Dear Valued Clients and Friends,

The effort to meet face to face with money managers, hedge funds, macroeconomic analysts, and other such “life of the party” luminaries began in 2006. Of course, back then I was overseeing just $100 million of client assets and busily deciding if I was going to move my business at UBS to either Bear Stearns or to Morgan Stanley (yes, that was a real dilemma I once faced; I’d say the angels aided me in my decision). But I had very limited access, basically no clout, and asset management firms that were perplexed by an advisor’s desire to do such intense due diligence.

“Your firm has told you these managers are good. Isn’t that good enough?”

“Your firm likes our fund. Why do you need to meet the managers?”

My stubborn insistence on actually creating my own process, on doing much deeper dives than the average advisor does, paid off in big ways for me. But I quickly found out that the “payoff” was not merely in how I was able to better vet products and solutions used on behalf of my clients. These meetings became a source of transformative learning for me in my career as an investment professional.

This week’s Dividend Cafe is not about the trip down memory lane, unless by memory lane you mean the last five days. But Brian Szytel and Deiya Pernas have once again joined me for over a dozen face-to-face meetings with stellar investment professionals, and we do so in a time where great questions exist about the current market cycle. About geopolitics. About China. About the Fed. About risk asset valuations. About societal stability.

So jump on into this week’s Dividend Cafe, and get a glimpse into what we learned this week. The results may or may not shock you, but they will not bore you.

What are we trying to do here?

I recognize there are clients reading this Dividend Cafe who have been a part of TBG since the very beginning of this annual tradition and have followed over the years its outcomes and developments. But of course, there are also newer clients and non-clients reading who may not fully understand what I am talking about, so a very small amount of context may be appreciated. And yet I promised to spare you the trip down memory lane, so let me just get this out of the way.

What began as a way to better vet investment solutions we were utilizing for clients matured a lot in the early years. Due diligence on managers we were already working with evolved into the additive pursuit of looking at new strategies, and as our hedge fund and alternatives exposure grew over the years it became a way to consider new frontiers in idiosyncratic investments.

But early in the process, a lightbulb went on and I realized that beyond the mere “checking in on strategies we were using” or even “looking at new strategies” – there also was access to a brain trust in these meetings that enabled me to really use the meetings for broad intellectual adventure. Meeting with some of the top mortgage credit hedge funds in 2009 did not merely give me an “update” on an investment a few clients may have held; it gave me a couple hours of discussion about the state of rates, liquidity, risk premiums, regulatory developments, or whatever else may be pertinent in that space, with the brightest people on Wall Street deeply inside the market.

The trip expanded to include macro analysts, economists, and on more than one occasion over the years, very high-profile people (Ben Bernanke, Steve Schwarzman, Jim Grant, Steve Eisman, Dan Loeb, and others I am sure I am forgetting).

My intention every single year is to do the following with this week:

- Open my mind to new perspectives that may be contrary to some of my own beliefs and leanings

- Thoroughly vet and dissect those we are already working with, or maybe are considering work with.

- Take every opportunity to dialogue about all the big picture issues I can with people in every asset class, every lane, every point of view, every perspective possible.

That last one has by far been the biggest benefit to this experience since the Great Financial Crisis. Asking a bond manager about interest rates is one thing; asking an emerging markets debt manager about them is another. A small-cap growth manager may come in to talk about a few companies they are looking at, but then to push them on their view of the Fed opens up an entirely new discussion. I don’t care if the manager trades currency or does due diligence on private equity idea generation, I want to talk about China, national debt, the Fed, and GDP growth with all of them. This approach has facilitated great conversations and enabled me to reflect on the issues I care about at a much deeper level. I know I speak for Brian and Deiya as well when I say that we have all grown as thinkers and capital allocators by taking this approach.

I detest people who get paid to allocate capital who lack a point of view. People can make mistakes (I have made plenty, swearsies) – but they cannot lack a true north. The framework that we operate from at The Bahnsen Group contains a lot of principles that were truly enhanced out of these meetings over the years:

- The dividend growth worldview we swear by was diligently cultivated in countless hours with dividend equity mentors like Lowell Miller.

- Our introduction to private markets has been heavily enhanced by the opportunities to sit in front of the great private equity and private credit managers of Wall Street.

- I went from a high school diploma to a Ph.D. (okay, maybe just a master’s degree) in understanding credit spreads as a result of these meetings. Whether in high yield, bank loans, mortgages, or any other spread product, learning to see spreads as prices that possess information as opposed to merely a yield to buy (or not buy) has been completely transformative.

- Seeing emerging markets as a generational theme of demographics and exposure to the growth that comes from new entry into free enterprise.

- Learning where an edge can be obtained via research (bottom-up company fundamentals) versus where pursuit of an edge is completely futile (interest rate forecasting).

Some of the managers and thought leaders we have met with over the years have become clients of ours. Many have become friends. Some have become ex-managers of ours (that may well be the case from this year, too). But in every meeting is an opportunity to put into practice the great exhortation that with a “multitude of counselors there is safety.”

2021 Priorities

You know from reading the Dividend Cafe that I have a strong interest in the role of monetary policy as a destabilizing force in the economy over the next decade or longer. And of course, we know that there are abundant topics in the here and now that require consideration (inflation, COVID recovery, economic normalization, government spending, market valuations, relationship with China, the U.S. energy story, etc.). We didn’t have to come into any meeting starved for something to talk about.

We also had a particular interest in the culture and energy of these New York-based firms, now 18 months past the launch of the pandemic. Who is going to work every day? Whose offices are open? Who is growing? Who is shrinking? Who is boosting culture? Who has decided culture does not matter? Who is aligned with our vision for proactive and engaged asset management? Who has a vision for normalization and long-held norms about ideal productivity conditions? Who has used the pandemic to enhance their own comforts at the expense of their clients? Who is demonstrating leadership and forward-thinking and who is creating a culture of fear and passivity and capitulation in their firm? These thoughts were all front and center in our agenda this week as well.

Did someone say China?

Yes, it turns out China was a heavy conversation topic this week (I know, this is shocking). But apart from the significant discussions we had with multiple managers purposely challenging our thesis about Chinese sovereign debt, we also had to explore national security matters, the status of the trade relationship, and the general global ramifications of the rather extraordinary steps China has been taking as of late within their own markets.

Our first meeting Monday was with Rene Aninao, founder of Corbu LLC, a macroeconomic think tank that sits at the nexus of financial markets, public policy, and national security. It is rather remarkable the degree of continuity we see in the Biden administration with the policies of the Trump administration as it pertains to China. Both those on the right who assumed the Biden team would go too dovish on China, and those on the left who assumed that the Biden team would bring in a big break from the policies they did not like of the Trump orbit, have been wrong.

Biden’s U.S. Trade Representative, Katherine Tai, is really cut from the same cloth as former Trump USTR, Robert Lighthizer. Not a single tariff has been lifted, or show any signs of being lifted any time soon. The continuity around trade, around currency, around agriculture, around every major category of this dynamic – has been the surprise of 2021 (for many of us, including me; not for Rene).

The issue of whether or not China will actually invade Taiwan or pursue an aggressive and highly destabilizing intervention there is on everyone’s mind. Corbu’s house position meticulously defended with abundant research, is that China will not and cannot absorb the blowback of such a foolish endeavor. Their strategic objectives are respected on the world stage, and to achieve that they need to maintain a strong currency, but not too strong (they are an exporter, of course). They need to open up financial markets to foreign investors. And yet they want to do so by maintaining what they believe is the self-respect of repudiating western doctrines and principles.

Across the board, Evergrande is viewed as a huge default event, foreseeable for ages, with direct exposure to direct entities, and not remotely systemic in a global economic context.

We met with the emerging debt managers at Voya Investment Management, JD Butikofer, and Bin Gu. The reiteration where China is in its own economic cycle and what its strategic initiatives are globally was quite compatible with the TBG thesis.

We met with emerging equity managers at Vontobel Asset Management. The entire team of Chinese company research analysts came in along with the Chief Investment Officer and Senior Portfolio Manager. Let’s just say that an approach to China that is entirely bottom-up is crucial, and that awareness of where China is targeting entire sectors has been key. Vontobel remains underweight China relative to benchmark but has doubled exposure over the last five years, purely in the sense that their universe went from 80% state-owned enterprises and 20% private (they won’t touch SOE’s) to the exact inverse – now 80% fully privatized. Their relative attribution in China this year is actually positive. The most damaged e-commerce name in China was an 8% weighting in their portfolio a year ago; they reduced it to 4% at the beginning of the year, and it is now much less than 1%, largely avoiding a 40% drawdown. Avoiding froth (EV space) has been key in the states, but it has been vital in China.

From Louis Gave to Rene Aninao to actual portfolio managers at Voya and Vontobel, a wide array of views on China exist, with some disagreements within a number of particulars. And yet the consistent theme is that their strategic interests are aligned with a stable currency and with low volatility in their sovereign debt bond market.

The emerging reminder

You cannot hedge away tail risk. You can’t price in extreme risks. If China attacks Taiwan, it will be bad (for U.S. equities, I would add). In Emerging Markets, part of the risk premium is a geopolitical tail risk, and you adjust for that in your weighting to the asset class, not within the asset class composition.

Fed ahead

A Fed “policy mistake” would be if “taper” becomes “tighten” while tail risk still lingers, or it “taper” turns to the “bond-selling” WHILE lifting off the zero-bound interest rate. Everyone believes they learned from 2018 (including us) and will not do that again. Most of this is political right now. If you start seeing a more centrist effort to pin Fed governor stock trading issues on Chairman Powell (meaning, someone else besides Elizabeth Warren), it likely means the administration is getting ready to use that issue as pretext for not re-nominating him. But everyone seems to agree the heavy odds are that he will be re-appointed.

What could go wrong?

I got to hear a housing analyst talk about how promising it is for the consumer that home equity is up and interest rates are down, leaving them in a perfect position to extract home equity to feed additional consumer spending.

This sounds like something that has never been tried before, and for which no precedent exists to tell us how it may end.

Ay yi yi.

Inflating the number of conversations about inflation

Every single meeting seemed to cover the issue of inflation, and of course, there was no consensus on this tricky subject. Some are vehemently in the camp that “this time it’s different” and that real sticky price inflation is here to stay. Some believe the Fed can create it. Some believe they can’t create it. Some believe (as I do) that there is price inflation unrelated to Fed monetary activity in select supply-related industries. Regardless, these were all robust and intellectually engaging conversations.

Major Thematic Takeaways

- Illiquidity – God bless it. Presents huge behavioral advantages. Avoids mark-to-market structural challenges. It captures additional risk premium. And the private markets we are determined to invest in are better above the ground and beneath the surface.

- People are over COVID and over the immediate post-COVID dynamics. From a portfolio planning and investment strategy standpoint, it is truly a post-post-COVID phase.

- Midstream energy. LNG export capacity. Refreshed capital discipline. Reinvented fundamentals. This theme is right fundamentally, and believe it or not, may actually soon be right in sentiment.

- No one seems complacent or content. Everyone – in every asset class – seems to feel the lack of anti-fragility that Fed policy has created. There seems to be a very realistic feel for where we are in the cycle.

Action Items

- We plan to incorporate a sovereign debt exposure from Asia ex-Japan within some Boring Bond sleeves and all Credit sleeves in short order, once the right product solution with sufficient trading and liquidity technicals is secured.

- Heavy commitment to a very particular private equity approach we want to intensify exposure to.

- An additional Direct Lending strategy with much larger cap companies entering our orbit.

- Increasing emerging dividend equity exposure inside our Income Enhancement sleeve.

- Re-allocating with Growth Enhancement, with details forthcoming.

- Re-considering a large manager exposure where their approach to re-opening their offices and growing their company culture has been lacking.

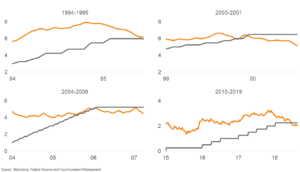

Chart of the Week

Is the 10-year just a tad influenced by the federal funds rate? History seems to suggest so.

Quote of the Week

“If you are candid, you will discover that each experience in your life was absolutely necessary in order to have gotten you to the next place, and the next, up until this very moment.”

~ Wayne Dyer

* * *

This week is officially in the books. But our takeaways are not. Onward and upward, and reach out with any thoughts or questions.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet