Dear Valued Clients and Friends –

November 3 has come and gone, and while the results may not yet be fully etched in stone, we have a pretty good feel for where things are headed. I suspect there are two camps of you who read the Dividend Cafe, and I do not refer to partisan leanings. What I mean is that I imagine many are excited to not hear about the election any longer, and then there are many who want to wrap their arms around everything as fully as possible (as far as what it all means to the economy and markets, etc.). I want to do a bit of both, personally. I want to accommodate that latter group today, providing as much useful analysis of where we go from here as possible, and then I look forward to having a lot less to say about the political implications of, well, most things.

The fact of the matter is that the political dynamic (a) Always affects markets to some degree, not just in a week like this one; and (b) Always has much, much less of an impact than people believe it does. Policies matter. And there are impacts in both macro and micro parts of the economy and investment markets that stem from policy decisions. But many investors have been utterly confounded over the years (including this week) by markets seeming to respond differently than they expected in response to some political outcome.

Investors who find themselves surprised by a market reaction to a particular political outcome that is different than they expected it to be can be forgiven since truth be told, market reactions confounding people’s expectations is the normal state of affairs. Much of it has to do with the ability of markets to have already priced in a certain outcome before it happens, meaning what seems to be a market response to something is really the market now adjusting to something else – that the market was ahead of the news headline.

And much of it, quite frankly, has to do with markets disagreeing with your interpretation of events. “If X happens, I just know Y will happen.” When X does happen, and Y doesn’t, it really could be that the error was us – assuming X would lead to Y when markets determined that Y was not a logical response to X. If I had a nickel …

So there is some degree of election synopsis this week, but more than anything else, it is my best attempt to offer a sober assessment of where we are, where we may be going, and what it means to X, and to Y, and to A, B, and C while we are at it.

If markets are going to surprise us at times, we may as well try to be as informed and prepared as possible. It can’t change the element of surprise that defines the nature of markets. But it can fill the time while we wait for the next surprise. And the next election. Dear Lord, “next election.” I’m not going there for a while …

Join me in the Dividend Cafe. (And by the way, check out today’s brief appearance on Stuart Varney/Fox Business here)

First the hard part

One of the hardest things about this autopsy on the election results is that it isn’t quite over yet. I am fully aware that (as of press time) there is uncertainty around the exact Arizona, Georgia, Nevada, and Pennsylvania results (as of press time). I have no choice but to let all that play out and to let whatever court filings and protests and lawsuits and disputes play out. Some of the things about to happen may surprise us, and some may not surprise us at all. As of press time, the betting odds have things at a 94% chance of Biden prevailing and a 6% chance of Trump prevailing. President Trump can lose Nevada but would have to flip Arizona, where he is down 47,000 votes, and then hold Pennsylvania, where is up 18,000 votes. You all can read the betting odds expectations as well as I can, and anyone cursed enough to use Twitter knows how much noise is picking up around the country (well, at least on the social media part of the country) about how tight all of this is.

I believe I am saying nothing remotely controversial to say that, at this juncture (typing at 4:00am on Friday morning), the odds indicate a high likelihood of a Biden electoral college win (just needing to win one of the remaining four states), while also acknowledging that some path exists for a narrow Trump win in these remaining states. Because betting odds are as impartial and objective as any of this can get, I find them more helpful than any media analysis may be, let alone the wishes and aspirations of partisan actors.

I also realize that apart from the final count of what happens in Pennsylvania, Georgia, and Arizona, there also exists some degree of wild card around potential court interventions. Might some controversial votes be dis-allowed, or some procedures and protocols be allowed, that alter the ultimate outcome? Of course, it is possible, but it certainly is not anything I could or would even attempt to forecast or predict.

Bottom line: I am watching everything, making macro and micro decisions, and offering macro and micro commentary on the highest likelihood of events.

Baseline expectation

The Senate appears set to end up at a 51-49 level for the Republicans, worst case, but much more likely, a 52-48 outcome. Even if both Georgia seats go to a run-off, the 99% likelihood is that one will be kept by the Republican incumbent, and the 91% likelihood is that both will be (based on the actual November results, and how “run-offs” generally go, especially when the Libertarian candidate is removed from the equation). It is my opinion that nothing has mattered to markets more this week than this, and I believe this is quite evident in market action and specifics within market action since Tuesday night.

In the House of Representatives, we still have 33 seats “too close to call,” with the Democrats right now having 209 seats secured and the Republicans 193 seats … The Republicans have flipped eight seats that were under Democrat control and the Democrats have flipped two that were under Republican control, so the net-net thus far is six seats. Of the 33 remaining, 18-22 are expected to end up as Republican seats, and 11-15 that are expected to end up as Democrat seats (this is from the New York Times own projections, and reflect current vote count plus remaining). So in the end, the Democrats will keep the majority in the House, but rather than add 15-20 seats as expected, they may end up losing as many as ~15 seats, and certainly, ~10 looks very likely. A 235-200 lead for the Democrats will likely end up around 222-213 – crazy close and totally, completely unexpected.

Divided we rally?

The country being as divided as it is presents incredible social and cultural challenges. Like many of you, I see it, feel it, and often grieve over it, as well. I do not want to mistake the divided government in Congress (Democrat majority House/Republican majority Senate) with the divisions and polarizations in the country. I do not want to mistake divided control amongst the branches of government with the divided leanings that exist between urban and rural areas in our country, or between red states and blue states, etc. The division I speak of as a positive thing is structural and procedural and governmental – and yes, I believe it is a very positive thing for investors and markets. I certainly do not see the continued deterioration of social cohesion as a positive, and while I could talk all day about that (I even wrote a book about it once), it is the gridlock of divided government that is most impactful to markets right now.

Why do markets like gridlock?

For one thing, it is an incomplete thought to say that markets like gridlock. What I mean in the current context is that markets prefer inaction to the alternative of market-unfriendly actions. If somehow there was a force of compromise, deal-making, and constructive policy-making that addressed health care, infrastructure, economic growth, and all the various issues of the day sensibly and rationally, I certainly concede markets would love that form of anti-gridlock much more than gridlock.

But in the context of this week, the issues that may have been at play dealt with taxes, regulations, and maintenance of our governmental institutions that served as a form of “tail risk” to markets – outcomes previously considered “unlikely but high impact.” If those high impact events are off the table (for now), it re-prices risk assets accordingly.

Stimulus

I forecast that a stimulus deal in the lame-duck session is not likely to happen and that a stimulus deal after the inauguration is almost certain to happen. However, without the pressure of a Republican President on a Republican Senate, I believe the Republican Senate is much less likely to give in on the areas it believes are ill-advised for a relief package. I can see the total price being anywhere from $500 billion to $1.5 trillion, but not $2-3 trillion that was certainly going to be the case had the Senate flipped. And I believe the composition of a deal will be less focused on direct payments to states and instead will be more targeted in its scope. This is the best explanation for bonds rallying the last couple of days.

Spending

When it comes to impact on bond markets, impact to deficits, and overall macroeconomic implications, we really are not just talking about a potential fourth “stimulus” bill – but government spending overall. Why is our view that bond yields stay compressed, rates low, and GDP growth contained to sub-3% real levels (if not sub-2% level once post-COVID normalization is done)? Because with any of these four possibilities, we see no containment of spending even remotely interesting to anyone’s agenda:

- Republican President, Democrat Congress

- Republican President, Republican Congress

- Democrat President, Republican Congress

- Democrat President, Democrat Congress

Admittedly, it is the fourth category up there where one presumes spending would have been the highest, and it is the third category that markets are now pricing in, where one assumes spending would be the lowest (Republicans seem to have a magical way of resisting spending more when a Democrat is President than when a Republican is President). But regardless, in all four scenarios, we see no deficit containment, and therefore the counter-intuitive downward pressure on rates that this deflationary spiral necessitates.

Bank on this

What are the impacts on the financial sector of no blank check existing from the Senate and the White House to go all Elizabeth Warren on the financial companies?

- The “financial transactions tax” – off the table

- Forced break-up of the big banks – off the table

- The political realities around how all this came together this week substantially increase the odds of a Treasury Secretary who will be more moderate than otherwise could have been

- Fed appointees that are more hawkish on capital constraints – much less likely now

- More politically tolerable to allow capital return to shareholder programs to resume (this is a Fed decision, not a political one, but, well, okay, it’s pretty political, and yes, it is my expectation).

Private Matter

The leading private equity sponsors that are publicly traded saw their stocks rise 6-9% the last few days in the aftermath of election results. Dangling out there had been the concern that (a) Companies would lose the deductibility of interest expense, (b) A backdoor tax hike would eliminate the carried interest benefit, and (c) A general tone and posture that is anti-private equity would become part of a new administration. I do not expect these things now, and in fact, believe in a post-COVID, low-rate, highly-liquid, economically-challenged opportunity set, the horizon for private equity and private credit is extremely opportunistic.

You can (anti)trust in this Game of Monopoly

There is no question that the immediate aftermath of the election saw Big Tech rally substantially, and it strikes me as perfectly appropriate to assume (prima facie) that some of that is the assumption that there would be less regulatory scrutiny around antitrust, privacy, and FTC compliance in a Biden administration than a Trump one. It also should be reiterated that the risk to Big Tech was never political, in my opinion (it seems to have done pretty well these last four years, last time I checked), but rather valuation. Our view is that the valuation risk remains and that it remains completely “un-timeable.”

Currency speaking

I envision the U.S. dollar weakening, but another way of saying this is that I envision the Euro strengthening (modestly, and only temporarily) as European tariff risks are diminished. The emerging markets equity space is the most obvious beneficiary of a weaker dollar,

Not all clear

Can the President with executive office authority, implement regulatory actions that impact key sectors (notably financials and energy)? Yes, indeed. I believe certain purple states with 2022 mid-terms (Senate and House, of course) become more vulnerable if certain actions are taken by the White House that do real damage to the U.S. energy industry (Ohio, Pennsylvania, Colorado, New Mexico, etc.). But net-net there will be regulatory headwinds in energy and financial sectors in the years ahead; I just believe that regulatory pressure will now be less than had been previously anticipated (and priced in).

Is there a tail risk of all this craziness?

Lawsuits. Overturned results. Social chaos. Public distrust. Escalations. Even violence (pray God, no). Are we sitting on a societal tinder box that could explode?

I can’t tell you that this doesn’t get worse before it gets better. I can tell you what I pray for, but the reality is that there does remain a lot of uncertainty on some things right now (as predicted over and over and over and over again by me in these very pages and calls and podcasts, but also by almost any other commentator or pundit who was paying attention).

History lesson

Do I believe we are entering a period of bipartisan deal-making? No, I do not. Do I believe Biden and McConnell will prove to be vanguards of compromise and unity in a dividend and torn nation? No, I do not. But I do believe readers deserve to know (or remember) that in 2010 it was then Vice President Biden and then-Senate Minority Leader McConnell who struck a deal to avoid a fiscal stalemate. It was Biden and McConnell who worked out the debt ceiling deal in August 2011 when talks broke down with Obama and Boehner. And it was famously Biden and McConnell who brokered the fiscal cliff deal at the end of 2012 going into 2013.

McConnell was the only Republican Senator who attended Beau Biden’s funeral, by the way.

Look – I am not saying there will be any kumbaya any time soon. But I am saying that there is a history here, and there is an unknowability as to how these winds will blow that should be factored into our thinking.

Hey now!

You may have noticed that I just wrote this entire Dividend Cafe under the assumption of a Biden presidency. I will, of course, re-write this should the electoral realities necessitate such. As I clearly stated earlier in the commentary, I am going off the 95% betting odds and nothing else. I can’t and won’t speculate on uncounted votes and potential changes in Nevada or Arizona, let alone legal disputes in Pennsylvania, etc. We know it is a bitterly close election, and we know that the pollsters who assured us of something not close have demeaned their profession, perhaps permanently. The blue wave did not happen, and yet, at this time, for the purposes of me writing something meaningful, actionable, and useful, I wrote around the overwhelmingly more likely ending. If that produces any offense for anyone, I apologize, but I do believe it was the right way to approach this.

And of course, if we wake up Monday with Trump having taken Arizona, and a big lead opened up in Pennsylvania, and betting odds showing this as newly competitive, I am a pretty hard-working guy … I can write another Dividend Cafe! =)

NON-Politics & Money

- Oh the irony – that I have a Politics & Money section here … (it seems like it has been all Politics & Money for quite some time). But since the entire Dividend Cafe was Politics this week, let me hijack the Politics section and instead say this – the biggest three (non-political) catalysts for markets in 2021:

(1) Corporate profits – 86% of companies beat expectations so far this quarter. Significant costs have been taken out of many company P&L’s (i.e., lower interest expense, lower wage and hiring costs, less CAPEX, etc.). Earnings estimates (forward) had gotten as low as $140/share for the S&P 500 in May of this year. The forward estimate is now $161. Meet that, and the ~21x multiple it represents (against a 0.7% ten-year treasury) is somewhat feasible but not cheap. But beat that, and all of a sudden, market indexes could very well have room to go in 2021. Does the $161 assume the cost-cutting I already alluded to? Yes. But does it factor in revenue growth as well? I doubt it. So the stars could very well align in such a way that a perfect storm lines up – unexpected revenue growth, expected changes to cost structure, and a positive sentiment, all coupled together against a <1% discount rate. Everything in this paragraph trumps the election results for 2021 market action.

(2) The Fed – Money supply (M2) is up 24% year-over-year. The Fed’s balance sheet has had $3 trillion added to it. Troubled companies can borrow at 3-4%; stellar companies can borrow at 1%. Sorry. But it is very, very difficult to bet against risk assets with this monetary backdrop, and the bias is for more booze in the punch bowl, not less.

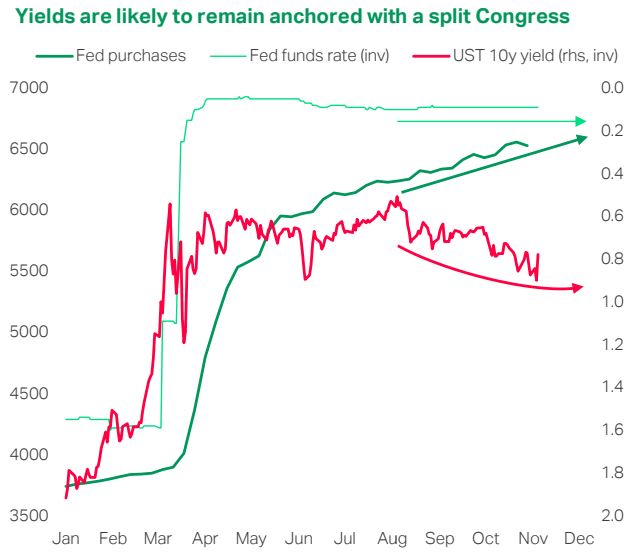

Chart of the Week

The ten-year low. Fed QE high. Fed funds rate zero. Same old song and dance no matter what is happening in D.C. And it drives financial markets.

*TS Lombard, Strategy Chartbook, Nov. 6, 2020, p. 8

Quote of the Week

“I mean to live my life an obedient man, but obedient to God, subservient to the wisdom of my ancestors; never to the authority of political truths arrived at yesterday at the voting booth.”

~ William F. Buckley Jr.

* * *

It has been an emotionally exhausting week for many. It has been physically exhausting for me (2-3 hours of sleep for three nights in a row now). Markets have been incredibly resilient. But I do pray for our country, and I do pray for all of you. This noise is not going away in the next week or so. But I hope today’s Dividend Cafe has given you a better feel for what does lie ahead, outside the noise, and inside the world in which my passions lie of financial markets. Corporate profits and Monetary Policy may bore some of you compared to political knife-fighting. But maybe boredom is under-rated.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet