On a few different occasions, over the last handful of weeks, I’ve had the pleasure of filling in for David Bahnsen on The DC Today. The format and style of these [The DC Today] writings are a lot different than what I am accustomed to. The focus is much more on current events, tidbits of all things markets, and politics happening around the world today.

When asked to fill in, I was reluctant at first. If I am being honest, I was a little overwhelmed by the task, but in hindsight, I can say that I really enjoyed the opportunity. I also gained even more respect for David Bahnsen – if that is possible, based on my already high regard – knowing that he produces this content plus much, much more, day in and day out. In the end, I did find it enjoyable/fulfilling to help people cut through all the noise of the everyday news cycle and to package everything in an easy-to-digest recap of the day.

This experience also made me meditate on the idea of how one goes about converting these tidbits of current events into application on the financial planning side. Yes, I know that not every news feed that comes across your desk will be or should be actionable, but I also know that if digested correctly, these small bits of information can be additive to your overall foundation of knowledge. And it is through this foundation that you derive your financial decisions and plans.

Today, I thought it would be fun to hopscotch through David’s common DC Today headers and discuss how these current events can be viewed, assessed, and applied. The intent, as is often here on TOM, is to teach you how to think and to give you a sneak peek into the paradigm of a financial planner.

So, without further ado….

Market Action

If you are a regular visitor/reader of DC Today, you will know that markets go up, markets go down, and markets go sideways without always having a clear reason why. You could conclude – and you would be correct – that markets are indeed unpredictable on a daily basis. I like the way David put it on Monday, July 18th, “We are not gifted with a footnote when markets move stating “this is why these prices did this at this point in time.”” The “why” is left up to the interpreter and will never be confirmed in an absolute sense. Footnotes would be nice, though, knowing exactly who was selling and who was buying and for what exact reasons.

Nonetheless, DC Today gives us that regular reminder that markets are unpredictable in the short run, and this should be a comforting reality. Wait a tick… that last sentence doesn’t seem right, does it? What could be comforting about uncertainty? Let me explain… Over the last 52 years, the S&P 500 has had a negative annual return 10 times or 19% of the time; this shrinks to 14% of the time when measuring by 5-year rolling periods, 4% with 10-year periods, and 0% of the time in 15-year, 20-year, or 25-year periods.

So, where is the comforting part? In knowing that this is just how markets are, this is the norm, this is how we should expect markets to behave. All we have to do is be patient. The probabilities work in our favor, as we flex our patience muscles. Yes, easier said than done, but if you get your daily digest of The DC Today, it will help you become more comfortable and familiar with the cadence and rhythm of markets.

Public Policy

The way the news cycle works in the world of public policy is that you will get a feed of what could happen. You get a sneak peek at what is being discussed and proposed. David does a great job in The DC Today sharing the details around what is being proposed, what incentives the associated players have, and some of what he hears from his contacts on the hill.

You should know what the details are regarding these conversations, and what the proposals are that are being brought forth. Yet, you should not react from a planning perspective to what could be; you must plan according to what actually is. This is a key lesson when digesting content on the daily, and I will lean on David’s explanation from his annual letter in January, as he articulates this point perfectly:

I do not think those who spent much of 2021 attempting to scare the [blank] out of you about changes to tax law will ever be held accountable. It is not that there was not an attempt to significantly raise taxes on income and investment – and it is not that there are not political leaders who would like to see that happen. But what those who spent so much of the year aggressively fearmongering did not understand is how a bill becomes a law in our country. The political reality was never suggestive of the most onerous tax increases in history coming to be.

My own view is that some suffered from a conflict of interest in the views they shared (they had something to gain in telling you that paradigmatic changes were coming in income, investment, or estate tax policy), and that most just suffered from a poor reading of tea leaves. If I had to bet, I would say some modest increase in corporate taxes and capital gain taxes was likely to have happened (but never the sensationalistic ideas around estate taxes and unrealized gains) before the political winds shifted in the second half of the year.

But a major story of 2021 was that the market never believed these things were going to happen, and the market was proven right. You can say the market knew more about Joe Manchin than anyone else did, but the better way to say it is that the market simply knew that the sausage-making of legislation in our Madisonian form of government was never going to be easy.

Again, the lesson here – we must plan for what is, not what could be, or even worse, what we wish it were.

Federal Reserve / Housing & Mortgage

I blended these two headers together because (1) the Federal Reserve has become the center of attention in much of the financial media, and (2) the decisions that they (The Fed) are making have a direct impact on mortgage rates and, therefore, housing.

What have we been reading over the last 6 months? The Fed is going toe to toe with inflation, and their weapon of choice has been ratcheting up the federal funds rate, which has a domino impact on interest rates across the spectrum. So, we’ve seen a significant uptick in mortgage rates, which led to houses staying on market a bit longer, driving up housing supply, and now we watch as sellers begin to soften their stance and lower prices.

What does this all mean to you? Where’s the application? Well, first off, if you have an existing mortgage, you can celebrate that fact and relieve yourself from watching markets for a refinance opportunity. Many readers have borrowing rates (mortgages) that are half the rate of what the current offerings are. For those looking to buy or take on a new mortgage, this might mean that you need to be a bit more creative in how you craft your borrowing. Do you use a portfolio line of credit as part of the equation? Does it make sense to explore some adjustable-rate mortgage options? These are all questions that are warranted in this type of environment.

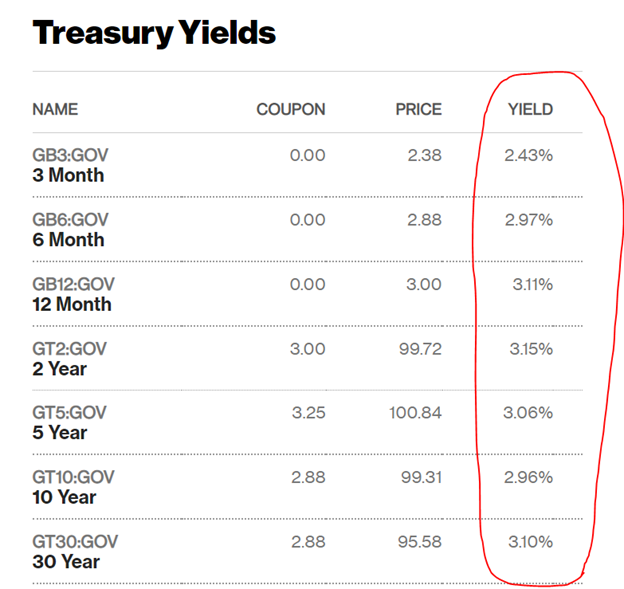

Also, it’s important to remember, that interest rates work both ways – an uptick in interest is a cost to new borrowers, and it can be a benefit to current savers. Take a look at what current government treasury rates look like:

Source: Bloomberg, July 21st, 2022

So, have you reviewed your cash savings recently? What is the yield on your reserves? Is this an area where you should be building out a simple treasury ladder to take advantage of current rates? These are questions you should be asking and discussing with your advisor. This is an example of how you find applications and actionable steps from the news you are digesting.

Against Doomsdayism

In all reality, a lot of the news feed can sometimes have a negative spin or feeling to it. Rising taxes or falling markets, or out-of-control inflation can leave us feeling a bit down. In this section (Against Doomsdayism), David helps you to clear your palette and reorientate yourself back to the fact that there has been incredible progress and improvement for all of us. Everything from innovations in medicine to improved techniques around farming has resulted in greater provision and quality of life for all.

On the nightly news, I think they try to break the somber tone of the negative news feed with some feel-good human interest stories about puppies and local heroes, which I think can bring us some joy and laughter, but they don’t shift our paradigm. On The DC Today, David challenges you to zoom out and see the changes and benefits that you enjoy on a daily basis and recognize the improvements that have been made over decades and centuries. Again, a nice little pallet cleanser.

A good reminder that we have to balance the content we digest. I reference this book title a lot, Triumph of the Optimists: 101 Years of Global Investment Returns, and I do so because it says it all. Look at market returns in the long run, and it’s hard not to be an optimist.

Ask David

If you have a question, you should ask it. Why? because a handful of other readers have that same exact question. I’ve attended a lot of David’s speaking engagements, and the Q&A is always my favorite. This gives listeners and readers an opportunity to focus their questions specifically on what tidbits and data points seem most applicable to their situation. This is where the rubber meets the road. This is where we best see the intersection between the news feed and financial planning.

Again, my encouragement, send that email and pose that question, as this is a great way to grow your own understanding of financial markets and financial planning.

Now…

Now, go read The DC Today and see if some of the things we discussed here on TOM can help you to digest this content in a little bit of a different manner. As always, you are welcome to email me at . I, and our entire team, would welcome the opportunity to be a resource 🙂

Until next week…