Dear Valued Clients and Friends –

Two events took place this week that had a profound effect on me:

(1) I participated in the annual Mauldin Strategic Investment Conference, albeit for the first time ever the conference was conducted entirely online.

(2) The Bahnsen Group “softly” re-opened our California headquarters for the first time since March 18

I will explain in a moment how these things in concert with one another impacted me, and what they mean to the investment thinking and portfolio positioning of Bahnsen Group clientele.

The COVID moment in our markets and in our society has completely destroyed my concept of time. A part of me feels like it was yesterday that I was last walking through mid-town Manhattan from my apartment to new office, markets beginning to sink in the face of COVID uncertainties, reflecting on the 9/11 and financial crisis moments that will always seem fresh in my mind. The economy had not been locked down at that time, and we would not end up hitting peak panic and fear in markets for two more fateful weeks. That was 11 weeks ago now, and part of me feels like it was yesterday, while part of me feels like it was three years ago. Quarantine can do that to your sense of time, I suppose.

But the Bahnsen Group offices in Newport Beach re-opened this week for about 70% of our team. Normalcy feels both within reach and distant, all at once, with reality being somewhere in between. But as certain blessings of normalcy were re-introduced to my life this week (driving to my office, seeing many of my partners and team members in the office), so also were some other “normalcies” that I have frankly not been totally focused on over the last few months.

The conference this week reminded me that managing investment markets for a living does not allow for a period of “normalcy.” The only thing normal about financial markets is that they are never normal. Certainly, there are periods of elevated volatility, and certainly, there are events that will prove more memorable than others in my investing career. But as I heard speaker after speaker in the virtual SIC, and participated in panels myself, a reality hit me like a ton of bricks as we were sitting there discussing financial markets in the midst of the COVID moment … Without doing it on purpose, we were not discussing the COVID moment. We were discussing fears around de-globalization. We were discussing the national debt. Inflation. Deflation. Technological transformations. Geopolitical uncertainties. Entrepreneurial opportunities. War. Peace. Elections. Taxes. Strong currencies. Weak currencies. Oil. Interest rates. Central banks. Booms. Busts. Valuations. History. We were implicitly acknowledging that there is plenty to both worry about and be excited about, totally apart from COVID.

I hadn’t actually forgotten over this period that there were ample issues governing financial markets besides COVID. But in my craving for normalcy, I am sure there have been moments where I romanticized what that means. As an investment manager, “normalcy” is a constant state of change, an inherent instability, and the adjudication of various risk/reward trade-offs that are never simple, but always significant.

This is the life I chose. I wouldn’t trade it for anything in the world. The present COVID moment has required intense attention, diligence, prudence, and analysis. But if there was a vaccine and 3.5% unemployment tomorrow, there are ten other things we talked about at this week’s conference that can take COVID’s place in the mental space of a truly engaged investment professional. Again, this is the life I chose.

And in this week’s Dividend Cafe we are going to dive into a bunch of these subjects – not because they are abnormal or extraordinary, but because they are normal. The normal reality of financial markets and of being engaged in the management of such continues its beat. And though I far prefer to do my analysis and work from my office with my team versus the sub-optimal conditions of quarantine, I embrace this normalcy and welcome the challenge of both this moment, but all future challenges and opportunities as well.

Let’s dive into the Dividend Cafe.

Before that market stuff …

Actually, this is very much connected to “that market stuff.” We have said since the real unleashing of the COVID reality on markets in March that there were three considerations driving markets:

(1) Fiscal ramifications (economic contraction, unemployment, government spending, taxes, etc.)

(2) Monetary policy (central bank interventions, interest rates, financial markets liquidity, etc.)

(3) The actual state of the health pandemic – both present, and future trajectory.

We stand by this general framework for now, though I believe that a time will come in Q3 or Q4 where the state of company fundamentals will gain clarity and legitimacy and transcend one or two of these categories. In the meantime, we postulated March 17 and continue to believe now that the primary driver was category 3 (health pandemic), though that category is now more specifically connected to the re-opening of the economy. Market conditions began to sustain a more dependable stabilization when it became increasingly clear that the doomsday scenarios for COVID were not coming to fruition, that the American health care system was not being overrun, and that the mortality rate was not going to be anywhere near previous fears and speculations.

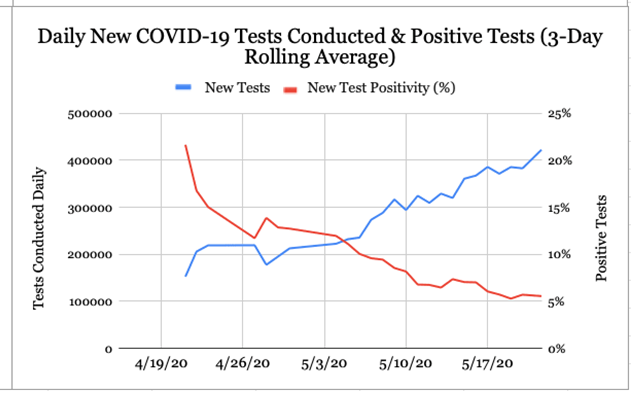

At this point, the health news most reassuring investors is that testing is increasing rapidly (providing greater confidence to the public), even as positive ratios are collapsing (reflecting greater health in the society). I would point your attention to these two statistical points in just one calendar month:

(a) Testing that has gone from 150,000/day to over 400,000/day, and

(b) A positive ratio that has dropped from above 20% to right around 5%

* The Dispatch, May 22, 2020

Week in Review

Markets exploded higher ~+1,000 points on Monday, gave back about 350 Tuesday, reclaimed those 350 Wednesday, dropped a benign 100 on Thursday, and as of press time, Friday is down ~50 points. Net, net, with plenty of volatility, markets are up ~750 points on the week.

I expected Friday action to be more volatile than it opened, as Hong Kong markets dropped over 5% Thursday night in response to China imposing new national security laws on the country. POTUS has said he will “address the issue very strongly,” and it sure seems as if this is additional fodder in the escalating issues between the U.S. and China.

Going on the record

Our view is that the risk of substantial widening in credit spreads has been substantially lessened by two things since March (and this is very important) – one is not so much improved fundamentals as it is decreased odds of worse case situation for fundamentals. Oil is $33, not $20. The market is 24,000, not 18,000. The economy is looking to a June re-opening, not a September re-opening. There is some fundamental improvement in trajectory and that has helped to sensibly stabilize credit spreads (I owe a more faithful periodic glossary refresher – credit “spreads” are the delta in the cost of debt for a company vs. the treasury/risk-free rate; “spreads” help to measure the relative perception of risk which is what matters as opposed to the absolute cost which could be incomplete information without a reference to the underlying interest rate).

But it would be financial malpractice to not recognize the role of the Fed’s various new facilities in tightening credit spreads across the risk curve. From munis to mortgages to corporates to securitized assets, credit spreads have all tightened, some places with more direct Fed support have almost completely normalized, and even in areas without direct Fed support spreads have stabilized.

So relative spreads are contained in the current monetary environment by Fed efforts. And absolute rates are, in our opinion, unlikely to move much behind Fed efforts to keep low (bond-buying, forward guidance, etc.). I am not in the camp predicting negative rates yet, as many very fine economists and analysts are, but that may very well be because I hope against hope that they won’t allow it, not that I actually believe they won’t do it.

Summary of our forecasts for current Fed actions and implications:

(1) Stabilized credit spreads

(2) Low absolute yields across the yield curve

(3) No negative rates

(4) Zero-bound for two years or longer

(5) Long-term moral hazard embedded in credit markets – expectation is now permanently embedded that the Fed is there to support access to credit. It is THIS point that has more profound implications for financial assets than anything else on this list.

People can disagree as to whether or not Fed policies are more driven by the need to fund corporate America, or the need to fund the government. The last two crises we have seen lead me to believe the answer is both. But regardless, and I cannot emphasize this enough, I plead with you to not set your investment policy on what you believe ought to be, but rather what is.

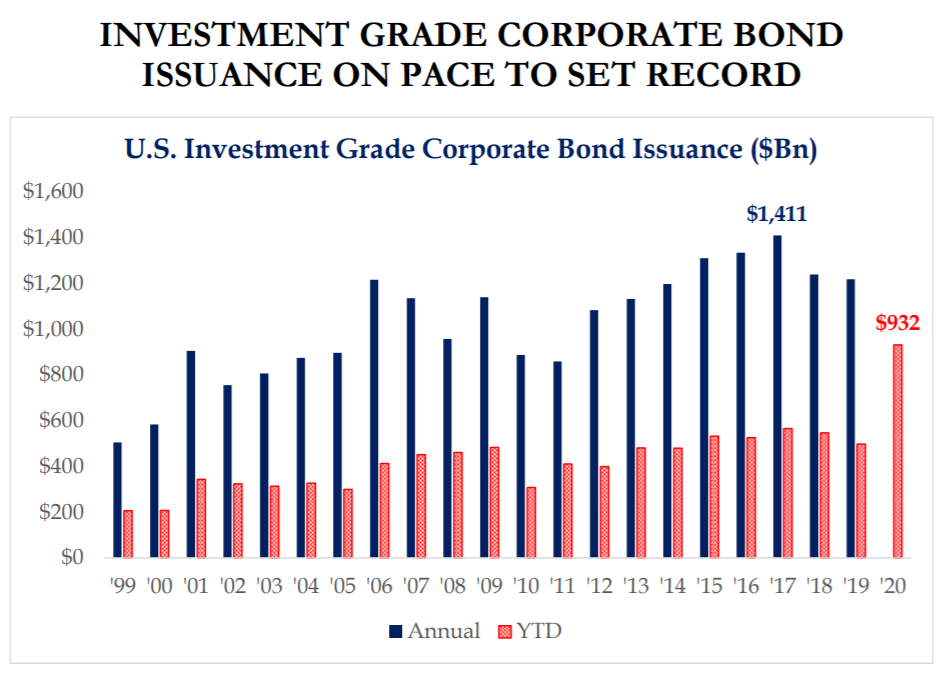

The Fed’s generous reach

The Fed’s direct intervention into bond markets has been incomprehensible, and the results in the corporate bond market have spoken for themselves these last two months. However, I would note that it is naive to believe that Fed support for the primary issuance of high-grade corporate debt only benefits bonds. At this level of low-cost debt with Fed support, companies are not just raising cash at a low cost of capital, but they are refinancing debt at a lower cost of capital. They are raising money for higher ROI projects they otherwise may not pursue. These things are directly beneficial to equity prices. This record-level of cash raise at record-low cost casts a wider net than many realize.

* Strategas Research, Charts of the Week, May 15, 2020, p. 15

Isn’t that positive?

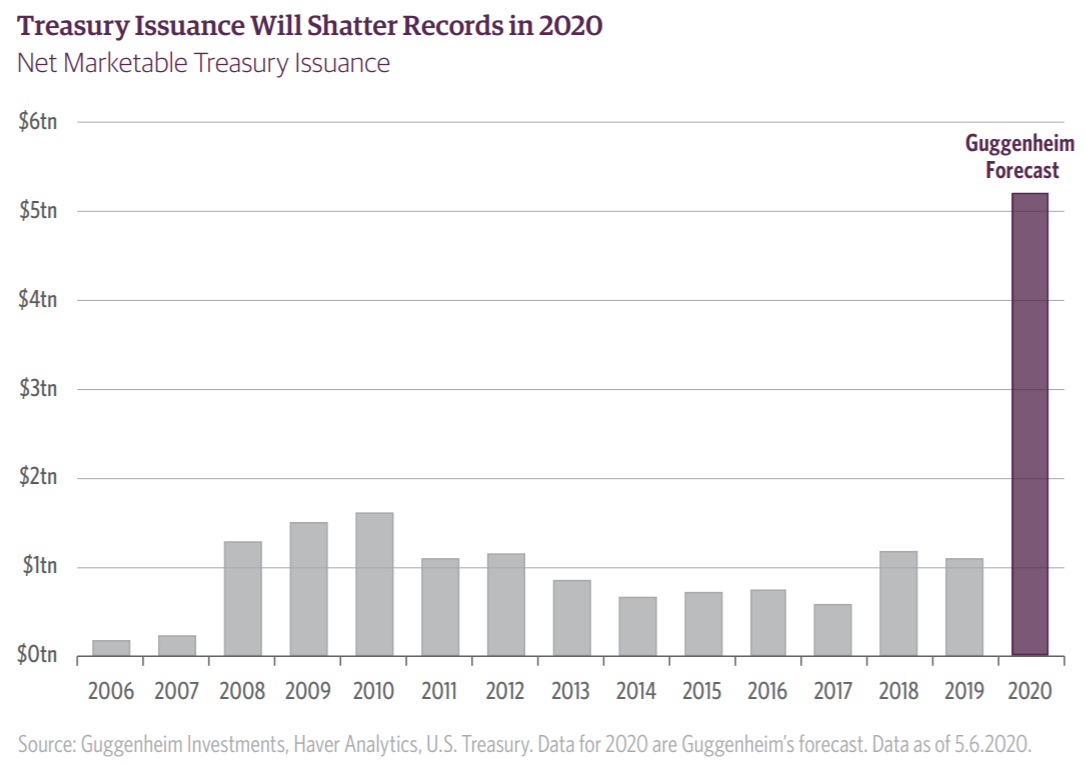

I think it likely is positive, for equity investors, at least for a time. The challenge I see as being the overwhelming need of our time is not central bank intervention in corporate borrowings, which for the most part of been productive borrowings, and even when not, have losses owned by the risk-taker, at least theoretically. The challenges we face that I am more focused on center around public debt, not private debt, so even though central bank interventions to private debt get a lot of attention, and much of it probably does flow down to the benefit of investors, it does not address what I believe is the central economic story of our time.

Doesn’t public debt trump austerity in the pursuit of economic growth?

This is the Keynesian mantra, and it also has found a real revisionist narrative about the last decade in recent years. To listen to many neo-Keynesian economists, you would somehow be under the impression that the last ten years have been a woeful tale of government austerity, budget-cutting, and fiscal starvation. It is by far the strangest view I encounter from serious economists, and I encounter it daily. Sovereign debt loads have exploded in recent years, and while central banks have not overly monetized them, they have used every monetary trick of the last decade to “hide” fiscal malfeasance on central bank balance sheets.

What has to be understood is that public debt is not savings – it is “dis-saving” – and we are headed to a place of a negative net savings rate as a country. Public debt is not productive in terms of growth-generation, and that diminishing return of excess debt is the cause of our deflationary spiral.

Speaks for itself

Even I snuck this in the middle of my commentary

Ask yourself this question – what did you hear most about this week in the news, in Bahnsen’s own writings, and in any form of financial media you intake:

(1) Economic re-openings/COVID data

(2) Vaccine hopes

(3) China flare-ups

(4) European debt mutualization

I am going to guess that the answers in a poll would have a 0% next to #4, and varying percentages and answers for numbers 1-3. I also am going to guess that the potential issues playing out in Europe right now are the most underrated wildcard in financial markets.

Merkel and Macron have proposed to the European Union a sort of mutualization of debt – a cross-EU recovery bond that is a complete and total transformation in the European project. The proposal is for bonds issued by the EU, guaranteed by the EU, denominated in the Euro currency, backed by the revenues of the European Union, not individual countries. There would be tax increases, and there would be leverage out of these funds, but it would represent a monumental change in European finance.

All it takes is one European Union member to squash it, and I have read brilliant analysis forecasting that this will get through, and brilliant analysis that is adamant Denmark or Holland will not allow it. All we can do it is wait and see. The ramifications for this are massive and it will not be the last time you hear about this in the Dividend Cafe, even if you can’t find a peep of it in any other media.

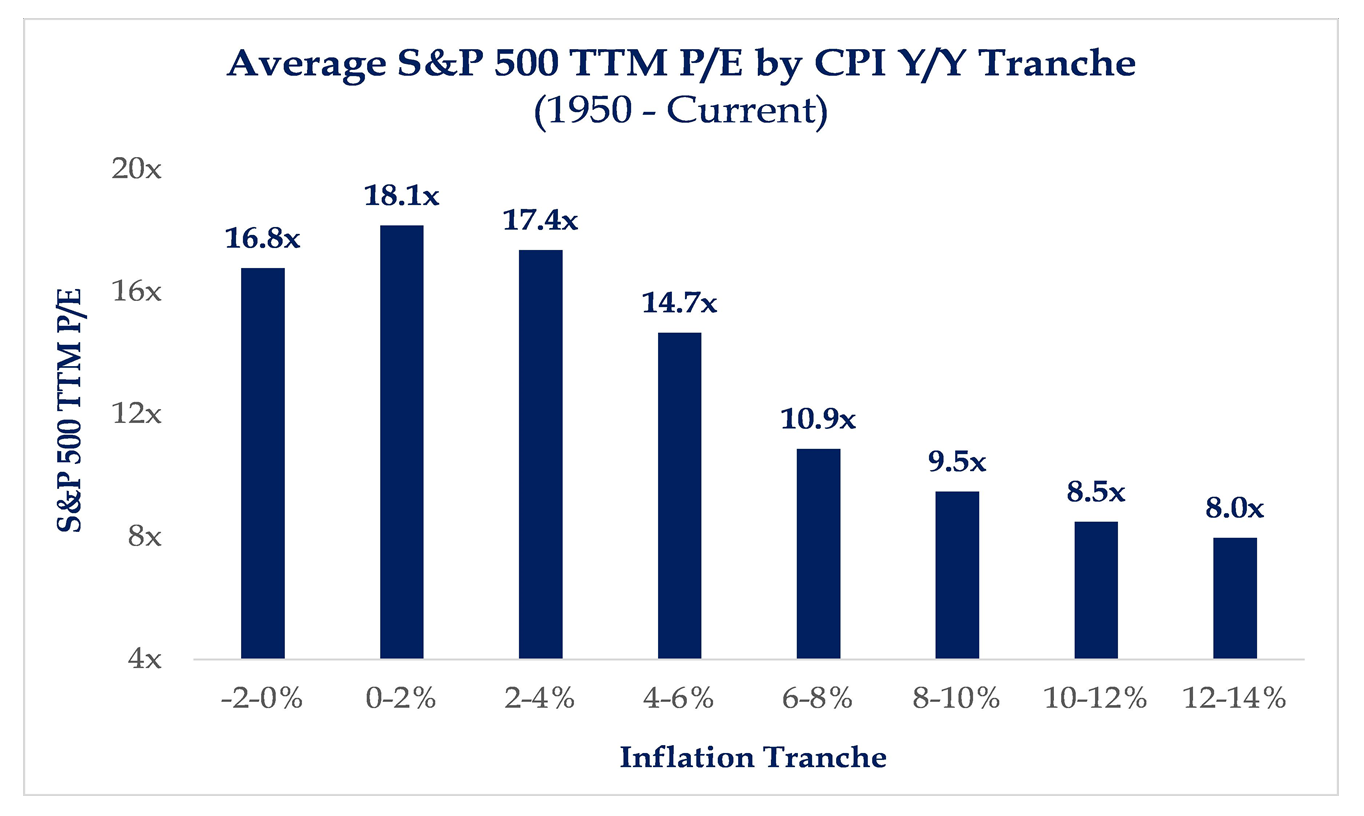

Define “expensive”

The P/E ratio of the S&P 500 – the level investors will pay to buy a certain earnings stream from the U.S. stock market (also called the “multiple”) – mathematically has an “average,” but the “average” does not exist in a vacuum. It is highly specific to a plethora of factors, and perhaps none are more important than inflation (and more particularly, inflation expectations). There is no question that the “average” multiple has varied a great deal around the prevalent inflation level in society, and that very low inflation facilitates a higher P/E ratio, just as higher inflation facilitates a much lower one.

* Strategas Research, The Daily Macro Brief, May 20, 2020

Suffice it to say, our view is that we face very low inflation for the foreseeable future, again, because of highly deflationary pressures that have compressed the velocity of money.

An update on emerging markets

The stubborn and ascendant U.S. dollar has held back dollar-denominated returns in emerging markets, and yet the macro theme of a significant portion of the world’s population aspiring for a better life remains highly attractive to us. Well-run companies with superior growth characteristics that can be bought for significantly lower valuations than in developed markets are there for investing. And unlike the early phases of emerging markets investing, they are not only in the energy, materials, and utilities sectors. Truly spectacular new companies in the modernized economy are there.

We still want to avoid SOE’s (state-owned enterprises) where possible, which is why country ETFs that have nearly all of their positions in SOEs remain very problematic. Passive investing is simply dangerous in the emerging markets space. Governance matters. Geopolitics matters. And more than anything, earnings growth matters. All of these things require the intervention of active management.

The space requires a long-term view and has been stunted for part of the past decade, not by underlying organic growth, but by macro-currency effects on valuation. That tide turning bodes well for patient, opportunistic growth investors.

Future of interest rates

There are two competing forces that affect longer-maturity bond yields (think about the 10-year, 20-year, and 30-year Treasury) – one is the Fed activities in quantitative easing to try and control yields, and the other is the weak economy which is expecting low growth and dis-inflation. I expect yields to stay low until we get economic progress, and then at that point, for the Fed to use Yield Curve Control to try and manipulate some manageable level of long-bond rates, while still holding the curve as steep as possible.

If all of this sounds like a balancing act, riddled with manipulation and intervention, it’s because I am writing in clear English, and you know how to read.

Any good economic news as we go into the weekend?

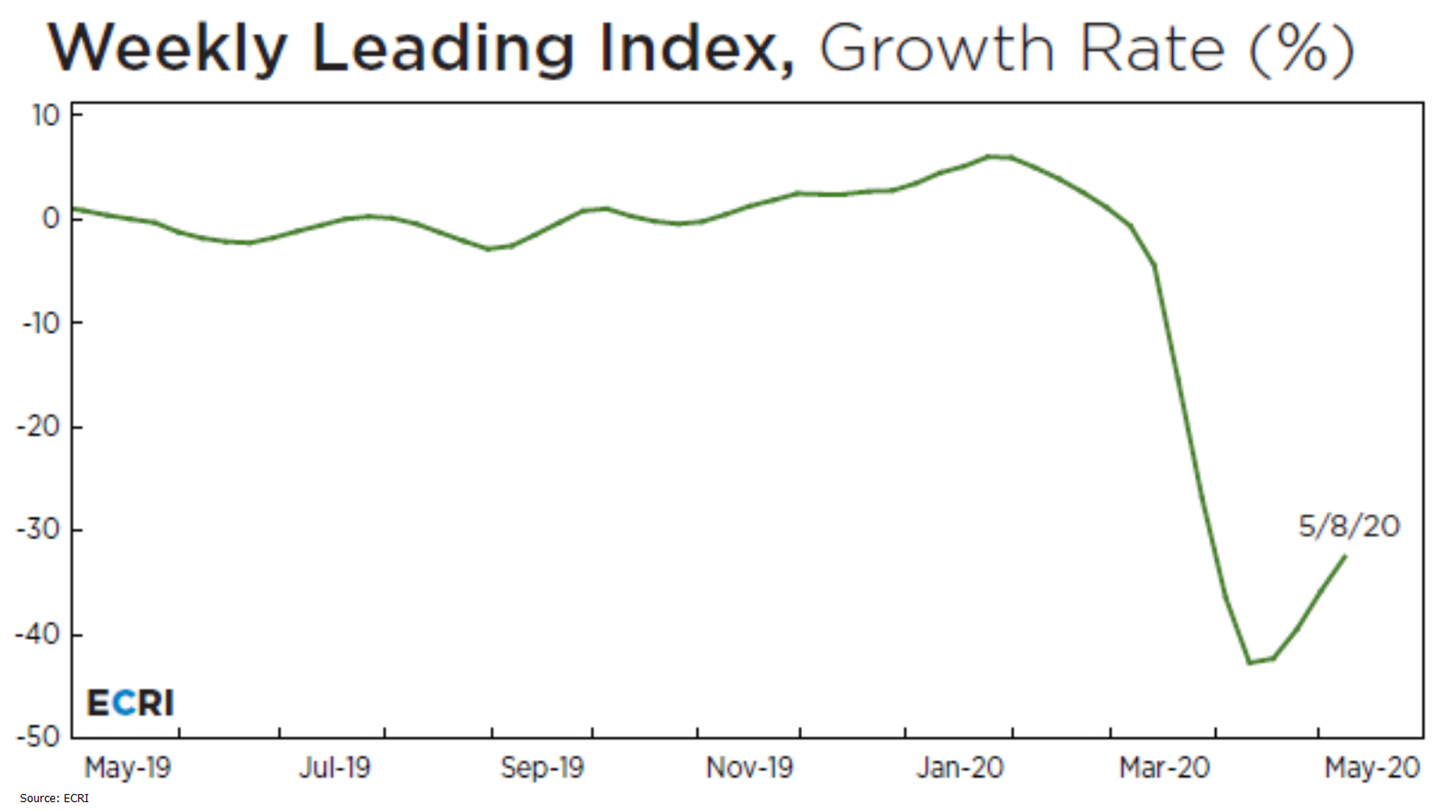

The Economic Cycle Research Institute does not share their proprietary components so what exactly makes up their Weekly Leading Index is unclear, but what is not unclear is how potent of a tool it has been for many years in forecasting leading indicators of economic improvement. This week’s chart was the first time since the COVID downturn began that the leading index has pointed up. It is still negative, mind you, but it is less negative than the prior weeks and showed at least some trend reversal in leading indicators.

* Economic Cycle Research Institute, May 15, 2020

And another?

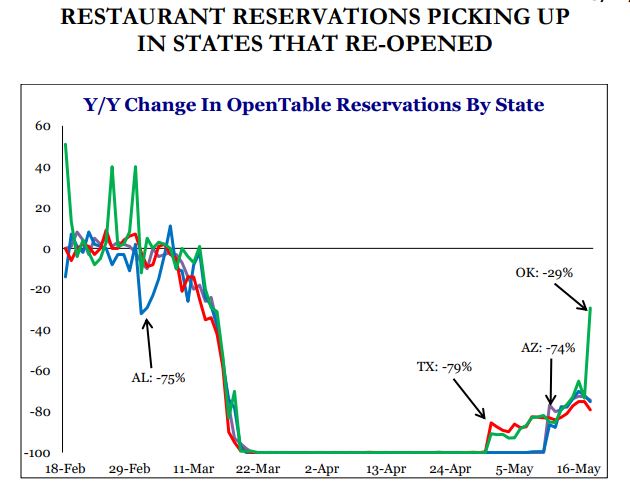

No one is more excited for restaurants to re-open for sit-down service than I (besides, I presume, the owners and workers of the great restaurant establishments of our country). I am well aware of the unpredictable pace and processes on our way to normalization but excited nonetheless. I share this with you as a snapshot of a moment in time. I welcome your projections of which states will lead the way in re-opened dining, and what number we end up at (i.e. how much recovery will we see in reservations). It is a significant economic metric, but we may as well have a little fun with it (while we wait for our orders).

* Strategas Research, Policy Outlook, May 21, 2020, p. 6

Politics & Money: Beltway Bulls and Bears

- The stage is set for a debate over Stimulus 4.0, and as I have been writing in COVID and Markets each day, I believe the two major fault lines are (a) State/local support for the Democrats, and (b) Liability protection for employers for the Republicans. The question marks are around the fate of the unemployment subsidy, and the White House’s push for a payroll tax cut. The timeline is not imminent, but not late summer either. I suspect there will be a 2-3 week fight from late May through mid-June and some vote to take place by late June.

- With apologies to the five or six deficit hawks still out there (I am one of them), I just want to prep you that I do not believe 4.0 is going to be the end of this. At a later stage in COVID recovery, I am rather confident that we are going to get some attempt at two additional endeavors … First, an infrastructure spending package (and I do suppose it is possible some part of this could get stuffed into Stimulus 4.0), and secondly, a massive national program to drive on-shoring of key American manufacturing (tax credits, national security mandates, pharmaceutical supply chain, etc.). I am watching all of this as closely as I can, working my Rolodex, and keeping my ear firmly to the pavement.

Chart(s) of the Week

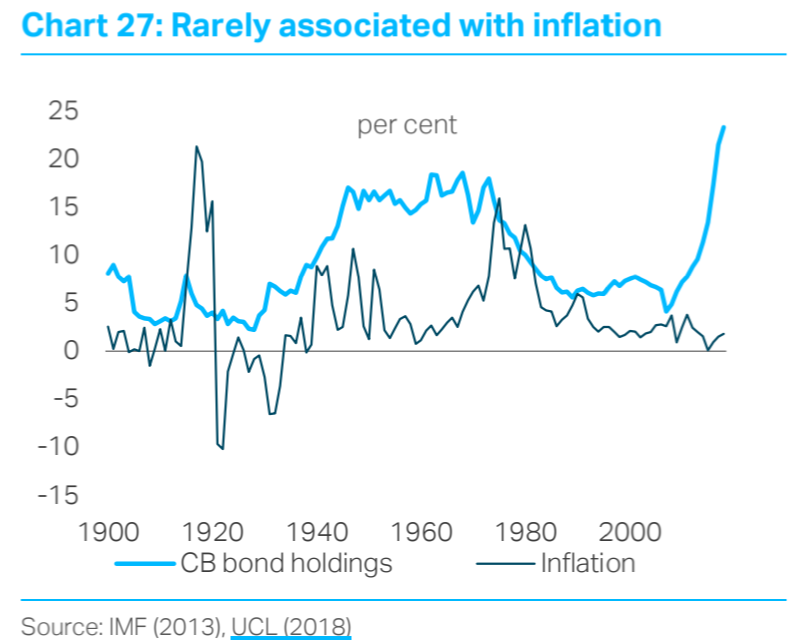

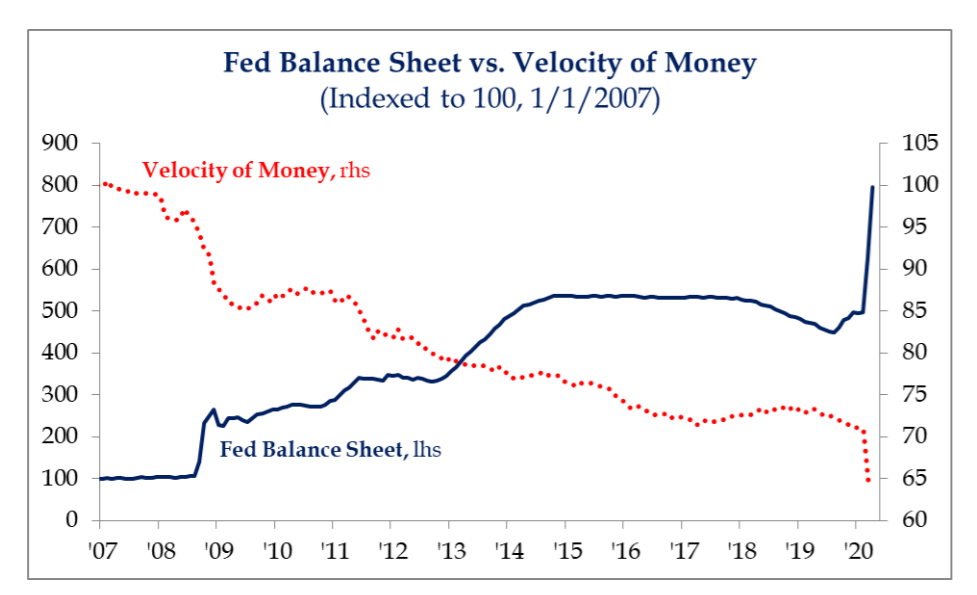

The inflation vs. deflation fight is best illustrated in this week’s Charts of the Week (a rare double feature). The first chart explains the “what” – namely, that central bank balance sheets do not create inflation … They do a lot of things – distort markets, hide price discovery, and create financial uncertainties – but they are not inherently inflationary.

But the second chart explains the “why” – and it is Irving Fisher 101. The balance sheet of central bank bond purchases cannot create inflation, because there is no velocity of money. And that “turnover” of money is not just needed for there to be inflation, but it is worked against by central bank quantitative easing. It is a competing force. These Fed efforts support financial markets in times of emergency, but they do not create the goods and services that make markets work. More importantly, I believe by distorting prices and suppressing interest rates, they dis-incentivize the creation of new goods and services.

* Strategas Research, Investment Strategy Viewpoint, May 8, 2020, p. 4

Quote of the Week

“Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance.”

~ Warren Buffett

* * *

I am covering the Fed a lot these days because the Fed is that big of a story, present, and future tense. But next week’s Dividend Cafe will offer a much broader summary of the 2020 Mauldin Strategic Investment Conference takeaways, and of course the state of economic recovery in this COVID moment.

From the COVID moment to the post-COVID moment, this really is the life I chose. And I am so, so grateful for all of it. To that end, I work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet

The Bahnsen Group is a team of investment professionals registered with HighTower Securities, LLC, member FINRA, SIPC & HighTower Advisors, LLC a registered investment advisor with the SEC. All securities are offered through HighTower Securities, LLC and advisory services are offered through HighTower Advisors, LLC.

This is not an offer to buy or sell securities. No investment process is free of risk and there is no guarantee that the investment process described herein will be profitable. Investors may lose all of their investments. Past performance is not indicative of current or future performance and is not a guarantee.

This document was created for informational purposes only; the opinions expressed are solely those of the author, and do not represent those of HighTower Advisors, LLC or any of its affiliates.