Dear Valued Clients and Friends,

Last weekend’s news was not a Lehman bankruptcy, a Silicon Valley depositor backstop, or a Credit Suisse acquisition. It was not even driven by U.S. forces, let alone the usual cast of characters in the Fed, Treasury, or FDIC. Rather, it was OPEC+ making an announcement of production cuts in oil. It didn’t crash markets – in fact, it caused a big rally in the energy sector. But it is a big deal, and it warrants its own special Dividend Cafe.

I would never dare spend a Dividend Cafe pontificating on where the price of oil is going. I do not know, and neither does anyone who trades or tracks oil for a living. Commodity prices are inherently unknowable, and oil is at the top of that list. Getting premises right is no surefire way to the right conclusion, and that applies to oil prices in spades.

But what I will spend this Dividend Cafe doing is pleading with you to see the non-oil ramifications of this oil move. And by “this oil move,” I really mean a lot more than “this” oil move – I mean an entire set of events and conditions that, taken together, represent a significant change in global geopolitics and, with that, investment implications.

So let’s jump into the Dividend Cafe and digest all that is happening.

|

Subscribe on |

First, what happened

The basic facts of OPEC+’s announcement last weekend are not that complex but should be re-stated for those who were too focused on last Sunday’s women’s college basketball game to have noticed. OPEC+ consists of the official OPEC members of the Middle East and North Africa combined with Russia, Mexico, and a handful of other non-OPEC members who are part of a “Declaration of Cooperation” agreement intended to expand the control OPEC and other exporters have over world oil markets (surprise, none of these non-OPEC oil-exporting countries are called the United States of America).

The OPEC+ cartel announced a commitment to cut a little over one million barrels per day of production beginning May 1 and maintaining that cut from production quotas for the rest of the calendar year.

The price level

My introductory caveat notwithstanding, I do reckon this puts a $70-75 floor in oil prices, though any number of other factors could change that. A better way to say it is that OPEC+ would like to have that floor in place, and I see no reason to think they can’t or won’t get what they want.

The immediate move was to go from $75 to $81 on WTI Crude Oil. And even that $75 was itself the result of a bounce off of $66 or so from the week before. So the market “priced in” the expectation that OPEC+ was going to reduce production, and it under-did it – OPEC+ moved more aggressively than even the frontrunners could have guessed.

But ~$80 could prove to be a floor, and a ceiling could prove to be back above $100 for a variety of reasons we will soon discuss.

The whole story looks to the White House and elsewhere

Okay, so President Biden fist-bumped Mohammed bin Salman, and some thought that Saudi and the U.S. were simpatico, and lo and behold, that didn’t stick. I am too busy to write an article just to dunk on President Biden, and the fact that Saudi is not working to coordinate its oil policies with American interests is extremely old news. So while it is true that Saudi is not playing nice in the sandbox with the U.S., I don’t see that as a big story right now, at least not limited to the news of supply levels and price aspirations.

But why would OPEC+ do this besides the general reality of enhancing profits for their own membership self-interest? Let’s first remember that reduced supply hurts business, too – if there is enough demand and margins are adequate at certain prices. In a nutshell, selling less of something at a higher price is in tension with selling more of it at a lower price when it comes to profit calculation, and those knobs turn in two ways. The decision to lower production and protect a price level (and hence a margin level) means that they do not fear being undercut by competitors.

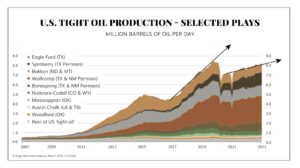

Let’s start with U.S. production. One of these trends is not like the other, and let’s just say that 2016-2019’s trendline is not what OPEC+ believes is coming back. 2021-2023 has seen extraordinary price recovery yet a completely different trendline, and that is the one OPEC+ is banking on (for good reasons).

I have been critical of President Biden’s energy policies so many times I have lost count, and I stand by everything I have ever said there. The tone, tenor, rhetoric, actual actions, and actual inactions have all been a primary reason for the decreased production relative to trendline, demand, and price opportunity.

But I am not a partisan hack. I call balls and strikes and simply do not care who hates me or likes me when I do so. I have no agenda in criticizing the Biden administration for their energy policies other than telling the truth, and because my agenda is truth-telling, it is incumbent upon me to make very clear that – wait for it – it is not all Biden’s fault! There are other factors that truth-tellers may want to mention when analyzing less-than-robust U.S. production of new oil supply.

Our shale producers are not willing to make the same mistakes they made in 2014 and again in 2019, where they ramped up production at high prices just in time for massive price cuts to wallop them where it hurts (debt, leverage, capex commitments, etc.). This is not a bad thing. This is not profiteering, as some economic dunces claim. This is P&L management. This is cost discipline. And it is a good thing for the shareholders to whom they owe fiduciary care of duty.

A cultural and political milieu that seeks to shame producers constrain capital, and limit supply all play into this, no doubt. But take away Biden, AOC, ESG, and the Sierra Club tomorrow, and you still have producers refusing to get over-levered again – I promise you.

Demand concerns?

Should OPEC+ assume global growth is about to surge in the face of central bank tightening everywhere, one looks? Should U.S. producers assume demand is surging when “recession” talk dominates the airwaves? What about those of us (myself included) who anticipated a million extra barrels per day needed from the China re-opening? That demand increase has obviously not materialized or OPEC+ would not be doing this. Perhaps it will, and perhaps it will but not yet, or perhaps it will but not to that degree – I do not know. I just know that while a demand collapse does not feel in the cards, a demand surge doesn’t either, and “playing it down the middle” seems reasonable for producers.

I will note, OPEC+ had been using 590k barrels per day as the expected increase from China re-opening, and they actually UPPED that estimate to 710k (h/t Sam Rines),

Oil prices this month and next month

A move from $75 to $80 in oil price after this weekend’s news makes sense, but really, $5 is not that much. The production cuts they announced were really much more about production quotas that already were not happening than they were about a drastically reduced supply. Now, pro forma, carrying this out through the end of the year – that is a meaningful amount of supply previously thought to be coming on the market that now will not be. But this isn’t really about prices this month or next month.

Essentially, OPEC+ knows this administration is afraid to turn the rigs on, to approve new production for the future, and that shale producers have moderated their growth aspirations out of a post-2020 commitment to fiscal responsibility. You blend that with a questionable demand environment, and this feels like a safe way to set up the 70’s as a “baseline” for oil.

But you said?

But there is a wildcard I have not yet mentioned – and that is the 180 million barrels of oil the administration has said they have to refill the strategic petroleum reserves with. Would not that change the supply/demand fulcrum substantially?

Why yes, yes, it would. And this is where OPEC+ is basically calling the Biden administration’s bluff. They. Do. Not. Believe. They. Will. Refill. It.

Will they? I don’t know. Maybe they punt to a future administration. Not beginning to refill between $65 and $72 may prove to have been a costly error. Somewhere in all this, there was a mistake made with the SPR that has to be fixed, and no one knows when or how it gets fixed (and OPEC+ knows that no one else knows when or how it gets fixed).

Oil prices came down last year without adequate supply because the Biden administration released 180 million barrels of oil. OPEC+ feels no need to be constrained by market forces when they make their own supply/demand assessments. The U.S. said it would set a floor in oil prices by buying back the Strategic Petroleum Reserves and, well, it isn’t, and it hasn’t.

So now a floor has been set by someone else. That’s really all this is.

I said there would be math

At $80 oil, let alone $100, these revenues to the OPEC-bloc countries are massive. They avoid forever the need to run deficits to fund fiscal obligations. And for shale producers in the states, that range not only generates substantial profits (without creating massive demand destruction) but it funds capital expenditures without having to go to debt or equity markets for financing.

Let me say this differently: $80-100 oil puts ESG out of business. Good luck constraining the fossil industry by constraining their access to capital when they don’t even need capital because they can self-fund capex.

But $80-100 oil has one problem to it – it can quickly become $120 oil!!! And then, all bets are off. Then you get demand destruction. Then you get recessionary probabilities. And then you get all sorts of disarray.

Inside the mind of Saudi

I believe Saudi sees Asia as its future, with China and India being bigger customers in the future than previous Western allies, and while they will take orders anywhere they can get them, they see a different knife buttering their bread in the future. And even apart from a changing macro of India/Korea/Japan/China being of more interest than the U.S. or Europe, within those four major nations, they know that China buys as much Saudi oil as Japan and Korea combined. For the first time since World War 2, it is clear to me that Saudi (and OPEC at large) have resigned themselves to not caring about U.S. production and would rather achieve their budgetary objectives with price than volume and with different trading partners than us.

New Best Friends

As I wrote about a long time ago, the U.S. and Saudi never, ever. ever had a relationship that was anything other than transactional. Some leaders got along better than others and enjoyed visits together more than others, but this has always been the textbook definition of a transactional relationship. “Shared Western values” were never on the table; just mutual economic and geopolitical interests.

How the U.S. can help Saudi these days and how Saudi can help the U.S. these days is less clear than it used to be. I happen to think there are still ample strategic imperatives in the region that could warrant some form of cooperation (protection of Israel being near the top of that list), but when it comes to economic interest, the ties, the trust, the back-scratching have all thawed over the last 10-15 years – a lot.

Then, meet China, post-COVID. The country with the biggest desire for a strong currency on earth with the biggest need to establish legitimacy with skeptical democracies (or quasi-democracies) in Europe and Asia also happens to need a lot of oil and a lot of gas and be experiencing a serious rift with their rival superpower (that’s us!) all playing out in real-time.

China and Saudi have totally different objectives from the U.S., totally different objectives than each other, and yet all at once, they need each other in a way that manages to really help each other and really not help the United States. These stars rarely align all at once as perfectly as they are now for Saudi and China versus the U.S.

A billion here, a billion there

I mentioned in the DC Today Monday that Saudi Arabia has funded $3.6 billion into a massive oil refinery in China and committed to sending 500,000 barrels of oil there per day. More infrastructure spending between the two countries is not a direct threat to the U.S.; it is merely indicative of a tighter and thicker bond between the two countries and less leverage for the United States.

The current on currency

Saudi Arabia has expressed a willingness to sell China oil with payment in Yuan, and China has expressed a desire to do so. China has already bought some liquefied natural gas from the United Arab Emirates, denominated in Yuan. Other Gulf states have expressed willingness to leave the petro system.

I get emails a lot saying, “if one country [say, China] starts buying oil from another country [say, Saudi] in a currency other than a U.S. dollar, doesn’t that mean the dollar is doomed and will crash, and we will live in a banana republic?” Then I start wondering why we would live in a 1990’s clothing store at the mall until I realize the banana and the republic are not capitalized, so they mean something else. But of course, it is not exactly normal that country A would buy from country B in the currency of country C, and we don’t usually think that when Europe or Japan settles a trade in either Euro or Yen that it means the end of U.S. dollar status. So why the fuss?

I suppose the first is a tad legitimate, and that is just that the potential end or marginalization of a trend (petrodollars whereby U.S. dollars denominate the use of a global commodity – oil) feels disruptive. Fair enough.

But far more important is why China wants to denominate in the Yuan versus the dollar, and that is the issue I just don’t think anyone seems to understand. China’s sincere and relentless belief that the U.S. dollar’s predominance is used against it when the current account deficit that comes from us buying more from them than they buy from us is settled in U.S. dollars. China believes the U.S. has an unfair advantage in the role our currency plays in settling trade imbalances and has made as one of its major strategies for achieving global respectability and strengthening the adaptation of Chinese currency in more global trade. More Asian trading partners and European trading partners using RMB vs. USD is a big step forward for China in its global economic agenda. Marginally moving the needle in global energy markets facilitates that objective.

She who has the currency has a unit of account that equals power. The U.S. has it and is not going to lose it any time soon. People who believe “the dollar is crashing” should google “U.S. dollar 2022” when we were supposedly in a tormented inflation situation. But this is not a binary matter – the world’s reserve currency vs. banana republic – it is a matter of margins, and marginally, the U.S. has not acted well to defend its dollar, and its forfeiture of global energy power carries with it a marginal loss of U.S. dollar power. Period.

Back to Saudi

First, they showed signs of apathy in their relations with the U.S. Then, they played footsies with China (telegraphing to the U.S. where things may go). And now, I would say Saudi is pretty explicitly siding with Russia and Putin across a number of geopolitical tensions. The OPEC+ decision is a pro-Russia, pro-Saudi, pro-China move, period.

Conclusions

(1) I imagine oil stays above $80 for some time to come, with a 70/75 floor now practically crystallized by the major actors on the global stage

(2) OPEC+ has provided leverage to China, Russia, and Saudi in various geopolitically strategic matters and done so because of inaction on the part of the United States to deny them that leverage

(3) The U.S. has lost leverage because OPEC+ does not care if they lose market share to U.S. shale now

(4) China’s Yuan benefits from all this, which gives the dollar less utility in controlling the nature of trade with China

(5) Energy provisions are more likely now to make their way into Republican demands in the debt ceiling debate. I can’t imagine those provisions will be that substantive, but I would think there would at least be something.

(6) I understand the argument that if oil is putting upward pressure on headline inflation, it may give the Fed cover to keep hiking; I am just not convinced the Fed is that oblivious or obstinate. I may be selling them short.

We live in interesting times.

Chart of the Week

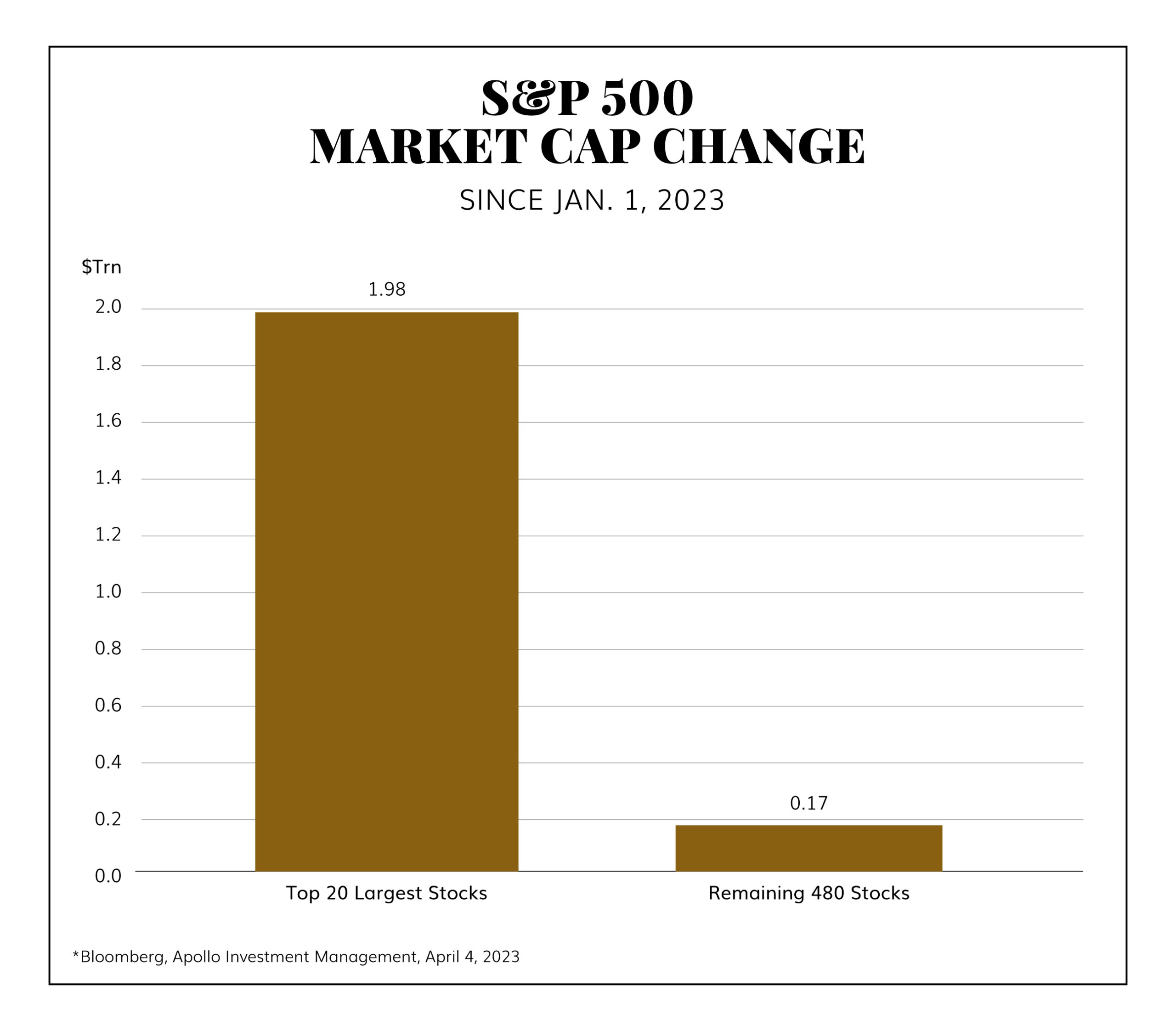

More or less, the S&P’s 7% move higher in Q1 was driven by 4% of the companies in the market. 96% of the constituents of the market pretty much did not go up at all.

*Bloomberg, Apollo Investment Management, April 4, 2023

Quote of the Week

“Truth equals facts plus context.”

~ Jeff Immelt

* * *

May you enjoy your Good Friday, your Easter Sunday, and all it represents. History has never been the same.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet