Guest Author – Blaine Carver

Years ago, as a sophomore at Seattle Pacific University, I did what any sun-starved college student in Seattle would do during Spring Break; I took a road trip with friends down to Southern California.

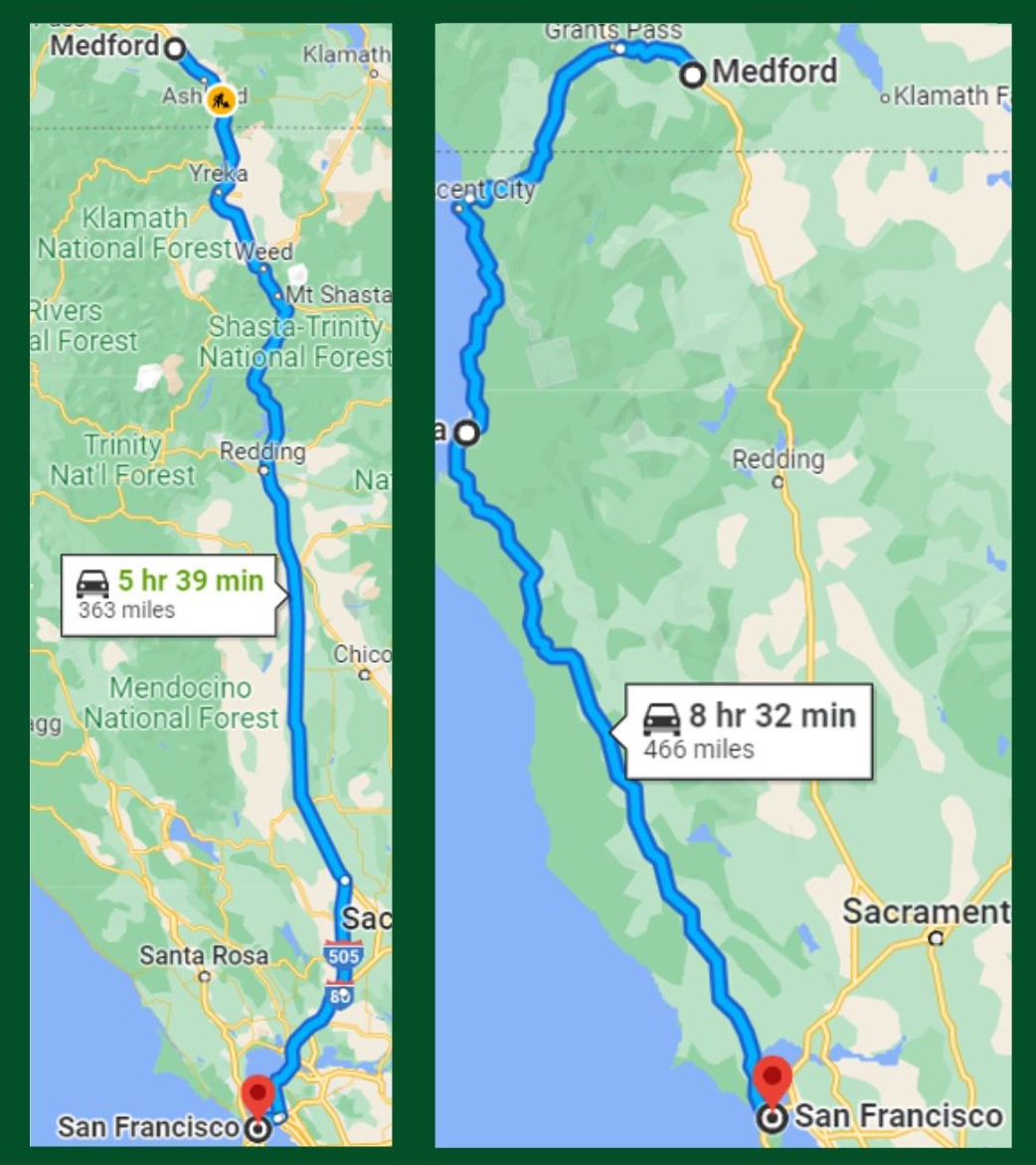

The travel time is about 20 hours, and the route for Day 2 was Medford, OR to San Francisco. Traveling from Medford to San Francisco has two options. Per the image below on the left, one could choose to take the I-5 for 5.5 hours. Alternatively, one could take the US-101 (Pacific Coast Highway), which Google Maps estimates at 8.5 hours.

Source: Google Maps

Based solely on the map, it was extremely clear which route we should take.

So, what did we do?

We took the scenic route, of course.

This decision cost us time and (more importantly for poor college students) gas money. Why in the world would we willingly choose an extra 3-hour drive to get to the same destination?

We chose the longer and less efficient route because the adventure, the breathtaking views, and the rich conversation with friends couldn’t be measured in time or money spent. Perhaps the journey was more important than the speed with which we arrived at our destination…

Financial Decisions

In the realm of finance, we frequently encounter pivotal moments that require us to make significant choices. These decisions, at their core, involve a blend of two distinct elements: the rationality of facts and the intuition of instincts. They merge spreadsheets with gut feelings, economics with emotions, and the intellect with the heart.

During my decade-long tenure as a financial advisor, I’ve come to realize that every financial decision hinges not only on assessing the economic costs and benefits but also on recognizing the emotional costs and benefits. We can focus on our financial balance sheet all we want, but if we neglect our emotional balance sheet, we’re bankrupt.

All Head, No Heart

When I was newer to the industry, I was so eager to deliver technically sound advice that would “optimize the numbers” for the client. I obtained my Certified Financial Planner® designation and was passionate and eager to improve my clients’ financial lives.

But meeting after meeting, there were roadblocks. The client didn’t implement these recommendations and strategies that were sure to optimize their financial plan.

Upon reflection, I was all facts and no feelings. I cared deeply about my clients, but much of my advice went something like this…

- “Re-allocate your accounts here, and you can increase your investment growth by 0.5%.”

- “Maximize your retirement accounts, and you will save __% on taxes.”

- “Pay the minimum amount on this debt, and you can have extra money to put towards your other goals.”

The advice wasn’t wrong. In fact, this advice was proper and sound and should be table stakes for any advisor. However, there is a deeper layer. That deeper layer comprises the emotions behind every financial decision, and these emotions often carry more weight than the spreadsheet.

The Numbers Still Matter

I’m a detail-oriented “numbers nerd.” If my client has any major or minor financial decisions to make, the first thing I do is run the updates through our financial planning, investment analytics, and tax software programs. The numbers are crucial, they cannot be faked or manipulated, and they inform us. But as I develop as an advisor, more and more I see the Emotional often outweighs the Economic.

Example – Paying off the mortgage vs. investing

Picture this: A 63-year-old couple is approaching retirement. They own a home with a $500k mortgage balance on an interest rate of 3%. Besides retirement accounts, they have a $2m taxable brokerage account. They’ve never had an urge to make extra payments on the mortgage… until now, as retirement is staring them in the face. They picture themselves in retirement debt-free, not beholden to monthly loan payments for the next 20 years.

They ask me, “Blaine, should we pay off our mortgage?”

Our team has built a financial plan showing the trajectory of their assets, and the first thing I do is update our plan to display a scenario whereby $500k of the brokerage account is liquidated to pay off the mortgage.

Before I plug the numbers in, I know the financial plan will look worse if we illustrate the client paying off the mortgage because it’s assumed the brokerage account will earn more than 3% over time, outweighing the cost of interest on the home. Additionally, this does not include the potential tax benefits of deducting home interest expense or the tax cost of liquidating a brokerage account.

But as this couple approaches retirement, they may simply want freedom from a mortgage payment. They understand the spreadsheet might look worse… but the emotional component (freedom from debt) weighs heavier than the economic component (more money at the end of life).

Consider other examples in which we choose something that the spreadsheet might not agree with.

- Accepting a job with less pay but more flexibility.

- Taking Social Security early (despite the software telling you to delay) because you desire positive cash flow in your early retirement years.

- Purchasing Long-Term Care insurance despite the fact you don’t need it provides confidence for you and your kids.

The spreadsheet may not agree, but some of these decisions just feel right.

An Advisor’s Duty

Many clients hire an advisor for a particular economic reason. The client may want to realize a high rate of return on investments and to understand how much they can spend in retirement. Or they may want guidance on the optimal time to take Social Security, how to navigate taxes in early retirement, and how to effectively leave wealth to heirs and charities.

As advisors, we are equipped to help. After all, we spend much of our days making sure the numbers line up. But the industry often defaults to “wealth-maximizing decisions.” Many advisors neglect “feelings” because they don’t fit in the spreadsheet.

But we must remember; that our job isn’t for you to die with the most money. Our job isn’t for you to beat markets. Our job is to help you progress towards your goals. And your financial goals, always and forever, have both an economic and emotional component.

There are many big financial decisions we’ll make in our lifetime, and these decisions should be designed to support our life goals. And our life goals cannot be suppressed into a mere spreadsheet.

“The best decisions are made with both the head and the heart.” – Nelson Mandela

“Reason can help us make decisions, but it is our feelings that tell us what is truly important to us.” – Daniel Kahneman

Blaine Carver

Private Wealth Advisor

bcarver@thebahnsengroup.com

Trevor Cummings

PWA Group Director, Partner

tcummings@thebahnsengroup.com