The Mystery of History

When it comes to financial markets, many of us have these same particular dates seared into our brains:

The Great Depression 1929.

Black Monday, October 19, 1987.

The Dot-Com Bubble of the late ‘90’s.

The Financial Crisis of 2008.

These are all memorable dates of when the stock market misbehaved. It wasn’t the entirety of the financial markets that took a beating during these events, but rather just the stock market.

In 1929-1932 the stock market returns were such -8.30%, -25.12%, -43.84%, -8.64%. During those same years the US Treasury Bond returns were +4.20%, +4.54%, -2.56%, +8.79%.

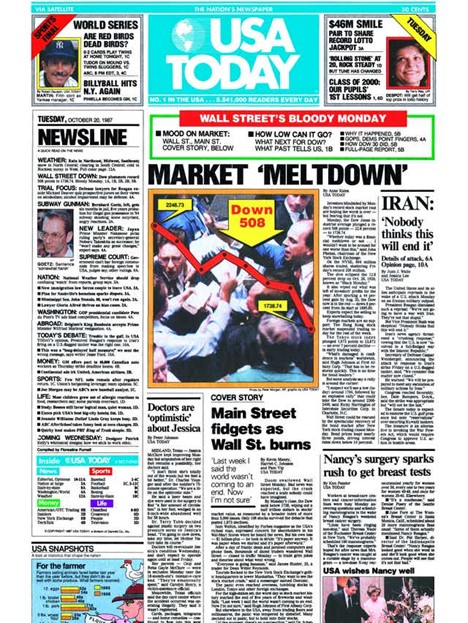

Here are some snips from USA Today on October 20, 1987 (the day after Black Monday):

“As panicked investors scrambled to grab what money they had left, the Dow Jones industrial average spun into a dizzying free fall, losing 508.32 points to close at 1738.41 Monday. The Dow’s one-day loss of 22.6% destroyed the record set by the 12.8% plunge on Oct. 28, 1929, Black Monday…

Yields on 30-year Treasury bonds fell Monday to 9.94%. But the bonds still are a relatively risk-free lure for investors frightened by the risk of stocks. Although the Fed always feels the pressure to keep rates down, West Germany and Japan have raised their interest rates, forcing USA rates up to remain competitive.”

(Author’s Note: a fall in yields is a result of a rise in bond prices)

Source: USA Today

At the turn of the millennium, the red-hot Nasdaq found itself plummeting, losing billions of dollars. It was October 4, 2002, when the Nasdaq found a bottom, about a 77% fall from grace. The stock market delivered negative returns for all three years from 2000 to 2002. How about the US Treasury Bond? +16.66%, +5.57%, +15.12% respectively.

Fresh in most of our memories is 2008. The S&P 500 nose dived 48% in a little over 6 months. I bet you know where I am going next… The US Treasury Bond skyrocketed by 20.10% in 2008.

Everyone Talks Stocks

Why all this background? Because the first quarter of 2022 should be one of these memorable moments that I am highlighting above… but it’s not. You might not even know what I am referring to. Stocks were down, but nothing abnormal or out of the ordinary. This memorable moment belongs to bonds. The aggregate bond index was down… drum roll please… nearly 6% in the first quarter of 2022.

But stocks get headlines, bonds don’t. These headline events that I highlighted were memorable because stocks behaved outside of their normal volatility. We measure these surprises or abnormalities by looking at the standard deviation. A standard deviation tells us how far an occurrence is deviating from its norm. A second or third standard deviation event is rare, and these moments – The Great Depression, Black Monday, The Dot-Com Bubble, The Financial Crisis, etc. – become infamous.

When bonds experience a second or third standard deviation event it happens quietly in the background. Financial nerds like myself are aware, and maybe an article buried between the comics and the classifieds highlights this story, but other than that – nothing.

Like Only Hollywood Can

Tell me if you’ve seen this movie. Two friends, inseparable, they’ve known each other since birth. They do everything together – same hobbies, same interests, practically family. Then high school. Whether it’s sports or beauty or popularity, this friendship experiences a swift break– a new set of friends replaces the legacy friend. One friend rises to the top of the social food chain, while the other is forgotten and left behind. A once flourishing friendship becomes almost an embarrassment for one of the friends.

You’ve seen this movie, right? It’s the classic Hollywood teen flick. That old friend was reliable, consistent, and always around, but they became boring. Then the whole storyline is about how this old friendship eventually redeems itself, and happily ever after.

Bonds are that old friend. They are predictable, they’ve always been around in your portfolio, and yet they are really boring. Stocks are the jocks, the cheerleaders, the beauty queens – they get all the attention.

I’ve been getting this question a lot lately – why do we even own bonds? This is the part in the movie where that age-old friendship seems like it is risking being severed forever. Everyone wants to break up with bonds right now, and go hang out with the cool kids (stocks, etc.)

Of course, people are asking this question right now – bonds are having their crisis moment, and everyone is ready to leave them [bonds] by the wayside.

Let’s talk through this…

Just To Be Clear

I personally have not broken up with bonds, I personally think bonds absolutely still play a role in financial markets and client portfolios.

Here’s the difference though I have the right expectations around bonds, and I don’t think most investors do.

I walk into any investment decision with a myriad of questions, but one of the primary questions is – what return should I expect from this investment? For a high-quality bond, I assume the return will be the yield. If the yield on a treasury bond was 2%, then I would anchor my expectations to a 2% return. I would accept that there would be some sort of “standard deviation” (or volatility of those returns) and that return would be an “average,” not an every year guarantee.

Are bonds disappointing me this year? Of course. They surprised me. They’ve done something they haven’t done in a long time. Just as stocks disappointed me in 2008 – why? They did something historically rare and the market surprised most investors, myself included. Suprises to the downside are always unsettling.

The Right Tool for the Right Job

Have you ever tried to screw in a screw with a hammer? How about hammering down a nail with a drill? Preposterous, right? You always need to use the right tool for the right job.

What job is most fitting for a high-quality bond? A defined liability in the short term. We call this asset-liability matching. We understand that for our long-term goals we can accept short-term volatility in exchange for higher expected long-term returns. So, we buy things like stocks, real estate, etc. These tools, though – stocks and real estate – are not great for jobs (or liabilities) in the near term.

So, whether you have an upcoming home purchase or college tuition or you just need an emergency backup fund, high-quality bonds might be your most appropriate tool.

Yes, interest rates are historically low. Yes, we all wish we could buy the bonds or CDs of our childhood today. But this doesn’t change the fact that high-quality bonds are still an appropriate solution when needing to match an asset to a short-term liability.

Here’s My Point

Stop!

Don’t be so quick to recalibrate your portfolio based on your first quarter 2022 feelings and disappointments.

Slow down.

A portfolio is built with a purpose and it should be laid on a foundation of philosophy and convictions that are not easily broken or changed.

If you find yourself wanting to change course often or deconstructing your portfolio just to rebuild it from scratch or making wholesale adjustments to your strategy regularly, you are probably doing more harm than good.

Bonds are a tool, a tool made for a particular job. You need to calibrate your expectations appropriately for your bond portfolio, and you need to accept the fact that you just experienced a very atypical event in bonds.

Don’t let your recent experiences repaint your philosophy. You have my permission to be mad at bonds, to hold a slight grudge for what they did to you over the last three months, but I encourage you to be thoughtful before kicking them to the curb. Why were you allocated to bonds in the first place? Does that purpose or reason still exist? This is the line of questioning you should be going through before dumping your bond allocation.

It’s simple, be thoughtful in your approach. That’s it.

And, that is all I have for you today – please join me next week for more of my Thoughts On Money.