Dear Valued Clients and Friends,

This week’s Dividend Cafe does cover a lot of topics, but all through the prism of looking at the recent past as well as the pending future. I think you’ll find it an interesting historical journey and, even more so, a good analysis of so many investment and market realities.

The market enjoyed a little roller coaster this week, and I also dive into some lessons from that. I think a lot of stuff that gets covered in Dividend Cafe may mean nothing to some readers. It all means something to me, but different readers may find different topics with varying levels of application and interest. But the one universal – the one thing I constantly pray will come through in the pages of Dividend Cafe – is the primacy of behavior. My unpacking of matters monetary policy, valuations, economic growth, profit trajectories, market history, alternative investments, and all those things – none of them – not a single one – will ever trump the underlying thing I most care about for investors: Their own behavior.

Some bad things happened this week – for those who behaved badly. Nothing terrible happened this week – for those who behaved well. That is more or less a dual truism that I could repeat every single week.

In the meantime, let’s jump into the Dividend Cafe!

What a difference 15 years makes

I was fascinated by a reflection piece I read this week from my friends at Strategas Research, who started their firm 15 years ago this month. What is interesting about September 2006 vs. today is that it pre-dates both the financial crisis and the COVID moment (nice bookends) with a bull market for the ages in between. The Dow was at 11,400 fifteen years ago. And after two of the worst events in modern history, is it at 35,000 today.

Oil was right around $70 then and is right around $70 now. Holy inflation, eh?

The Fed Funds rate was 5% then and is 0% now. I think we’ve covered this plenty. Actually, we should probably just keep discussing it.

The ten-year Treasury was 4.8% fifteen years ago and is 1.3% now. Holy inflation, eh?

The average life expectancy for a male has gone from 75.2 to 75.1, whereas the average life expectancy for a female has gone from 80.3 to 80.5. Fascinating.

The budget deficit was $269 billion fifteen years ago (we were in the middle of two expensive wars). Today, there are no wars, and it is $2.8 trillion. Go figure.

We had $8.5 trillion of national debt fifteen years ago. It is $28.4 trillion now. Go figure.

Credit spreads for BBB bonds (the lowest rated of the “not junk” category are basically the same (125bps to now 107bps).

The Fed had less than $1 trillion on its balance sheet fifteen years ago. They have over $8 trillion now.

The S&P was trading 14x earnings. Today it is 22x.

And most importantly, USC was then the #1 team in the country. Today they are unranked.

But seriously, think about this for a moment

Does anyone think fifteen years is that long? I mean, in the grand scheme of things, don’t you think fifteen years is a pretty short period of time to see the national debt almost quadruple? To see the entire concept of putting a price on the time-value of money eradicated? To see the Fed’s balance sheet increase over 800%? I don’t know if fifteen years sounds like a lot or not to you. I know that if I am working with a 40-year old married couple, I assume I have as many as FOUR 15-year periods in front of them when it comes to their financial needs. If I am working with a 60-year old newly retired couple, I assume they have TWO 15-year periods (plus change?) in front of them.

I mean, can every fifteen-year period really have a financial crisis, a quadrupling of debt, a complete reconstitution of the role of central banking in the economy, and a categorical change in the entire BOND market (5% down to 0% in rates) and the entire STOCK market (total leadership change and multiples from low/average to high/above average)?

Everything is so wonderful and so awful

A lot CAN happen in fifteen years because a lot ALWAYS happens in fifteen years. But my friends, the period of time we are living in is truly remarkable -, and as my friend John Mauldin always points out, this is both good and bad.

I cannot think of an area in medicine that has not gotten better in the last fifteen years (government agencies and bureaucracies being a separate subject). From biotech to oncology/immunotherapy to vaccines to skincare to diabetes to orthopedics to heart valves to 3D body parts to gene therapy technology to Hep C treatment to pretty much any category you can think of – we have made a thousand years of progress medically in the last decade or two. Praise God!

The conveniences and amenities of modern life are almost impossible to think about. That the iPhone did not exist fifteen years ago is surreal. Ridesharing. Food delivery. The cloud. Our entire understanding of a digital experience. Wait times. E-commerce. Now, I am well aware of the controversies and differing thoughts around some of the drawbacks to certain developments here. The social and cultural impact of social media and portable electronic devices is certainly a mixed bag. But the economic productivity boost, and the acceleration of ease, efficiency, and convenience, are not up for debate.

The other side of the coin

Yes, the advancements in medicine and technology, and lifestyle convenience are unbelievable. But look at some of the other glaring realities from those data points above. $28 trillion of national debt now (only in the United States), nearly all of it racked up in peacetime. A budget deficit right now of $2.8 trillion with no wars going on and the vast majority of COVID expenditures behind us, while a further $3.5 trillion spending bill is in front of Congress. A Fed that has the Fed funds rate at 0% while the economy is growing above 5% and unemployment is at or around 5%. A Fed that has $8 trillion on its balance sheet is buying $40 billion per month of mortgage bonds while mortgage rates are at their lowest level in history, and housing prices and housing unaffordability are at their highest in history.

The cheat sheet of the ledger

Innovation – good

Medicine – good

Technology – good

Modern amenities – good

Entrepreneurialism – good

Debt – bad

Spending – bad

Dependency on the Fed – bad

Political dysfunction – bad

Social cohesion – bad

I am open to arguments that I have scored some of these wrongly (not really).

Investing in the future

I see nothing inconsistent or controversial about formulating an investment strategy in 2021 that says two things at once:

(1) The next 10-20 years could be wildly opportunistic, exciting, and beneficial for those who believe in profits, cash flows, innovations, freedom, and market mechanisms. Health, prosperity, and quality of life are all on the move, and we may be early innings of how humanity can grow.

(2) The next 10-20 years could be wildly challenging when we look at the downward pressure on growth excessive debt is likely to create, and the unwinding of a zombie economy the Fed has facilitated with excessive interventions and market distortions.

Equity Investing in the here and now

Dispersion of returns amongst equities has been brutally low. Volatility has been extremely low. Even bond volatility is extremely low despite being at a place where it would seem yields can only go higher, and every day someone is screaming that 1970’s inflation is about to come back (or has come back). Earnings growth has consistently outperformed aggressive expectations, and margins have continued to grow despite fears of higher cost structures (inputs, labor, etc.).

All this feels like the good times roll forever.

And yet …

Some of the great companies of the future put off going public as long as they can.

Private Equity assets are larger than ever as more and more opportunities stay in the less troublesome waters of private markets.

Listed public equities are down substantially.

Almost 50% of small-cap index companies have no profits whatsoever.

Valuations are stretched, and an unfathomable amount of people buying stocks right now have never experienced a 10% correction, let alone a 20% bear market or 35% whooping.

This week’s investment reflection

Dividends have been 47.8% of the market’s total return since 1930.

In the 2000-2009 period, the market was down 24% on a price basis, but the positive return from dividends wiped out most of (not all) that negative pricing).

When prices are not going up, dividends are. Prices contribute to a positive and negative return; dividends only contribute to a positive return.

What was 47% of the market’s return for 90 years is only 9% of the market’s return now. This is not sustainable.

A reminder on realistic expectations

A week like this week that saw huge downside Monday followed by weeping and gnashing of teeth around the alleged implosion of markets over a failed real estate company in China, only to see markets rally hard in the days that followed, leave open a little historical reality I do not want to lose track of. And that is, the historical norm is much more intra-year volatility than we have seen for some time. We did not get to a 5% drop from peak to trough in recent weeks, and we have not had a 10% drop since COVID. Yet, the intra-year average – the norm, the regular, the common, the expected – is 14% intra-year downside (almost always in the midst of what ends up being a positive year).

*Strategas Research, Daily Macro Brief, Sept. 17, 2021

Chart of the Week

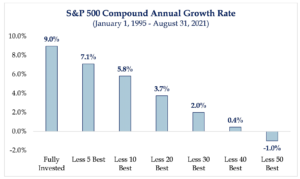

There were those who thought it wise to “time” their way around equity market volatility this week, even buying into the latest financial pornography that claimed a development company they had never heard of was the new Lehman Brothers moment. History has not been kind to those who missed even just a few key days, versus those who stay invested in the right portfolio come thick and thin.

*Strategas Research, Daily Macro Brief, Sept. 21, 2021

Quote of the Week

“Life is divided into three terms – that which was, which is, and which will be. Let us learn from the past to profit by the present and from the present, to live better in the future.”

~ William Wordsworth

* * *

I love the fact that we are living through history. I don’t understand why more people don’t see this as the norm – all people are always living through history, and it is awesome. The present is our future past, and that is thrilling to me. There are thrilling things happening in the present (both good thrill and bad thrill), and in the future, we will be able to look back on those things as past events that formed us, shaped us, influenced us, changed us, and more. Things are happening that affect our portfolios now, and that will affect them in the future. And we have a past to help inform us about the future, as long as we have a foundation of principles that helps us assess change and news and information cogently and intelligently.

I love some of the things happening right now, and I have serious concerns about some things happening right now. That was true ten years ago, fifteen years ago, and fifty years ago. It is going to be true in another 10, 20, 50 also.

I can’t do much about how people personally process the good and bad inputs of life. We are all wired a little differently, I suppose. But what I can do is encourage investors with the application of present realities to this category of their life … There are wonderful things playing out right in front of you if you will just have the eyes to see them, and there are concerns and threats that require awareness and diligence and engagement.

To those ends, we work – every last one of them. 10, 15, 20, and 50 years to come.

And we can’t wait.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet