These last few weeks have been wild, to say the least. For some, these two weeks have felt like two years as so much has changed in such a short amount of time. We’ve seen our country take drastic measures to “flatten the curve” and we’ve seen our government step in with a monumental fiscal response.

It seems as if everyone around us is taking action and some of us are left wondering, “What action do I need to be taking?” Questions fill our minds about changes to our financial plans, adjusting our investment portfolios, and stocking up on toilet paper.

I have a unique vantage point in all of this, as I have literally had hundreds of conversations with investors in the month of March. Investor’s reactions vary, but I’ve found that most fit into one of these three buckets: Fearful, Opportunistic, or Apathetic. Today we will speak to each one of these emotional responses and provide guidance on how to best temper your reactions.

And off we go…

Fearful

It makes sense. How could some level of anxiety or fear not creep in? What is going on in our country feels like a threat to our health and our finances, two things we hold near and dear. It is absolutely ok to feel unsettled about the unknown; this is a natural reaction and there is a lot that is still unknown.

I will say it again – it is ok to be a little fearful. Mark Twain articulated it best, “Courage is resistance to fear, mastery of fear—not absence of fear.”

Where fear can get you in trouble is when it takes over. Fear has a tendency to befriend our imagination and together they like to speculate about a very dreary future. This imagined fate begins to put anxiety on us today and leads us to want to take drastic measures.

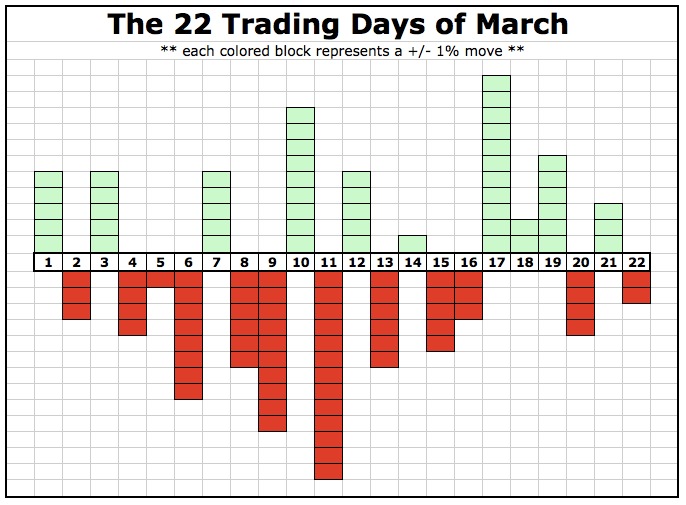

What might a drastic measure look like? For some, they’ve contemplated “throwing in the towel,” selling all their investments, and waiting in cash until this blows over. Here’s the problem with this timing strategy, it’s impossible to execute. The up and down swings are so violent that you may end up selling investments for 70 cents on the dollar and then trying to come back in later paying full price.

I like the way a friend in the industry described it to me, “The market is like a speeding train going 1000 points an hour, you’re going to get banged up if you jump off, and banged up if you jump on.”

To illustrate this, here is the daily performance of the Dow in March:

Opportunistic

A reaction that seems quite the opposite, but still common is the opportunistic response. Buffett (Warren, not Jimmy) is often credited with the adage, “Be fearful when others are greedy and greedy when others are fearful.”

For some, these market environments can bring out the gambler in them. These investors are trying to pinpoint the bottom and pick up some investments at bargain prices. I admire the optimism and the ambition, but the trouble is that they often dial up their risk exposure beyond what is prudent or fitting for their financial plan. And don’t get me started on those that even add leverage to this ill-advised practice.

My opportunistic-friends, be patient. I know you are chomping at the bit to rebalance, adjust, double down, etc. but often making these large wholesale changes in a portfolio mid-crisis can amplify the pain. Let me be candid with you – you won’t perfectly time the bottom.

The week of March 23rd, 2020 represented the 2nd best 5-day performance of the S&P 500 of all-time. What was the best 5-day performance in market history? The week of November 24th, 2008. Yet we know the market didn’t bottom until March 2009. Will this be the fate of our current market? I don’t know, but in all humility I hold tight to the words of Bernard Baruch, “The main purpose of the stock market is to make fools of as many men as possible.”

Apathetic

For some, this season of life represents even more busyness. First responders and others that have an elevated commitment in this crisis and many are burning the candle at both ends. For others, this calamity has caused them to “ostrich” and bury their head in the sand. Both parties have by necessity or fear disengaged from their financial plan and investment portfolio.

I have heard of many folks that are yet to open a statement or look at their online account. They’ve elected to just avoid it. Again, I get it; some of us need to take extreme measure like such to avoid bad decisions.

For those that can withstand to see the gore of their portfolio I would encourage them to do so. This seems like odd advice, right? But here’s my reasoning, I believe full heartedly that we will get through this and that better days are ahead. As equity (stock) investors we need to be fully aware – eyes wide open – that throughout our investing lifetime stocks do and will get cut in half.

Yes, it is absolutely painful to experience, but if we can embrace these moments they will make the recovery and advance that much more meaningful. These moments are building up our tolerance to endure the next event that is bound to present itself on our investing journey.

I absolutely love this account that David Bahnsen referenced in a recent Dividend Café and I believe it captures this point well:

As Mark Twain and fellow novelist William Dean Howells stepped outside together one morning, a downpour began and Howells asked, “Do you think it will stop?”

Twain replied, “It always has.”

No Regrets

I would like to close out today’s entry with one last piece of advice. Over the coming weeks and months you are inevitably going to hear stories about friends that sold all of their investments at the right exact time or hear from an advisor that will tell you that they timed this perfectly for their clients. These war stories may lead you to question your strategy or approach and it may leave an open door for regret.

No regrets, my friend. My hope is that you came into this crisis with a plan in place and emergency strategies for a time such as this. If not, that’s ok; life is all about adapting and pivoting. A plan is important and needed. Use this season to re-calibrate your plan with your advisor and let this planning provide the needed peace-of-mind to help endure.

As always, please do reach out to me anytime at . My colleagues and I are working hard to serve our clients through these trying times, so please do resource us as needed.

Until next week, this is TOM signing off…