Dear Valued Clients and Friends,

As of press time, the market has moved significantly higher on the week, bouncing in a meaningful way Tuesday, Wednesday, and Thursday this week (after further sell-off Monday). As I type Friday morning, the market is down 650 points, off its lows (but still middle of the day). We all know that we don’t know what the rest of the day (or weekend) will bring.

This very special Dividend Cafe (long, but I think we all have extra reading time this weekend) attempts to combine a lot of investment application, macroeconomic commentary, and basic financial wisdom, into one trip to the Dividend Cafe. Jump on in.

General market synopsis

The market decline of last week spilled into this week, as Congress did not complete the stimulus bill over last weekend and a final bout of selling pressure was felt on Monday. Technical action Tuesday through Thursday leads me to believe a big bout of ill-timed short-selling came on Monday as well. So we dropped 600 points Monday, to close at what has thus far been the low closing level of 18,591 in the Dow (essentially, what the Dow was on election day, 2016).

On Tuesday the market rallied over 2,100 points as the stimulus bill prospects became more clear, as “extreme” selling pressure had largely worked its way through the system, and as more opportunistic long-term players sought to take advantage of generational sales. Short-covering ensued en masse. On Wednesday the market was up another 1,100 points with fifteen minutes to go in the trading session, but closed up just ~500 as Bernie Sanders threatened to upend the stimulus bill. Those plans fell through Wednesday night and the Senate passed the bill (96-0), and on Thursday the market advanced 1,300 points.

And as I type Friday, the market is four hours into its trading session and is down 600 points, having been down by nearly a thousand earlier. The House has now approved the stimulus bill, and it is headed to the President’s desk for signature.

The heavy volatility continues. Yes, there were big, big up days this week, and I would be lying if I did not say I far prefer those days to the nightmarish ones of the weeks prior. But I do not take this week’s market action to mean we are out of the woods yet.

So summarizing?

(1) The heavily dislocated, “forced-selling” market (system wide de-leveraging) has largely subsided, praise God. This is because most of the selling simply got done, and because the Fed’s interventions in credit markets have already worked their way through the system.

(2) Long-term, markets are significantly beneath prices that reflect the value and earnings potential of incredibly profitable and defensible and well-run companies, especially those who pay attractive, growing dividends.

(3) Short-term, we do not yet know when the country, or parts of the country, will re-open for business. That makes measuring the Q2 economic contraction and the trajectory of hopeful Q3 recovery impossible. Therefore, continued volatility is not just likely but virtually assured. Could this mean a re-testing of the market lows? No one has any idea (see my answer to this question in the video below). Simply put, three months from now is a better barometer than three days from now; and most investors (okay, all investors) ought to be looking out far more than just three months, too.

Stimulus bill redux

In the middle of the night Wednesday (going on Thursday) the Senate approved the bill HR748 (which I am sad to say I have now read all 883 pages of). The House has now voted as well (right at press time). Here are the final and noteworthy components I think you should know about:

- At ~$2 trillion, this equates to about 9.5% of total GDP. Almost all of this is being spent in 2020.

- My estimate is that economic output will be contracting by $700 billion from the coronavirus pandemic, so this bill will represent 2-3x the amount of that economic contraction (though those numbers are certainly fallible)

- $500 billion to large corporations (via bridge loans in concert with the Federal Reserve)

- Does include a ban on companies who tap these facilities from buying back stock until a year after the loan is paid back

- Has compensation restrictions for executives of companies who use these facilities

- The restrictions put on companies who tap these facilities are actually less than I had anticipated they would be

- $350 billion to small businesses (via debt forgiveness packages – loans that will not have to be paid back under certain conditions primarily related to funds being used to preserve payrolls)

- Includes a tax credit for retaining employees, worth up to 50% of wages paid during the crisis, for businesses forced to suspend operations or that have seen gross receipts fall by 50% from the previous year.

- $500 billion in direct payments to taxpayers ($1,200 to individual adults, $2,400 to married couples, plus $500 per child). Phases down above income of $75k single/150k couple …

- Unemployment insurance has been extended by thirteen weeks, and will allow workers to maintain full salary if forced out of work due to the pandemic (adds $600/week from feds, on top of state benefits)

- $117 billion direct to hospitals and veteran’s health care

- Provides a $16 billion fund for stockpiling future pharmaceutical and supplies needs

- $25 billion in grants to airlines for wages and benefits of employees, and another $25 billion for loans and loan guarantees to airlines

- Delays payroll tax for employers whereby due taxes can be deferred into 2021 and 2022

- Suspends student loan payments through September 30

- Corporations will now have a five-year Net Operating Loss carryback and can deduct interest expense up to 50% of EBITDA

- NOTE: They struck the language in the final bill that would have provided for $3 billion of oil purchases for the Strategic Petroleum Reserve.

I want readers of Dividend Cafe to understand something: The REAL muscle of this bill is the part no one is talking about. The Treasury Department will put $400 billion into the Exchange Stabilization Fund, but the Fed can lend 10x that amount – $4 trillion – when fully levered. A 10-for-1 multiplier on that capital. This is not being discussed because most do not understand it. I want you to understand it. The Treasury is writing a check for $400 billion that means $4 trillion in corporate lending!!!!!!!!!!

Ghastly unemployment

The weekly unemployment claims came in at 3.28 million yesterday. Why did the market go up 1,350 points after such a development? Because it was well known that the number was going to be, ummmm, really, really bad. There were some claiming 1.5 or 2 million were expected. I personally heard countless economists and analysts on the street projecting 5 million or even 7 million … So the really bad number was baked in, and at some point, really bad is just really bad. It certainly was not, substantively, worse than was projected.

And how do we know everyone knew unemployment was going to jump higher? I sort of thought that was the reason they were passing a $2 trillion stimulus/support bill??? The fact of the matter is that the number this week was expectedly terrible, and we will see more expectedly terrible unemployment numbers for weeks to come. But I do think the 3.3 million claims this week is the high mark, and we will see “slightly less bad” awful numbers from here, until we get to full blown improvement (in due time)

Some monetary policy realities I just have to talk about

Really important to understand through the bazooka of activity coming from the Federal Reserve, is the unprecedented level of coordination between the Treasury Department and the Fed (I mean, explicit coordination). My people tell me this has not been seen since the 1950’s. The role of the Fed as a “lender of last resort” seemingly gets missed on occasion, but in this case, the emergency measures taken required much coordination with Treasury.

I am still not clear where certain Fed actions are under Section 13.3 (they’re emergency provisions) or under the Exchange Stabilization Fund of the Treasury. Either way, aggressive execution of the belief that lender of last resort means “lender of last resort” (and with it, “by any means necessary”) have been on display.

But understand this – for good and for bad – the Fed’s balance sheet is headed to north of $7 trillion. That will not mean “actively intervening in the market.” That will make them the market. The Fed’s significance to capital markets is going to places no one ever thought possible, and the ramifications are not fully understood or appreciated at this time.

A History Lesson

Two things happened the first week of March in 2009.

One – the suspension of the mark-to-market rules in FASB 157 that were suffocating banks and the flow of capital, and keeping the entire country on a perpetual margin call out of fidelity to an accounting system that was just as fantasy-land (to the negative) as allowing companies to make up their own pollyanna upside numbers would have been.

Two – the Fed’s approval of the Term Asset Backed Securities Loan Facility.

Both of these things happened the first week of March. The generational bottom took place on March 6, 2009.

Both a new “COVID-TALF” facility and ample relief of mark-to-market accounting regulations are part of this week’s policy response. Economically, this is not just about “stimulus.” This is about allowing a maximum Return on Invested Capital relative to the Cost of Capital. These are policy tools that are not necessarily going to boost equity markets today or tomorrow or next week.

But over the weeks, months, or at least quarters to come, I find the likelihood of these endeavors boosting equity returns very likely.

Will the Fed lose money?

I like the way one of my favorite analysts put it this week (h/t Corbu) – the Fed is not buying bad assets – they are “harvesting the illiquidity premium.” Meaning, private markets can’t bear the illiquidity right now (which ultimately pays its owners); the Fed can – so the Fed will bear that cost, and then receive its rewards. Ask Maiden Lane (Bear Stearns mortgage assets circa 2008). My own projection is not just that the Fed will not lose money, but will make a fortune – a bloody fortune.

Significant but under-reported financial story of the week

Most under-reported story of significance in financial markets: The SEC giving reprieve to mutual fund companies on redemptions (allowing them to tap their parent companies for funding of customer redemptions for next three months rather than continue the forced selling that, for example, $40 BILLION OF TAXABLE BOND REDEMPTIONS LAST WEEK ALONE, put into the system. Can you even fathom how distortive to markets daily liquidity allowance is with $40 billion of forced sales of money-good assets? Extra flexibility to fund sponsors in how they meet redemption requests is a very positive step.

Mortgage Reality – Part I

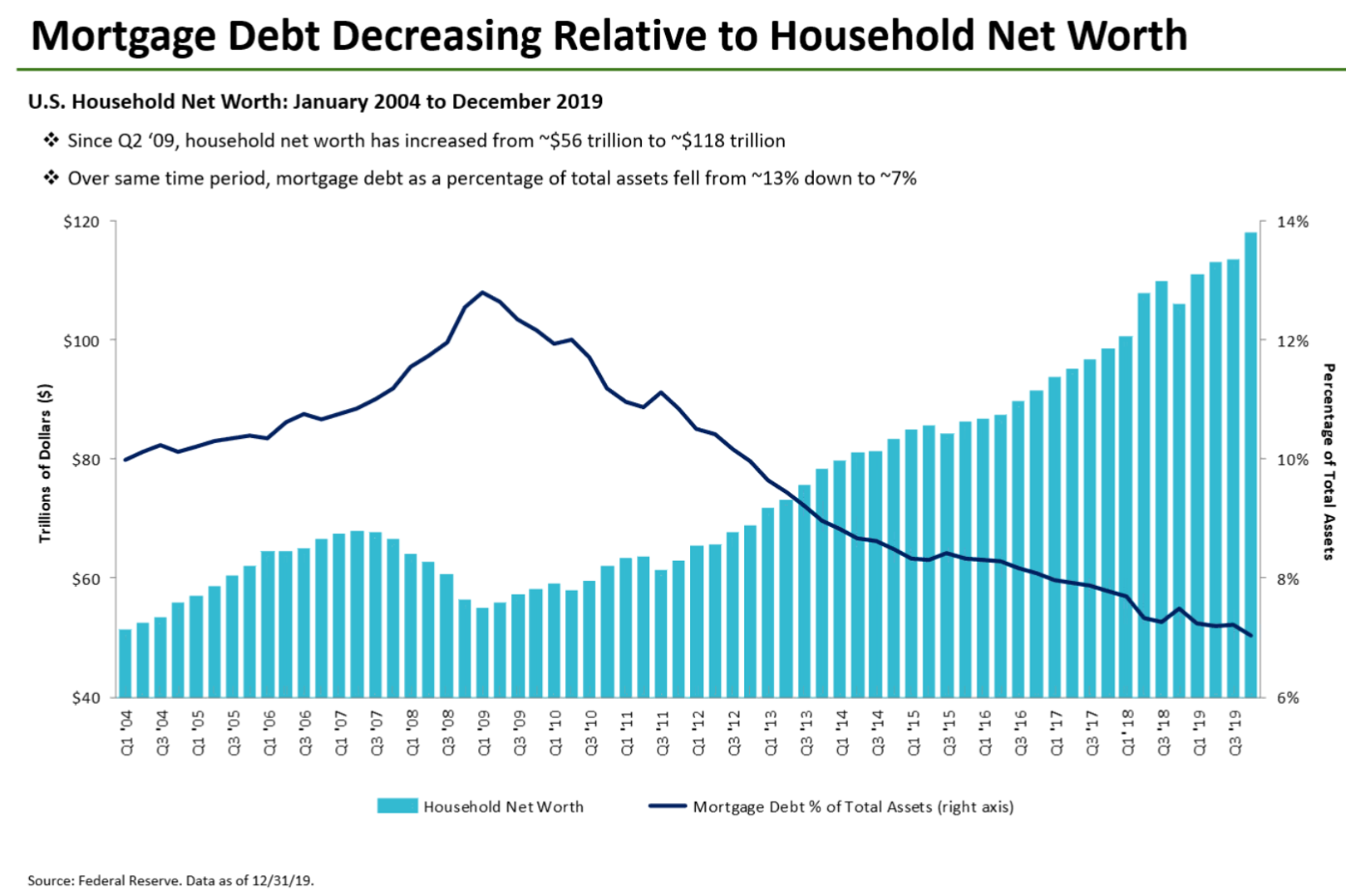

The “net worth” of American households has declined as financial markets have been slammed in March, but it is useful to see the data as this pandemic began, to understand why a 2008 repeat in housing is not in the cards. Essentially, the starting point entering this mess was one of much greater equity, and much less debt-to-value, than we had entering 2008/9. It is always and forever protective equity that serves as the cushion to help weather storms. Always. Student loans and credit cards have the largest default rates. Why? There is no “protective equity.” The less debt relative to the value, the less likely a negative feedback loop ensues that hammers underlying values.

Mortgage Reality – Part II

One of the most common questions circulating in American economic life right now is why interest rates are at historical and extreme lows, and the Fed is buying hundreds of billions of dollars of mortgage securities, yet home borrowers are frozen out from mortgage capital (especially on the re-finance side). Without being overly technical, the reasons are very unintended consequences of the policy measures themselves. From hedging costs, to wild swings in the MBS market, to borrowers walking away from locked rates (looking for better ones), to ambiguity about how mortgage servicers will be treated with the forebearance the new stimulus bill offers, etc., the “benefits” of new interventions in the mortgage market have created a real pandemonium.

Several policy amendments are underway to clear the field, but more important than anything else – Main Street must understand that “the fed funds rate” being 0% is not the same as mortgage rates. Many other factors are impacting the supply and demand of mortgages, and the supply and demand of the money that feeds mortgages. Please reach out to us for a more technical understanding of this dynamic.

Alphabet Soup – Fed Index Card

Just for your own reference, the policy response (facility by facility) of the Federal Reserve in the last two weeks:

- FOMC (Federal Open Market Committee) has pledged unlimited QE (quantitative easing) to support transmission of monetary policy. This is essentially bond-buying – Treasuries and Mortgages – by the bank, with money that does not currently exist

- PMCCF and SMCCF – Primary and Secondary Market Corporate Credit Facilities to buy corporate bonds of 1-5 year maturities (new issue and traded market)

- TALF – Term Asset Backed Securities Loan Facility – supporting the issuance of securities backed by SBA loans, auto loans, student loans, and consumer credit

- MMLF – Money Market Liquidity Facility – allowing the Fed to buy a wider range of instruments that help feed liquidity and efficiency to money market funds

- CPFF – Commercial Paper Funding Facility – allowing the Fed to provide liquidity in the vital commercial paper market, and even use the market to buy short term municipal paper

- MSBLP – Main Street Business Lending Program – allowing the Fed to support lending to small and medium sized businesses (basically by securitizing SBA loans)

- PDCF – primary dealer credit facility

- And even though it lacks acronyms, the openness of their discount window, the creation of swap lines with international central banks to provide more dollars to foreign banks (see below), a suspension of various reserve requirements, etc.

An emerging concern

I have talked a lot, and the media has talked some, about the significant dislocations in the municipal marketplace, the corporate bond marketplace, and to a lesser degree, the Mortgage-Backed Security world (not that the dislocation was lesser – it was actually far worse – just that I have talked about it a bit less than I have the broader world of municipal finance). I have only anecdotally mentioned the same levels of dysfunction in emerging markets debt, even though it has ravaged some of the best-run alternative strategies on the planet.

The EM debt world has rallied over 11% on the week, still ~15% disconnected from pre-covid levels, as the Fed announced dollar swap lines with key EM central banks (Brazil, Mexico, South Korea, Singapore). Why does this matter to U.S. investors? Dollar-denominated debt rolling over in a period of dollar shortages brings unbelievable pain (and distortions). Even with these swap lines, dollar liquidity is tight in EM, and where countries are highly correlated to China, export activity, and commodities, pressure will be on for greater fiscal or monetary stimulus (EM generally has much lower debt ratios than developed markets – DM). Why is this a problem? Because unlike in most DM, especially the U.S., “stimulus” in EM has a taboo, and generally shakes the tree of “capital flight.” And the consensus weapon against “capital flight” is “capital controls” – which is never good for investment.

The new leader is?

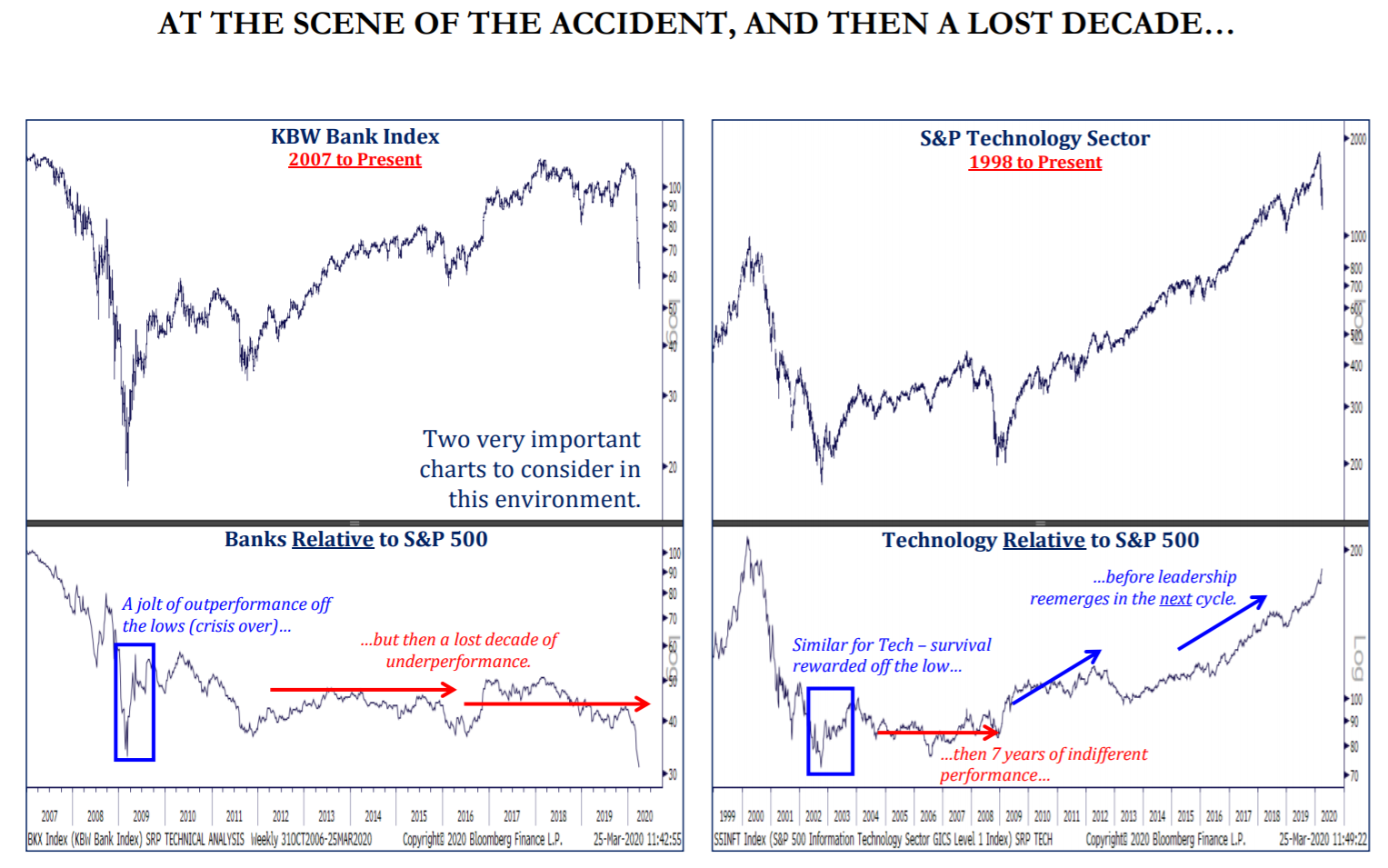

After the market crash of 2000, Technology did not come back as a leadership sector for years and years and years (really until FANG in 2013).

After the financial crisis of 2008, the financial sector was nowhere near the leadership group in the massive bull market of 2009-2019.

In other words, each market “reset” then followed by a recovery generally sees a new sector take the mantle for market leadership, replacing what had led the market before.

* Strategas Research, Technical Research Strategy Report, March 26, 2020

What do we think will lead into the future? More to come.

A lesson for municipal bond buyers

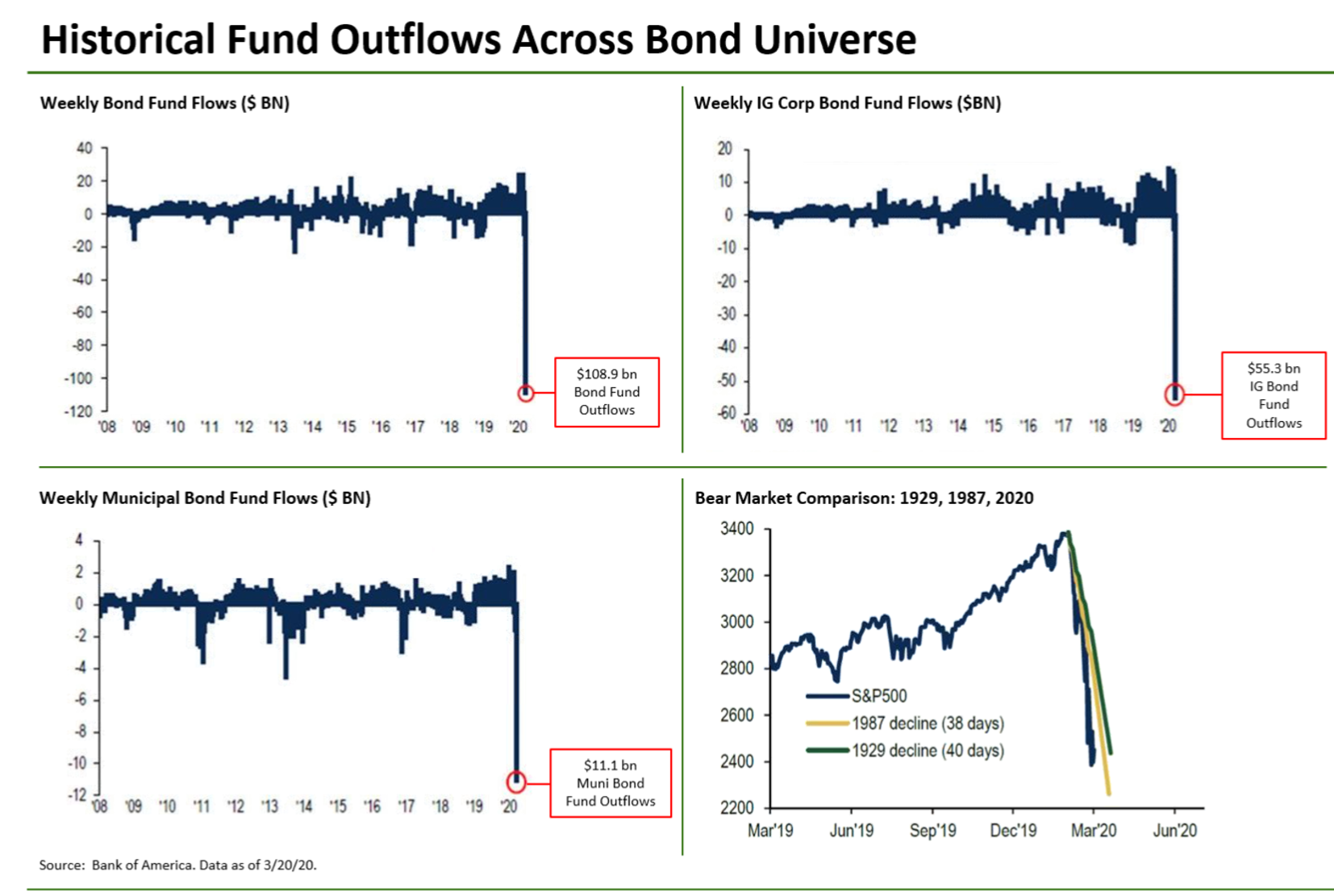

Heavy flows into retail mutual funds are the best predictor of future turmoil in the muni bond space. The market becomes dependent on those inflows, and prices are driven higher by the heavy money entering the space (forced buyers). But then, heavy “fast money” in municipal bond funds mean a one-second button to hit for a brutally inefficient exit, punishing all other holders of the asset class.

Last week there was $2.15 billion of redemptions on Monday, $2.19 billion on Tuesday, $1.72 billion on Wednesday, $2.57 billion on Thursday, and $1.34 billion on Friday – just from mutual funds. These insufferable periods have repeated themselves multiple times (financial crisis, Meredith Whitney, taper tantrum, and rate fears post-2016 election) – the value of the bonds drops a bit, which forces people who have no business owning municipal bonds to sell their funds, which forces values down a lot more. Rinse and repeat.

Do these dislocations matter? Well, yes, in the moment. They disrupt the fundamental benefit of asset allocation which is to see zigs and zags, not universal correlation. But they also present inefficiencies that are buy-able. So there is a half-full and half-empty glass here, and the direction we take this depends on individual client liquidity needs. None of this is easy, but all of it is manageable.

A question for long-term equity investors

Take all of the bearish data points, many of which I agree with. Assume recession, economic contraction, compressed P/E on the S&P, and a one or two quarter period of declining S&P 500 earnings.

But then ask yourself this question – for I think it is profound going into Q3, Q4, and certainly early 2021 – will a P/E ratio (market multiple) below 15 on the S&P 500 make sense with a zero-bound fed funds rate, the Fed doing Yield Curve Control across Treasuries, and $7-10 trillion on their balance sheet? Can the multiple go and stay that low?

Multiples below 15 make sense during recessions. But multiples below 15 with that kind of monetary offset? This will be a fascinating development in the year ahead.

A reminder for long-term equity investors

Odds of a positive return in U.S. stocks the last one hundred years:

1-day: 54%

1-quarter: 68%

1-year: 74%

10-years: 94%

20-years: 100%

Don’t like this relative

From the beginning of this market torture to the lows at Monday’s close, emerging markets were down 5% less than the S&P 500 (-27% vs. -32%). I ask you: How many could possibly feel “good” about that “relative out-performance”? It is, of course, the case, that down is down, and down a lot is down a lot, no matter how much worse on the margin one asset class did than another. But in reverse, why is it different? Why is it bad to be in emerging markets when the S&P is up 22% and Emerging Markets are up 19%? This reveals one of the most unfortunate things about human nature in investing: People are inclined to be “relative performance” investors when things are good; and “absolute performance” investors when things are bad. It doesn’t work in real life. Planning-driven investing does.

In all thy getting, get this:

Markets can go up like this week and down like last week, but ultimately, with the hopeful removal of technical factors and forced selling from polluting market activity, we still have to deal with this basic fact of life right now …

There is no way to gauge the short-term direction of markets right now when there is still so much uncertainty on the health aspect and the societal response expectations. There is upside-tail-risk that some therapeutic treatment of wild success enters the stage (or is already on the stage and not yet universally approved). There is obviously downside tail-tail-risk around the inability to bend the curve of diagnoses and deaths relative to recoveries. The shape of the inevitable economy recovery:

V-shape – best case

U-shape – medium case

L-shape – worst case

is unknown, and will be for weeks or months. AND YET, what is known is this – a fiscal and monetary backdrop stands ready to reward owners of legacy risk assets, and America has a history of overcoming adversity, with a vengeance.

Patience. Discipline. Hope.

Chart of the Week

This is almost too striking to not have as the Chart of the Week. How dislocated have bond markets been the past two weeks as equities sold off and an international margin call ensued?

Quote of the Week

As Mark Twain and fellow novelist William Dean Howells stepped outside together one morning, a downpour began and Howells asked, “Do you think it will stop?”

Twain replied, “It always has.”

* * *

A lot has happened since the financial crisis. For one thing, we got out of the financial crisis. It didn’t feel like that was going to happen when we were going through it. The ~six months that lasted from September 2008 through early March 2009 were simply unfathomable in my life and career (I offered much reflection on all this last year).

A close family friend sent me and Joleen this picture a few days ago, and that is my baby girl, Sadie, on my shoulder. During the lowest level of the financial crisis she was 18 months old, and that is exactly when this photo was taken. She is now a few months away from turning 13 years old.

When I look at this picture, I am brought back to an era of fear, anxiety, and uncertainty – even as I held my precious baby girl in my arms. And yet, when I look at Sadie now, and reflect on all that has happened post-crisis, I am emboldened by the miracle of human life, the aspiration of the human spirit, and most of all, the hope that is embedded in the truest words about all human affliction:

This too shall pass.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet