My original aspiration for TOM was to make personal finance more understandable; to translate the complex into the simple. I wanted to share good ideas that would help people improve their financial lives. I had an interaction with a friend last week that was a good reminder of this mission.

My friend came to me looking for some help. She said she wanted to “get her financial house in order” and was looking for advice on how to get started. I wanted to create something simple for her, something that would act as a sort of financial report card that she could use to take inventory on her own financial matters. I imagined the type of report card I would have received in grade school with categories like, “plays well with others” and “follows directions.” Something simple and easy to remember.

In my mind, this needed to capture all the aspects of financial planning in a short list of specific topics. And this is the list I came up with: Earn, Save, Spend, Protect, Grow, and Give. Most personal finance topics, strategies, etc. will all fit into one of these six categories.

I know from experience, that trying to do a total overhaul of your financial life overnight is not realistic. My hope is that you’d use this report card to conduct a self-assessment on your own financial life, and then introduce new habits that would help to create incremental improvements over time. I’m reminded of this adage I read on twitter, “Advice for nearly everything: start slowly and maintain traction.” – @mmay3r

Without further ado lets discuss your personal financial report card…

Earn

This is a category that often gets left out or forgotten when it comes to financial planning. If we were talking about a business, this would be the revenue or total sales number, one of the most important metrics for any company.

When you are assessing your financial situation and your financial plan you should identify opportunities to increase what you earn. This could be your salary or dividends or rental income. Sometimes this means that you might need to invest in yourself. Is there a certification or degree that would improve your earning potential? Is there a technology or tool that would increase your productivity? Do you have a strategy in place to grow your investment income?

Warren Buffett described the principal of investing in yourself this way,

“But ultimately, there’s one investment that supersedes all others: Invest in yourself. Address whatever you feel your weaknesses are, and do it now. I was terrified of public speaking when I was young. I couldn’t do it. It cost me $100 to take a Dale Carnegie course, and it changed my life. I got so confident about my new ability, I proposed to my wife during the middle of the course. It also helped me sell stocks in Omaha, despite being 21 and looking even younger. Nobody can take away what you’ve got in yourself — and everybody has potential they haven’t used yet. If you can increase your potential 10%, 20% or 30% by enhancing your talents, they can’t tax it away. Inflation can’t take it from you. You have it the rest of your life.”

How would you grade yourself on the Earn category? Have you done anything over the last 12 months to improve your earning potential? What is one thing that you could change today that would make the biggest impact?

Here at The Bahnsen Group, we are obsessed with Dividend Growth and our team is regularly engaged in research to make sure we are helping our clients EARN more each year.

Save

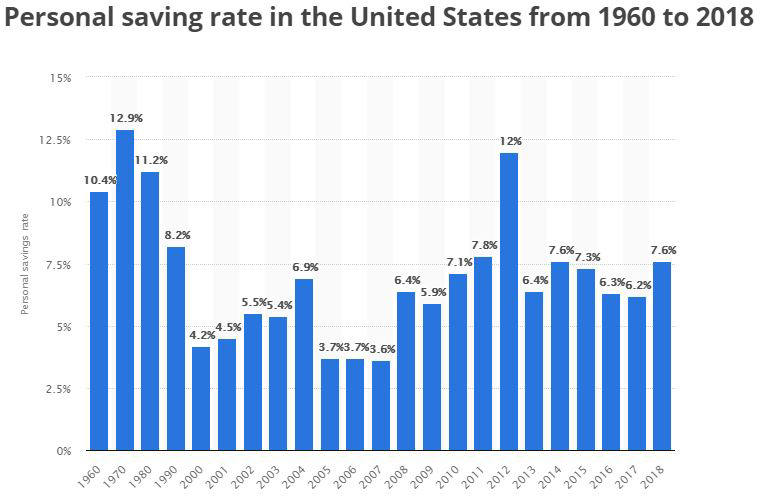

Saving is one of the most impactful financial planning tactics and probably the most underutilized. Here’s a look at the personal savings rate in the US over the last 58 years:

Source: www.statista.com

For most financial plans a 7.6% savings rate just isn’t enough. I ran some numbers to see what this might look like over a 40-year period. I accounted for inflation, investment growth, etc. and after the 40-years, the illustration showed that my hypothetical saver had only accumulated about 7.5 times their current income in savings. If we expect to withdrawal about 5% from our savings in retirement, then we’ll need about 20 times our current income stored up (see Weathering the Withdrawals). So, what’s the solution? Save more.

When it comes to financial planning there are some things that you can control and others that you can’t control. You don’t know how long you will live, you don’t know exactly what your rates of return will be, and future inflation rates are unknown as well, but you can control how much you save. Having a strong savings rate is key. In the spirit of taking small steps and creating sustainable change, perhaps you could increase your savings rate by 1% per year. Also, remember, the incremental increases you generate in your earnings can flow directly into growing your savings rate – an extra dollar earned can be an extra dollar saved.

So, what grade do you give yourself when it comes to Saving? What is your current savings rate? Have you set a goal to increase this in 2019?

Spend

Spending is perhaps one of the hardest of the categories to control and maybe the toughest to stay on top of. This section will not, and should not, be a guilt-inducing rant about how you should spend less. Yes, some of us need to spend less, but more importantly, all of us need to be aware of how much we actually spend. The very first TOM entry was on this exact subject and it wouldn’t be a bad idea to take a look back to brush up on the topic – BE AWARE or BEWARE.

When assessing your spending habits there are a plethora of items to review and strategies to implement to become a better spender. I would encourage you to ask yourself questions like this: Do I have any strategies in place to reduce my taxes? Do I have any recurring monthly subscriptions that I no longer use, but still pay for? How much do I think I spent over the last three months? How much did I actually spend over the last three months? How much do I pay in interest expenses each month (credit card debt, auto loan, etc.)?

Here’s a hint, if you earn a little more and spend a little less then you can save a lot more.

What grade would you give yourself in the Spend category? What are some changes you could implement starting tomorrow to improve this grade?

Protect

Everyone’s favorite 9-letter word – insurance. Maybe not, but it’s something we all need. Sometimes life throws us curveballs and we need to be prepared. We work hard to earn and save; it would be a shame for this hard work to be destroyed by one expensive unforeseen event.

It can be expensive to be overinsured, but it is darn right foolish to be underinsured. It’s a worthwhile exercise to take an account of your life and brainstorm the potential risks that could be financially damaging for you and your family. You have to play the “what if” game and make sure you have appropriate coverage if one of those “what if” events was to occur. What if I got in a car accident, do I have sufficient coverage? If I got injured and could no longer work how would I supplement my income? If someone got hurt on my property and sued me am I protected? If I needed additional care in my later years how would I pay for it?

I really can’t stress this enough, all the best financial habits in the world can be ruined in a moment if the right type of protection is not in place.

How would you grade yourself in the area of Protect? Did you identify any insurable “what if” events that you are currently not covered for? When is the last time you reviewed your coverage for your basic insurance (home, auto, umbrella, etc.)?

Grow

This is the category that makes the most headlines and often gets most of our attention. Growing your money is the exciting stuff, right? In this excitement, though the purpose is often lost. One of the primary reasons that we need to grow our money is to maintain our buying power. Yes, we need to diversify, manage risk, and make prudent investment decisions, but the telos is making sure our money can buy just as much stuff tomorrow as it can today.

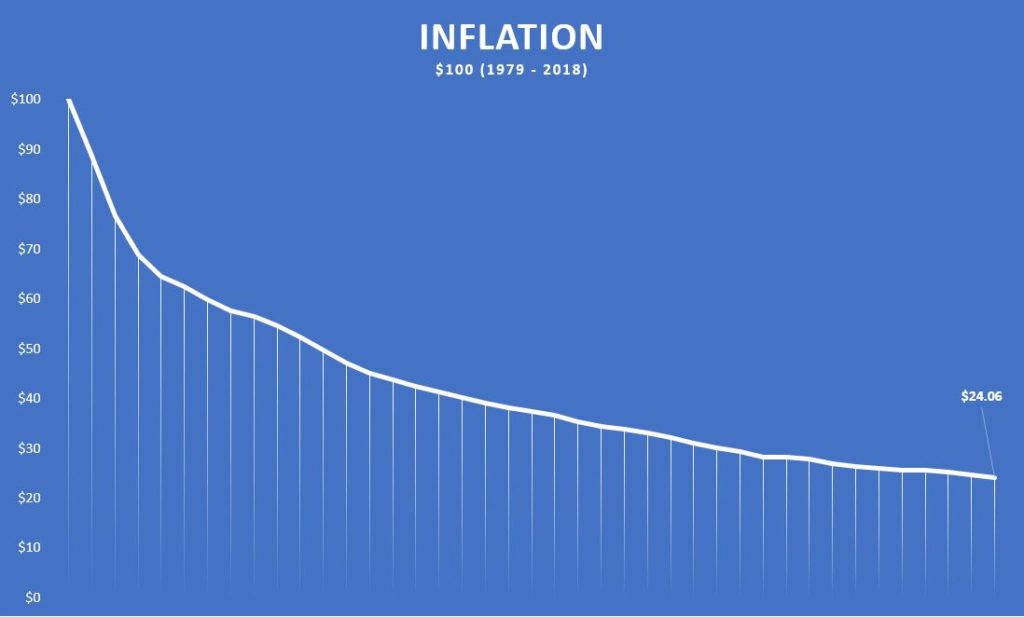

Over the last 40 years, inflation has averaged somewhere around 3%. This is a small enough change that it can often go unnoticed year by year, but when you zoom out you can see it makes a BIG impact. Let’s take a look at the last 40 years and see what a $100 was worth in 1979 compared to 2018:

Source: www.minneapolisfed.org

What once would’ve bought you $100 worth of goods and services would only by a quarter ($24.06) of that 40 years later.

This is why you can’t leave your money under your mattress. You must have a plan to grow your nest egg. Yes, the volatility associated with investing does instill a sense of risk and uncertainty but doing nothing also introduces another risk – inflation risk.

Do you have a plan in place to Grow your assets? What is your target growth rate? Is there a chance that you have too much allocated to cash? What grade would you give yourself in the Grow category?

Give

As we all know, when our time is up we can’t take any of this with us. Eventually, it will all be given away. Some will make plans to give it to charity, others will make plans to pass down their wealth to the next generation, some of this will be done during their lifetime, and some will be bequeathed after their passing.

The problem is that some of this will not go according to plan, because a plan wasn’t properly established. Unfortunately, this means that much of that wealth will be funneled to legal fees and Uncle Sam due to a lack of proper planning. I’ve written about this exact topic on TOM, The Most Procrastinated Part of the Plan and I can’t stress enough how important this is. I’ve seen too many situations in which a small error or omission can cause BIG problems for a family. Beyond the expenses, this lack of clarity and direction also causes a lot of calamity amongst family members. It’s not pretty.

For those looking to initiate their giving during their lifetime, there are also wise strategies for implementing this. I’ve written on this subject as well and you can find that article here: A Helping Hand.

So, how well have you done at planning how you will Give? Do you get an A+ in the Give category? What do you need to do to improve on this in 2019?

Did You Pass the Class?

Ok, that’s it. That’s TOM’s simplified version of a financial report card. When self-reflecting, I am sure some of us had some areas that we did great in, while we had other areas that needed some attention and have room for improvement. I know to go through this exercise myself I have identified a few items in my plan that I need to work on this week.

I’ll close out with this reminder, remember that “Rome was not built in a day.” Financial planning is a life long journey and it will serve us best if we set out to identify those incremental changes that will help us improve the trajectory of our plan. I hope that everyone can continue to improve on how they Earn, Save, Spend, Protect, Grow and Give.

This is TOM signing off again. Until next week…