Dear Valued Clients and Friends,

Last weekend I watched a new documentary series on Netflix called Madoff: The Monster of Wall Street. Some of you know I am a bit of a geek for all things Wall Street history, and I seriously doubt you would believe me if you knew how many documentaries, fictionalized movies and TV shows, not to mention real books, I have taken in over the years covering various elements of Wall Street history. Many of them have a protagonist (at least from my perspective), and many cover the escapades of either the evil or the incompetent. This latest Madoff series manages to do both – cover the evil and the incompetent.

But the entire Bernie Madoff saga also reinforces one of the most important and actionable realities of investing, universally applicable and relevant to all. And it really has very little to do with the red flags to avoid when it comes to international Ponzi schemes. Don’t get me wrong – I remain earnestly opposed to Ponzi schemes. =) But there is another lesson in the Madoff saga that transcends even that, and it applies to the core of human nature. And that is the subject of today’s Dividend Cafe …

|

Subscribe on |

First, the backdrop

For those who weren’t following the story in 2008 and 2009 or who haven’t followed the various media depictions since perhaps a little background is in order. Bernie Madoff was arrested in December of 2008 as the country was still in the midst of the unprecedented economic collapse of the financial crisis. Just three months after the fall of Lehman Brothers and the bursting of the national housing bubble, as an economic recession raged, as markets tanked, as a new administration prepared to come in to implement the controversial TARP regime, and as the Fed began a period of serious intervention to stabilize financial markets, a more soap opera like tale hit the tape. A Wall Street fixture named Bernie Madoff, the one-time chairman of the board at Nasdaq, the owner of a market-making firm that cleared nearly 10% of all trades on the stock exchange, a forty-year industry veteran and titan, was arrested by the FBI after being turned in by his adult sons for running a massive Ponzi scheme. $65 billion or so massive. He was quickly convicted and sentenced to 150 years in prison (and has since died in prison). Both of his sons tragically died after this arrest before Bernie died. His houses and yachts were seized. Billions upon billions of dollars have been recovered and returned to investors. And the entire story has become culturally iconic.

It was and is the largest Ponzi scheme in history. Interestingly, over 80% of the funds have been recovered and returned to investors (primarily by seizing ill-gotten gains from other investors) – but the 80% refers to the amount of money invested, whereas the $65 billion refers to how much money investors thought they had (the fake gains over the years on top of the principal invested). Those of tens of billions of fake gains could never be recovered because, ummmm, they weren’t real.

Besides the massive size of the fraud, the stature of the perpetrator, and the alleged sophistication of many of the people invested, the story has another piece that is quite fascinating … There were no investments. None. There was never an attempt to buy or sell securities. The Ponzi was not necessary because the underlying investments declined; there was never a pretense of managing money. Just cash in and cash out, and as long as there was more cash in than cash out (which there almost always was), it worked.

How did no one catch this for decades?

Just for the historical record, consider this article from Barron’s magazine written in 2001 – seven whopping years before the public discovery of his fraud and arrest – wherein one of the most well-read financial media publications in the world flat out said, “no one knows how this guy makes his returns” – and – “no one really believes that he could be making it the way he says he is” – but clearly the takeaway was – “no one really cared – because, you know, people believe what they want to believe.” This was never a matter of people not having the faintest idea of suspicion or skepticism. It was a matter of hope trumping cognitive reality. And hope is the charitable word.

The return on increased regulation

A popular line of reasoning is that Madoff and other scams like it are a problem of under-funded and under-resourced regulators. It has become popular to say that budget cuts to the SEC, and such, leave the regulators behind the eight-ball in catching shifty bad guys like Madoff. We did some digging because it didn’t sound like any government agency I know to routinely see budget cuts. Sure enough, the $300 million annual budget of the Securities and Exchange Commission (SEC) in 1995 is over $2.2 billion today, a gain of 7.38% per year for 28 years. And besides one tiny drop of 2.7% one year and another of 0.7% another, the budget was increased year-over-year for 26 of the last 28 years. No, this is not a problem of adequate resources.

There was no actual account holding securities. There were no trades being executed. There were a couple of guys from Queens printing fake statements on a dot matrix printer, and multi-billion dollar investors believed it was real. Yeah, okay.

Ponzis are bad

If someone steals your money, that is a bad thing. I am against fraud. I am against Ponzi schemes. I hope people will be smarter about such things, more vigilant, more diligent, and more thorough. I hope the regulators would investigate things presented to them that clearly create the smell of foul play. I find such theft and evil grotesque. I apologize if this moral certitude is offensive to anyone.

Now that the hard part is out of the way …

But of course, everyone is against Ponzi schemes and fraud, at least those not committing them. Only the most ethically depraved would condone fraud and theft, and I think there are only a few Dividend Cafe readers who are in that category (just kidding). So why is this subject of universal importance?

Because the first sin was the lie

No one. No one. No one. Generates 15% returns with no risk. No one. Ever. It does not happen. And no one, no one, no one, generates 12-16% returns year over year over year with 4 down months in 12 years. It. Can. Not. Happen. Before a single dollar was stolen, the first mistake of investors was committed, and it was not a failure to verify a custodial account, a lack of due diligence, or inadequate governance or controls.

It was the willingness to entertain a fantasy.

The heart wants what the heart wants

Grown-ups know better than to say stupid things like that in a serious context, but we all have a sort of romantic element to our personality – a dreamer, someone who hopes the aspirations that make life fun. And yet when it comes to investing, there is a simple rule that is universal and inescapable – reward comes with risk. One cannot wish it away, hope it away, or dream it away. The first mistake was not investing with Bernie. It was believing Bernie even exists. Because that Bernie doesn’t. He never had, and he never will. But there is more.

The Bernie trying to get you is not a Ponzi scheme

The part I see over and over and over and over and over again is not people believing something absurd about a given investment and then having their money stolen in a scam. What I see over and over is an investment that is too good to be true, proving not to be, and even though the money is not stolen, it is set on fire. And I think that accomplishes the same thing for the investor, yes?

And by the way, if you are told, there is a 12% investment, and it cannot go wrong, and you get your money back and your 12% back, it does not mean the promises were true. It means it worked out that time. And it means that the reward side won out over the risk side. The danger is not that all investments are bad investments, obviously. It is presenting them as lacking risk – either volatility risk, or credit risk, or erosion of value risk, etc. Risk and reward are inversely married, and that does not cease to be true when an investment pays off. In fact, the payment is the reinforcement of this principle (the reward came as a premium to the risk the investor took, whatever that may be).

“I know a guy”

These are worse words than “meet my friend, Bernie Madoff.” The “I know a guy” sentence almost always precedes an explanation of someone who did a real estate deal and was guaranteed 15% and then this and then that. And if it all works out, then the person who “knows a guy” is really emboldened. It may be time to do another deal. It may be time to bring the friends into the deal that initially you were just bragging about the deal to. But it doesn’t end well.

Conclusion

There are appropriate illiquid investments that have a serious risk of loss of principal that could be totally legitimate, opportunistic investments that work out very well. But they were not risk-free whether they panned out or not. There is risk in various elements of public market investing, bond market investing, private markets, real estate, etc. All human attempts to pretend otherwise (and there are many effective tactics for creating the illusion of safety) do not change the basic principle. But human beings want and need to believe things at times that are not true.

Sometimes, they want a Bernie Madoff.

But what they need is the truth about life, markets, and their own nature. To that end, we work.

Chart of the Week

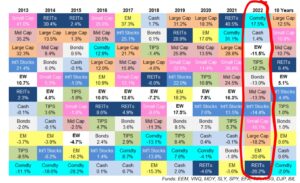

I always enjoy updating the greatest graphic illustration of why investors’ assets allocate every year. I am struck by the reversal of fortune reality that plays out (the worst or one of the worst performing asset classes becoming the best or one of the best the next year, and vice versa, repeatedly happening). I am also struck, of course, by how poorly nearly every asset class performed in 2022 (already discussed in the white paper). It is also noteworthy that “inflation-protected bonds” (TIPS) did nothing to protect against inflation. And finally, the very strong decade for the typical “large-cap U.S. stock” space finally ran into troubled waters. And post-crisis, it was a strong decade, no doubt. History is constantly being made.

*Wealth of Common Sense, Ben Carlson, Jan. 8, 2023

Quote of the Week

“When I was a child, I spoke as a child, I understood as a child, I thought as a child: but when I became a man, I put away childish things.”

~1 Corinthians 13:11

* * *

Have a wonderful weekend, and we shall be back Tuesday with a long and special DC Today!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet