Dear Valued Clients and Friends,

I really do like the SOP for Dividend Cafe (that’s “standard operating procedure” for those of you who have time to say full words instead of acronyms that always require explanation anyways, hence adding triple the time to what could have just been said in long form to begin with). What I mean here is that I have for several years now selected a singular topic for each week’s Dividend Cafe and written a 2,000-3,000 word piece on that topic. There have been a few exceptions where we did a wide array of “Q&A” as our focus, and we will continue doing that once a quarter or so when we get an excessive build-up of “Ask Davids” that the DC Today cannot bear. But for the most part, the Dividend Cafe is, I think, better as a deeper dive week by week into a given topic on my mind and heart. I keep it investment and economy focused, of course, because if I went anywhere my mind and heart went, I would end up doing some Dividend Cafes about my favorite steakhouses in New York City, what is wrong with today’s Republican Party, or what in the world my daughter’s vernacular in our family group text chat means. But Dividend Cafe will stay in its lane, I promise. Focus, David, focus.

This week I am doing something a little old school – which was really the norm (“SOP”) for many, many years. From the time I started writing this weekly market commentary as a Friday email blast back in September 2008 until just a few years ago, it was always done as a sort of “go anywhere” potpourri of market or economic commentary. I write it throughout the week ad hoc as various things came up that inspired me, and the result was a not very cohesive, multi-topic, somewhat unfocused kaleidoscope of content. In other words, a buffet, not a meal. It would be nice if I could make it through one paragraph without a food analogy.

Anyways, today I am doing the buffet thing, but I didn’t write it throughout the week – I wrote it all at once. I simply had three “mini” topics I wanted to address instead of one “mega” topic. I hope it is cohesive and interesting, but if you hate it, at least you know next week, we will go back to the single-topic norm of the Dividend Cafe – our SOP.

***********

Before I go too much deeper, we did get some reports of some with GMAIL email addresses having issues with last week’s Dividend Cafe delivery. The link has been re-provided here to double up on making sure you received it.

************

And with all that said, let’s jump into the Dividend Cafe …

|

Subscribe on |

A historical non-precedent

A pretty basic rule of thumb is that a rising “discount rate” (the risk-free rate against which risk assets are priced) brings valuations down, and a declining “discount rate” boosts the valuation of risk assets. A past Dividend Cafe was devoted to unpacking this basic concept of how an equity value works. It stands to reason that one of the challenges equities faced in 2022 was re-pricing – that is, valuations came down as interest rates went up. Easy enough, and vanilla math. The expectation may be that valuations now go higher when interest rates drop. Indeed, as it pertains to the long bond, as yields have dropped these last six weeks, equities have gone higher. I’ve talked about this ad nauseam. But as the fed funds rate begins to come down in 2024, does it stand to reason that P/E ratios – valuations – will go higher, still, for equities?

Here is the problem. In theory, yes. In practice, I am not so sure. Historically, valuations that are 17-20x might come down to 12-15x in a “re-pricing” from higher rates. And then when rates drop, valuations might reverse to the upside, back to something at 16x or higher, let’s say.

But what do you do when valuations were 22x, came down to 19x, and now are still 19-21x (depending on specifics)? Historically, these laws of mathematics would have caused valuations to dip lower when rates went this much higher. Since there has not been much correction around valuation, why would there be much restoration to valuation? It doesn’t add up.

That said, it doesn’t mean it won’t happen. My friends at Gavekal Research believe the operative variable will be oil prices. If oil prices decline, it will put upward pressure on valuations and vice versa. I am not sure I agree. I mean, I am sure I agree, to the extent that higher oil prices as an input price compress profit margins, and higher oil prices as a sign of geopolitical risk compress valuations because of, well, geopolitical risk. So they are exactly right there. But what if lower oil prices are caused by mass erosion of demand in a rapidly declining economy? Is that a boost to equity valuation? Almost certainly not. So oil prices, like bond yields, are not an automatic “this” or “that” for equity valuations – the reason behind their particular move matters.

In a reasonable world of analysis, moderating or declining oil prices combined with a declining risk-free rate ought to boost equity valuations. But in a reasonable world, the starting point of that is 12-15x earnings, not 19-21x …

Private Credit Apocalypse w/ Government Genius to follow?

The history of financial meltdowns has generally been something like this: A thing happens. It does well. It makes more people want it. It does better. Other people start borrowing money to buy more of the thing, which means that other people start lending to help facilitate people borrowing to do more of the thing. It does even better. And then it stops doing well, and borrowers, lenders, and people in the thing all get their faces ripped off. And then, the government comes in with some ideas to keep it from happening again which generally makes sure we get less of the good things.

Sounds about right?

Well, right now, private credit has been doing pretty well. Like, really well. We should know – we have been heavily invested in it for many years before it was “a thing.” A lot of money gets to borrowers right now outside of commercial banking channels. Whether it is middle markets, direct lending, or big cap private borrowings, “private credit” is a big universe that does not use depositor money and does not use taxpayer money. And yet, people are banging their heads against the wall about what could go wrong. And they are right; things can go wrong.

One of them is that investors who took a risk for a premium return could lose money. Can you imagine the horror and cosmic injustice of someone trying to get a 10% return and instead incurring some loss? Next, they’re going to tell us that stocks can go down, too. But of course, I see this as a feature, not a bug, because, you know, investments can’t make a premium if they don’t have a risk (look it up).

But too much risk can become systemic, even when it is just investors losing money. So the question is, what preemptive actions are needed to keep the world turning into a world where people borrow money, and sometimes don’t pay it back?

Well, one idea is to have more of it be lent from pools of capital that were funded by risk-takers who can afford to lose money and less of it be lent from widows and Grandmas who deposited their money at their bank hoping to get some out on Christmas Eve in a Jimmy Stewart movie. You get the idea, Private Credit is a solution to a problem, not a problem needing a solution. What if the money going into private credit becomes excessive (maybe they already are?)? What if the investors funding the pools of capital say that they know they can lose money but don’t really know they can lose money? (Do not forget Bahnsen Law 83, which, like the other 82, was stolen from someone else – “investors do not want safety; they want the illusion of safety). What if the high amount of capital funding private credit leads to a lower quality of credit being extended just to keep the game going?

I am going to go out on a limb and say all of this is possible, even probably, and none of it is a bad thing whatsoever. And it most certainly is not “systemic.”

Private debt funds do not involve taxpayer money, and they do not involve depositor funds who are unaware of the risk they are taking. They involve risk-takers who can absorb losses and who swore they were accredited investors under the penalty of law. The vast majority of the investors are very sophisticated institutional investors. The space is already very regulated (SEC, insurance, states, etc.). And the funding ratio is even debt to equity (now compare that to fractional reserve banking, thank you very much).

Middle-market companies cannot access the bond market, and banks are hiding behind fake mustaches and sunglasses before it comes to actually doing a loan. Private credit meets a need in capital markets, and it does it with an alignment of risk and reward. If one day, there are losses that make people sad, and someone screams for a bailout of some sort, I am going to lose my mind. There is no systemic risk, only the risk of a profit-seeker taking a loss. The risk of loss is mitigated by the risk-taker through diversification, manager selection, quality underwriting, and professional management. The risk of loss to our economy is enhanced by those screaming for more regulation, limitation, and other forms of insanity with no track record of success.

Piling on the Indexes

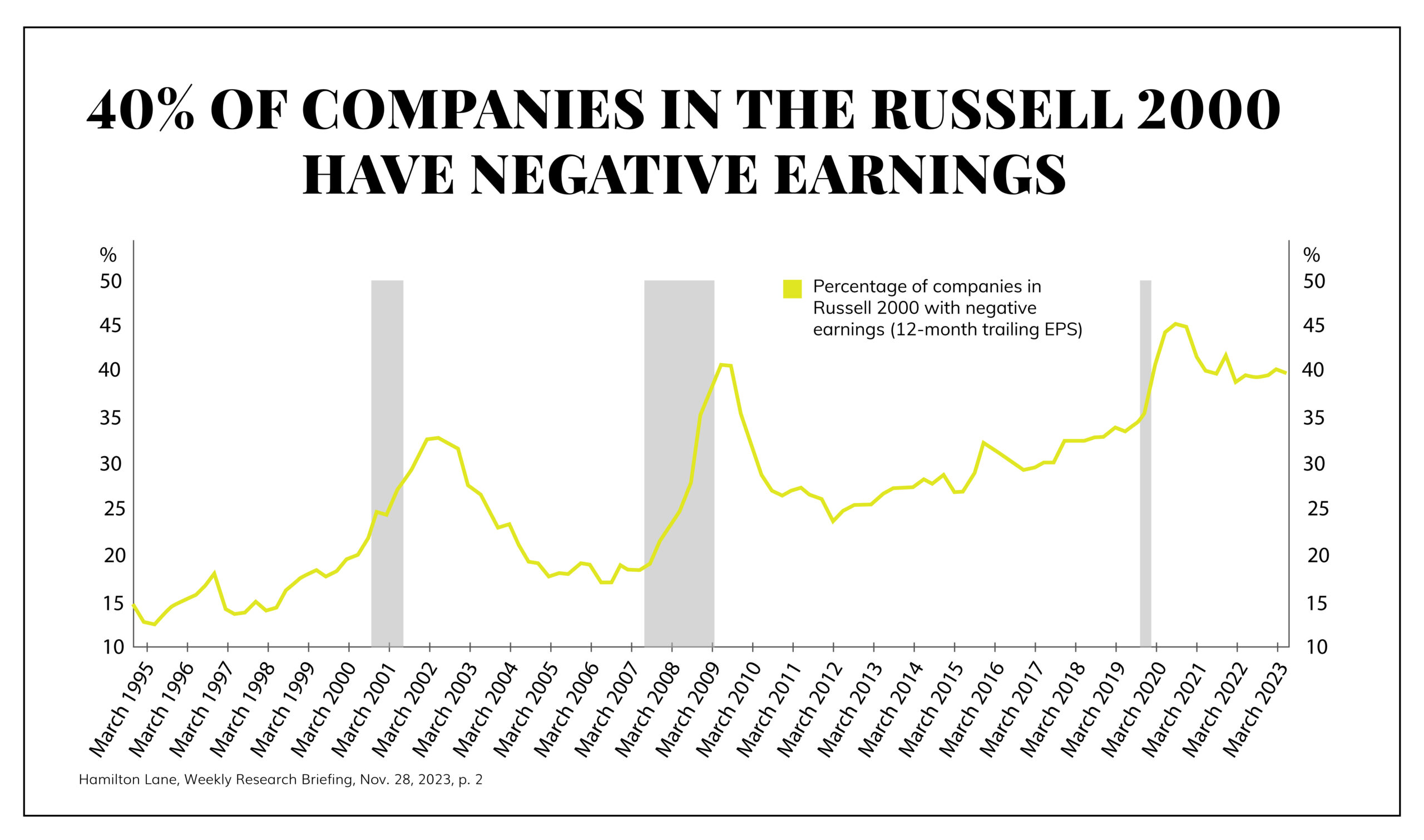

This paper out of Hamilton Lane is a really important piece of information for those wanting to understand our aversion to index investing. I believe that an S&P 500 trading at 20x earnings is expensive (see above). But what is it really trading at, across all five hundred companies? Something closer to 25x if the Russell 1000 is any indication, as “unprofitable companies” are removed from the P/E calculation. But isn’t an aggregate index supposed to aggregate profits? And doesn’t an aggregation of profits include the profits and losses, in aggregate? Food for thought, and an extraordinary read.

Chart of the Week

Nearly half of the companies in the largest small cap index on earth do not have any profits. Nearly half. Active management in small cap, perhaps?

Quote of the Week

“It’s waiting that helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred gratification gene, you’ve got to work very hard to overcome that.”

~ Charlie Munger

* * *

Have a wonderful weekend filled with Christmas shopping and all the things. It’s the most wonderful time of the year.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet