Dear Valued Clients and Friends,

I first want to thank everyone for the extremely positive feedback last week on the somewhat unique Dividend Cafe juxtaposing USC football and markets. It was fun to write and, at least for some of you, appears to have been fun to read.

But for those who prefer the serious stuff, we are back to normal this week, and I think it is time I cover a topic that comes up a lot anecdotally, but I don’t think has ever received headline treatment in the Dividend Cafe. And yet, it is one of the single most important topics in the field of economics and finance …

I refer to currencies, the U.S. dollar in particular, but really the overall global dynamics of currency and what it all means to investors. Currency ramifications impact all investors all the time, yet we rarely contemplate why or how. Today I want to play around a bit with some aspects of this critical topic in the present reality.

Jump on into the Dividend Cafe …

|

Subscribe on |

Yardstick

We are going to start with three letters – DXY. It is an index of the U.S. dollar against six major global currencies, in this case the Euro, the Yen, the Pound, the Canadian dollar, the Swedish Krona, and the Swiss Franc. This basket of currencies that DXY is measured against has been the same since 1974, with the obvious caveat that the Euro’s entry in 1999 replaced the various European currencies held before the Euro consolidated those nations’ currencies (Germany, France, and Italy).

The weightings of these six currencies were set a long time ago and have not changed for various economic reasons over time, on one hand giving the index the benefit of consistency and “apples to apples,” but on the other hand failing to “keep up with the times” if one country’s economic significance or trade dynamics changes.

The Fed created a “trade-weighted” version of the dollar index in 1998 to measure currency movements relative to the importance each country in the index has to U.S. trade purposes. So if one country is 20% of our import/export activity and another country is 5% of our import/export activity, those trade particulars should be reflected in the weighting of each country in the index.

So some form of a “trade-weighted” index or the basic DXY (dollar) index are the two major measurements we have of U.S. dollar activity relative to other currencies.

Basic reminder

We do not measure Apple relative to Microsoft. Investors buy a share of Apple and pay what they pay, regardless of what Microsoft or any other company costs. It is an “absolute” number, and the relative number is just anecdotal. Why can’t a currency be the same? Why do we have to measure the dollar relative to other currencies? Well, some of this is a tautology. We actually do have an absolute value for the dollar. It is called, a dollar. Or, if you prefer, $1. Or $1.00. Or one dollar. I can go on and on.

By definition, all a currency is a unit of exchange. It is a medium for exchange that allows for extraordinary convenience and divisibility. If one party wants a cow and another party wants a yellow pad of paper, it is far more convenient to use dollars to affect the buys and sells and let each party figure out the difference for optimizing their yellow pad needs and cow needs. To trade the yellow pads and cow directly could get messy if you know what I mean. Currency gives us a medium to effect vast transactions of different size, complexity, and particulars on an even playing field (as opposed to waiting until one needs as many yellow pads of paper as one cow would trade for, dollars allow us to trade at our own volume need and pocket the rest for other needs).

So currency indexes must inherently be relative. When the dollar goes up, it does not become $1.20. It is one dollar. But if that same dollar buys more Euros than it did before, or less Euros than it did before, then we have a measurement of value relative to other currencies. This is what we mean by currency value – the relative value to other currencies.

King Dollar

Let’s start with what is supposed to be the good news but is, in fact, more nuanced than that. The U.S. dollar has been on a massive tear. I mean, massive.

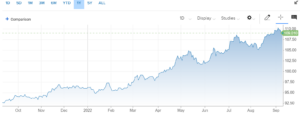

Here is DXY – the basic dollar index we have used my whole life that is measured against six major world currencies as mentioned above.

*CNBC.com, DXY, Sept. 9, 2022

You will note a +17.8% move higher for the dollar relative to this blended basket of currencies over the last year alone.

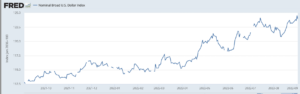

And here is the Fed’s “trade-weighted” version of the same:

*St. Louis Federal Reserve Economic Data, Sept. 2022

It is not quite +17.8%, but a +10.7% jump in one year is still massive.

If this is a good dollar, cancel my subscription

Part of the confusion for people is that they know prices are higher (that is, their dollars buy less things), so they naturally wonder how the dollar can be higher in value (relative to other currencies) when the purchasing power of their own dollars (domestically) feels lower. It is, in fact, not confusing as much as a counter-argument to the idea of perpetual U.S. inflation. Historically, the dollar does in fact weaken when there is high domestic inflation as global actors price in the reality of a given currency buying less things in the future. The dollar’s relative strength in this cycle (and that is an under-statement) may not be confusing as much as a simple statement that we are wrong about what is going on – that the primary cause of our own price level increases was not monetary pressures as much as woeful supply imbalances relative to demand (I know, you’ve heard this before).

Don’t we love a stronger dollar?

As a general rule of thumb, it strikes me as counter-intuitive for an American to root for a weaker American dollar, and it seems to make a lot of sense for an American to want a strong American dollar. This doesn’t seem nationalistic to me; it seems logical. So why hand-wringing over the state of the strong U.S. dollar?

Well, problem number one is not a problem for everyone, but it certainly needs to be said for our purposes … Those invested in international investments suffer when the currency of the thing they are invested in drops relative to the dollars they forfeited to make the investment. At The Bahnsen Group, we have almost 0% weighted to Europe and 0% to Japan, so this has helped us a great deal in recent years (especially this one) relative to most U.S. investors with more traditional global weightings. That said, we do have an allocation to Emerging Markets in our Growth Enhancements portfolio and a different EM strategy we use in our Income Enhancements portfolio. A rapidly rising U.S. dollar hurts any non-U.S. dollar asset.

But the investment particulars to someone invested in another country’s stock or bond markets are not generally what people refer to when bemoaning a strong U.S. dollar. Usually, dollar strength phobia refers to the global economic reality of goods being more expensive in foreign countries, so companies with strong overseas business have profits weakened by the hit to competitiveness in foreign markets that a strong dollar represents.

Now, advocates of a strong, stable dollar (like myself) are quick to point out that this concern is a big for some but a feature for others. Americans traveling to other countries like a strong dollar (they can buy more things in the converted currency of the place they are visiting). And of course, for a country like ours that imports a lot of goods, we get more bang for our buck with a strong dollar, buying more of the same products because our currency pays for more when it is strong.

But yes, a strong dollar (strong and still getting stronger) is a headwind to the profits of companies who do a lot of overseas sales, period. Importers like it. Exporters don’t like it. And most multinationals do a bit of both, so it is complex.

Economics 201

I don’t want to pretend this is a simple concept, but it isn’t overly complex. One of the issues about hand-wringing over a strong or weak currency (within a reasonable band) that bothers me is that it ignores a basic economic reality of human action … Maybe not on day one or day two, but eventually, the effect of a stronger or weaker currency is washed as demand moves up or down with the currency’s reality and gets reflected in the price. Equilibrium is found, even if not in a linear manner. It is not like humans are oblivious to the reality of currency fluctuation; markets price it in, and then supply/demand realities move in the rational course.

Investor reality

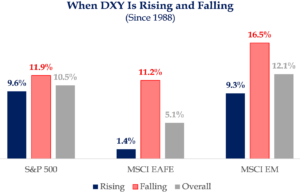

Emerging markets like a falling dollar the most. Developed international markets have a very tough time making money when the dollar is rising. And the S&P being filled with importers and exporters is basically fine in both scenarios (modestly better with a falling dollar than a rising one, probably because of coincident dropping interest rates in those times boosting valuations). (See Chart of the Week below)

In the weeds

The U.S. technology industry receives 58.1% of its revenues outside the United States. Utilities receive less than 2% of their revenues outside the United States. Does that make sense? Therefore, a sector like Utilities is not impeded by a stronger dollar, and the tech industry is.

Materials is another sector with large foreign revenue. Real Estate is another sector with low foreign revenue.

You get the idea.

So what has caused this dollar move?

It is easy to believe that the only thing that moves a currency relative to another currency are interest rate differentials. That is, one currency is offering 3% on deposits and another 1% on deposits, so the value of the higher-yielding currency is worth more than the lower-yielding. Dollar to yen comparisons are fair here. But of course, nothing is ever that simple. Expectations matter. Rule of law matters. Relative policy sensibility and stability matter. Political health matters. Often times it is worth not just evaluating the “point in time” value of a currency but its “over time” volatility! A high fluctuation of a currency makes economic calculation hard and speaks to unpredictability and dysfunction.

The dollar has strengthened because it has tightened monetary policy, yes. But so has everyone else besides Japan. The dollar has strengthened, rather, because embedded dynamics across trade, rule of law, flexibility, and the rest, combined with other factors, have been more attractive than the alternatives.

None of these things are great for the U.S. But they don’t have to be. A dollar is a dollar. It is the relative weighting that currency values reflect. The Euro and the Yen have weakened more than the dollar has strengthened, and that is the simple fact of 2022.

Can we make money on this?

No. The dollar is not likely to stay in this upward trend. It is not currently a weak or a strong currency unless we limit our time horizon to a very short period where “strong” makes sense. It is over the medium and long term (past and future), somewhat unpredictable and volatile. Our policymakers are happy to use it not as a store of value but as a tool. I wish that were not true. But it is.

I offer no prediction on where it will be in a year. And I would rather play fantasy football for money than guess what politicians will do with the currency of their citizens over a given year.

Conclusion

I will offer some more commentary in an upcoming DC Today on why Asian currencies ex-Japan have been softening and what I think the macroeconomic reality is around such moves. But for now:

- a weaker U.S. dollar will help emerging markets the most

- the stronger U.S. dollar has hurt those with the highest foreign revenues the most

- the dollar is not stronger because of monetary policy; it is stronger because other currencies are weaker

- that dynamic points to a lack of belief from global economic actors in sustained U.S. inflation

Chart of the Week

*Strategas Research, Daily Macro Brief, Sept. 9, 2022

Quote of the Week

“Empathy does not grant us the right to distort reality.”

~ Father Robert Sirico

* * *

I am jumping on a plane to Washington D.C. right now, where I speak at a symposium tomorrow (actually a debate in defense of financial markets). I will be in New York City from there and have a full schedule in Manhattan next week.

Reach out with any questions you have on this topic, and get ready for next week’s additions to our DC Today format. It is going to be fun.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet