That’s right, SOUND THE ALARM!

Recruit Paul Revere. We need to make sure everyone knows.

What’s all the fuss about? Well, one particular asset class – a popular one at that – had one of its worst years in 2021, and no one is talking about it. How in the world is this flying under the radar? Why are we not sounding the alarm?

A bit dramatic? Of course, but hear me out.

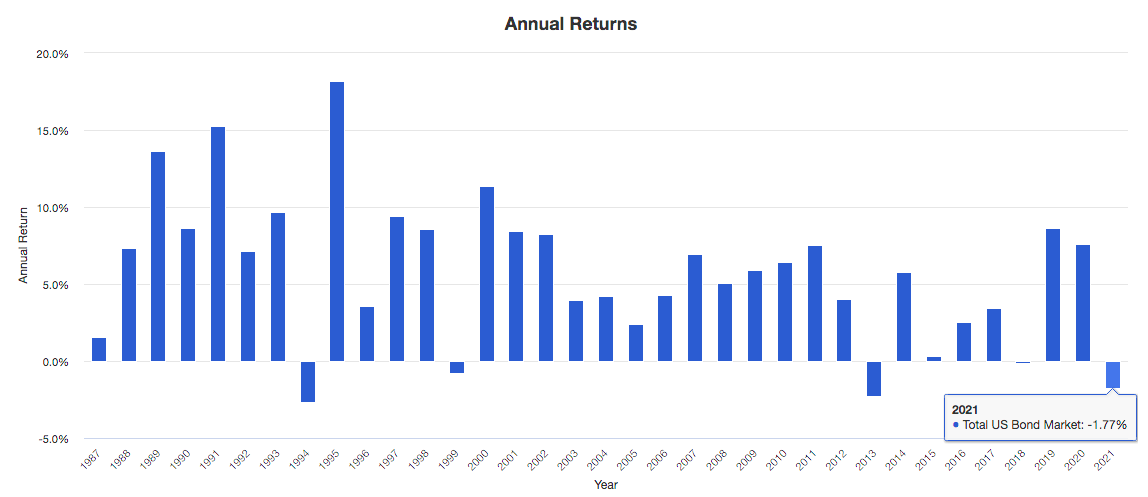

Here are the last 34 years of returns for the Total US Bond Market:

Source: Portfolio Visualizer

4 out of these 34 years posted a negative return:

1994: -2.66%

1999: -0.76%

2013: -2.26%

2021: -1.77%

As you can see, last year was one of the worst years on record based on the last handful of decades. Why is no one talking about this? Because it was a movement of less than 2%, and stocks often move that much on a bad day.

My clients hear me say this little quip regularly, “Investors want stability and growth; they can have one, but not both.” In a very simplified description, bonds offer stability with not much growth potential, while stocks offer growth with not much stability.

Our current interest rate environment – where savings accounts pay next to no interest and mortgage rates sit near all-time lows – has led many clients to ask me, why own bonds at all? The question is sparked based on the currently low yield on bonds, but the question misses the objectives of bonds altogether – stability.

Again, the objective of most portfolios is two-fold: stability and growth. Why? Because a portfolio is designed to meet the objectives of a financial plan and a solid financial plan balances the needs of prudent risk management (e.g., emergency funds) and the compounding growth of capital (wealth accumulation). A mature investor can separate these two initiatives – risk management and growth – to assess the different portfolios’ allocations based on their expected outcomes.

Let me say this another way. Imagine if Michael Jordan and Joe Montana competed in a slam dunk contest during their prime. Who would win? Michael Jordan, of course. Why? Because dunking a basketball is well within MJ’s scope of expertise, and although Joe Montana is an amazing athlete himself, a dunk contest is not his forte. Imagine Babe Ruth in his prime, trying to swim against Michael Phelps. Comical, right?

In that same vein, why do we, as investors, expect our bonds to deliver exciting growth? It is outside of their [bonds] scope of expertise. Bonds are excellent at delivering stability, and in a situation where you are trying to match an asset to a near-term liability (living expenses, large purchase, tax bill, etc.), bonds can provide that much-needed stability, predictability, and liquidity.

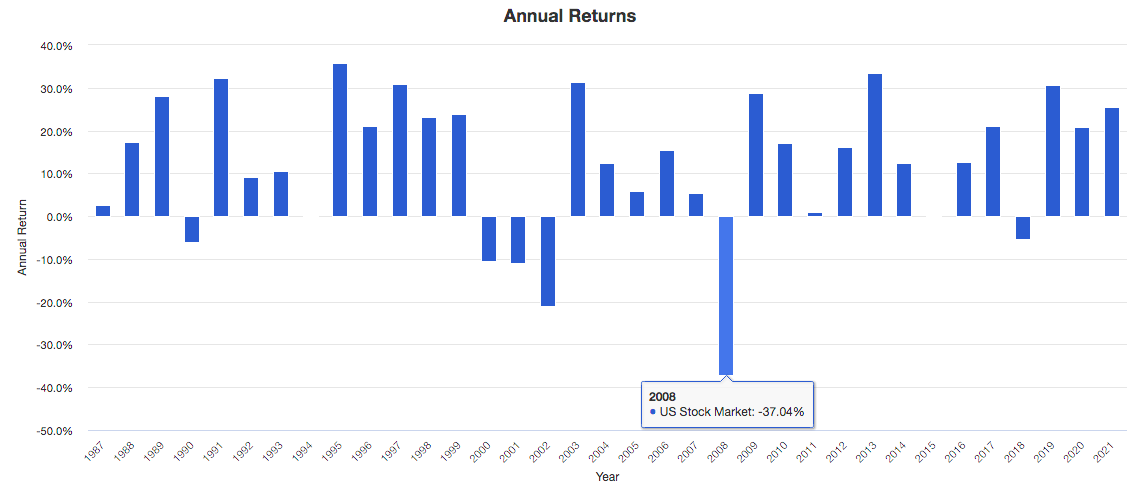

Just to further illustrate this, here is what instability looks like – the US Stock Market over that same time period:

Source: Portfolio Visualizer

Again, a bad year in bonds is a rough day in the stock market. And there is a lesson here too when the stock market delivers a 2008 moment, and it really shouldn’t surprise us. Yes, it’s not fun, never easy, and often accompanied by a surprise economic event, BUT it’s to be expected with an unstable investment. The growth is the compensation for enduring volatility.

This is why portfolio design is so crucial. So much of an investor’s results(returns) will be driven by balancing this need for stability and growth. The “stability bucket” needs to be sufficient to provide enough safety nets if something catastrophic happens. Knowing that life tends to throw us curveballs and that markets tend to misbehave, catastrophe is more of a when than an if. Building safety nets into a portfolio – cash reserves, high-quality bonds, sufficient insurance coverages, robust investment income (dividends), and access to borrowing (e.g., lines of credit) – is absolutely necessary.

The moral of the story, stop pressuring your bonds to be something that they are not. Embrace them [bonds] for what they are, size up your allocations to match the needs of your financial plan, and measure them against your expenses. A financial plan without any safety nets is just foolish, and safety nets come in all different shapes and sizes; sometimes, the perfect tool for the job will be high-quality bonds.

Maybe some of the concepts I introduced today are new to you, and you have questions or just want to discuss further. You can contact me at TOM@thebahnsengroup.com. I welcome any of your comments, questions, or even your critiques 😊