Spike Lee & Company

The New York Knickerbockers, the “Knicks,” have won two NBA championships. Their last championship was in 1973. For context, Richard Nixon was the president of the United States in 1973, and General Motors was one of the largest companies in the world.

I have sincere respect for the faithful Knicks fans that have not wavered throughout this 40-year drought.

In sports, we have a term for fans that only show up when their teams are performing well, a fair-weather fan. We also have a term for fans that rotate their allegiance based on which team is winning and in vogue, a bandwagon fan.

Again, you have to respect those whose fanhood runs deeper than the current performance of their beloved team. While dedication to a team may be relative to family heritage or one’s hometown, your investment strategy will have deeper intellectual roots. Yet, your commitment to that strategy can’t be “fair weather” and can’t be “bandwagon.”

Back in 2020

One of the struggles for investors in 2020 was this disparity of results between the top 5 companies in the S&P and the other 495. A short-lived work-from-home rally distorted market returns, which breaded jealousy, greed, and investor misbehavior. Those that didn’t own the largest 5 companies or some of the work-from-home darlings felt like they were missing out. A sort of fair-weather-bandwagon mentality started to kick in.

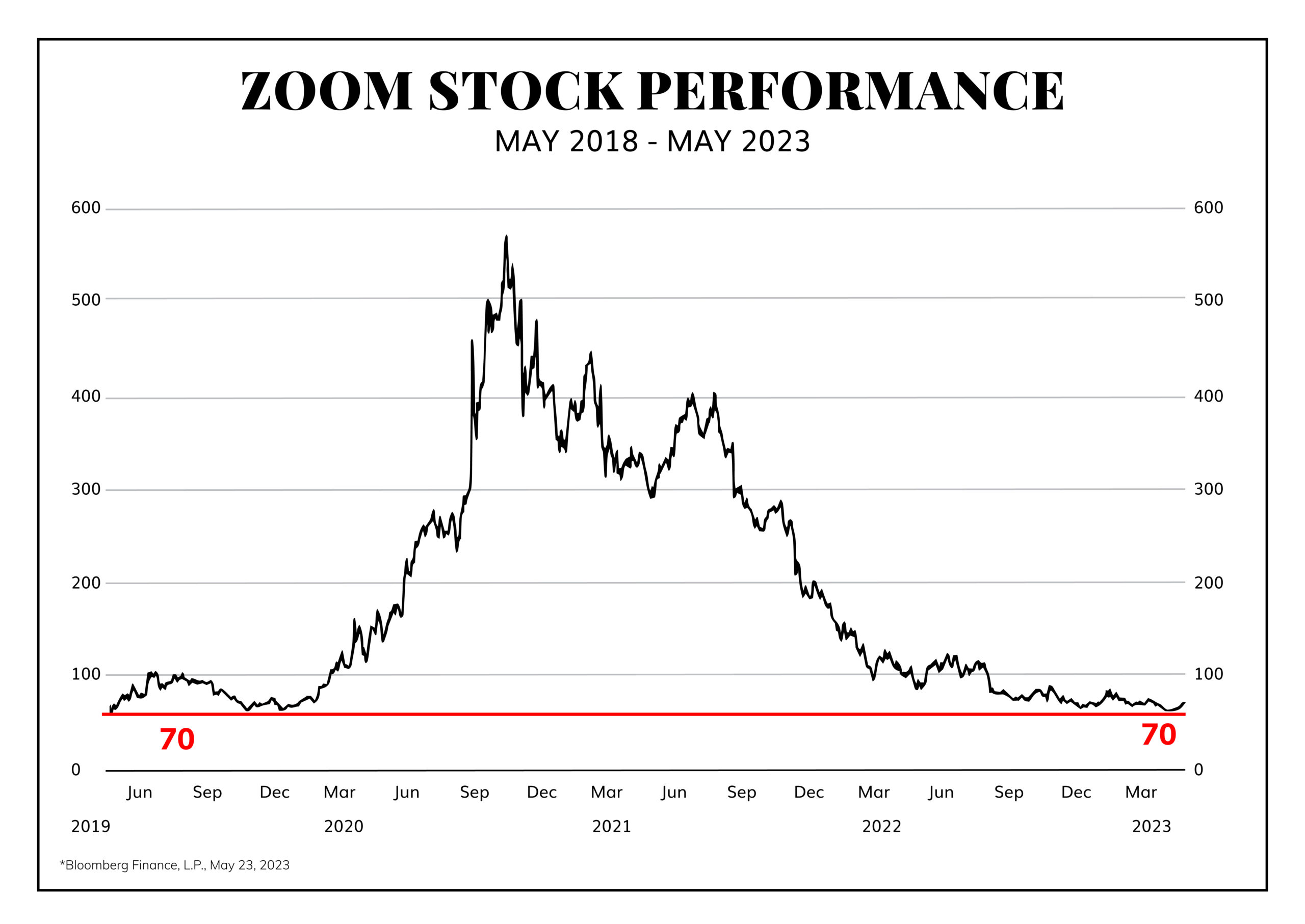

In hindsight, we now have a better vantage point of how the gravity of a marker fad works, see the example below:

Viva La Resistance

Those investment strategies that led investors to opt out of these trends and fads may have been difficult at the moment. Why? Because the results produced looked much different than their neighbors. Good self-talk and a thorough review of the thesis behind one’s investment strategy hopefully helped retain their fanhood and commitment in 2020.

Recently we’ve seen a company, that many Americans may not even be familiar with, hit a valuation of $1 trillion. This company is now one of the top five largest companies in our country, and the stock was up over 180% in the year. For reference, it is not typical for this large of a company to see this type of stock price growth in such a short time period (less than 6 months).

All the Buzz

In the late 90s, companies added the words “dot com” to their name to participate in the mania of a bubble that would eventually burst. In 2017, the Long Island Ice Tea Corporation, a company that sells ice tea and lemonade, rebranded/renamed their company Long Blockchain Corporation. Again, it can be assumed that this company did so to participate in the blockchain/crypto frenzy of the day. Although the buzzwords dot com and blockchain have lost their luster, there is always a new trending word or term to take its place. We are now living in the moment of “Artificial Intelligence” or “AI.” Although many lack the ability to provide a meaningful definition of what exactly “AI” is and isn’t, this new buzz lingo will surely get attached to beverage companies and pet products to attract attention and growth.

A quote often accredited to Mark Twain, “History doesn’t repeat itself, but it often rhymes.”

My caution to you – beware of narratives that lack substance. An investment thesis built on sizzle without substance will always disappoint in the long run.

Hindsight is 2020

I’ve personally been pondering these factoids from David Bahnsen’s DC today this week and thinking how “2020” this feels:

- How top-heavy is this market right now? The S&P 500 is at YTD highs, yet only 44% of the stocks in the S&P are above their 200-day moving average.

- How top-heavy is this market right now (and this one is staggering)? MORE THAN 100% of the S&P’s gain on the year has come from the top ten largest companies. The bottom 490 companies are (in aggregate) negative on the year.

- One of the big themes in the market right now is the relative weakness of defensive sectors like Consumer Staples, Health Care, and Utilities. And for a contrarian like me, it makes me like them even more. The momentum is in one very narrow space right now. That boat has a capsize risk in front of it as 2023 progresses. In the meantime, 4% of the large-cap universe is at a relative high right now, while 25% is at a relative low. Weird, wacky stuff.

Open Shots

I started with a basketball reference, so we will come full circle and close out with a basketball analogy as well. I’m 38 years young, playing pick-up basketball a few days a week – all for fun, but still determined to improve my game. I’ve realized from watching, coaching, and playing that it’s a lot easier to make open shots. If you went to the stat nerds, you’d learn that contested shots have a much lower efficiency than uncontested shots. So, this is an empirical truth, yet one that you don’t always remember in the middle of a game. With sweat dripping, adrenaline spiking, and emotions flaring, you sometimes forget the importance of shot selection. How do I combat this? I literally remind myself throughout the game, “Look for open shots” or “Open shots make the game easy.” For me, this self-talk and these reminders are needed.

You can be good at basketball, you can have natural talent, you can understand the game, and you can have amazing court vision, but there is still this aspect of basketball maturity and how you express this game knowledge in the moment of competition. Shot selection is a huge aspect of basketball maturity.

Warren Buffett studied under the famed investor and professor Benjamin Graham. Buffett, early in his investing journey, adopted this style from Graham of “cigar butt investing.” This concept of finding discarded companies (cigars) that still had a few good puffs left in them – picking up something off the street for free (a butt) and extracting a bit of value or enjoyment from it. As Buffett matured as an investor, he evolved and shifted his paradigm stating, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” This was Buffett’s version of “open shots,” he began to understand the importance of shot selection when it came to stock selection.

So, do you know what strategy you’ve subscribed to? Will your convictions help you endure the lures of greed and jealousy? Speculation and get-rich-quick investing are tempting, but it’s like taking contested shots – some will go in, but the odds are less favorable. So, whether it’s dot com, blockchain, or artificial intelligence, please ensure your strategy runs deeper than a trendy narrative. These are your hard-earned dollars, your precious nest egg, and your financial future – treat them with care, respect, and caution.

REFERENCES

[1] Zoom