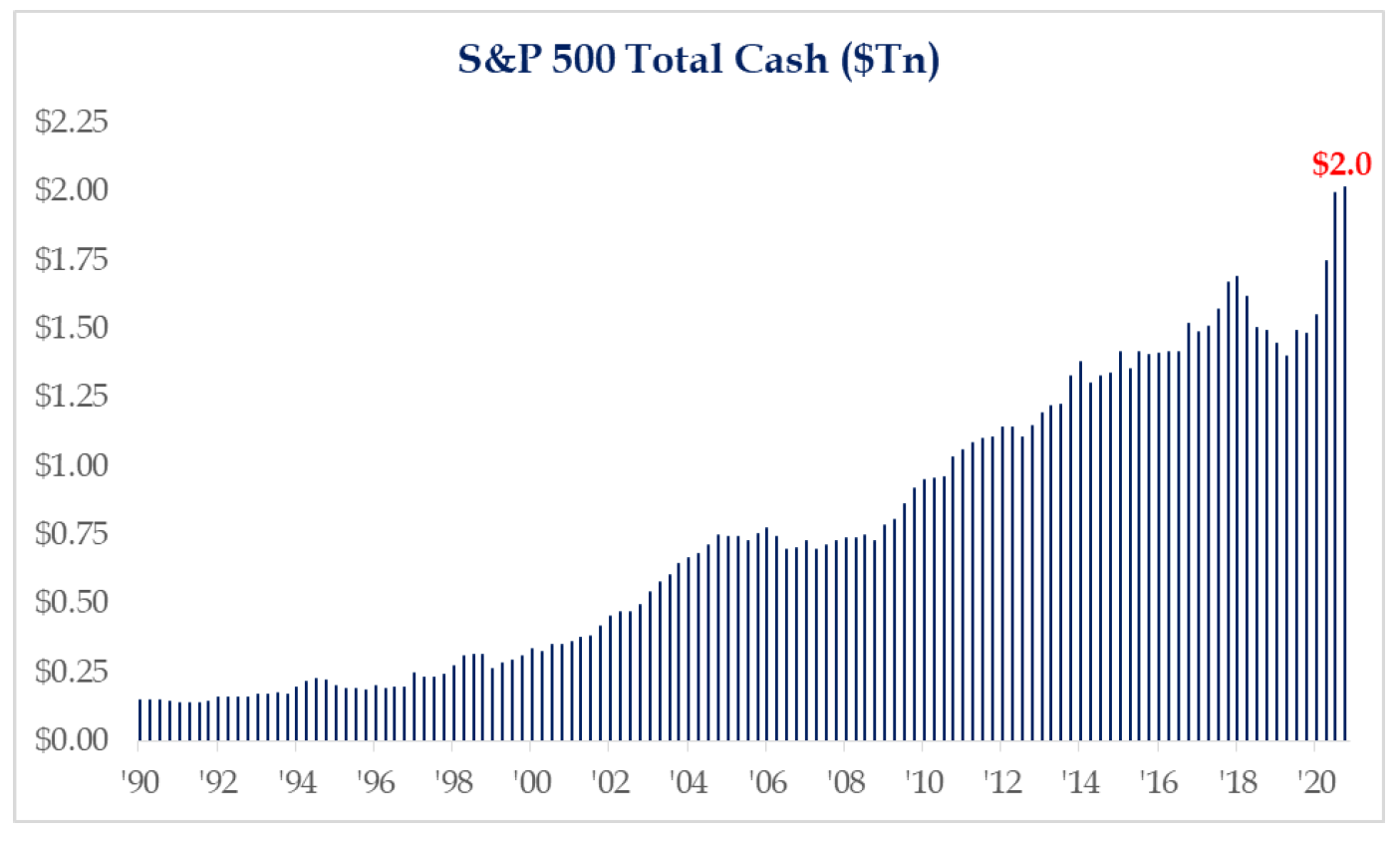

A case for M&A, Exhibit 5

The cash levels on S&P 500 company balance sheets are why I remain bullish in my 2021 M&A theme. I do believe some companies will reduce debt with this cash, but not much, since (a) Cost of that debt, is so low, and (b) The market has hardly been rewarding companies who de-lever as of late. I also believe dividend payments and stock buybacks will re-accelerate. But again, we know some companies simply do not have the cash return philosophy we wish they did. What we also know is that many stock prices are high, which creates a valuable currency, and cash levels are high, which is the obvious currency, providing ample incentive and ability to transact.

*Strategas Research, Investment Outlook, Feb. 19, 2021, p. 2

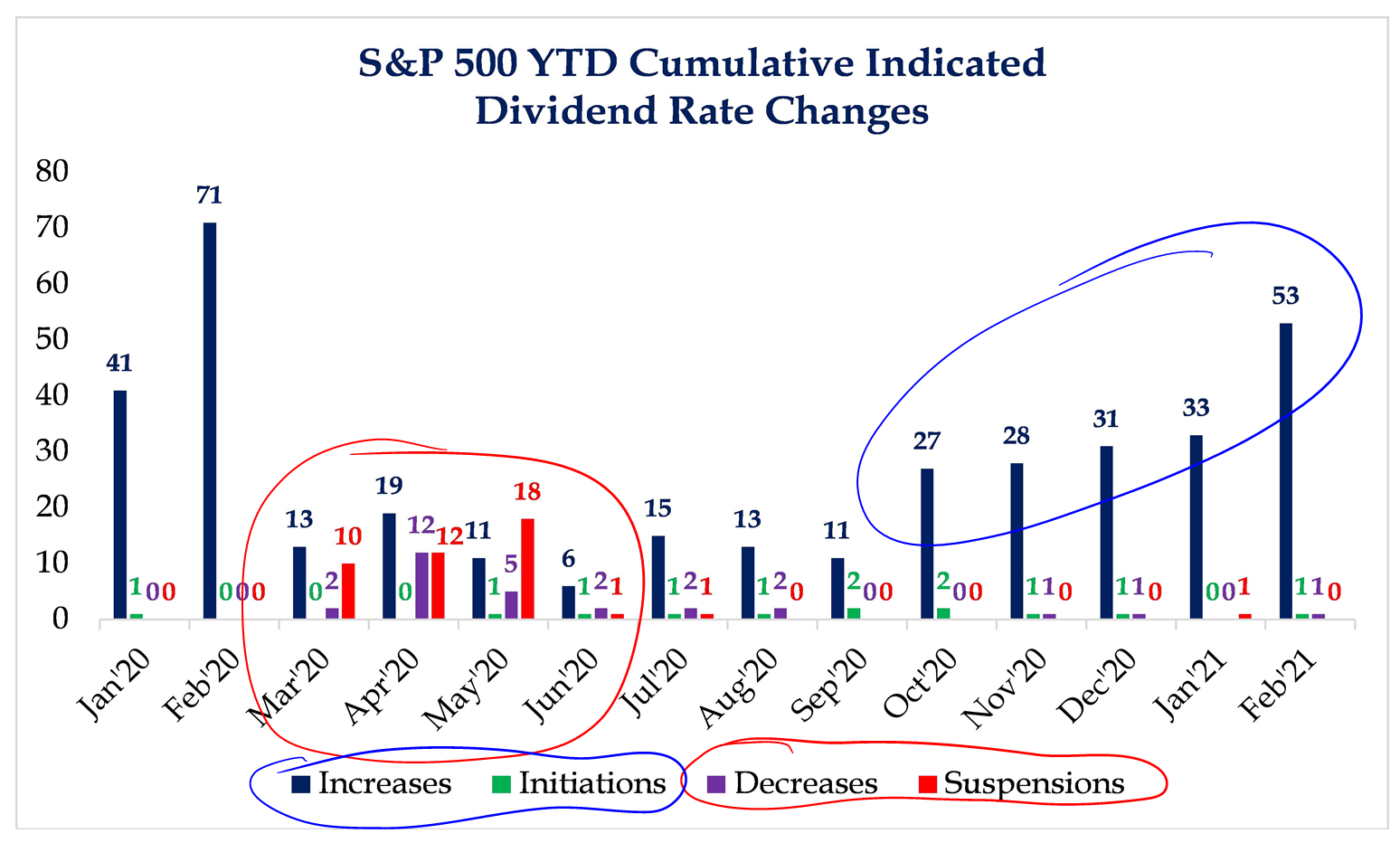

Dividend Growth Universe

And speaking of cash levels, the number of companies elevating their dividends is continuing to increase. Obviously, it is almost all of the companies inside our own dividend growth portfolio (a tautology), but in broader equity markets, cash conditions and economic optimism are causing more and more companies to raise their dividend. This speaks to broad market conditions but also expands the universe for TBG. However, companies that cut last year and now are back on the horse are still in the penalty box, as they should be.

*Strategas Research, Investment Outlook, Feb. 19, 2021, p. 2

Financial Sector, Exhibit 6

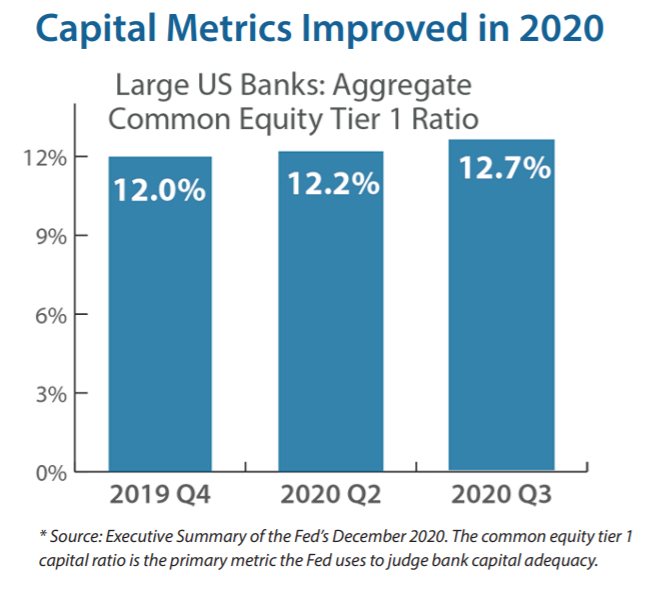

One of the things that most needs to be understood about recent strength in the financial sector … it is not just that dividends will soon be increased, and that loan losses have proven to be far less than anticipated, and that net interest margin is picking up as the yield curve has widened, and that valuations were all preposterously low … All of those things are true, but we also are going into this improved period with better capital resiliency, less leverage, more of a buffer, and therefore, a less marginal risk to price in.

*Miller Howard Investments, Q1 2021, p. 2

Emerging Markets and Bond Yields

Few assumptions are more common in global risk investing than this basic thought process: (1) Higher bond yields push the dollar higher; (2) A higher dollar hurts emerging markets; ERGO, higher bond yields hurt Emerging Markets investments.

Six months ago, the 10-year treasury was about 0.6%. Today it is about 1.4%. EM bonds in this period are flat, and EM stocks are up +30%. What gives?

One thing I would suggest is that the mere movement of yields higher is not actually damaging to EM valuations; it is the expectation going forward that could potentially impact price valuations. In other words, one could conclude if they were so inclined that the lack of price concern in Emerging Markets tells us markets do not expect bond yields or dollar strength to move much higher.

But I would propose something else. I think historical reactions in some emerging markets to the U.S. bond market and currency market action are not all that useful. First of all, it was never true that Peru and India were the same things even back in past times. Their economic response to U.S. action may have been similar then, but that was not inherent in the idea of a “monolithic emerging market” vs. U.S. economic dynamics. Different economic conditions, different trade realities, different budget deficits, different debt profiles, and different central bank posturing should always lead to different responses and relationships in different countries. Past correlations were incidental to those similarities, but there are a lot fewer similarities today than there used to be. In other words, not all emerging markets will respond to U.S. activity the same because Brazil and Vietnam are not the same.

Most emerging economies are in a better position to deal with a stronger dollar than they have been in past disruptions. They are not merely responding to stronger U.S. conditions with improved export-strength; they have their own domestic markets that are also strengthening in the aftermath of a vaccine-environment.

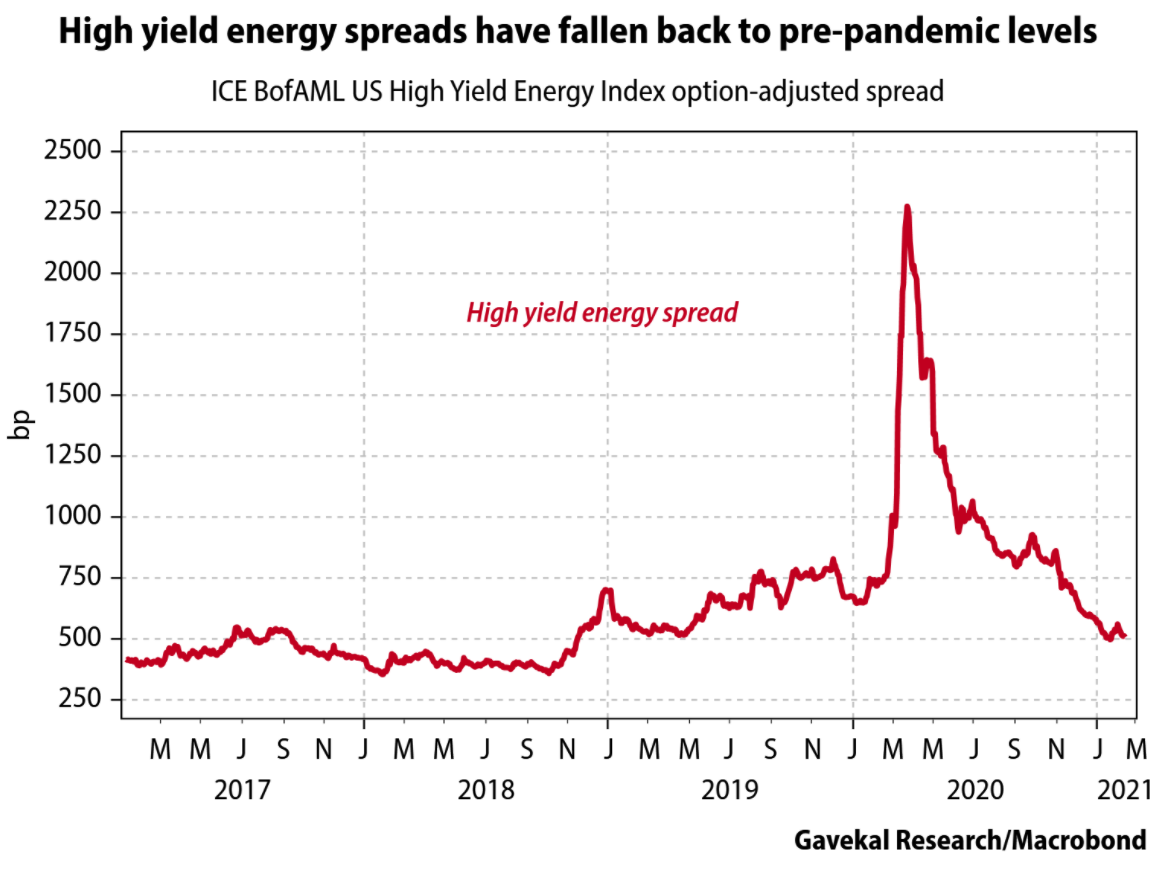

Chart of the Week

We know how energy equity prices have performed in recent days and weeks, but what can we learn about the real fundamental strength of the space from credit markets? BOND investors are now demanding just the same yield for energy credit that they demanded before the pandemic. This spread compression is an even more telling story than the sector’s equity rally.

Quote of the Week

“The last leg of a bull market always ends in hysteria; the last leg of a bear market always ends in panic.”

~ Jim Rogers

* * *

Would love your feedback on today’s Dividend Cafe, and grateful for your readership. If I were only an audience of one, I’d still write it. But I do hope it serves you in some small way. Now go enjoy your weekend.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.