Dear Valued Clients and Friends,

I telegraphed last week a special Dividend Cafe on energy today, and I reiterated that plan several times in DC Today this last week. But as I began pulling it all together in my hotel room here in Washington D.C. at 4:00 this morning, it occurred to me that we appear to be living through a market doing much of what I have been talking about for a very long time and that I have an obligation to make Dividend Cafe as current and relevant as possible. The treatment on the Energy sector I want to present must be written, but it can wait one more week. That topic is no less significant, but from a timeliness standpoint, the market events of the week (and really of all 2022 thus far) provide a golden opportunity to reinforce some more practical investment lessons right now.

As a general rule, I do not like the idea of making Dividend Cafe a weekly response to headlines or market circumstances and have mostly avoided doing so for quite some time now. But this week’s Dividend Cafe is not a mere “this week in markets” play. Rather, I want to use the obviously predominant story in financial markets to illuminate a few key elements of our thinking at The Bahnsen Group. In other words, the inspiration is some current market action, but the lesson is far, far more evergreen.

And I think it is going to really surprise you.

So jump on in to the Dividend Cafe …

Where are we in the markets?

As of press time the Nasdaq is down over -13% from its November 22 high. It is true that the calendar year drop is now -10%, but the Nasdaq was beginning to experience weakness in late 2021, even as the Dow and S&P enjoyed a December post-omicron rally of new highs. The Nasdaq is just above 14,000 as I type. It was at 13,000 when 2021 began, so it remains up +7% in the last year or so.

The Dow is also off 2,000 points now from recent highs, but of course, as a percentage, this only represents a -5% drop or so. Some holdings in the Dow have been hit, but the more stable diversification of this index composition features a lot of offsets to the names that are in a decline.

The S&P is off -6% from recent highs as well, not as bad as the Nasdaq but a bit worse off than the Dow.

So what’s next?

Of course, I do not know, and neither do you, and neither does anyone else. That said, I do feel that versus the last five drops in the broad market, this one has the best chance to become a more standard 10-14% drop in the broad market. That could reverse in one second, but there does generally feel to be less appetite for buying dips right now, and unlike the various drops of the last year, this one has something behind it that is counter-intuitively more concerning.

What is that you ask?

The answer, is nothing.

And that is the worst basis for a market decline.

Let me explain.

A good reason for a drop is a good reason for a reversal

The omicron market drop of November, the Delta drop of July, and a couple other “headline-driven” drops last year may very well have bothered investors last year for one if not two days. But the best thing about those drops was what caused them – that is, irrational panic that was identifiable and demonstrably susceptible to refutation. “Weak hands” selling can only hurt markets for so long Those event-driven bouts of investor insanity can not and do not last, and they always represent the transfer of stocks from those who should not hold them to those who should.

When markets drop for a reason, one can identify what the catalyst would be for reversal.

“We are worried the economy will shut down again.” Markets down.

“Hey look, the economy is not shutting down again.” Markets up.

Pretty simple.

“I think Brexit is going to really hurt world trade.” Markets down.

“Hey, why in the world did I think Brexit was going to hurt world trade?” Markets up.

Some severe drops (the COVID March 2020 national margin call) have a massive degree of uncertainty behind them, and force to the forefront of our consciousness the scariest reality of modern global finance – that is: it is a highly leveraged and highly interconnected financial system, and when there are more sellers than buyers, the borrowed investing system sees a surge of downside that takes time to be absorbed before price stability can be found.

But even then it normalizes, eventually.

So what is scary about “no reason”?

When no particular reason catalyzes a drop it stands to reason that no particular reason will catalyze an increase. But I would say there is more to that in this case.

Most of “no reason” this time simply means – “because they were too high.” Valuation seems nebulous because it lacks a headline or event, but it is not so nebulous – it is an economic law that simply lacks timing predictability.

Valuations trump good things when valuations matter at all

The fascinating thing about irrational exuberance is that valuations can go higher even when there is bad news, and yet valuations are all that matter even when there is good news once valuations matter at all.

As I am typing the leading brand name streaming service in the world is down -24% on the day. Who knows where it ends on the day, but my point is only this: This is not happening because of bad news, or bad earnings; it is happening despite an outperformance of earnings expectations. How can so much price deterioration take place if the earnings were better than expected?

Because valuations get to a point where forward inputs and forward projections require perfection, and perfection is hard to sustain.

Reality Check

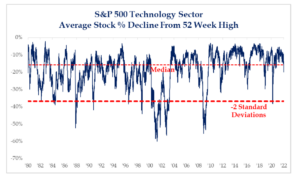

The current market environment is down 6% for the S&P or 13% for the Nasdaq, or whatever, but the reality is that the “average technology stock” is down -20%. It is with the benefit of “market cap weighting” that this has, so far, been softened. During periods of market volatility since the great financial crisis, the average tech stock drop was -30% before a bounce could surface.

*Strategas Research, Daily Macro Brief, Jan. 22, 2022

Is this just a tech story?

First of all Consumer Discretionary is down -13% from its highs just as the Nasdaq is, so no, it is not merely a tech play (though Consumer Discretionary is also higher beta, higher P/E, higher leverage, and higher speculation).

But no, it is not just a “tech” story when one looks at “peripheral” sectors that were also very over-inflated. It is mostly a “shiny object” story. And what I mean by “shiny objects” is that which have generated great interest from investors because of their hype, their sex appeal, their momentum, and their popularity, but not because of a real, rational, calculated projection of something tangible about the future. And by the way, that “something” is supposed to be cash flows – that is what investments are worth – the sum of future cash flows discounted into the present by an appropriate discount rate. Period.

Speculators can make money. Speculators who exit trades profitably can avoid losing money. But speculators have a very hard time repeating their process, largely because they rarely have one. But even when they do, speculation is tough to rely on, for tautological reasons – speculators subject themselves to coin-flip odds in investing.

The most important takeaway about shiny objects

But beyond the various weaknesses that may exist inherently in some “shiny object” investments – beyond those fundamental assumptions we may [rightly or wrongly] disagree with – whether it be crypto, solar, electric vehicle, NFT, dotcom, social media, app gaming, innovation, or anything else you want to make up under the sun – it is imperative that we explain that “shiny object” investing is first and foremost problematic only because it is shiny object investing.

The unsustainability of an investment working because everyone likes it is the thesis behind shunning shiny objects. In a past life, this was called “contrarianism” and it is deep in our ethos at The Bahnsen Group.

Investors are human beings. They are susceptible to greed and fear cycles that are self-reinforcing, and that can disconnect investments from rational explanations. The national margin call of 2020 was more technical driven around the math of excessive leverage in a time of sellers outweighing buyers; that is NOT what I am referring to here. What I mean here is that after enough time of irrational exuberance, the dismissal of fundamentals as obsolete, and the notion that economic laws of logic have been displaced, there eventually comes a time of recalibration, resettling, repricing, and rethinking.

Shiny objects put investors on a cycle of booms and busts that can destroy an investor’s capacity for financial success.

We simply cannot participate.

What is working in 2022?

The only calls I got in 2021 about performance were related to Emerging Markets. They are, of course, leading the pack so far this year (talk about a contrarian principle I could set my alarm to). Energy, Oil, Commodities, and many pockets of dividend growth.

But for heaven’s sake, it has been three weeks. The reason to be allocated to anything must have more than a three-week rationale for it.

Our basis for emerging markets is that valuation is reasonable and there is discernible growth one can buy without having to pay up for it.

Our basis for Energy investments is not the price of oil but rather the profit-making capacity of the companies who produce natural gas and oil (in some cases), and especially those who transport and store it (so-called midstream companies). [More on this next week]

We are not generally prone to heavy direct commodity investment because of the lack of internal rate of return, and the speculative nature of supply/demand characteristics that determine price.

We like dividend growth no matter what is happening in the world because we are committed to the profit-making capacities of well-run companies, and seek to monetize this through the receipt of those profits in the form of dividends. It makes good investors agnostic to noise, and valuations solve for themselves. We root for market volatility for accumulators, and we don’t worry about volatility for withdrawers.

So in all of this, there is no aspect of our feelings for emerging markets, oil, commodities, or dividend growth that has anything to do with how it has done the last three weeks or the last three months or the next three weeks or the next three months. We invest for the next three decades and have rational reasons for how and why we do this.

Going forward

Can there be a big reversal in this recent re-pricing of shiny objects? Sure. It could happen. But I don’t believe new excess liquidity is coming into the markets (a prior source of boost). I don’t believe multiples face imminent expansion both because the prevalent risk-free rate is going higher, not lower, and because valuations were just already too high. And I don’t believe that a whole new class of investor is coming who only wants these kinds of things.

I would see this moment, and whatever comes of it in the 3-6 months ahead, as the optimal time to do the right thing in one’s portfolio – to de-speculate it – to make it less shiny – to make it unpopular.

Unpopular with all but you and your own goals, that is.

Chart of the Week

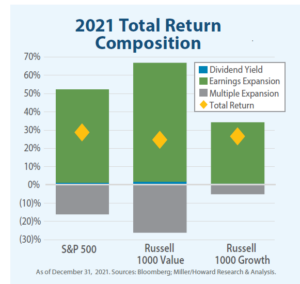

Earnings grew a LOT last year, but the multiples did not come in much for growth stocks (from elevated places); they did much more so for value. Dependence on P/E expansion is the great problem facing growth stocks, and for that matter, the S&P 500 … It is clearly less of a problem for the world of value.

Quote of the Week

“After all, the chief business of the American people is business. They are profoundly concerned with producing, buying, selling, investing and prospering in the world. I am strongly of the opinion that the great majority of people will always find these the moving impulses of our life.

Of course, the accumulation of wealth cannot be justified as the chief end of existence. But we are compelled to recognize it as a means to well-nigh every desirable achievement. So long as wealth is made the means and not the end, we need not greatly fear it.”

~ Calvin Coolidge

* * *

Energy next week. You have my word. Unless something else comes up again.

Just kidding.

Have a wonderful weekend, and thank you for hearing me out on these crucial subjects. We want our clients to avoid the mistakes that can derail financial success. That’s it. That’s why I write about this stuff and feel as strongly as I do. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet