When it comes to investing, one of the biggest obstacles that an investor must overcome… is themselves. In today’s TOM we examine a real life story about the costs and consequences of bad investor behavior that we can all fall victim to.

“Imagine how much harder physics would be if electrons had feelings!” -Richard Feynman

Capitulation

On a recent road trip, I got into a conversation with a friend about investing. The conversation went something like this:

Friend: “Trevor, I made a big mistake.”

Me: “Oh no, what’d you do?”

Friend: “I sold all of my investments in my IRA… and I bet you can guess what day I did it.”

Me: “December 24th?”

Friend: “Yup.”

If you are wondering why I knew the date, it’s because that happened to be the bottom of the recent market sell-off at the end of 2018.

Source: www.us.spindices.com

For many investors, the drop from early October to Christmas Eve felt like it was beyond what they could endure. It represented almost a 20% drop. In the world of investing, we call this type of panic selling, capitulation. This word is actually derived from a war term which means to surrender; to wave the white flag. On Christmas Eve of 2018, many investors waved the white flag.

This type of panic selling has always reminded me of one of those car giveaway competitions. The ones in which each competitor must have their hand on the car and the last one left still touching the car wins. Some contestants last hours and other’s days, until they finally reach that breaking point. The point in which exhaustion outweighs their desire to win the car.

You’re Not Alone

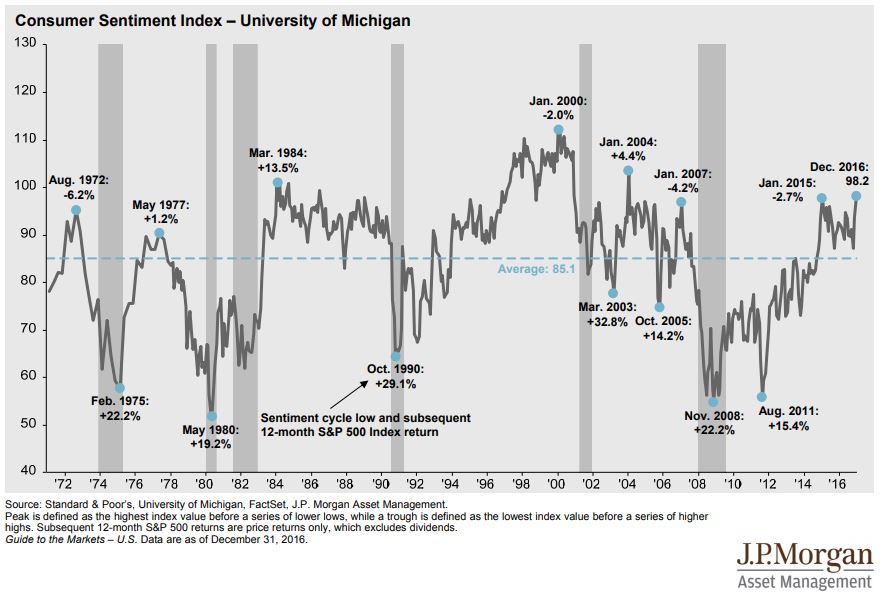

My friend was clearly embarrassed and in fact ashamed to confess his mistake. In hindsight, he knew he made a bad decision. This is a common mistake made by many investors. Typically, we see an inverse relationship between investor confidence and future returns. Take this chart of consumer sentiment as an example:

Source: J.P. Morgan

When consumer sentiment is below average (represented by the blue dotted line), the subsequent 12-month stock returns are above average. When consumer sentiment is above average, the subsequent 12-month stock returns are typically below average.

Perhaps this is why Warren Buffett’s advice to investors is to be “fearful when others are greedy and greedy when others are fearful.”

Excess fear in the marketplace leads to bargain prices, while excess greed in the marketplace leads to high prices.

Bad Behavior

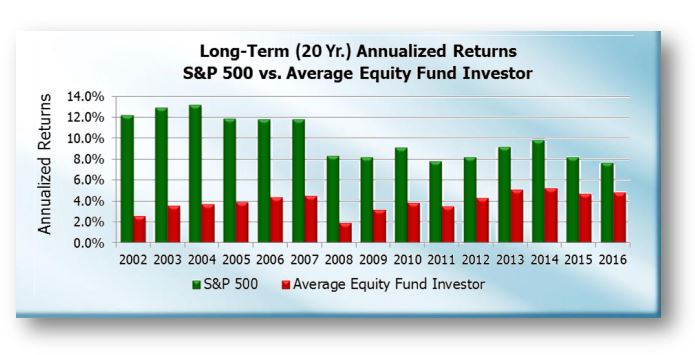

So, what does this bad behavior cost the investor? DALBAR has been conducting its Quantitative Analysis of Investor Behavior study since 1994 and identifying exactly what this cost is to investors. The study concludes that because the average investor has a tendency to come in and out of markets, buy when things are expensive, and sell when things are cheap, they actually underperform significantly.

The original analyses began in 1984, so 2002 represents a 19-year analysis. Starting in 2003, the long-term analysis covers a 20-year timeframe.

Source: DALBAR

The study goes on to say, “Investor behavior is not simply buying and selling at the wrong time; it is the psychological traps, triggers, and misconceptions that cause investors to act irrationally. That irrationality leads to buying and selling at the wrong time, which leads to underperformance.” Again, when it comes to investing, sometimes we are our own worst enemy.

Imagine the experience of a stock investor who sold everything on December 24th, 2018 and two months later sees what they once owned has now appreciated almost 20%. This is not only a deflating experience; it’s a costly one.

Two Are Better Than One

I’ve always been a big advocate for doing things together. In school, I enjoyed study groups, when I traveled I preferred having a friend along for the ride, and even at work, I’ve seen the benefits of collaboration.

As the saying goes, “Two are better than one, because they have a good reward for their toil. For if they fall, one will lift up his fellow. But woe to him who is alone when he falls and has not another to lift him up!” (Ecclesiastes 4:9-10).

When it comes to investing the same truth applies. Having a wise counselor, an advisor, along for the journey will serve you well. I’ve seen people who I have the utmost respect for making the most classic investing mistakes. I’d like to believe that some of us are immune to these behavioral hiccups, but this hasn’t been my experience.

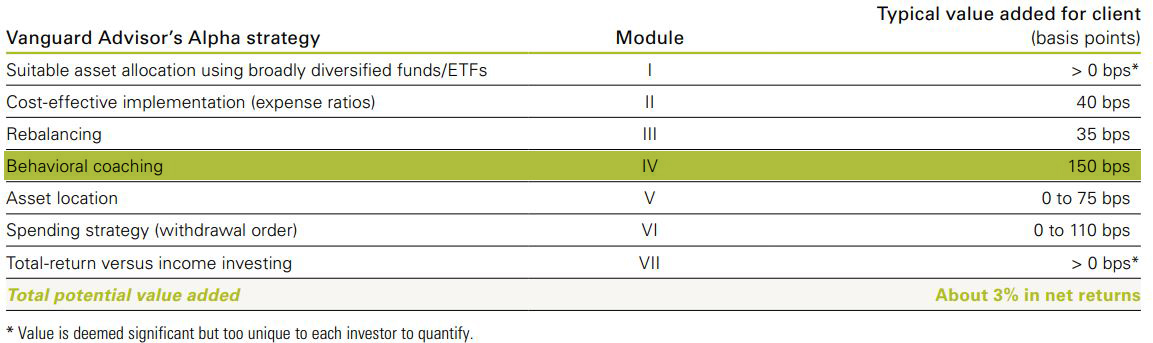

Vanguard, perhaps the most popular “Do-It-Yourself” investing institution, published a very interesting white paper on this exact topic. The paper sought to quantify the value-add of an advisor, and these were their findings:

Source: Vanguard

Their research suggested that the total potential value add of an advisor is about 3% in net returns, but what I found most interesting is the category that provided the most lift – Behavioral Coaching.

In a recent issue of Dividend Café, David Bahnsen said it this way, “To spend “enough time” on [Behavioral Coaching] it means it would represent 90-95% of our attention, as behavioral decisions surely represent 90-95% of what matters in our investing results.” Again, woe to him who is alone when he falls and has not another to lift him up!

A Marathon, Not a Sprint

Our emotions may be fleeting, but the consequences of bad investing decisions can be lasting. Remember, building long term wealth is a marathon, not a sprint. You will be regularly distracted by that “shiny new thing” whether it be investing in crypto currencies, that real estate deal you just can’t pass up, or that one particular purchase that your family “must have.” The greatest reward will be won by the patient investor that can stay the course.

If it’s not greed, envy, or consumerism that reels you in, then fear will be sure to come knocking on your door. As an equity investor, you will have to stomach the volatility of the markets each year, and the markets will consistently try to make you second guess yourself.

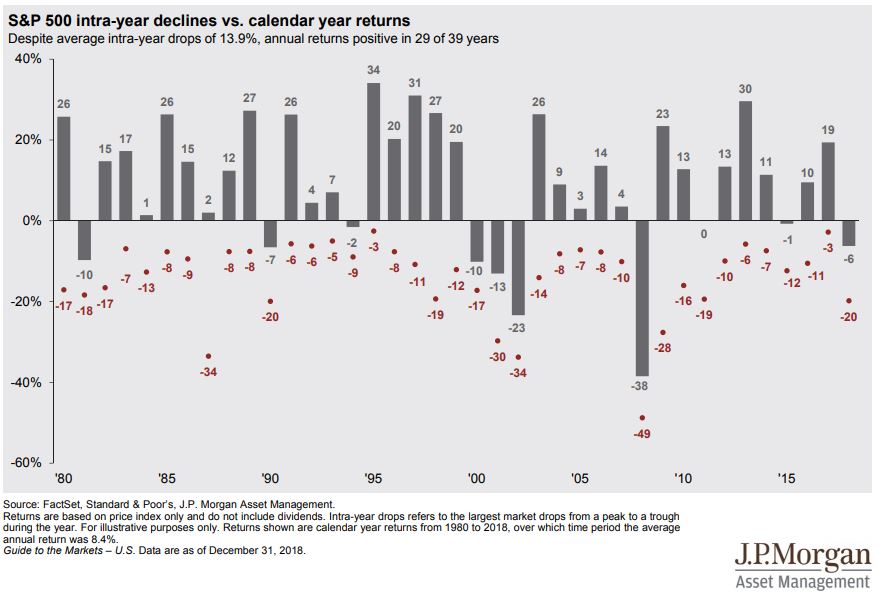

Source: J.P. Morgan

In the chart above, the grey bars show the stock market return year by year, and the red dots represent the intra-year peak to trough drawdown for that particular year. Although 29 of 39 years showed positive returns, the intra-year drops averaged -13.9%.

For an advisor, those red dots represent a conversation with a client. A time when a client needed the advisor to help put their goals back into context, to remind them why they have an allocation to stocks, and to help the investor avoid a bad decision.

P.T.S.D.

I haven’t had the chance to follow up with my friend, but my hope is that his decision to derail his financial plan was short-lived. Inevitably we will all fall victim to these types of mistakes every now and again, but the real measure of an investor is how they react to one of these behavioral missteps. Bad experiences in the market can be debilitating, and I know many investors that still haven’t engaged in investing post the 2008 financial crisis.

There will be many obstacles along the way when it comes to building wealth – inflation, expenses, etc. Do everything you can to make sure that you don’t become one of those obstacles.