Hello TOM community, I am excited to introduce a guest post from one of my favorite colleagues here at The Bahnsen Group, Kenny Molina. Kenny works with our Solutions & Analytics team and holds an advanced certification as a Chartered Alternative Investment Analyst (CAIA®). Along with his many skills and talents that he brings to our operation, he is one of the kindest and smartest individuals you will come across. Kenny has prepared a great discussion on behavioral economics that I know you will enjoy. So sit back, relax, and enjoy the ride. Off we go…

**********************************************************************************************

It’s Easier To Look Good than to Be Good

Recently, during a quick run to my local Walgreens, there was a section on the credit card reader that prompted me to consider donating a dollar to a charity. The donation amount was pre-selected and I was able to decline or continue and thus adding the donation to my transaction. I initially decided not to donate but in an attempt to not “look bad” in front of the cashier, I selected the dollar donation and I left feeling like I had done my good deed for the day.

This experience got me thinking about the whole idea of the “things” that can move us to make financial decisions. In this case, that charity had figured out a subtle but effective way to “nudge” people into giving to their cause.

The Economy of Behavior

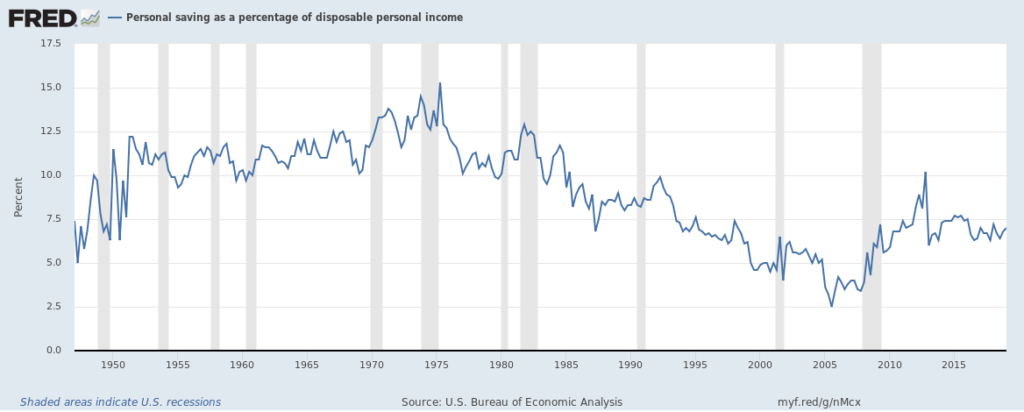

As a society, we generally don’t exhibit good financial habits, especially when left to our own devices. For example, the chart below illustrates how across generations our ability or willingness to “invest” in a savings account has had a bumpy and ultimately trending in a negative direction over the past 50 years.

This one bleak example of imprudence illustrates that it is a challenge of “behavior.” It’s very much like trying to lose weight, we all KNOW that we need to eat less and exercise more, right? But why is it so hard?

Bad finance related behavior can hold us back from achieving stated goals when we don’t account for our own predispositions, we have to find out ways to ‘hack’ ourselves through habit.

As the aforementioned charity has figured out; we are susceptible to behavioral guidance. There are cognitive biases (a disproportionate weight in favor of or against one thing or action) as human beings which can lead us to make ‘sub-optimal’ decisions around our financial behavior/savings and life in general. For example, I’ll assume that a few of us have made decisions which we counted on our future-selves to handle (read: finance). Whether it be a vacation, auto loan, or other it can be easy to have an ‘over-optimistic’ view of our future circumstances or purchasing power. A more sensible approach for an expected big-ticket purchase is to create a sub-saving account and contribute a small portion monthly so that it is either partly or fully paid for by the time it comes to purchase (a strategy covered in an earlier edition of TOM – Please, Save Me). Working on those very biases using steps we can implement to increase savings and develop common-cents spending habits is the key.

Through observations and experiments, behavioral economics has begun to incorporate ‘nudges’ as an effective and (theoretically) unobtrusive manner to help shape decision making for the better. As behavioral-economic Nobel prize-winning researcher Richard Thaler explains:

A nudge, as we will use the term, is any aspect of the choice architecture that alters people’s behavior in a predictable way without forbidding any options or significantly changing their economic incentives. To count as a mere nudge, the intervention must be easy and cheap to avoid. Nudges are not mandates. –

Improving Decisions About Health, Wealth, and Happiness

We can think of nudges as “signs on the road” that one would follow while never prohibiting any one path. With an ever-increasing number of services, sales, discounts, and ‘experiences’ to be had, all vying for our attention and ultimately our income, we should surround ourselves with goal-minded nudges.

A great example of how “nudges” have been incorporated in financial planning is through Thaler’s, and fellow researcher Schlomo Benartzi’s “Save More Tomorrow” (SMarT) program. SMarT attempts to not only strengthen an individual’s commitment to retirement savings but do so in a way that increases their contribution through a relatively negligible manner. The program strives to educate plan contributors about the benefits of a well-funded retirement plan and articulate best-steps on how to achieve one. Thaler & Benartzi understand that, among many possible hindrances, making immediate changes to financial allocations for an individual or household can be difficult or unfeasible. Instead, a commonly advocated step is enrolling in contribution auto-increases for a company or employer-sponsored retirement plan. In doing so, no immediate compromise is “perceived” and thus the individual is nudged towards better choices while intrinsically helping overcome behavioral biases discussed above.

Framing the choice in a way that takes advantage of how we are already wired to think about issues that require self-control allows us to make good long-termed decisions for ourselves, now.

A survey on framing was conducted by UCLA associate professor of marketing, Hal Hershfield, in which individuals were asked if they could save a certain amount of money monthly but the amount was broken down into a monthly lump-sum, weekly deposit, or daily contribution. An overwhelming number of participants chose the daily amount since it seems easier to accomplish than larger lump-sums, even though at the end of the month it would be the exact same nominal amount!

What we can take away from all this is that we can influence ourselves into making better choices in our spending and saving habits in a way that not only considers our biases but do so in ways that are less ‘painful’ than we might otherwise think. As Chaucer writes “A reed before the wind lives on, while mighty oaks do fall”, so too must we come to understand ‘hard and fast’ changes in our lives are most often improbable but approaches which not only accommodate for but perhaps capitalize, on our natural, human behavior can prevail!

**********************************************************************************************

I hope you enjoyed today’s contribution from Kenny Molina. This was a great reminder that sometimes our biggest obstacle to overcome is ourselves. I like how Kenny explained the importance of implementing these “nudges” that will help to steer us in the right direction and keep us on the right financial path. I’m definitely going to take inventory on my own personal finances to see if there might be a few nudges that I can implement.

As always, please contact us with comments and questions. This is TOM signing off…