Over the last few weeks, we’ve seen a few headlines of folks winning at the game of chance. There was Gregg Nigl, the neuropsychologist from Columbus, Ohio who correctly guessed the first 48 games of the March Madness tournament. Then we had James Adducci of Wisconsin who wagered $85,000 on Tiger Woods to win the Masters Tournament, and with 14-1 odds, Adducci brought in a profit of approximately $1.2mm.

“And may the odds be ever in your favor.”

– Effie Trinket, The Hunger Games

These are great stories and make for good watercooler conversations, but there is still one that stands above all others in my opinion. This is the story of Jerry and Marge Selbee of Evart, Michigan. The couple that turned the game of chance into a business of chance.

Meet Marge and Jerry:

Over nine years, the Selbees won the lottery numerous times and hauled in somewhere close to $27 million of gross winnings. By chance you ask? No, ma’am. With some simple arithmetic and a keen mind for solving puzzles, Jerry was able to turn this common game of chance into a successful business venture. This story has caught so much steam and attention, that the rights to the story have already been purchased for a future Hollywood flick.

Jerry Selbee has a diverse background – struggling with dyslexia growing up, the father of 6 children, once a cereal packaging designer at Kellogg’s, and later the owner-operator of a local convenience store in the small town of Evart, MI. A town of fewer than 2,000 residents. Along this journey, Jerry also accumulated a handful of degrees: a bachelors in mathematics, a Masters in Business, and partial completion of a Masters degree in mathematics. All this to say, that Jerry is your not-so-average average American.

In 2000, the then retired Jerry Selbee came across a pamphlet describing a new lottery game in the state of Michigan called, Winfall. Always looking for patterns and puzzles to solve, Selbee recognized a potentially profitable “glitch” in the game details. The game was simple; you pick a combination of 6 numbers ranging from 1 to 49 and the perfect match, 6 for 6, would land you the jackpot. The odds of winning the jackpot were rare (1-in-9.36 million), so about every 6 weeks, the accumulated pot would “roll-down” the jackpot to be distributed amongst multiple winners with tickets with 5 correct numbers, 4 correct numbers, and so on. With the greater rewards allocated to the tickets with the most matching numbers.

Jerry recognized that this elevated reward associated with the roll-down made the statistical potential of winning greater than the cost of the ticket. A piece by the Boston Globe Spotlight team – yes, the same team from the Academy Award-winning film, Spotlight – described the anomaly this way, “Because of a quirk in the rules, when the jackpot reaches roughly $2 million, and no one wins, payoffs for smaller prizes swell dramatically, which statisticians say practically assures a profit to anyone who buys at least $100,000 worth of tickets.”

That gives you a rough outline of the story, but I would encourage you to read Jason Fagone’s 10,000-word account of the Selbees. You’ll read about the 10-hour days that Jerry and Marge spent in front of the ticket machine, the 4-day laborious task of organizing tens of thousands of tickets, how their lotto ventures migrated to Boston where they came across a group of MIT students implementing the same strategy, and much much more.

This is a fun story and one I thoroughly enjoyed reading about and writing about. The Selbees exhibited a level of skill and success in the most unlikely place – the lottery. This brought me back to an old adage a former boss would always tell me, “Success leaves clues.” He provided this advice when he was encouraging me to meet with a peer or a competitor to sleuth out what they were doing to achieve success.

Here are four takeaways or “success clues” I gathered from the Selbees story:

1. Start with a Plan, Stick to the Plan

If you read the full story, you’ll learn that Jerry is actually a very risk-averse individual. Each step he takes is very calculated, and although he was participating in what most of us see as a game of chance, he had a plan. The Selbees only participated in the lottery about 12 times a year because those are the times that Jerry had calculated that the odds were in their favor. In a discussion about the financial crisis of 2008, Jerry commented, “They [corporations] were taking far more risks than I was, based on their rewards. That’s why I did a risk-reward analysis after every game, to make sure I was still on track.” This coming from a man who was buying $300,000+ worth of lottery tickets at a time.

The Selbees had every opportunity to break their own rules and get blinded by wealth, but they didn’t. They had a plan and they stuck to the plan. This is advice that can be regularly applied when building out your personal financial plan.

2. Math Matters

Just like Jerry’s calculations about the lottery, in the world of investing, we have historical data and statistics to help craft our portfolios. These allocation decisions should be made based on risk-reward calculations that match up with your financial plan. They should not be created haphazardly without attention to the underlying statistical realities – math mattered for Jerry Selbee, and it matters for your portfolio.

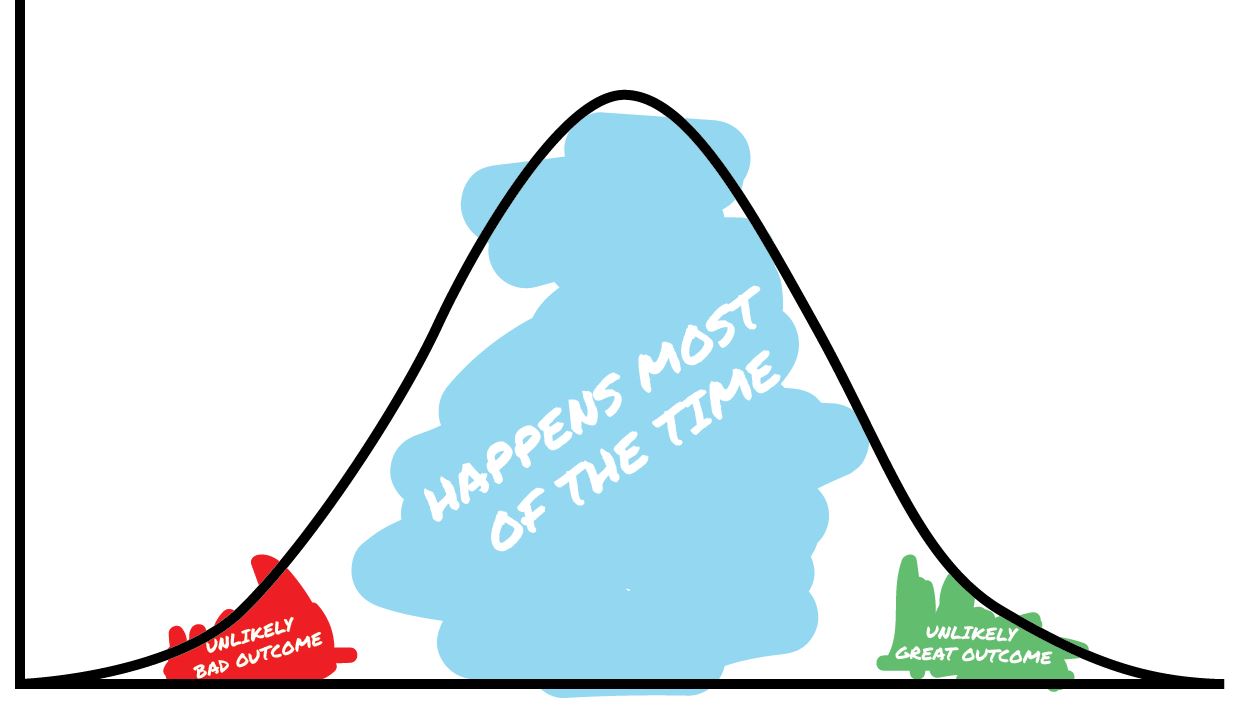

Without getting into some of the granular nuances of portfolio construction, let’s cover one simple math truth that tends to pop up often – probability. Many things in life follow this common distribution:

For Jerry, he figured out a way to put math on his side. He made an “Unlikely Great Outcome” into something that “Happens Most of the Time.” The Spotlight team described it this way, “Mark Kon, a professor of math and statistics at Boston University, calculated that a bettor buying even $10,000 worth of tickets would run a significant risk of losing more than they won during the July rolldown week. But someone who invested $100,000 in Cash WinFall tickets had a 72 percent chance of winning. Bettors like the Selbees, who spent at least $500,000 on the game, had almost no risk of losing money, Kon said.”

In the world of investing, strategies like combining non-correlating assets to diversify a portfolio or developing risk exposures based on the time horizon of specific goals are just a few ways an investor might create a statistical edge for themselves.

3. Gambling vs. Investing

Today we learned that you can gamble in the lottery or you can invest in the lottery as Jerry and Marge did. The same is true for your portfolio – you can gamble on the stock market or you can invest in companies. It’s important to not confuse the two, as I have seen many gamblers get burned by the market and then swear off investing. They are not one and the same. Gamblers play knowing they are likely to lose it all, while investors seek to avoid losses and implement strategies to build long term wealth.

If you haven’t had the opportunity to watch David Bahnsen’s whiteboard video on our investment philosophy here at The Bahnsen Group, I will encourage you to do so now. It helps to reiterate this point:

4. Avoid Lifestyle Creep

The last tidbit about the Selbees story that I found most encouraging is that their lifestyle didn’t change much after winning the lottery many times over. They still live in the same house, in the same town, and frequent the same diner. When asked if they’d take a cruise with some of their profits Marge responded, “I’d rather go pick rocks in a quarry.” The 60 minutes crew that covered the story described the wholesome nature of the family and touted the homecooked treats that Marge prepared for them when filming their interviews.

In life, we tend to let our expenses rise with our income, which creates a pinch on our capacity to save. Take note of the Selbees and be wary of lifestyle creep.

That’s All…

I hope you enjoyed this week’s journey into the odd world of the lottery, chance, and what we can learn from the Michigan couple who beat the odds. As always, please reach out to me with any questions or future topics you’d like covered here on TOM. I hope everyone has a great week and until next time, this is TOM signing off…