Dear Valued Clients and Friends,

It has been a wild week in the world, somewhat around market action (the market is down roughly 600 points on the week as of press time – not exactly a barnburner), but more so around broader news events and uncertainties.

China actually left the headlines this week (it never fails to amaze me how the “next Lehman moment” one week doesn’t even make p. 18 the next week). But actually, a lot more needs to be said about China, so we’re going to say it this week.

The ambiguity around the infrastructure bill and the $3.5 trillion spending bill has led right where we thought it would end – to much political gridlock, confusion, and borderline hilarity. As of press time, the effort to convince progressives to vote for the infrastructure bill and the effort to get moderates on board with some form of reconciliation bill continues – without real clarity as to where it will end.

There remain serious questions about “prices” and “price stability” – and what has turned into the political hot potato of “inflation.” I think you’ll find my commentary on such this week useful at punching through much of the semantics and misunderstandings that drive this discussion now. If practical takeaways are what you are after, you’ve come to the right place.

“Mitigating risk” becomes a huge topic in times like this, and I have much to say on it in this week’s Dividend Cafe.

First things first

I understand that the soap opera of Manchin/Sinema/Pelosi/Squad Infrastructure/Reconciliation/Etc. became more exciting this week to the news cycle than the China story did, and I also understand that the ignorant melodrama from which the Evergrande story in China was presented left plenty of investors ready to move on.

But the overwrought misunderstandings of Evergrande China exposure do not mitigate the fact that the overall China story remains one of the most important stories for investors in global economics. Long past us is the Mao era where China was irrelevant in the global economic stage. Regardless of what exposure one thinks they have or do not have to China, their size and stature in the economy and as a trading partner make them “too big to ignore.”

Evergrande

A few nuggets I have picked up in a variety of research efforts, conference calls, and analysis since last week that I feel worth sharing …

- As he usually is, Louis Gave was extremely helpful in this point – much of the utter panic and capitulation and contagion when Lehman failed was that everyone knew the U.S. government was trying to rescue everything. The bazooka of summer 2008. Fannie and Freddie in conservatorship. Weekend cram sessions to sell Lehman to BofA or to Barclays. It was an all-hands-on-deck mission-critical effort to “save Lehman” complete with a CNBC countdown clock (I remember it like it was yesterday). The efforts all failed, and then all hell broke loose. In this case, every single detail is different. Not only, as I pointed out in DC Today this week, is the structure of the Evergrande debt categorically different and less systemic, but the Chinese government is not trying to save anything – they want them to fail!

- I know because I was there – the “Lehman” crisis was NOT about “Lehman.” They just went first. It was Citi. It was Merrill. It was Wachovia. It was almost every major American financial institution that had levered themselves to the hilt with toxic mortgage explosives. Any look at the bond pricing, liquidity position, and access to bank credit across the Chinese developer ecosystem shows a categorically different systemic position than where U.S. markets were in 2008.

What is going on?

One needs to take a big view here to really appreciate the irony of this Evergrande story in the context of current China realities.

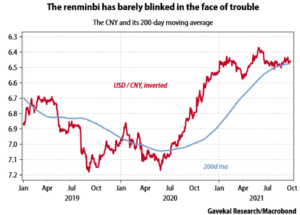

- First, a Chinese currency that has barely budged in all of this, and is, in fact, above its own 200-day moving average.

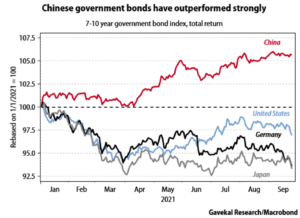

- But wait, there’s more! What about the government bond market in China? Surely they have been hammered as the debt load of a large real estate developer looks to implode and questions abound regarding the fiscal stability of the entire country?

A very possible explanation for Chinese currency strength and government bond strength (not corporate bond) is that this is actually perfectly consistent with the strategic imperatives and priorities we have been writing about in the Dividend Cafe for months.

Perhaps the Chinese mandate for a globally attractive currency and sovereign debt market to enhance their position with trading partners and gain the leverage that having more trade denominated in their own currency would represent is even more powerful than thought? Perhaps it actually views the short-term pain of an over-levered property developer’s failure as preferable to the long-term pain of being a perpetual bailout checkwriter?

Maybe not. Maybe they blink. But there is one thing we know in the United States once one goes down that path: “Your first bailout won’t be your last” (this is a play off of one of the first things I was taught in this business – “your first margin call won’t be your last”). I believe the currency and sovereign debt response to the Evergrande situation indicate that China may be more focused on the long game than even I suspected.

What is he thinking?

I don’t have a lot of good things to say about President Xi in China for the simple reason that I am not a Communist, and he is. I fully accept that today’s Chinese Communist Party is not the same as Mao’s, but Marxism is Marxism, and I reject it religiously, politically, and economically.

But my fervent disagreements with the totalitarian flirtations of Xi are no excuse to pursue ignorance as to what he is doing, what he is thinking, and what the real agenda of China is in the midst of these global economic times.

I am firmly convinced that China’s dependency on American semiconductors, American energy, and the American dollar is the source of much angst for Xi and the CCP, and is driving much of their current thinking and actions (h/t Gavekal Research). I can unpack this more, but I have already made the case as to why these conditions all drive a strategic mandate for a stable currency and strong sovereign debt market.

Some China conclusions

(1) I expect their growth to slow even further

(2) I expect more headline tales of financial excesses having their day of reckoning

(3) I expect more governmental crackdowns in their tech sector. They want the tech sector to serve national interests, not programming more video games.

(4) China’s COVID policies look to be very counter-productive and getting worse

(5) China’s relationship with the U.S. is getting worse, not better since President Trump left office

(6) China’s underlying governmental philosophy, treatment of their own businesses and people, and regard for the west is highly destructive and troubling.

(7) All of these things are harmonious with the conclusion that their currency and sovereign debt may represent a safe haven asset in the present economic order.

Semi-transitory?

For reasons I have written about ad nauseum in this publication, I categorically reject the idea that excessive government spending and excessively accommodating monetary policy are inherently inflationary. I reject this idea for the simple reason that it is demonstrably false from the clear and overwhelming testimony of history, such as the last thirty years in the United States, Japan, the UK, and Europe. I reject it economically because I have learned to appreciate the dynamic of diminishing returns excess fiscal and monetary policy represents, and the negative feedback loop generated by this collapse of money velocity and loan demand.

When we see prices higher in 2021, it most certainly feels like inflation where it matters. Much of the data was skewed by “base effect” (comparing commodity price inflation to collapsed numbers from a year earlier). But even normalizing for COVID price deflation, many numbers in the “price level” now reflect higher prices.

Sure, many were clear and obvious outliers that already corrected (lumber FLEW higher out of a massive under-production problem, and has since COLLAPSED). Many are more confused (oil prices that are up huge from when the world shut down 18 months ago, but also in exact line with where they have been as a median level for most of the last decade).

So what is the real inflation story now?

Nothing is impacting the price level right now more than the worldwide shortage in semiconductors.

And before I elaborate on that, the one caveat I will happily give (actually, I give this unhappily) is Housing, where there is no question policy decisions are distorting prices on both the supply side of capital used to purchase housing, and the supply side of housing itself. The end result is a substantial unaffordability debacle.

But back to the subject at hand. Price levels are most problematic where something touches the semiconductor story. And guess what? A LOT of things touch the semiconductor story! Years of under-investment into capacity for such has caught up with us (it’s always and forever the supply side, my friends), and whether it is an electronics product or an automobile, the supply chains are turned upside down. Economics 101 tells you what happens next. Prices go up when demand stays steady or grows as supply comes down. Period.

But wait, there’s more (again). At the same time that supply chains are devastated by under-investment in semis (and peripheral circumstances like a demand surge out of post-COVID re-openings), there exists a complete and totally unfathomable shortage of laborers in the United States. Blame it on government policy. Blame it on a shortage of certain skill levels. Blame it on the stay-at-home mentality of COVID and what has happened in the culture. Blame it on all of the above (I do). But regardless, there are 11 million job openings and 8 million unemployed people. Something is off.

Supply shortages and labor shortages to boot boost prices. No, it is not government spending and monetary policy causing it (they are causing a lot of other things, none of which I like), but increased prices are increased prices if you are the one paying them.

And yes, I fully understand why one political party may try to make hay of this.

The bond market has fully agreed with my position all along (actually that is a silly arrogant way to put it; I have agreed with the bond market’s position). As we delve into a potential reflation 2.0 story in the months ahead, investors would be wise to make some effort to parse the details.

Risk mitigation in a world of destabilization

When the realities of market downside volatility surface or, horror of horrors, the market actually has a down month, it is common that the theme of “risk mitigation” comes up. What can investors do to “mitigate” the risk of portfolio volatility?

Much of the problem with this thinking confuses “up and down movements in price” with “risk,” and in fairness, much of the problem is created by an industry and academic movement that has explicitly used volatility (standard deviation, which is the variance of return around its average) as synonymous with risk (which I think practically-minded people would see as the possibility of failure or permanent loss).

I am on record as believing that “volatility” is:

(a) Usually not in need of mitigation, in so much as it has no impact on the financial goals of investors who behave, and

(b) Addressed with conventional means like asset allocation (the use of non-correlated asset classes to reduce up and down movements only for the purpose of increasing the chances of good investor behavior).

But I most certainly believe that there are what we call “tail risk” events that feel like a gut punch. Those feelings of complete market meltdown that make people wonder, “Is this time different?” It never has been, and those are expensive words to act on (h/t Sir John Templeton) but the sudden, violent, and multiple standard deviation downside events such as March 2020, the financial crisis, and others are always events certain investors are looking to “hedge.”

A fair critique of Modern Portfolio Theory is that it does not help you achieve optimal and needed absolute return – it only helps you find the sweet spot of risk-adjusted return. I am not totally sure what anyone believes can be done about that, but I am sure it is reasonably correct and equally sure many charlatans will have a product to sell to address it.

What people do to mitigate risk with a “product” or solution (beyond asset allocation) – risk parity, hedges, treasuries – create little return in a crash and cost so much in the good times that they don’t work. Gold has offered little real offset to “tail risk” in bad times and the drag on performance in good times is self-defeating.

I believe the bulk of destabilizers in the economy are the risks of Fed overreach and excess liquidity/credit. To quote Mark Spitznagel in his exhortation/rebuke to the crypto crowd: “Crypto price action is not the ANTIDOTE to excess liquidity; it is CAUSED by excess liquidity.”

“Black swan” events (those unexpected high-impact market disruptive events) often come from excess valuation. Not always, but often. 2008 and Japan 1990 did, but the excess valuation was in Real Estate and Credit, which then created a deflationary recession when the bubble burst and bled into equities. Nasdaq 2000 was a valuation excess, but COVID 2020 was not. In theory, a nuclear war, a Long Term Capital Management implosion, or even a deflationary spiral (Great Depression) are not valuation-driven. I sort of see valuation bubbles as a separate category from black swans, but more a subset.

I tend to believe that the Fed no longer can or will let bubbles pop. This does not mean other things will not cause bubbles to pop that are outside of the Fed’s control – I am quite confident there are some things the Fed cannot control (though perhaps fewer things than many of us realize). But I do not believe we can know what such bubble-bursting events are or when they activate. My experience (2000 and 2008 personally; 1990 Japan from studying the history) is that there is no clear identifying catalyst; just the weight of excess prices.

Taking on high leverage for risk mitigation is self-defeating. Market timing replaces low probability event risk (black swans, valuation bubble bursts) and replaces it with high probability risk (human error, misplaced timing expectations, opportunity cost). “Tail risk” hedges exist but have a cost.

There’s no free lunch. Someone should write a book.

Talk to us if you want to fully understand a philosophy of risk mitigation marinated in principles, not products for sale, and applied consistently, not in tandem with the evening news.

Chart of the Week

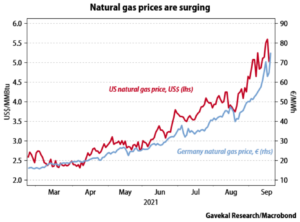

This is when demand has been highly constrained from still-limited global economic activity. If there was ever something that was clearly supply-driven, it is this. The energy infrastructure story is as vital as ever.

Quote of the Week

“Margaret Thatcher said that the problem with socialism is you eventually run out of other people’s money. Well, the problem with Credit is, you eventually can no longer borrow other people’s money.”

~ Mark Spitznagel

* * *

I spoke a bit about Lehman this week, and I have spoken about my passion for economic reopening and real-life normalization post-COVID a lot over the last year. Well, tonight those two things come together in that Joleen and I will attend our first real Broadway show since before COVID, and the show is called The Lehman Trilogy, a play covering three generations of the story of Lehman Brothers beginning in the 19th century. My life has been pretty “normal” for a long time now (where there’s a will, there’s a way), but going to a packed live show with my wife in the city is pretty “normal” – as it should be.

DC Today will resume Monday, no doubt with plenty of updates on the state of affairs in Washington D.C. Markets may give us this long-awaited correction, yet (one can hope). Or they may not.

20+ meetings await me and our Investment Committee next week with our top research and portfolio management friends and confidants. I look forward to breaking all that down next week! In the meantime, reach out as needed, and welcome to the final quarter of 2021.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet