Like many Thoughts On Money [TOM] topics, a conversation I had last week inspired today’s discussion. A friend called and wanted to understand why his portfolio was trailing the market. At first, I thought this question was in jest as we were only around 30 trading days into the year – but no – his inquiry was not only genuine but came from a sincere place of frustration and disappointment.

My friend and I went on to have a long conversation, and I walked away with two important truths that I would like to unpack today:

(1) Why I am content to underperform

(2) The trouble that comes from coveting your neighbors’ returns

And off we go…

Running Out of Energy?

My friend’s portfolio, and my portfolio for that matter, both have an elevated exposure to the energy sector and a relatively smaller exposure to the technology sector (as compared to the market). This tilt in sector allocations are intentional and the reason for my lagging performance in this first 30 trading days of the year.

Source: StateStreet (as of 2-18-2020)

So, why am I content to underperform? Well, I believe this allocation decision is well thought out and prudent. Without getting into the granular reasoning, let’s take a quick look at some statistics that make this an attractive investment to me.

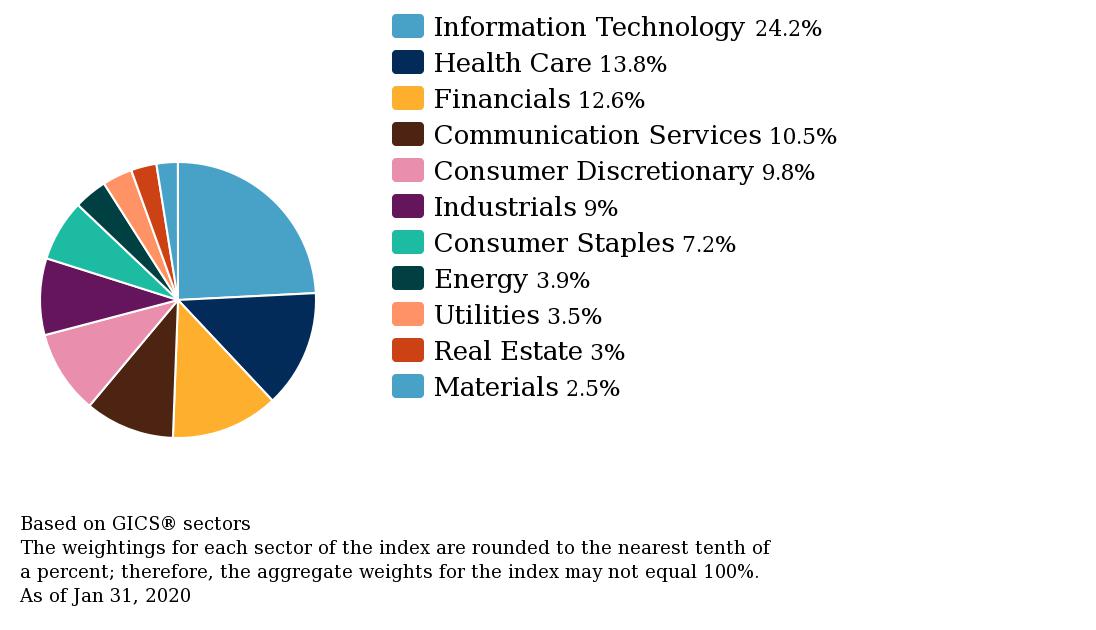

As of January 31, 2020, the Energy sector, by market capitalization, makes up less than 4% of the market.

Source: S&P

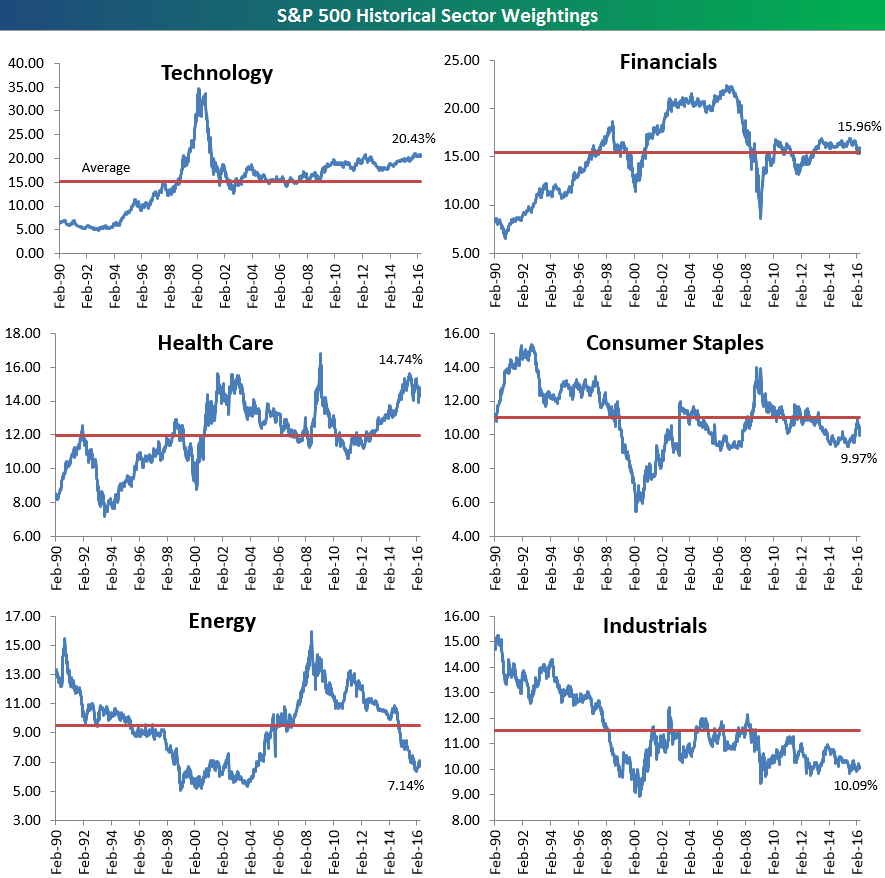

As compared to the historical average of approximately 9%.

Source: Bespoke Investment Group

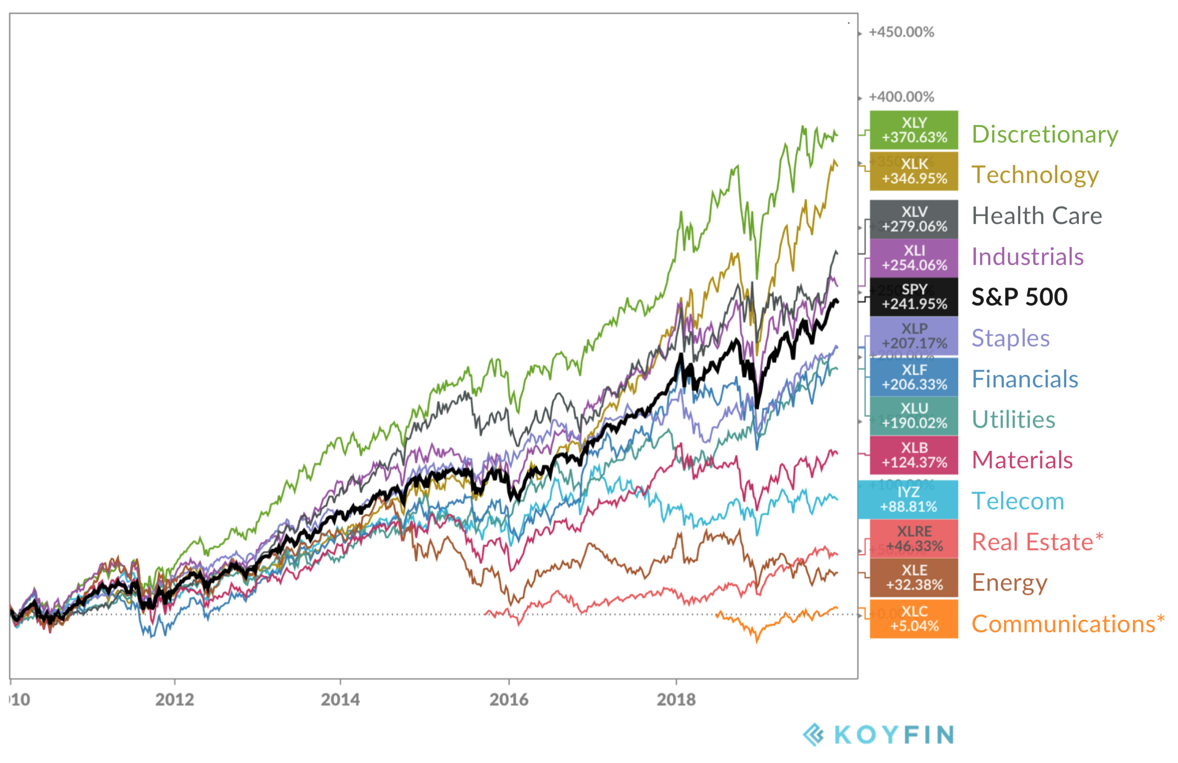

Energy has been the worst-performing sector over the last decade.

Source: Koyfin

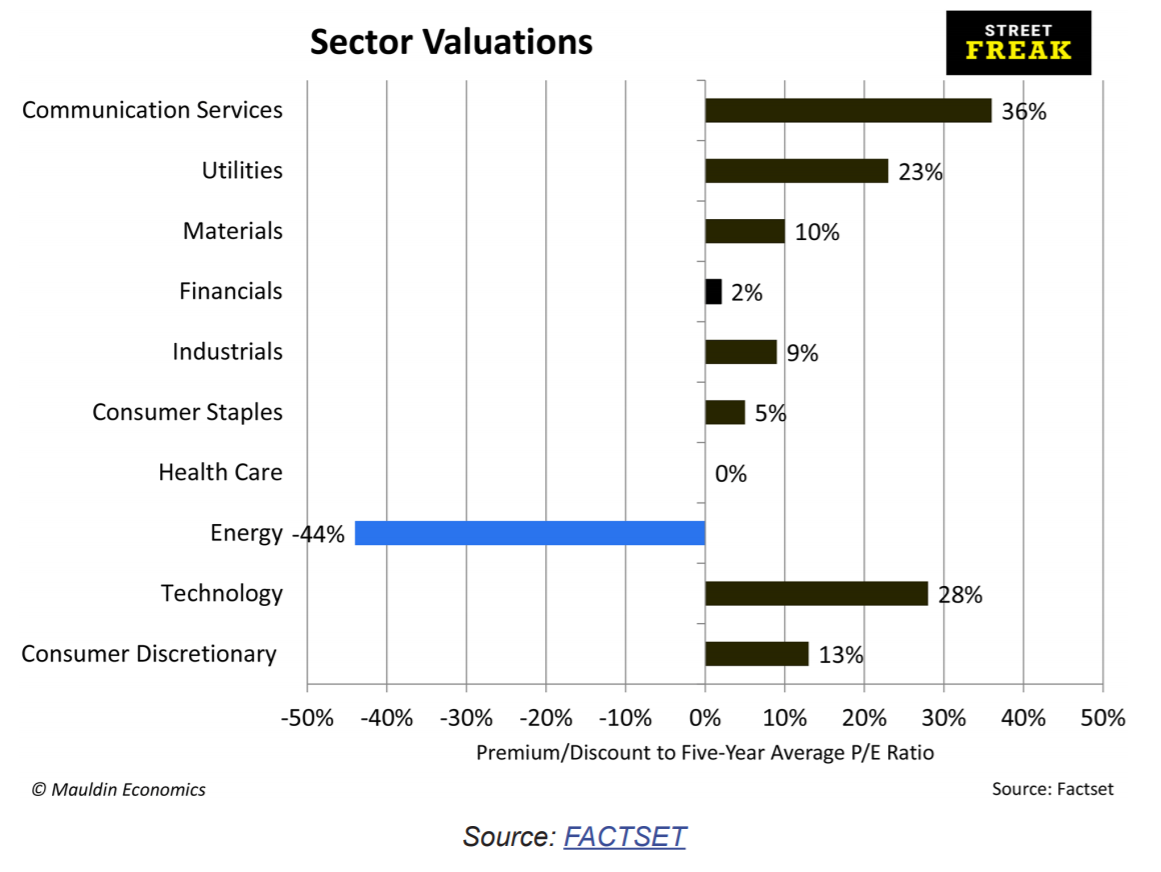

And Energy continues to be the most unloved sector by investors, as reflected in its price-to-earnings ratio that is -44% of its five-year average.

Source: Factset

What’s to like about all of this? Well, markets tend to be mean-reverting, meaning what was out of favor yesterday tends to have its day in the sun tomorrow. True investors LOVE great deals and the items on sale within this segment of the market look to be attractively priced.

So, yes, for the time being, I am content to lag my neighbor and continue to accumulate shares while they are on sale. I’ll reference one of my favorite quotes from Cullen Roche, “The stock market is the only market where things go on sale and all the customers run out of the store…”

My time horizon is not 30 days, it’s much longer than that and I want to build an investment strategy that I believe will yield the best LONG-TERM results.

Thou Shalt Not Covet

“It’s not greed that drives the world, but envy.” – Charlie Munger

In 1954 social psychologist, Leon Festinger proposed his Social Comparison Theory. Psychology Today describes the theory this way, “Social comparison theory states that individuals determine their own social and personal worth based on how they stack up against others.” We are wired to observe, compare, and react accordingly.

The original research thought this comparative exercise to be positive, a way of measuring progress and creating self-motivation for improvement. Some 65 years later, we probably have a different perspective on this. Social Media has led to this compare and contrast culture, constantly viewing one’s life versus that of their friends carefully curated lives that they present online.

Here’s the problem – this excessive barrage of data/feedback coupled with our innate desire to compare ultimately leads to discontentment. And this same truth most definitely applies to investing.

Like I mentioned in the introduction, my friend was truly disappointed with how things were going in the first month and a half of 2020. He didn’t want to slow down to analyze his portfolio or decipher what attributed to the varying outcomes; he just wanted a quick fix to improve his returns ASAP. This discontentment caused by the comparison game typically leads to bad outcomes. It encourages an investor to chase after yesterday’s darlings and hope what’s working today will also ring true tomorrow as well. Investors chase the new hot thing, they pile in one after another, until the music stops and someone is left with the hot potato – an overpriced piece of junk investment.

Perhaps you think I am overly dramatic? Let me ask you this though, what caused the dot-com crash of the early 2000s? Or the financial crisis of 2008? These were bubbles caused by excess. Investors that stopped caring about price, leaned into speculation, and just hoped that someone would pay more tomorrow than they paid today.

Buffett vs. Nasdaq

I, too, have fallen victim to “return envy.” It seems almost unavoidable. I see a stock that has jaw-dropping performance and I think to myself, “If I would’ve just put $10,000 in that stock, what would it be worth today!?” We all want to stumble across that winning lotto ticket and sail off into the sunset. After I am done daydreaming, I transport myself back to reality and remind myself that investing is a marathon not a sprint.

One humbling example of this is the short-term embarrassment or discomfort that Warren Buffet must’ve had to endure during the late ’90s. As every investor was pouring into all the hot dot-com names and enjoying the spoils associated, Mr. Buffett stuck to his tried-and-true investment strategy. Buffett was committed to buying great companies at good prices, which eliminated all the dot-com names from his shopping list.

So, what were the results in 1999 for these two approaches? Buffett’s Berkshire Hathaway was down -22.13% in 1999, while the Nasdaq Index was up a whopping 85.59%. How’s that for underperformance!? The story didn’t end there, though. Over the next three years (2000-2002) the Nasdaq would post the following results: -39.29%, -21.05%, and -31.53%. As for Mr. Buffett, I suppose he had the last laugh, posting results of 28.63%, 7.26%, and -4.04% from 2000-2002.

In Conclusion…

What’s the moral of today’s story? Sometimes your portfolio won’t post the best results in the neighborhood, and that’s ok. Have a financial plan and have an investment portfolio that supports that plan. Allocate based on sound investing principals, not performance chasing. Develop an investment philosophy that is enduring and not easily shaken and stick to it.

That’s all I have for you today. I hope you enjoyed our discussion, and I encourage you to email me at if you have any questions or comments.

This is TOM signing off… Until next week…