I’ll be upfront with you. I had reservations about tackling today’s topic here on Thoughts On Money [TOM]. Why, you might ask? Because my goal in this communication is to translate complex financial topics into something palatable, understandable, and relatable. AND these topics – the Federal Reserve, interest rates, and the yield curve – are intimidating topics for me to try to translate. They almost feel too complex for translation. Some of this just begs for a general base of knowledge and the financial language needed to even participate in the conversation.

On the other hand, I absolutely couldn’t help myself. I find these (the Federal Reserve, interest rates, and the yield curve) to be the most interesting topics in finance right now. I literally wake up every morning and look at the current treasury rates across all the different maturities – I study the yield curve and the day-to-day changes. Nerdy? Sure, but these interest rates permeate every corner of our financial markets; they matter a lot.

So… here are my encouragements. Write down the words you don’t know and look them up. Listen to the accompanying podcast where Deiya Pernas and I walk you through these topics – you can literally listen in on our conversation about these very subjects. Lastly, you have my email (). Please email me any questions, as I would welcome the opportunity to help bring more clarity around any of these matters that feel esoteric.

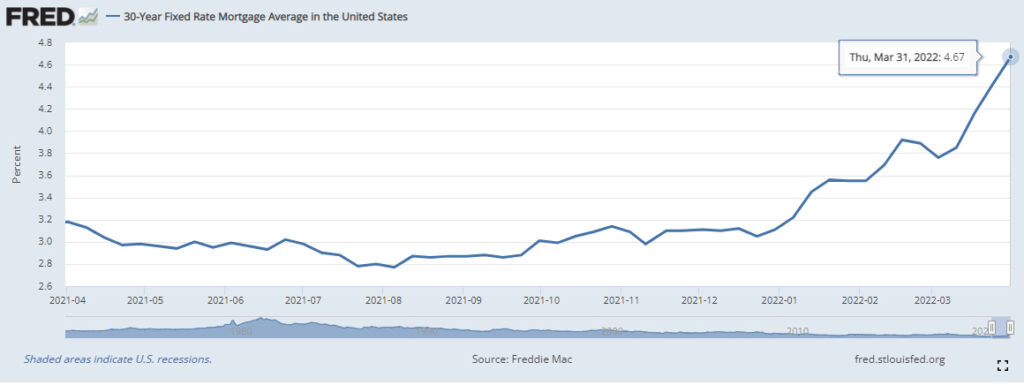

I also know it’s imperative for me to make the why-is-this-important-to-you connection. As I said above, please know that these interest rates have a deep and meaningful impact on finance. In a real practical sense, they impact you as a borrower, a saver, and as an investor. Everything from your mortgage rates to the yield on your savings accounts to your stock portfolio valuation, and much more. Check out what the 30-year mortgage rate has done recently (see below). That spike isn’t a fluke, and it’s not happening in a vacuum, but it is instead a direct result of these topics we are tackling today.

Now, for the format. I called in a friend that I believe has a MUCH greater grasp on this subject – Mr. David L. Bahnsen. David has a recent book publication with Pastor Doug Wilson called, Mis-Inflation: The Truth about Inflation, Pricing, and the Creation of Wealth. The format in this book is simply the exchange of letters between Bahnsen and Wilson, and the reader gets a financial education sitting in on their exchange. A collection of financial epistles of sorts. Our format today borrows the spirit of those letters.

Here on TOM today, you get my five questions for David Bahnsen on what’s going on with interest rates, the Federal Reserve, and the yield curve. Without further ado, here are my curiosities and David Bahnsen’s conclusions:

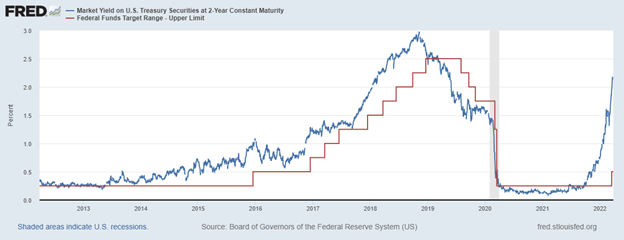

David, Some pundits state that the Federal Reserve follows the 2-year treasury – is this true? If so, how’d they get so behind the curve?

There is a never-ending chicken-or-egg conundrum embedded in this question. Is the Fed supposed to be setting the Fed Funds rate around what the 2-year does or is the 2-year trying to reflect what financial markets believe the Fed is going to do? My opinion is that the 2-year treasury yield skated to where the puck is going quicker than normal this time because the Fed policy tool of so-called “forward guidance” has gotten excessive. The Fed has told markets for nine months what it is going to do – nine months! The bigger question would be why the 2-year would not be at this point already. Now, with markets front-running the Fed one can logically ask, “what is the point of the Fed not hiking their own fed funds rate sooner?” – but at the end of the day, the Fed believes “forward guidance” is not just an informational tool but a policy tool, and in this case, they used it quite early.

We’ve seen lots of activity/commotion in the treasury markets following the Federal Reserves’ recent action and Jerome Powell’s comments – Does the Fed do this, telegraphing to get a glimpse of how the bond market would react? Will they [the Fed] do what they said they would? If not, why not?

I do not believe it is merely to glimpse into how the bond market will react, but rather to get the bond market to react. They are not trying to see what will happen as much as they are trying to make something happen. But that said, we have seen in the past (more so with the dollar than the bond market) that sometimes markets do the Fed’s work for them.

If the 30-year treasury is a proxy or estimate of future growth and you believe that future growth will be muted (below the trend line), what would it take to budge the 30-year rate higher?

One of two things (and you can apply this to the 10-year as well, not just the 30-year; in fact, the far higher use of the 10-year than the 30-year makes it a better proxy in my view): (1) A belief in higher sustainable inflation; (2) A belief in higher sustainable growth.

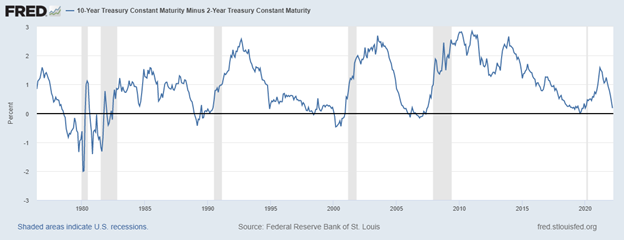

Lately, we’ve heard the mantra of “lower for longer” echo through financial media. Should this include “flatter for longer” too?

I hope not, and anyone who wants healthy economic growth should hope not, but if you mean predictively, I believe we will be flatter than normal for a longer than normal period. This is more descriptive than aspirational, though.

When the yield curve inverts, should we be concerned about a recession around the corner?

Not around the corner, no. There have been times the yield curve inverted and we did not have a recession (1998, for example). Historically it has depended on how long the yield curve stays inverted. But an inverted curve is not a cause of a recession as much as an indicator of looming problems. And when one uses a yield curve inversion to forecast a recession they are also stuck with a timing problem, as historically there can be a year or more until such a thing takes place.

***

Well, I hope you enjoyed a look into what questions are top of mind for me. Again, I will invite you to listen to the podcast and contact me with any questions or curiosities you might have.

And of course, I will be back next week with more of my… Thoughts On Money.