Last week on TOM we discussed a simplified system for categorizing and self-assessing your personal finances; we called it your Personal Financial Report Card. This financial report card was broken down into 6 categories: Earn, Save, Spend, Protect, Grow, and Give. Hopefully, your self-assessment provided some good perspective on where you currently stand and where you aspire to be.

Now, it’s time to get those grades up!

Today we dive deeper into the “Save” topic and discuss some key tactics for becoming a better saver. We will discuss the benefits of dollar cost averaging, the advantages to saving now vs. later, the reasoning behind growing your personal saving rate, and some tips for diversifying the types of accounts you are saving into.

And off we go…

Dollar Cost Averaging

If you are not familiar with this term, Dollar Cost Averaging (DCA), it is a strategy in which you systematically invest a set amount of money at regular intervals. The goal of the strategy is to reduce the impact of volatility by purchasing investments at different times and different prices.

Many of us unknowingly are already implementing a DCA strategy by simply participating in our 401(k) plan at work. Each paycheck a set amount is contributed into the 401(k), and those contributions are allocated to whatever investment choices you’ve elected.

Here’s the thing that I find interesting. Although this kind of systematic investing is a common practice for people to incorporate within their retirement plan at work, I rarely see this strategy being implemented elsewhere. Whether it is a 401(k) plan, taxable investment account, Roth IRA or any other type of account, you can always set up a regular savings plan in which a set dollar amount is invested each month from your checking account or paycheck.

For those who wish to enlist this investment strategy, technology allows you to automate much of this process. The heavy lifting is completed on the front end during the setup process, and the maintenance is simple. The ability to essentially “set it and forget it” will create a HUGE positive impact on the growth of your nest egg over time.

What will happen if you don’t have a system like this in place? Whatever surplus of cash you have at the end of the month will most likely accumulate in your checking account until one day you notice that you have more money in the account then you are used to seeing. This excess will become a temptation to buy a new toy, plan an extra vacation, or some other type of unplanned expense.

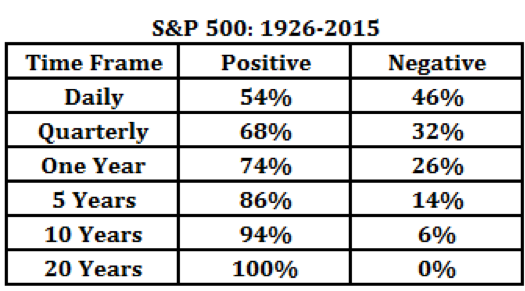

There is a healthy amount of research that shows when you compare DCA to making a lump sum investment, that the lump sum will create a better long term result a majority of the time (see Vanguard Research). This truth is self-evident because markets are positive a majority of the time, especially as you stretch out the time horizon.

Source: www.awealthofcommonsense.com

Remember though, today’s discussion is all about saving from income, not about how to best invest a lump sum.

Saving Now vs. Later

When I worked in the fitness industry the most common phrase clients would say was, “my diet starts tomorrow.” Making changes to your lifestyle, like your diet, is extremely difficult. Realistically “tomorrow” never comes.

Saving is a discipline, just like a diet, and maybe just as difficult to get started. When it comes to saving though, starting today vs. tomorrow makes a BIG difference.

I like the way this Vanguard article puts it, “It might seem backwards to worry about the last money you’ll need before you think about meeting any other financial goals. But because compounding is so powerful, starting early gives you more flexibility later on in life.” (Referring to retirement savings)

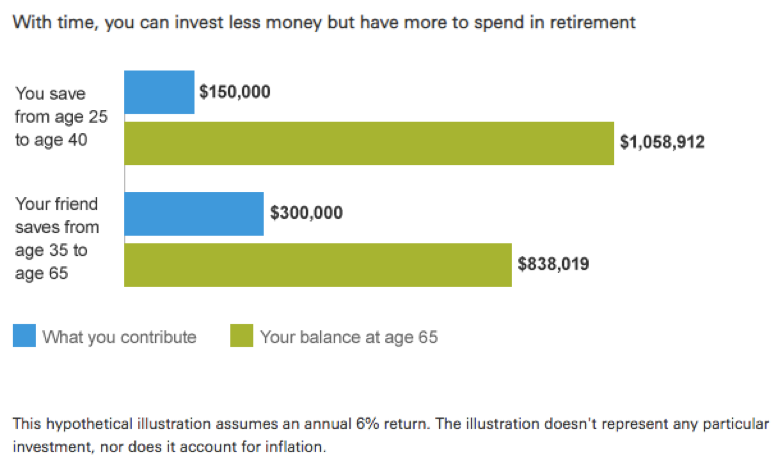

The accompanying chart helps to further express this point:

Source: Vanguard

In the first example, the saver started earlier, saved for a shorter amount of time (15 years) and ended up with a balance that was 25% greater. This is due to the power of compounding. The moral of the story is to start saving ASAP.

Some of you may read the scenario above and think it doesn’t relate to you because you are not 25 years old. The ages used are intentionally designed to better illustrate the point, but this truth is universal regardless of your age. The longer you delay saving, the less impactful compounding will be.

Grow Your Savings Rate

Ok, so far we’ve discussed DCA and the importance of setting up systematic contributions and automating your savings. Next, we looked at the importance of starting early and the impact that compounding makes. Basically, we want to save early and often, and now we will discuss the importance of saving more.

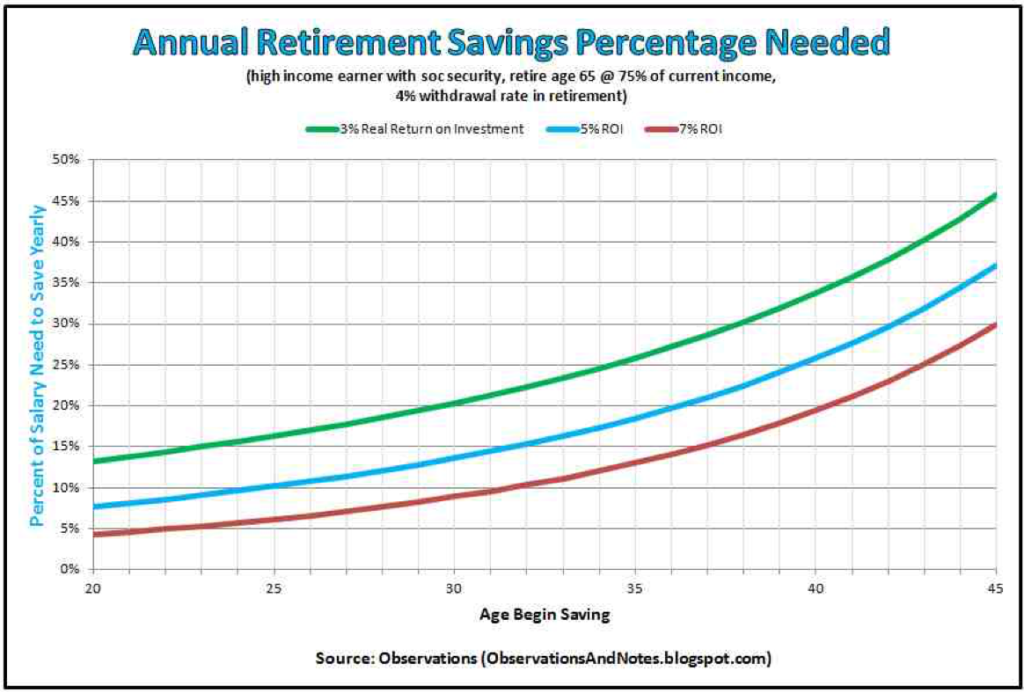

Last week we mentioned that the national average savings rate in 2018 was 7.6% and this just isn’t enough. It is difficult to make a blanket recommendation for all readers on what their savings rate should be, as it depends on a number of variables. To provide context though, I believe this chart should be helpful:

Source: www.observationsandnotes.blogspot.com

You can study the chart for all the details and assumptions to see how this might apply to your specific situation, but let me draw your attention to the basic reality of this graph. If you are 36 years old (x-axis) and haven’t started saving and you believe that your after-inflation returns will be 5% (blue line), then you will need to save 20% (y-axis) of your income each year for almost 30 years.

I will note that a 20% savings rate is almost three times the national average, which shows you how important it is to not follow the herd when it comes to savings rates. This needs to be an area where you are much above average. The good thing is that it doesn’t take a high IQ or any special skill set to have a strong savings rate, it just takes discipline.

Diversify Your Savings

An interesting phenomenon that I’ve seen during my time as a financial planner is how investors anchor their annual savings rate to targets that have nothing to do with their personal financial plan. Some investors only save 4% of their paycheck because that’s what the company matching rate is or some will look at what the IRS maximum contribution limits are for their retirement account and that’s all they’ll save.

You might say to me, “Well, they can’t save anymore because they’ve already maxed out their contributions” which may be true for that particular account, but that doesn’t mean they can’t make contributions into other accounts. As an example, there is absolutely no limit to how much you can save into a taxable investment account. Your savings rate should not be determined by IRS contribution limits, it should be determined by what’s needed for your personalized financial plan. If you make $300,000 a year and you are maxing out your 401(k) at $19,000 that means you are only saving 6.3% of your gross income. That savings rate is actually below the national average that we discussed earlier.

This truth may sound simple, but I can’t tell you how many conversations I have had with investors that don’t know what their next move is once they max out their contribution limits and still have a surplus!

One of the additional benefits of saving across different account types – traditional retirement accounts, Roth accounts, Taxable investment accounts, and others is that you can diversify the tax treatment for your contributions and distributions. This allows for some tactical opportunities to reduce your overall tax bill during both the accumulation phase and distribution phase of your investing lifetime. Many investors get caught up in this idea of wanting only tax-deferred accounts. It’s important to remember that even in a taxable investment account the unrealized gains of an investment are deferred until the sale of that investment. Additionally, the long-term capital gain rate on that investment is often preferential compared to the distribution of a tax-deferred account that is taxed at income tax rates.

So, remember, first set your savings rate and come up with a total dollar amount that you want to save for the year. Then create a strategy that directs which account types these savings should be directed to. Work with your advisor and tax professional to custom design the most tax efficient way to allocate these funds.

Bringing it All Together

Alright, you want to be an A+ saver, right? Make sure you save often (DCA), early (now vs. later), more (increased savings rate), and everywhere (diversified accounts). That should be easy to remember – save often, early, more, and everywhere.

In the world of financial planning, saving is a key element that you can control. There are countless items that are out of your control such as rates of return, the longevity of life, health issues, taxes, inflation, and so on. This is why saving deserves so much of your attention as your decisions and habits in this area will make such a BIG difference over your lifetime.

If you Google search “retirement crisis” you will find countless articles and videos about the looming issues for our future retirees here in America. Each story illustrates that there are discussions to be had about growing employment opportunities, increasing wages, and other economic improvements that could be made across our country. I am surprised that not more is being written about how many of these ills could be solved by just being better savers.

I hope this article provides a few tips that you can implement and improve your Savings grade! Until next time, friends. This is TOM signing off…