A lot of my friends are real estate investors. They love it; they have a true passion for investing in real estate. Some flip homes for short-term profits and others are buy-and-hold long-term investors.

Personally, I think sometimes this zeal and/or passion can distract one from realizing why they invest in real estate. In the past, when I’ve inquired, I would get answers like:

“I love real property – you can see it, feel it, touch it – it’s tangible”

Or

“The leverage makes a big difference. The fact that I can put 25% or 30% down and the bank will cover the rest is amazing”

Or

“My parents bought this property for $75,000 originally, and now it’s worth north of $500,000 – it seems like real estate just always goes up”

Yes, all of these beliefs and experiences do paint the picture of their affinity for investing in real estate, but I think people rarely articulate the REAL or primary reason. Humans hate uncertainty; people despise the fact that they don’t know what the future has in store for them. Investors also know that they will never really have the benefit of knowing the future, so they settle for the next best thing – something predictable and reliable, something they can count on.

What feels predictable and reliable when it comes to real estate investing? Rental income. All investors invest to generate a return. We can bifurcate returns into two different categories: appreciation and income. Appreciation falls into that uncertain and hard to predict category. Income, on the other hand, feels reliable, consistent, computable, and it feels certain.

Investors desire certainty or at least the perception of certainty. And, for most buy-and-hold real estate investors, something like half of their returns will be generated from the income production (rental payments) of their property.

Now, let’s talk about what can be unsettling for savers. The idea of working your whole life to accumulate a nest egg, and a sizable one at that, and then having to decipher how you go about distributing (withdrawing) those monies. And the difficulty of doing this in a prudent fashion to assure those funds will last you a lifetime. How does the old saying go? “Retire and live off the interest.” This idea that one would quit working, but their money wouldn’t quit working, and that very interest earned would support one’s lifestyle/retirement.

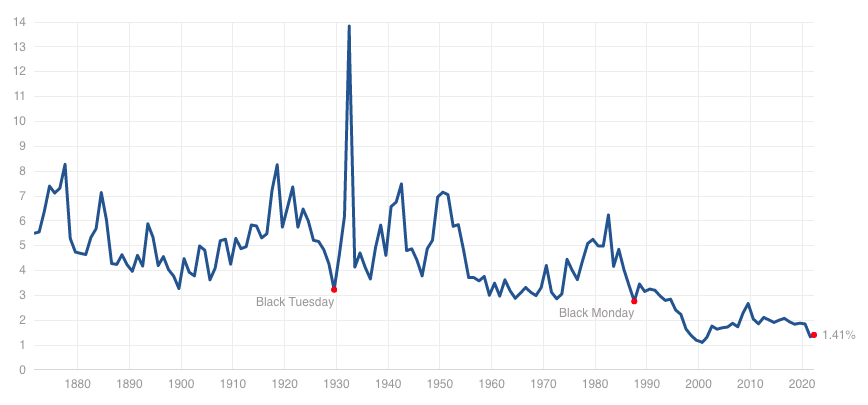

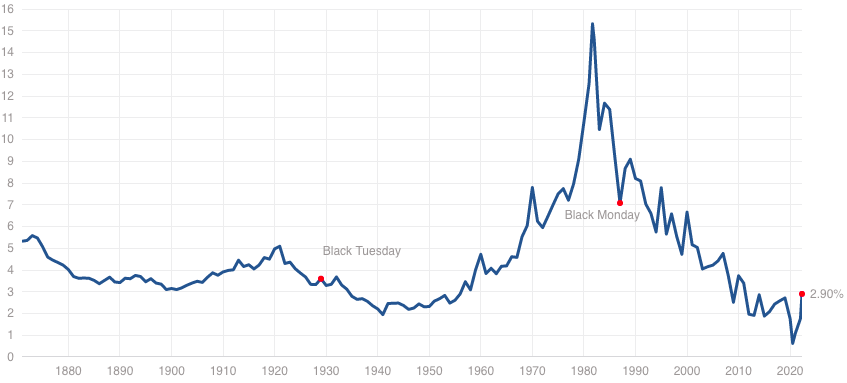

Again, humans hate uncertainty. If given the choice, most investors would prefer to model their returns in a more predictable and less volatile way. BUT, it’s hard to live off the interest when stock dividends, on average, are less than 1.5% and bond yields are less than 3%.

S&P 500 Dividend Yield

10 Year Treasury Rate

Source: Multpl.com

So, if a new retiree has a portfolio mixed with traditional stocks and bonds and they plan to spend 4% of their portfolio per year, their portfolio income just won’t be enough. This means that their expenses will rely on principal, and essentially will lean on the portfolio consistently growing over time.

If you plan to spend down principal, when markets misbehave – which they will – you may find yourself in quite a precarious planning position. Needing to sell assets at depressed values to meet your expense/withdrawal needs can be detrimental.

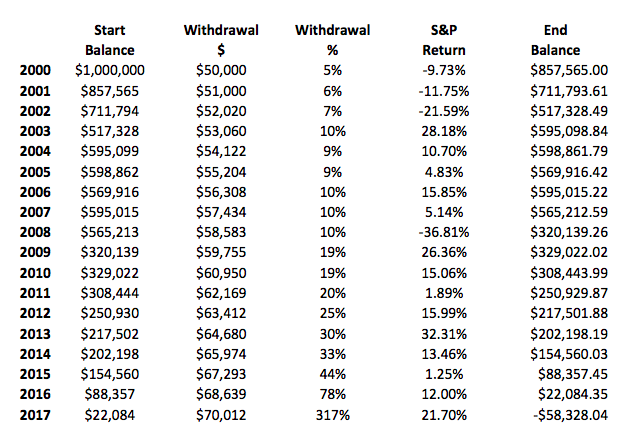

Here’s a hypothetical retiree with a $1,000,000 stock portfolio. They started withdrawals in 2000 at $40,000 per year (4%) and increased their withdrawals by 2% each year to keep up with the cost-of-living increases (inflation). Unfortunate timing for this retiree? Yes.

*display purposes only

*display purposes only

Our hypothetical friend ran out of money 17 years into retirement. Yes, this person should have diversified and yes, this was a bad time historically to retire, but this hypothetical account should be a warning sign of how important prudent planning is.

In the world of financial planning, we call this sequence-of-returns risk. It’s the idea that an unfortunate sequence of returns creates a big risk for an investor who’s withdrawing from their nest egg. For some, the first quarter of 2022 felt like an unfortunate “sequence,” as both stocks and bonds posted negative returns – it felt like there was nowhere safe to hide and nowhere safe to withdraw funds.

So, what’s the answer? Well, I think our real estate investors have the right idea. If total return is the summation of income plus appreciation and we know that income tends to be more predictable and reliable, then shouldn’t we create a portfolio that seeks to derive more of its total return from income? Yes, I believe so. It’s a delicate dance, as we don’t want to just seek out high yielding investments that may introduce unintended consequences or risks, but rather investments that fit those key characteristics of sufficient income that is sustainable, growing, and somewhat insulated from the market volatility that tortures the appreciation part of the equation.

For me, the ideal financial plan is one supported by an investment portfolio that produces enough income to meet most or all of the expense (withdrawal) needs of an investor. A fine-tuned portfolio made up of a diversified collection of securities ranging from dividend stocks to real estate to fixed income instruments all synchronized to meet an investor’s withdrawal expectations.

To sum this all up, our conclusion is simple. Financial planning is an exercise of questions, a collection of questions, peeling back the layers to understand our needs and how we will fulfill those needs in the future. Whether you are retired currently, planning to retire soon, or even far from that date, here’s the question I would encourage you to ask, “Where will my future withdrawals come from?” Will your withdrawals be funded from the hope of appreciation or will you create income sources to match your expense needs?

I hope these questions and the thoughts introduced in our discussion today will lead to some fruitful planning for you and your family.

Until next week…