Things Ain’t What They Used To Be

If you hang around the personal finance “water cooler” long enough, you are bound to hear stories about retirement planning of yesteryear. Perhaps your grandfather worked for the same company for 30+ years, and when he decided to call it quits, he had a pension waiting for him. This pension would provide grandpa a comfortable lifestyle throughout retirement. It was great – the pension was able to eliminate so much of the uncertainty around replacing employment income, and there really wasn’t much to plan.

Then yesterday came and went, and so did pensions. Unless you are a government employee, there is a good chance that you will not have this guaranteed source of income waiting for you at retirement. Hence the financial planning movement was born, and folks needed to start making a plan for how they might retire.

If You Build It, They Will Come

Savers needed to figure out a way to build their own pension.

If you read my article on the SECURE Act, you know that the government is already trying to insert some legislation to help future retirees solve for this income dilemma. Many of these proposed solutions are aimed at (1) driving awareness by illustrating how much you can safely withdrawal each year without running out of money or (2) providing options to actually convert your nest egg into lifetime income via an annuity purchase.

Does the Cost Outweigh the Benefit?

So, yes, even the government is trying to help you build your own pension – yikes, that’s a scary thought. Although an annuity might seem like a simple solution, as you are essentially exchanging your savings for a guaranteed paycheck, I would argue that it typically is not the ideal solution. Here’s why:

- The Cost – annuities tend to be expensive

- The Lockup – you typically are giving up some or all access to your nest egg

- Inflation – most guaranteed income is fixed and doesn’t provide a cost of living adjustment

So, What’s an Investor to Do?

To come up with a better solution, you’d need to find a way to reduce expenses, preserve access to the funds, and protect against inflation. Any guesses on how one might do this? If you said dividend growth, then you are CORRECT!

I’d encourage you to listen to David Bahnsen’s recent conversation with Steve Forbes in a podcast episode titled, Wall Street Turbulence And Dividend-Growth Stocks Are Perfect Together or if you want a more thorough overview, order David’s newest book on the subject The Case for Dividend Growth Investing in a Post-Crisis World.

Time Out

Now, a quick pause for disclosure, today’s discussion will not be advocating for an all dividend growth portfolio. Your particular goals, tolerance for volatility, time horizon, etc. will dictate how you would design a complete portfolio. I encourage you to connect with your financial advisor for that discussion. Today we’ll take a look at how an allocation to dividend growth specifically solves for the issues we outlined above.

The Cost

Over the last decade, there has been a resounding demand from consumers to have access to investing at a more reasonable cost. Perhaps the impetus of this was Charles Schwab in 1971 starting the discount brokerage movement or in 1975 when Jack Bogle’s Vanguard Group introduced their first index fund. Since this time, the media has jokingly referred to this battle of expenses and slashing of prices as “The race to zero.”

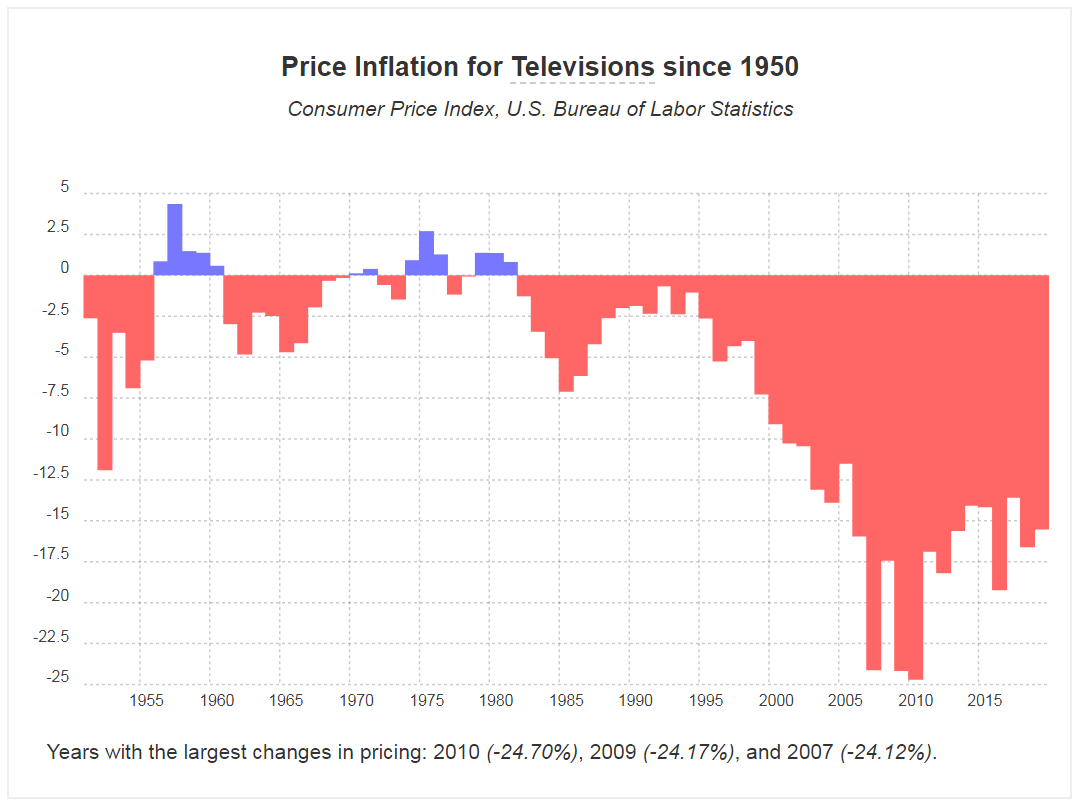

Now, I will say this drive for cost efficiency is not unique to the finance industry, but rather just a result of technology. Technology has created a more efficient infrastructure for trading and delivering these products to the end consumer. Let’s illustrate this with a really simple example – over the last 20 years, the inflation on televisions is -16.4% (yes, that is a negative number). The same effect we are seeing within the technology consumer goods space (televisions), we see in finance/investing.

Source: http://www.in2013dollars.com/Televisions/price-inflation/

So, if we know that annuities tend to be expensive, and we know that technology has pushed the overall cost efficiency of investing, what is perhaps the most cost-efficient way to get stock exposure? Well, it’d be owning the stocks directly. Exactly what one would do when building out a dividend growth portfolio. The annuity or mutual fund or ETF all act as an intermediary to creating that stock exposure, so buying the securities directly is essential the lowest cost solution.

The Lockup

Have you ever made a decision that you wish you could go back and change? Honestly, it happens all the time in life, and it’s not always because we made a bad decision, but rather that we have new information that we didn’t have previously. This is why locking up your money in investments with heavy surrender charges or no access to your original capital can create BIG problems.

Pensions are great for the consistent and perpetual income they provide, but you typically don’t have access to the original lump sum of contributed savings once you begin receiving the income. Suppose an emergency came up and you needed access to those savings or there was an opportunity you wanted to pursue, without access you are very limited. Although annuities might provide greater access than a traditional pension, the associated penalties are usually a big deterrent.

Again, if you were building your own “custom pension plan” with all the bells and whistles and you could design it any way you like, you’d give yourself as much access as you can to your original contributions. A dividend growth portfolio can do just that. The individual securities that make up a dividend growth portfolio are very liquid, meaning there are plenty of buyers available to convert your investments into cash quick and seamlessly. Although the prices fluctuate according to the marketplace, the access is still there if needed.

Just for reference, to understand the importance of this feature, I’ve come across annuities that clients were sold with a 15+ year surrender period. Yikes! That’s a long time. The original iPhone was released June 2007, that was only 12 years ago – a lot can change in 15 years, right?

Inflation

One great feature about social security is that the payouts include a cost of living adjustment each year. This means that those receiving social security get a pay raise every year to make sure they can maintain the same lifestyle.

You would be hard-pressed to find an annuity that provides this same feature (inflation protection) and those that do, have a significant cost to add on this feature.

If inflation confuses you, here’s an easy way to look at it. If you had $100 in 1999, you know, you could buy $100 worth of stuff with that money. Now, if you decided to leave that $100 under your mattress and pulled it out in 2019 to spend it, you’d find that all the stuff you want to buy got more expensive. That same $100 would have only bought you $64 worth of stuff. That’s what ≈ 2.2% inflation over 20 years will do to your money. Now we were talking about $100 but imagine what that looks like with a million dollars – you would have lost about $360,000 in buying power.

To combat inflation, you just need something that grows at a pace greater than inflation. Hmmm… any guesses? If you guessed dividends, then you are correct. Over those same 20 years, the companies within the S&P 500 grew their dividends at a rate of 6.57%.

Security and Solace

At the end of the day, when it comes to money, most of us are just looking for security and solace. Life is already full of so much uncertainty.

We opened today’s discussion talking about grandpa and how retirement was much simpler for him because of his pension. He knew that the transition from employment to retirement would be seamless because he would still have that perpetual paycheck depositing into his account each month.

It was the pension that brought so much of this financial tranquility, and that’s what warrants the argument for building your own custom “pension plan.” The nature and mechanics of a dividend growth portfolio make for a great nucleus to this plan because of all the key features we discussed today: cost-effective, accessible, and inflation-protected.

And you know what the greatest part of having financial tranquility is, it allows you to focus on all the other parts of life that matter so much more – friends, family, and making great memories.