To Sell, or Not To Sell, That is the Question…

I met with a few friends this week. It was an advice-giving gathering where our meeting of minds led us to this scenario.

They’ve owned a property for some time and were contemplating a sale. One of the primary objectives was just to relieve themselves of all of the general maintenance and the burden of being a landlord. The fact pattern made a lot of sense – they’d gleaned great benefits from this property over the years, and they were ready to pivot. Then the non-sequitur, “I don’t know… with everything going on with the stock market lately, maybe we should just put this decision on hold for a bit.”

Say What!?

The “stock market?” The tax impact should be a factor to consider. How this impacts their estate plan should be weighed and pondered. Finding the right buyer at the right price should be a priority. But the not the “stock market?”

The current real estate market has strong demand and what seems to be lighter than normal supply. These dynamics create bidding wars, and sellers benefit from some historical record-breaking sale prices.

BUT the TV screens are flashing red, and the anchors are talking about a struggling stock market in 2022. All of this with not even a month in the record books yet.

Definition, Please.

And I ask again, what is the stock market?

Is it the Nasdaq? The S&P 500? Or perhaps the Dow Jones Industrial Average? Yet, all three of these examples have highly differing results thus far this year – so which is it?

Source: Google

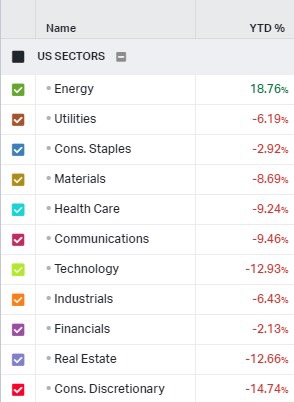

We can peel back the curtain further and see how the energy sector results look much different from the results of the technology sector at the start of 2022.

Source: Koyfin

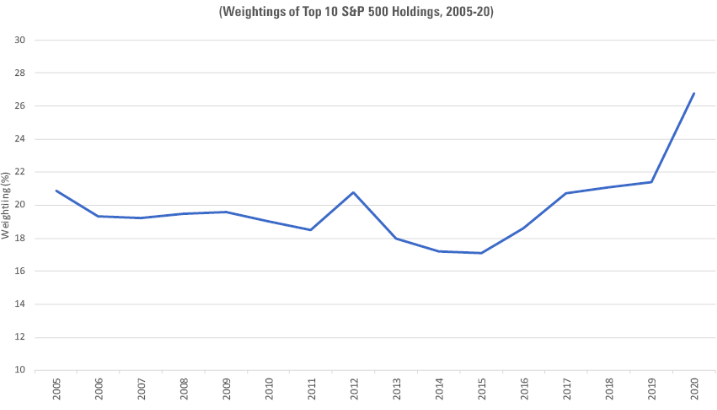

Or we can dissect one of these common stock market references – the S&P 500 – and see that the top 10 holdings now represent 28% of the weighted results.

Source: Morningstar

Again, that is 10 out of 500 (or 505 to be exact) responsible for a quarter of the outcome (returns).

So, should I conclude that the results of these ten companies over the last handful of weeks are what caused a cerebral block for my friend, paralyzing her from being able to make financial planning decisions around her potential property sale? That seems odd if you ask me.

Businesses > Stocks

Sometimes micro positions in very large, well-established companies, but they are business owners regardless. At The Bahnsen Group, our clients don’t own the “stock” market; they own businesses. We understand the value of diversification and the risk associated with concentration, so we own many businesses. We have a team – yes, an entire team – dedicated to analyzing these businesses, as we intend to own growing companies at reasonable prices.

Is this just semantics? I don’t think so. Think about a business owner, you know… I will give you a moment… got it? Does that person have an intimate understanding of the particulars of their business? Are they passionate about the results of their business? Is the business a reflection of their blood, sweat, and tears over many years? Do they get excited about the families that work for their business and how it provides for those families?

Now, on the other hand, how about a stock? Something you hope to “buy low, sell high.” Perhaps stocks were part of your high school econ competition – see who can pick the “best” stock for the semester. Stocks are not people; they are pieces of paper. Business owners care about people and know that as their people flourish, as will their business.

This framing matters. If you allow your portfolio to be built with “stocks,” it won’t be too long until greed and jealousy slip in. These attributes have no place in your financial plan and will lead to ruin. Stock owners are shortsighted, while business owners hold firm to their convictions and exercise patience. Stock jockeys have wandering eyes, constantly wishing they owned that highflyer they were a day late on.

Price Matters…

Sometimes investors forget that there is such a thing as a great company at a bad price. Valuation matters, and there needs to be a process around how someone goes about determining fair value.

Imagine that you and I went to business school together, you were top of our class, and you’ve got a resume chock-full of great companies that you’ve started, grown, and sold. You’ve got the Midas touch. I bump into you in the neighborhood, and you are busy with your next endeavor – The Lemonade Stand. Right there on the corner of First and Main, a simple stand, a line around the corner, and the best tasting lemonade, I’ve ever encountered. Impressive, and what I’ve learned to expect from you.

Then you pop the question – the business is growing, you require capital for expansion, and you invite me to invest. It seems like the stars are aligning, right? If you tell me this one stand on the corner is worth a billion dollars, and my investment will be denominated based on a billion-dollar valuation, should I invest? Do I say yes, or is there some additional diligence that needs to be done? I don’t know – more details are needed. When it comes down to it, all investors are interested in making a return on their investment. A return or, better stated, a profit on the money they put at risk. This is at the nucleus of investing.

Easy Come, Easy Go

Stocks are bought with the hope that someone else will hopefully pay more for that stock in the future, a speculator’s endeavor. A business is purchased with the belief that growing profits will grow the value of the business, your investment. Again, framing matters.

All this to say, often, the “stock” market can be a distraction. A distraction from the real art of investing and it [the stock market] can influence foolish behavior, like our planning decisions around selling a piece of real estate. I’d encourage you to build a portfolio of businesses, researched investments – lemonade stands, if I may; lemonade stands purchased at attractive valuations.

So, this week when you are at coffee with some friends or chatting after church, and the subject of the “stock” market comes up, poke and prod a bit, ask your friend what exactly is the “stock market?”