Dear Valued Clients and Friends,

As I have teed up all week, I am devoting today’s Dividend Cafe to the takeaways from this week’s SALT Conference here in New York City.

The quick qualifier I will offer is that this is not going to be a boring recap of all the speakers, all the events, and all the things that you don’t care about. I did not attend the Chainsmokers concert on Tuesday night, and I did not attend the luncheon address from Paris Hilton on Wednesday, either. In the ten years I have attended the event in Las Vegas I don’t think I ever got a concert either, despite such names as Lenny Kravitz, Duran Duran, Train, One Republic, and The Killers performing. I did attend past luncheons with Dennis Miller, Magic Johnson, Coach K, and the now late Kobe Bryant. In fact, that lunch event with Kobe Bryant started a domino train that led to me doing a real estate transaction with Kobe – but I will save that story for another day.

But as much as they have always done to make this a pretty fun event with a powerful complement of entertainment to the symposium of content, whether in Las Vegas or now this year in New York City, there is nothing that they can do to make me a fun person. I absolutely love the speakers, and for the last two events, I have been honored to be a speaker myself.

But whether or not you care about this conference, I believe there are some takeaways from the event this year that are going to make this a meaty and substantive Dividend Cafe. So read on, and I promise I won’t let you down.

History of SALT

The founder of the SALT conference is Anthony Scaramucci, known to some people for the eleven days he spent in the White House, but known to me as a leading figure in the hedge fund industry. And truth be told since I met Anthony in 2009 when he took over the Citi alternative investments business just as Morgan Stanley (my firm at the time) was buying Smith Barney from Citi, he has become a very good friend of mine.

I disagree with Anthony on some things. He disagrees with me on some things. We agree on a lot of things. But I know him to be one of the most loyal, driven, intelligent, capable, and community-minded people I have ever met. They say Wall Street is a tough place to do business though I have never really believed that. But whatever people think about doing business on Wall Street, Anthony is someone everyone should want to transact with. He is that rare person who earnestly wants his counter-parties in a transaction to do well. He is a big picture person. I have learned a lot from him over the years. He and I will be friends for life.

And this year’s SALT conference is a huge “case in point” of the kind of man Anthony is. The initial SALT conference was inspired by what was happening to the corporate convention business in Las Vegas during the Great Financial Crisis. Business travel had died, President Obama suggested companies cancel their jaunts to Las Vegas, and the tourism industry was dead, too. Anthony and his blue-collar DNA knew that the people hurting the most were the bellhops, the busboys, the bartenders, and the valet drivers. He knew Vegas was not just a city of high rollers, but a city of people up and down the income scale all dependent on traffic and activity. And the genesis of SALT was a desire to help contribute to traffic and activity.

So SALT was born in Las Vegas and became the leading hedge fund symposium in our industry in no time. Over the years it not only brought out the top hedge fund names and asset managers from around the world, but former Presidents Bill Clinton, George W. Bush, future President Joe Biden, countless cabinet Secretaries, diplomats, world leaders, and yes, the occasional celebrity (I mean, really, Anthony – Paris Hilton?). The cancellation in 2020 due to COVID was painful, but not as painful as everything that has happened to New York City over the last 18 months.

New York Tough

Anthony’s decision to bring SALT back and to do so in the brand new wing of the indescribably beautiful Javitz Center of New York City was exactly out of the old SALT Las Vegas playbook. The very first event in this new venue in the very first moment of city re-opening. And there was no sense of “easing” this back in. Open for business means open for business, and 3,000 people agreed that enough was enough.

So SALT came to the Big Apple this week. And the hotels, busboys, convention center employees, electricians, stagehands, nearby coffee shops, bars, uber drivers, and so forth, all say thank you.

Okay, let’s talk investments, but first politics

It was appropriate that the very first speaker to appear on the SALT stage at an event held in NYC to symbolically represent the comeback of NYC was the Democratic nominee for Mayor in NYC – the obvious next Mayor of New York City – Eric Adams. There is no discussion of the economy or markets right now that is not intertwined to a large degree with the economics of cities, with partisan realities, with a view of governance and policy, with a take on social order and crime, etc. So the talk was not quite as disconnected from markets as one might believe, but I cannot imagine that there was a Republican or Democrat in the room who would have been upset by what Eric Adams said from the SALT stage.

Where markets would be post-summer 2020 if the cause of continued disintegration of American cities was popular, I do not know. But one thing I believe has never been mentioned as at least a minor factor in the cohesion of our economy post-summer 2020 is the fact that the overwhelming mandate of the American people is to see strong police protections, a real response to homelessness, a real effort to address the issues that eroded safety, etc. I am well aware that significant policy disagreements exist in many cases around how to address those issues, but it was encouraging to me to hear SALT launched with a forward vision for America’s largest city that was so non-partisan and constructive.

What cities and portfolios have in common

It also was intriguing to hear New York City’s financial industry neither demonized (as the current Mayor consistently does), but also not held up as the one-trick pony of the city. Rather, strong a future as the world’s most important financial center was upheld, all the while pointing out the incredible diversification that has taken place and will continue to take place in New York City’s economy. Just as Texas succeeded over the last 20 years in becoming not just an oil and gas state, but also a major hub for technology, business services, and agriculture, so New York is well on its way to not merely being a financial center and a media center, but also a vibrant place for technology, innovation, research, and health care.

Diversification of economic strength is as important to major cities and states as portfolio diversification is to investors, and for largely the same reasons.

Distress not all around

I won’t say that “from an investment standpoint, the one thing about the COVID moment I will never forget is …” because there was a lot more than one thing. But surely one thing that the entire alternative investment and opportunistic investment space will never forget is how quickly the opportunistic distress set went away in COVID 2020 vs. the financial crisis of 2008. There were still ample, and I mean, ample, distressed assets in real estate, credit, and private equity for at least two years (if not longer) after Lehman’s September 2008 bankruptcy. Many asset managers would have thought a global economic (and physical) lockdown would have done the same thing in 2020. And certainly, there was some hyper-distress in 2020, for about ten days.

An early Monday morning panel featured some superstar managers from top distressed opportunity hedge funds like Fortress, Canyon, and Mudrick. Generally, a credit manager playing in the first lien loan space might raise their eyebrow and get their ears perked up when they see first-lien debt trading at $0.90 cents on the dollar. But when all of a sudden a first tick brings par value loans to $0.50 cents on the dollar, it isn’t like there is a lot of time to analyze or evaluate. Not only was time-limited in March 2020 for careful analysis of credit fundamentals but they were all shut down, too. Working remote may have become more functional as the pandemic wore on, but it is not like the first couple weeks of it were optimal for deep analysis and research collaboration. This has been an under-covered aspect of conditions distress managers faced at the bottom of the COVID moment.

You snooze, you lose

The fact of the matter is that anyone who did not call all capital committed for deployment by early Q2 of 2020 missed the boat. The only easy money in the COVID moment was for those who were willing to prioritize speed over caution and deliberation. By the time anyone’s process of cautious deliberation had played out, the Fed had largely taken away severe distress opportunity.

Strategies in this space that have to think about mark-to-market realities were far more vulnerable than those who didn’t. Who has to think about mark-to-market? Well, daily NAV strategies, for one. If you make liquidity available for a strategy where liquidity can evaporate in a second under severe distress, you are vulnerable. Certain leverage risks make mark-to-market a big factor as well. The rare actors who could avoid the distortions of how assets were priced were largely unlevered, illiquid strategies – and they soaked up all the opportunity in spring 2020.

So what now?

18 months after the COVID moment, what are managers in this space doing? The disintermediation of commercial banks is still the #1 theme in debt markets. Assets may not be trading at $0.90 cents on the dollar anymore, let alone $0.50 cents, but the opportunity set is still thematic. Public debt distress is gone (larger blocks of publicly traded debt trade above par and at insanely low yields). It is private credit where there is still yield and price action that can be considered investible. This has been a theme of ours for some time now. Borrowers in the middle markets space are willing to pay a higher coupon for the flexibility private structures provide and especially the assurance and timing of closing (commercial banks are just as slow and obnoxious for big corporate borrowings as they are for your mortgage lending).

Final takeaways in this space

Debt-to-EBITDA in this space used to run about 4x. It is now running about 5x, so leverage has moved higher. That is just a fact – leverage (and therefore risk) has gone higher. One other thing I learned this week is that even 5x debt-to-EBITDA talk is really on “adjusted EBITDA” – more accounting gymnastics that in an apples-to-apples sense actually means we are closer to 5.5x or sometimes even 6x. If debt managers are underwriting to a default, your recovery can take a long time (of course, the returns can be huge, too). But any return requires an exit, and exits mean there is a robust M&A environment and that probably means a pretty healthy public equity environment.

I do not buy the argument that private credit and public equity are not correlated. In terms of mark-to-market dynamics and in times of “quick exits at robust prices”, I believe they are. However, as we have seen time and time again, with patience and flexibility inside the capital structure, private credit opportunities can pay off substantially regardless of the noise generated during times of equity distress.

Capital structure matters and the amount of capital being lent (and therefore being borrowed) in the non-bank private credit space makes this one of the most important asset classes in the investible universe.

A structured component

I loved the fact that all three of the panelists on the Structured Credit symposium (Axonic, Angelo Gordon, and Monroe) were part of the alternative investing platform at TBG. It meant not only getting to hear insights from multi-billion dollar experts in this field but getting to hear it from people I know personally and have invested substantial personal and client capital with.

Direct Lending is an asset class all of its own these days. The senior-secured, first-lien lending space attracts those who want to borrow against their cash flows, not against assets (commercial banks are almost entirely in the business of asset lending post-GFC, and not at all in the business of cash flow-lending). Being senior in the capstack has meant defaults that are almost non-existent and easily cured (loans are covered by ALL resources of the company), and loan-to-value ratios are generally peaked at 50%. Yet spreads are high, even as the LIBOR rate they are spread over is at or near 0%. Lenders offer quick execution but these loans hardly have a liquid marketplace. The idea is to “buy and hold” and to be paid for doing so (3-4x the risk-free rate in most cases, without leverage).

The structured credit space at large offers the opportunity to buy into dislocation, it organically monetizes risk taken, and there is asymmetry in the information and opportunity. There also are generally variable rates that give rate and inflation protection – not to mention the underlying assets of the debt structures are generally inflation hedges, too.

High Yield and Investment Grade corporate debt have advantages, but they do not organically de-risk. Reinvestment risk is preferable to credit risk.

There is liquidity risk and price dislocation risk in structured credit – that is never going to be lost on us. And we’ll always be concerned with the leverage profile of our managers, here. But this is a post-COVID space we believe still offers attractive investment opportunity and income premium.

Real Estate reality

I believe a theme has set in that evokes a picture of Americans moving from the cities to the suburbs in droves. Not only is it pretty substantially over-stated in numbers, but it is often misunderstood. A key theme at the conference this year around real estate was that density still matters. The lifestyle afforded by density has not become less desirable for younger members of the workforce; it is just that quality of life and cost matter within that aspiration for density. Cities like Phoenix and Austin have been huge beneficiaries. Cities-with-bad policies to-cities-with-good policies has been a bigger real estate theme than city-to-suburb.

The developer of Hudson Yards in New York City and one of the prime real estate firms in the country, Related Companies, told of having 80% occupancy in their rental portfolio a year ago and having to give away three months of free rent to secure a new tenant. Fast forward to now, and they are at 99% occupancy with no free rent concessions whatsoever. What a difference a year makes.

“City growth” comes where citizens and residents are viewed as customers. Nimbyism and bad policy hurt cities, period. But density is not out of favor and the belief that it is has caused many investors to get this wrong.

Crypto Conversation

It was impossible to attend SALT this year and not be inundated with crypto/bitcoin conversation. Some could argue that the level of conference stage time around this new space is a contrary indicator, but I digress (indeed, 30% of the panels at the conference – 15 out of 50 – were crypto-oriented).

What I did want to highlight is one Ray Dalio, hedge fund extraordinaire at Bridgewater, who was perhaps the only speaker I heard all week connect the dots between the potential “success” of crypto leading to the “killing” of it by regulators. Readers of The Bahnsen Group’s literature have heard this argument many times, but Ray Dalio was speaking with the authority of being worth $20 billion (for whatever that is worth). To Dalio, the catch-22 is that regulators won’t touch it if they don’t believe it is going mainstream, and if it does go mainstream they will touch it (with their heavy hand).

“I think at the end of the day if it’s really successful, they will kill it and they will try to kill it. And I think they will kill it because they have ways of killing it,” he said.

But he also said he owns some, as did billionaire hedge funders Steve Cohen and Dan Loeb (both of which TBG has investments with either through an intermediary or directly).

So what do we do with information that a rich, successful, smart person has a view on something? We generally listen to all views from all comers, but no, the “appeal to authority” fallacy does not become cogent when we are talking about a financial matter. Forget crypto for a second – let’s just talk equity markets. How many times in my career have I heard a rich, smart guy say “up” and another says “down.” The argument that a rich, smart guy is never a conclusive argument as long as one other rich, smart guy takes the counter-view.

One has no choice but to form their own argument and their own point of view doing their own research and analysis, and that is what we do and have done. The crypto issue is compelling because there are some who say they think it is speculative and a little crazy, but yet still own it (so what side of the argument do you go with there?). And there are people like Cathie Wood who love bitcoin; people like Ray Dalio who think her valuation metric for it would place it above the value of ALL non-fiat money in the entire world (like, ALL the gold on the planet, and all the digital coins on the planet, put together). Dalio was not saying this approvingly, I assure you. Guys like John Paulson and Warren Buffett (who were not at SALT this year) believe it to be “going to zero.”

One thing is clear – there is an entire cottage industry of folks playing in this space, and the “bitcoin” story is becoming a multiple-product digital currency story, with totally different theses for ownership across different evangelists in the space. I sat with multiple newly minted crypto-millionaires this week and can only say that some are impressive people, some are really, really not, and many have totally different arguments for why such-and-such is going to happen.

Dalio’s thesis that crypto is more of a play on gold than anything else is perhaps the most intellectually interesting, yet even that leads to a quite bearish conclusion as it plays out. We remain a firm invested in “internal rates of return.”

The Hedge Fund Industry

You can’t attend a conference like this with this kind of hedge fund talent without diving deep into the state of the hedge fund industry. I was shocked how many hedge funds went away altogether from 2015-2018, including some really big-name funds. I was shocked that despite the +8% net return of the average long/short fund this year, the average alpha in that space is down 7% year-over-year.

One thing I know about this space that becomes more real to me every year: It is a people business. It is all about talent. Good analysts identify and systematize opportunities. But good portfolio managers have to have a risk gene. Scale is important to retain talent at hedge funds, but with size and scale come complexity and potentially a diminished opportunity set.

But I absolutely loved what one of the most successful hedge fund investors of all time shared – “when it comes to cultivating talent, you simply cannot be transactional, no matter how hard-wired you may be to thinking transactionally. Humanity has to be foundational to how you operate.”

The optimism of the great alpha-generators in the asset management business over the next 20 years is palpable. This is not because they do not fear political dysfunction, excess debt, and so many of the geopolitical and monetary fragilities we all think about every day. It is because they believe – to a man and woman I spoke to – that we will overcome what threatens us, and that talented managers will extract value from dislocations along the way.

My final summary takeaways I am most deeply absorbing

(1) Something may pop the various asset bubbles that may or may not exist out there, but it will not be the Fed. Some other factor or circumstance will have to do the popping.

(2) Investment opportunity path – THEME, then PEOPLE, then EXECUTION

(3) Even when the Fed does taper, they will be BUYING more (not selling) than they did in the entire Q1/2/3 period post-financial crisis. Is tapering tightening? Sure, directionally. But the Fed is simply not programmed to take away a punch bowl, ever. The central bank is not merely a buyer of debt; they are a HOLDER. This makes them inherently invested in downward pressure on rates.

(4) Crypto is not an antidote to excess liquidity; the crypto craze is CAUSED by excess liquidity.

Chart of the Week

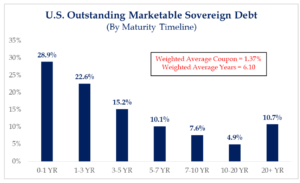

When I talk about the juxtaposition of policy and markets, something like the term structure of U.S. debt is as great an example as anything. The policy side continues to lead to new debt issuance (at a faster pace than old debt matures). This has big implications for the term structure of U.S. debt, the shape of the yield curve, and other decisions (and non-decisions) of policymakers. 57% of U.S. debt maturing in four years or less speaks to the need for a steeper curve and short-term downward pressure on yields. It speaks to why they have resisted the common-sense idea of a 50-year or 100-year Treasury. And it is all the mix of policy and markets.

*Strategas Research, Investment Strategy Report, Sept. 13, 2021, p. 2

Quote of the Week

“If you have people, you have problems”

~ Steve Cohen

* * *

It was a great thrill to be on this stage talking about the state of the wealth management industry. I made the case that being “open for business” trumped video screen relationships and that those who are meeting with clients and collaborating with their teams day by day are doing the best at preserving their culture. I also argued that worries about the disintermediation of the advice business fundamentally misunderstood what the advisor is on earth to do.

I have strong opinions about the role of the advisor in delivering an outcome and experience to a client. And it is true, my opinions don’t allow for the idea that advice can be or ever will be replaced by some of the silliness I see people wringing their hands over.

But I have the luxury of not worrying about that because at TBG we love our clients, love them and will work harder and longer and deeper and wider to show that love than any firm I have been a part of. My time at the SALT conference this week provided me ample inspiration for new value, new work, new thoughts, and new services around the way we relate to our clients. All part of the love.

To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet