One of the basic objectives of TOM is to help bring to light common financial mistakes, pitfalls, and oversights. Although each of us has our own unique financial plans, we all face similar obstacles. One of these common obstacles is identifying the right amount of life insurance one would need.

I’ve found that most people fit into one of these three problematic categories:

- They’ve been sold too much life insurance

- They haven’t purchased enough life insurance

- They never bought any insurance, as they found the whole process confusing and overwhelming

Today on TOM we will do three things – we will solve for all of the above, provide a quick lesson on why one would own life insurance and a back of a napkin trick for calculating sufficient coverage.

And off we go…

Why Own It?

It is logical to assume the everyday items we purchase we intend to use, right? You buy a lawnmower because you have a lawn that needs to be mowed, a sofa so you have something to sit on, a coffee mug to drink from. Aside from the occasional piece of workout equipment that collects spiderwebs in the garage, the original intention was to make good “use” of it. Insurance, on the other hand, is much different, it’s one of the few items that we purchase and hope to never use. Think about it, you own car insurance and are covered if you ever get in an accident, but you hope to never get in an accident.

While car insurance may be easy to understand, life insurance can be a bit more confusing. So, why would someone purchase a life insurance policy? For most, life insurance is meant to cover the loss of income for the surviving family or business that could be catastrophically affected by one’s unexpected passing.

Here’s an easy example: John and Sally Smith are married, they have 2 young children, a mortgage, John is a stay at home dad, while Sally is the sole income earner. If something was to unexpectedly happen to Sally, would John and the children continue to have expenses? Would they still need to pay the mortgage each month? Of course! John and Sally need a life insurance policy that provides a death benefit to help cover this loss of income for the whole family.

How Much?

Ok, so we agree that John and Sally definitely need ample coverage from the loss of income. Here’s the part where people get stuck – how much coverage is needed?

Now, if you were to search online for a “life insurance calculator” you’d find a plethora of complicated calculations that might lead you to give up on the whole process. Or, if you were to contact an insurance salesperson, they might try to convince you to buy more coverage than you need that’ll cost you more than you want to spend, more often leading to problem number three – just giving up on the whole idea!

Don’t give up! There’s an easier way.

Remember, life insurance is intended to replace income, that’s it. So, let’s use our example, the Smith’s, to produce a simple calculation for their coverage need.

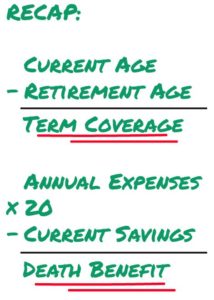

First, determine how many more years you plan to work before retirement. This is the period you will need to make sure you have coverage; in the world of insurance this is called the “term.” If Sally is 40 and plans to retire at 65, then she needs 25 years of term coverage. Next, we will multiply the Smith’s family’s annual expenses by 20. So, if they spend $100,000 a year then this number would be $2 million. Lastly, we subtract from $2 million the family’s current savings (not including retirement savings), so in this case, we will assume John and Sally have $500,000 of savings. $2 million minus $500,000 is $1.5 million and we can conclude that the Smith’s should purchase $1.5 million of coverage for a 20-year term.

Understanding the Numbers

Ok, that was a lot of quick math. Let’s take a moment to review the above to get a better understanding of why this back of a napkin math works.

Let’s start with the term. The reason we narrowed down the term to be from today to retirement is that those are the only years that most of us expect to earn income. The typical lifecycle for most investors will be to work, earn income, and save for a defined amount of years and then transition out of work and use the income produced from our savings to retire. The point of life insurance was to insure against the potential loss of earned income, so it is no longer needed when income is no longer earned. Just like an individual that doesn’t drive doesn’t need car insurance.

Next, we calculated the death benefit. We agreed that if Sally was to pass today, John and the kids would still need to cover all of their expenses and those totaled to be $100,000 per year. Of this $2 million death benefit, what percentage would need to be withdrawn each year to meet the $100,000 expenses we determined earlier? It’s simple, back of a napkin math – $100,000 / $2 million = 5%.

This five percent number is also an important number in this insurance calculation. By only spending this 5% of the total benefit, this leaves the remaining 95% as an investment tool, that entrusted to an experienced financial advisor, could make that $2 million last a very long time, maybe even a lifetime.

As part of the final calculation is to incorporate their current savings ($500,000) as a form of “self-insurance” that when properly managed, allows them to buy less coverage, which reduces the cost. This is why the Smith family only needed $1.5 million worth of coverage, as opposed to $2 million.

Always Exceptions to the Rule

What we provided today was a simple formula for finding the coverage needs for most people. But most does not mean everyone. Maybe you have a unique situation that would warrant a slight tweak to the calculations we discussed above. For dual-income earners this might look a bit different, for parents of children with special needs this may look a bit different, for folks with health issues this could look much different, all this to say that your unique circumstance will create additional variables that need to be considered.

Additionally, these coverage calculations are sometimes being calculated for long time periods, so there is a chance that “add-on” coverage may need to be added in the future to account for inflation, growing expenses, etc.

This is where an advisor comes into play. Today’s lesson will provide you context, give you perspective, and equip you to have an intelligible conversation with your trusted financial professional but you will still want insights from that advisor to make sure you’ve accounted for everything. If you don’t have a trusted financial professional, feel free to contact me and we can discuss your personal coverage needs, I’d be happy to.