This past week I had the pleasure of getting lunch with a recent high school grad to discuss the wonderful world of finance. He’s a bright young man and is exploring what he wants to study in school and the career path that most interests him. He’s got a knack for numbers and thinks investing and/or advising might be a good fit.

These exploratory conversations about finance often tend to spark some really interesting dialogue, getting me to the core of why I do what I do.

With such a tumultuous time in the market on his mind, this young lad asked a simple question – Why do people invest? While the question is simple, the answer does have some interesting components to it. This week’s Thoughts On Money takes on this and more.

So off we go…

Why Ask the Question?

If you watch financial news and if you’ve tuned in to the media much over the last few weeks you are well aware of how much of an emotional roller-coaster investing can be. The anxiety, the anguish, the disappointment, the fear, etc. You can see why one would ask the question of why because in times like these, investing can be emotionally exhausting. Well, what makes it so hard to tolerate?

A common example of something that we all agree is universally exhausting – Running. Do you have any friends that are runners? I’m referring to those people that just love to run, the ones that live for that “runner’s high.” These people run marathons, they run ultramarathons, and they actually enjoy it! But all of these runners will attest that the only reason they do it is that they BELIEVE that the discomfort they might experience during the feat pales in comparison to the payoff in the end – achieving a worthy goal.

The same goes for investors…but in a different way. Read on.

Income Now or Income Later

If you haven’t had a chance to listen to The Bahnsen Group Investment Committee weekly podcast, I would encourage you to do so. In this week’s podcast David Bahnsen provides a real concrete answer for why people invest:

“There are only two things that we believe people are investing for, that is income now or income later. That’s it.”

I will amplify this a bit further by saying that people invest because they want to buy something in the future (today or tomorrow). Again, I know this sounds oversimplified, but stick with me.

When you invest, you have a goal in mind – retirement, college funding, new home, etc. Either you can’t afford to make that particular purchase today or you want to make sure you are still able to afford it in the future as prices increase.

Can’t Yet Afford It

For some goals, you just don’t have enough money today to make the purchase yet and you’d like to be able to make it sooner than later. Investing can allow you to shorten the affordability time horizon based on compounding interest. This is where we derive this common personal finance adage of “Make your money work for you.”

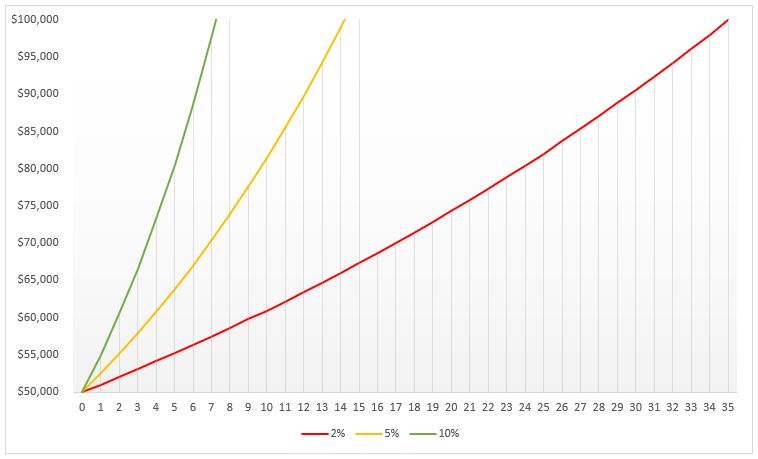

In the theme of keeping it simple, let’s suppose you want to purchase something that costs $100,000 and today you only have $50,000. How long will you have to wait to buy what you want?

The graph above represents $50,000 growing at three different rates of return: 2%, 5%, and 10%. As you can see, the length of time to grow to $100,000 shrinks as the rate of return increases. A 2% rate of return took approximately 36 years to double in value, while the 10% rate of return took less than 8 years.

So, why do people invest? To spend more tomorrow than they can spend today.

Buying Power

Another fact of life is that most things we are interested in purchasing get a bit more expensive each year. The financial term for this is inflation. Over the last 40 years, prices (according to the Consumer Price Index) have increased by about 3% per year.

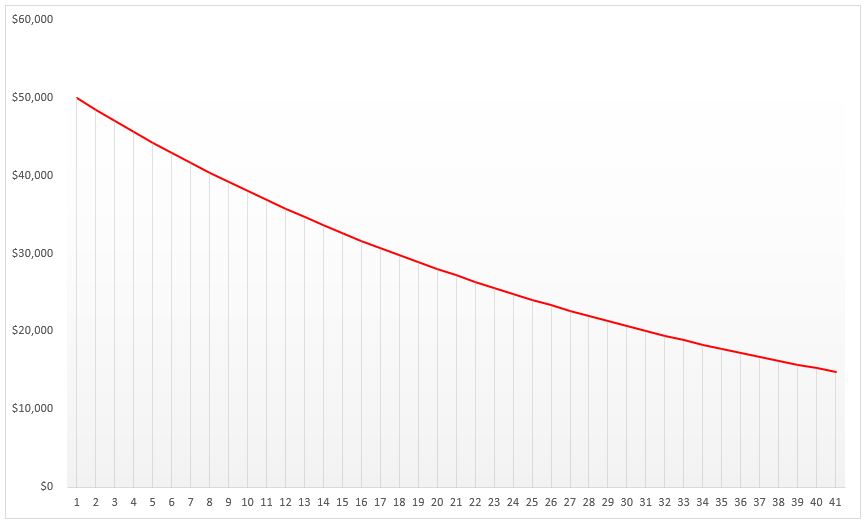

Going with our above example, let’s assume that I took my $50,000 and decided not to invest it, but instead buried it in the backyard. 40 years later, I decided to dig it up and spend it.

That 3% inflation we mentioned, eroded my buying power over those 40 years, which means that my $50,000 could now only afford about $15,000 worth of stuff.

So, again, why do people invest? To retain buying power.

The Volatility Spectrum

Ok, the answer to our question is starting to become clearer, as we now understand that the desire to invest is based on the objective of growing our money and retaining our buying power. These are the outcomes though and say nothing about the discomfort we must endure to achieve them.

The compounding rates of return example I provided above compares three different return examples, at varying rates. Each of these examples was illustrated as a fixed rate of return. Obviously, if investing was that easy – just choose from these fixed return options – then we wouldn’t need to endure much of anything. Quite the contrary though, investors do need to cope with the reality that typically higher expected returns are accompanied by higher expected volatility.

These last few weeks have definitely tested our tolerance as investors and for some of us, it may have caused us to question our approach. But the prudent investor, who sticks to the concept of allowing their investments to help them achieve their buying goals sooner, does require a steady, consistent pace. I don’t know of anyone who ever ran a marathon by sprinting for a mile and walking for a mile.

Yet human beings are emotional creatures and if I could rephrase the question, I might ask it this way, “How can I stay invested?”

Here are two more areas in which an investor needs to recognize is part of their human nature and should be avoided.

1. The Illusion of Safety

In times of calamity, one common response is to throw in the towel. When it comes to investing people will say things like, “sell it all and go to cash.” This hide-it-under-the-mattress or bury-it-in-the-backyard approach has the illusion of safety. It creates a short-term solution for your frustration with the volatility of your investments, but it presents a more glaring long-term risk.

The problem is two-fold. First, your financial plan depends on you generating a rate of return to minimally retain your buying power and second, you are faced with the impossible task of when to “get back in the market.” Believe me, the consequences of an extreme decision like this often outweigh the temporary relief they create.

2. Framing Matters

Again, as humans, it is natural for us to be short-sited. We are hardwired with this fight-or-flight mentality and we must challenge our natural instincts daily.

I want to encourage you to try to view your investments in context the goals you have over time, often referred to as the time horizon. For example, if you were cooking a recipe that required you to bake for 2 hours. Would it be prudent to judge the success of the dish by tasting it after just 20 minutes of cooking? I think not.

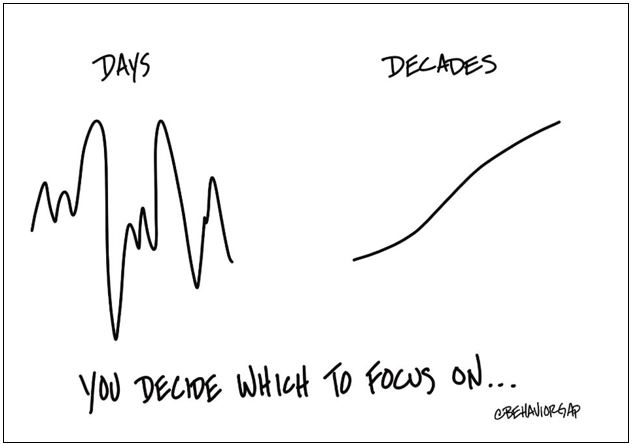

We will wrap up today’s piece with this illustration by Carl Richards that I believe beautifully illustrates this “don’t miss the forest for the trees” investment truth:

Source: http://www.behaviorgap.com

Again, we invest for a reason – to grow our money and to retain our purchasing power. It is the job of you and your advisor to craft the appropriate financial plan and portfolio to help you finish the race. I hope you enjoyed our discussion today and please feel free to email me at with questions or comments.

Until next week…