Is it safe to invest when markets are at all-time highs? This is both a common question and a valid one. We derive many of our investing instincts from the natural world. Sir Isaac Newton taught us that everything that goes up must come down and we intuitively apply this truth to our beliefs about markets.

But is it true? Does a new all-time high mark an apex. Does it provide a clear signal that things are about to turn negative?

In David Bahnsen’s recent Dividend Cafe podcast he coins “all-time highs” as the most irrelevant metric. David goes on to point out that in the past decade the market has achieved new all-time highs 215 times. David concludes with candor,

“I want to gently, intelligently, and clearly expose the problem with the thinking that an all-time high tells you anything whatsoever about what happens next. It is stupefyingly bad logic, and I cannot begin to calculate how much damage it has done to people to play into this thinking 214 times over the last decade.”

David’s conclusion is accurate and I have seen it first hand. Investors use this false signal (all-time highs) as a timing mechanism to trigger a sale and their game plan is to “wait on the sidelines” until a more attractive entry point (purchase price) presents itself. More often than not, that time never comes and one is left missing out on the compounding benefits of staying invested. And as David describes, by this point the financial damage has already been done.

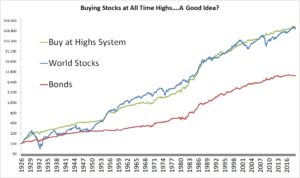

Maybe you’re still not convinced. I understand, our instincts, whether right or wrong are hard to break and we hate nothing more than the thought of potentially losing money. Here’s a fun illustration, that I think might be helpful. Meb Faber of Cambria Investment Management, ran a basic backtest to calculate the returns if you were to only own stocks when they were at all-time highs. Here’s the simple rule he set up for this test, “check at the end of each month…if stocks are at an all-time high, then you invest in stocks for the next month, and if not, then bonds.” Here were the results going back to 1926:

Source: Meb Faber

So, did the results align with your assumptions? I will speak for myself and say, most definitely not. This simple rule of buying at all-time highs produced a better outcome than being invested the whole time. Wow! I did not expect that.

Now, just so I don’t lead you astray, this would not be an advocation to implement this “buy only at the highs” strategy. If you were to dissect the data and graph above, you’d find that diversification was one of the biggest contributing factors to the outperformance – the fact that you owned both stocks and bonds.

The real takeaway though is that all-time highs should not be feared. What David labeled as an irrelevant metric is exactly that, not a signal of any sort but just noise. So, although talking about all-time highs makes for good headlines and some may use it to instill fear about the future, remember to just ignore the noise. Hopefully, you’ve designed an investment portfolio based on a financial plan tailored to your goals and needs. Sticking to this plan is priority number one and you cannot let your instincts, some fearmongering pundit, or the financial media derail you from your plan.