When the Bad Outweighs the Good

I grew up racing BMX bikes. At one point, I aspired to do this professionally. Many of my peers still continue to compete and one childhood friend even took home the bronze medal at the 2008 Olympics in Beijing. I have lots of great memories from this season of life, but due to injuries, other career aspirations, and the like, I decided to hang up my racing career.

Coming up the ranks as an amateur, I remember the different goals I used to set for myself. First, it was to win at the local level, then once that was achieved, I wanted to place at the state level, and the next natural progression was to be competitive at the national level. Once I got a taste of success, the goals got bigger and more aspirational.

I was no longer content with winning at the local level – I had a been-there-done-that attitude about it. When you are competing at the national level you are ranked according to your top finishes across multiple races. This means you travel around the country from California to Florida to Texas to Illinois competing at different venues and trying to improve your rankings with better finishes.

I specifically remember making the trek out to an event in Colorado and the only result that would’ve improved my rankings at that time would’ve been a 1st place finish. It was a two-day event and on day one I crashed while leading the race and finished 2nd on day two. I flew home from Colorado disappointed that I got 2nd place and kind of threw a tantrum for losing.

A few years prior, I would’ve been ecstatic about a 2nd place finish at a national event, but my expectations and aspirations had changed a lot since then. Was 2nd place a “bad” result? No, not at all, but it wasn’t about “bad” or “good” it was all about “better” or “worse” than expected. My expectation was 1st place and nothing less.

When the Good Outweighs the Bad

Here’s where financial markets come in; they operate the same way. In the past few weeks, I’ve received countless messages from clients and friends with the exact same question, “How can the market be doing so well with all this bad news out there?” To this question, I remind the inquirer that markets are not pricing securities based on bad or good news, but rather if the news was better or worse than expected.

Perhaps you’ve heard the adage “buy the rumor, sell the news.” The rumor sets the expectations (it’s the anticipation) and the news is the report of whether the outcome was better or worse than expected. Traders buy the anticipation (rumor) and then sell the position (take profits) once the anticipated outcome has been met (the news).

Bad News BEARS!

Here’s the takeaway – all the bad news out there you read about has already been priced into the market. While this is a common term for those of us who work with capital markets for a living, it’s not so easy to understand, so bear with me here. When employment data feels comparatively bad, but it is better than the market expected then the market goes up or if retail sales data is not as good as it was last year, but it is better than consensus expectation then the market goes up. David Bahnsen puts it this way, “The message in the economic data is not about jobs, or housing, or consumer spending, per se. It is about a forming trend whereby expectations are being continually outperformed. Markets like that, a lot.”

My hope is that you’ll see that the markets discount or “price in” a particular sentiment or expectation accordingly. While that is a wild oversimplification of how the markets behave, we often forget that markets are complex systems and as we lean into first-level thinking, we come to conclusions like “the markets must go down based on…” or “the markets have to go up because…” And it’s just not entirely that simple.

Economist John Maynard Keynes in his book The General Theory of Employment, Interest, and Money (1936) tries to describe these market pricing complexities with his famed beauty contest analogy. It goes something like this… Imagine a newspaper put out a contest that you must pick the 6 most attractive individuals from a list of 100 photos and those who pick the 6 most popular faces would win a prize. Maybe your gut intuition would be to pick the 6 photos that you believe to be the most attractive, but then you would realize that in order to win you need to pick the same 6 faces that others would pick. You’ve now concluded that you need to identify consensus or popular opinion and that your opinion doesn’t actually matter for this contest. Keynes then goes on to describe the complexity that this seemingly simple contest introduces,

“It is not a case of choosing those [faces] that, to the best of one’s judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.”

Again, markets are complex systems.

I really like the way that David Bahnsen summarizes this point of how markets price securities, Bahnsen is able to capture the heaviness of the season we find ourselves and yet express the timeless reality of how markets operate:

“But beyond the human response that I know all readers share regarding all the matters at hand – we do have to ask, “how can markets go up so much with such disarray in the society around us?” The answers seem crass, impersonal, cold, and even offensive. But they are accurate descriptors – markets are pure discounters of future earnings – period.”

A Genius Today, A Fool Tomorrow

Here’s why this is so important. Perhaps you have a strong conviction or premonition about what the economy will do over the next 12-24 months and maybe your outlook is doom and gloom. It’s ok to have these feelings and forecasts and maybe you are absolutely right. BUT when you let these predictions lead you to begin trading within your portfolio, you need to remember that the market may not react the way you think it will. Howard Marks, the famed investor, is known for this saying, “you have to be a contrarian…and you have to be right!!” Meaning that a consensus prediction won’t benefit you much when it comes to investing, you’ll need to be contrarian to find bargain deals and then your thesis will have to play out for those bargain deals to appreciate.

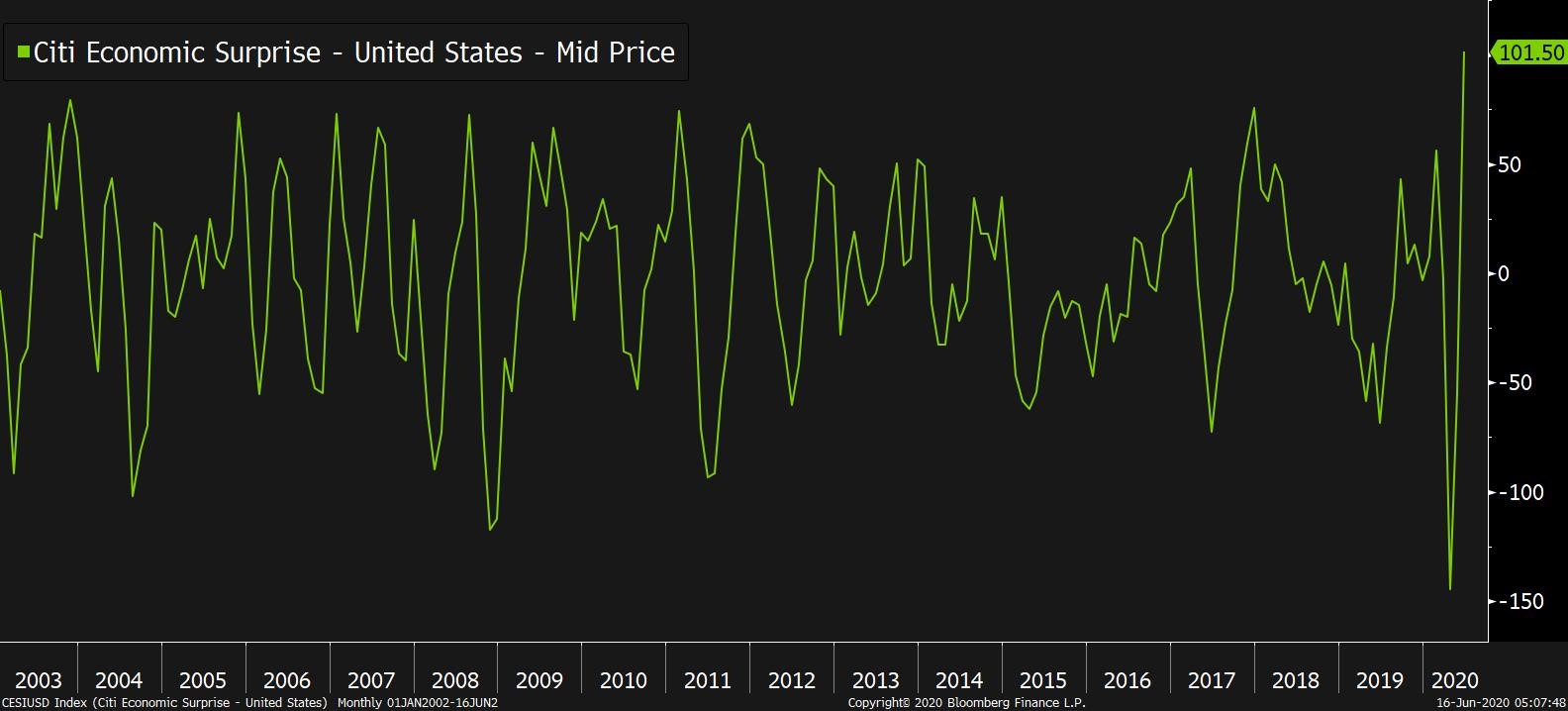

If this is getting confusing and perhaps overwhelming, that’s good. Let me comfort you though, this feeling of confusion about why markets are doing what they are doing is not unique to just you and I. The Citi Economic Surprise Index measures economic data relative to the consensus forecasts of market economists and it just hit its highest level in history.

Source: Bloomberg

Source: Bloomberg

You are not alone, the “experts” have been surprised by this market too.

Circumstances Matter

When I raced BMX, I was always ambitiously seeking to be competitive at the next level. I set high expectations for myself. I also had a lot of injuries and during those seasons of recovery, I did cut myself some slack. If I broke my collarbone and sat out for half the season, I didn’t expect to win my first race back. Of course, I’d always compete, but I tempered my expectations based on my circumstances. Our economy just suffered a broken collarbone and the markets are definitely tempering their expectations as the economy is rehabbing. So before you go make some drastic changes in your portfolio based on your personal forecasts, I would encourage you to temper your expectations as well.

Remember, opinions are free and we all have them, but hastily acting on those opinions in your investment account can be costly.

And… that’s all we have for you this week. As always, please do email your questions and comments to .

This is TOM signing off… Until next week…