Line Dancing

Since childhood, I have always enjoyed dancing. I remember learning the lyrics and choreography to songs in the movie That Thing You Do Starring Tom Hanks. In high school, I discovered swing dancing and would spend my weekend nights at swing dancing clubs, which led to teaching gigs at various events. And now, in my adult years, I have discovered line-dancing, specifically at a place called The Ranch in Anaheim (highly recommend for our southern California readers). But don’t let my dancing history fool you; I am a white boy through and through with zero rhythm and the most awkward movements the human body can conjure up. This is probably why I’ve enjoyed line dancing so much; all I have to do is memorize some basic steps and follow the cues of those around me, and I’m happily dancing the night away. One lesson I learned from line dancing is that you need to master each specific step and know the sequence of which steps come next – otherwise, you’ll perform the steps out of sequence and find yourself halfway across the floor, woefully lost.

Putting the Pieces into Place

Sequencing is defined as the process of putting events or actions in a certain order. What I find interesting about this concept is that it teaches us there are at minimum two variables involved: the specific actions must be accurate, and the order in which they are performed also matters. A simple example would be mapping out the direction to a friend’s house. First you must know the amount of right and left turns and then the order in which you take those various right and left turns. In the case of my line-dancing experience, I had to grasp the dance moves as a whole and then know which steps to do in sequence.

Same, but Also Different

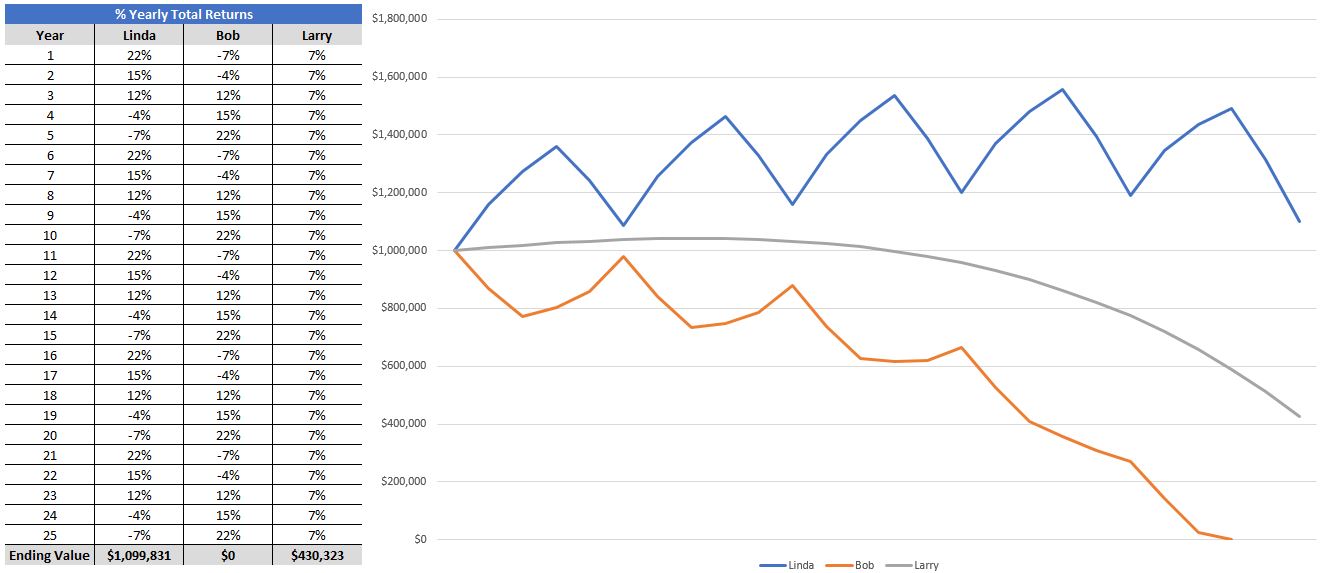

So how does this play out in investment planning? So glad you asked! Below is a list of three investment returns for a 25-year period. Each investment averaged 7% a year, but the sequence of those years was different. See below for an illustration:

Source: Blackrock

During an investor’s accumulation phase, the years spent building wealth, the sequence of returns did not matter if the individual stayed invested. This is a crucial point to remember, as it reassures us that staying invested is a key strategy for wealth building. Now, let’s dive deeper into this concept by looking at the same chart above but adding another variable: distributions. This means the investors in our example have now crossed from accumulation to distribution – spending down those hard-earned dollars each year. In this case, we assumed the retirees each withdrew $60,000 annually (adjusting for inflation over time) from their respective portfolios. Here’s what happened:

Source: Blackrock

Of the three investors, one ran out of funds in about 22 years; another had $400,000 remaining (even less when you discount into present value), and the final investor ended with a similar balance to when they began.

All three investors successfully hit their target of earning an average return of 7% per year; the difference was how they got there. This brings us to the next step in the sequence puzzle: understanding the difference between Risk and Volatility.

Balancing Two Extremes

The terms “Risk” and “Volatility” are commonly used in financial jargon and often appear to be the same thing. I believe the key to developing a resilient retirement portfolio is understanding how these two terms are defined and, more importantly, how to account for them in your investment strategy.

We define “Risk” as the permanent loss of capital. For example, the stock market drops, and you sell at a low, thereby locking in the losses.

We define “Volatility” as the daily fluctuation in pricing. Every day, the stock market begins at one price and ends at a different price.

A common link between these two is that volatility often drives investor behavior to buy & sell, thereby creating risk. Learning to manage the relationship between Volatility and Risk is a key driver in the growth of wealth over time and can be integral to your retirement. At one extreme, we know that holding cash under your pillow would remove daily volatility and reduce risk but would exclude you from long-term wealth creation. On the other hand, holding highly volatile stocks would allow for long-term wealth creation but expose you to the risk of selling in down markets (as shown in Exhibit 2).

The Steps to the Retirement Dance

So what is a person to do? Learn to line dance!

While financial planning is as much an art as it is a science, there are specific steps we take with clients to help with managing these tensions.

- Monte Carlo Simulations — A stress-testing tool called Monte Carlo is a common approach advisors use during the financial planning process. This allows advisors to run 1,000 different stock market scenarios for each client situation to explore how sensitive their financial plans are to volatility and the risk of permanent loss. A high score shows resilience to a wide range of market outcomes, and a low score shows sensitivity to stock market returns.

- Cash Flow is King—A core belief here at TBG is the power of compounding dividends. Said differently, great companies reward their shareholders with a portion of the profits that grow over time. Developing portfolios that are more dependent on Dividends instead of Appreciation allows for greater stability, even during uncertain times. While stock prices change daily, a properly constructed Dividend portfolio maintains steady cash flows and minimizes the risk of selling in down years.

- Safety Buffers – I like to think of asset allocation as the “lines of defense” for protecting your castle. These safety buffers allow investors to sell fewer volatile assets during times of uncertainty. Generally, I build in 3 to 6 months of living expenses in a money market or rotating treasuries, followed by 2 to 3 years of living expenses in quality fixed income, and then a combination of dividend-growing and price-growing investments for the remainder of the portfolio. As readers are well aware, every client portfolio and situation is unique, but the above allocation should be a helpful starting point for your own strategy.

Preparing for your retirement years often instills excitement and uncertainty in investors. Take time to think through your approach; observe how sensitive your holdings are to market swings and evaluate if you have the proper safety buffers in place during market corrections. Learning the steps to a prosperous retirement dance is not complicated, but it does take time and effort. As always, we are here to be a resource.

Happy dancing,