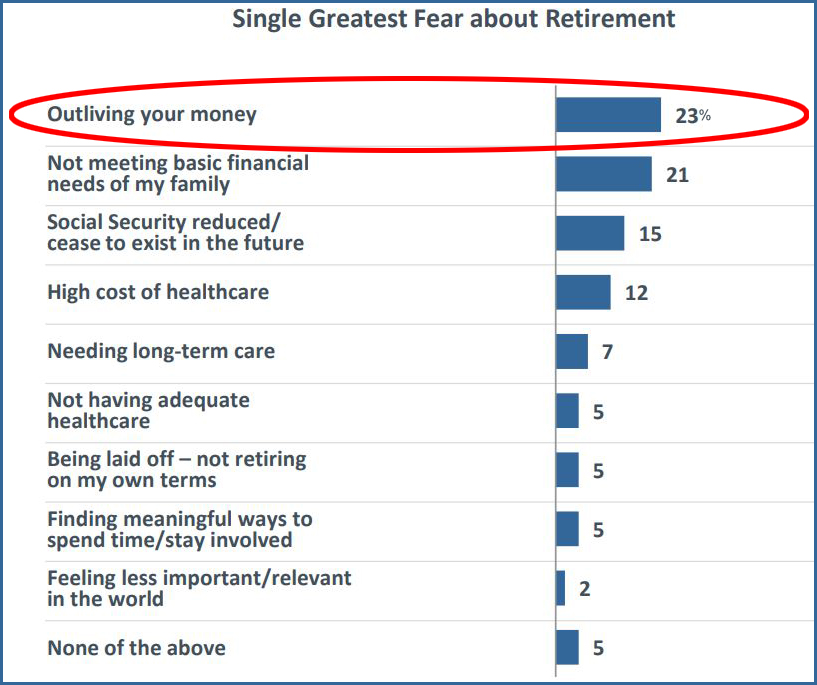

For a retiree, there is plenty of media out there to help instill this fear that you may outlive your savings. Talks about rising healthcare costs, fearmongering about the next financial crisis, rumors of disappearing social security, etc. etc. etc. The financial “things-to-be-afraid-of” list seems to be never-ending. It is no wonder that many surveys find a majority of retirees worried about potentially running out of money.

Source: Transamerica Center for Retirement Studies

Crippling Fear

Some fear can be helpful, as it may instill some ambition around preparing, saving, and planning, but an excessive amount of fear may be paralyzing.

As an advisor, I work with some quality clients. Most of them have lived a life I often describe this way, they’ve spent less than the average person and saved more than the average person, which has positioned them well for retirement.

From many interactions and countless conversations, I have found that this transition from work to retirement can be very difficult for some. In financial planning, we call this the transition from accumulation to distribution. More simply put, from being a saver to a spender. Surprisingly, many retirees are afraid to spend.

Breaking Good Habits

Although this may not be intuitive – to think one would be afraid to spend – it should be understandable. These individuals have lived a life built on principle and prudence. They have established strong habits around saving and controlling their spending. Habits are hard to break, and this habit is no different than any other.

Here’s the message that I would like to deliver today, “It’s ok to spend!” If you have done the appropriate planning with your advisor and you two have agreed on a suitable distribution strategy then I encourage you to have no fear. You spent a lifetime saving, you spent a lifetime controlling your expenses, and now I commission you to enjoy the fruits of your labor.

For some, this may sound antithetical to the traditional advice you might read here on TOM. Perhaps you’ve heard us sound the trump about “SAVE! SAVE! SAVE!” and it seems sacrilegious to hear an encouragement to spend, but these two pieces of advice are not in conflict with one another. We advise you to diligently save in your accumulation years so that you can diligently spend in your distribution years. Or as the personal finance author, Dave Ramsey commonly says, “If you will live like no one else, later you can live and give like no one else.”

A Plan vs. Planning

In 2012, John Mayer released a hit song titled, Love is a Verb. The echoing chorus of the song is that “Love ain’t a thing, Love is a verb.” I believe this same concept translates well to financial planning. Many advisors work with clients to create “a plan” and this becomes a lengthy bound document that is reviewed once and then collects dust in a filing cabinet. Financial planning is not something you do (once), but rather something you are constantly doing.

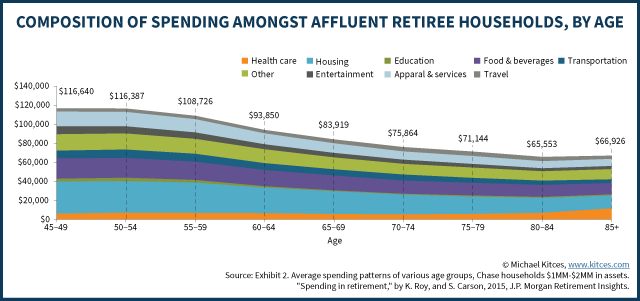

If you just create “a plan” and you project out your retirement spending in a linear fashion (the same each year) then you might not come to a favorable conclusion. Meaning it might look like you are spending down your nest egg too quickly and this may instill some fear about running out of money. But guess what, this is not how things are going to play out. As we age, our spending typically tends to decline.

Source: www.kitces.com

This is why it is important to constantly be reviewing your plan and adjusting the plan accordingly. Future spending is not the only unknown factor, your future portfolio returns are also unknown. Many plans are forecasted using average returns, but it is actually very rare that you will have a year in which you achieve an average return. Here’s an example, from 1928 to 2017 the S&P 500 had an average total return of 9.65%, yet in those 90 years there are only 4 times in which the annual return was actually between 8% – 12%. This means most years you will have above-average returns or below-average returns and when you zoom out, over a long period it will all culminate together as average returns.

Enjoy the Above Average

Most clients we work with will have a retirement plan built around primarily spending the income (dividends and interest) that their portfolio creates. Remember, the total return of a portfolio is made up of two parts, appreciation and income. Income tends to be a much more reliable/predictable number, as opposed to appreciation. Again, as an example, since 1960 the S&P 500 has recorded 16 years in which the price depreciated year over year, while the dividends had a year over year decline in only 6 of those 54 years.

This means that income is a great resource to fund all of your ordinary annual expenses. As for your extraordinary expenses, how about resourcing some of the appreciation from these above-average years that we discussed? So maybe a year like 2018, when returns were below average you might defer some of these extraordinary expenses (home improvements, special vacations, college funding for grandkids, etc.) and perhaps in a year like 2019 when we are experiencing above average appreciation, you might build a plan to resource some of this excess.

It All Goes Back in The Box

Not so long ago I heard a sermon where the pastor referenced a book by John Ortberg called, “When the Game Is Over, It All Goes Back in the Box.” The sermon and theme of the book were the same, in the end, we don’t take anything with us. When our tour of duty here on earth is done, our things stay here. This message stuck with me and it led me to ponder about how people might maximize the utility of their wealth and derive the most joy from it during their lifetime.

I’ve read numerous studies that associate this relationship between wealth and longevity, which leads me to believe that many of my clients will live well into their 90’s. This means that their children will eventually inherit this wealth when they [the children] are most likely already retired and are already well prepared for their own retirement. Passing down this wealth to one’s children is far from meaningless, but I do wonder if one might make this wealth transfer even more meaningful through more intentional planning.

I have seen families design creative ways to spend their money on their loved ones through the funding and management of family reunions, group vacations, or charitable contributions in the name of all those in their family. Families of significant wealth spend a great deal of time with this kind of planning that considers both ledgers and legacies, often positively impacting those well beyond their blood relatives.

If you’ve already done the basic work regarding withdrawal rates and spending strategies, this kind of legacy planning could be more fulfilling and possibly closer to the core and what matters to you most.

For those of you fortunate enough to have planned well, it truly is a beautiful thing to be able to employ your resources during your lifetime in a way that is meaningful and fulfilling. Meet with your financial advisor to create a plan that consider how to spend, donate, and share your wealth today, tomorrow, and beyond.