Dear Valued Clients and Friends,

Happy Independence Day weekend to you and yours. Or for those without much historical interest, Happy Fourth of July.

Today’s Dividend Cafe is not going to dive into the state of the market, though I can promise you that Tuesday’s DC Today will have plenty to say about the first half of 2022 and our expectations for the second half.

But for today, I want to look at this Independence Day holiday that we celebrate in our country, and analyze what the Fourth of July has to do with markets and economics. I make no bones out of the fact that I love my country, and much of that has to do with understanding what this country is – an idea, and an exceptional idea, at that. How the exceptional idea of America ties into markets, economics, and investing, is where we are going in today’s Dividend Cafe. Jump on in – there will be time enough for BBQ and sun this weekend.

|

Subscribe on |

A Declaration

The authors of America’s founding document, signed and sealed 246 years ago this weekend, made no bones from the very outset of the document about why they were doing what they were doing (emphasis mine):

“When in the Course of human events, it becomes necessary for one people to dissolve the political bands which have connected them with another, and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature’s God entitle them, a decent respect to the opinions of mankind requires that they should declare the causes which impel them to the separation.”

Having affirmed their own need to explain and defend their decision to declare independence from Britain, they then laid out the most glorious and famous words connected to our founding:

“We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness – That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed.”

The document goes on as a case study in eloquence, human rights, human nature, and a vision for a liberal society. The colonist’s complaints were certainly of a political nature, and a deeply philosophical one at that. But they were rooted in economic categories as well, as one who carefully reads the documents will immediately extract. The claims of the authors in itemizing their rationale for separation included the facts:

- That rule of law was necessary for the public good

- That representative government amongst the people was necessary to combat the potential for tyranny

- That excessive regulation separated from rational purpose undermined the public good

- That population growth was vital for growth and prosperity

- That a separation of powers was needed for effective government and administration, not making those who interpret law and settle disputes reliant on those who make and enforce laws

- That new agencies, bureaus, and regulatory entities impeded the substantive growth of the people’s prosperity

- That private property was an essential right in a functioning society

- That free trade and exchange were not to be cut off or impeded

- That taxation should be by consent (as taxation extracts from growth in the private sector where resources are most efficiently allocated, thereby necessitating consent of the taxpayers before taxes are imposed for the public good)

- That tricks and loopholes to undermine the rule of law were unacceptable

What strikes me every time I read this glorious document is how far they went to avoid having to write it. The humility, patience, and caution with which this all unfolded is extraordinary. And they did not seek to put reason above religion and revelation (as the other famous revolution of this time period did), but rather sought to use experience, history, and human nature to allow a new and stable government to be formed.

Life and Liberty

The sanctity of human life is a sine qua non in a market economy. Where there is no regard for human life it is unfathomable that a regard for private property or for free exchange or for the division of labor or for the profit motive will be upheld. Ultimately, to optimally preserve the principles that a market economy relies on, there simply must be an underlying regarding human life.

But our founding fathers highlighted two other unalienable rights as well – liberty, and the pursuit of happiness.

When we talk about liberty I have always found it useful to create categories. Political freedom, economic freedom, and civic freedom all overlap, are all important, are all vital in a truly free society, and yet are all categorically distinct.

Milton Friedman went out of his way to point out forty years ago that economic freedom is a necessary but not sufficient condition for political freedom. You cannot have a free economy in a political tyranny, but you can have some degree of economic freedom without political freedom. The optimal recipe is for both, always and forever. Our founders knew this, and the Bill of Rights that enshrines our Constitution is a masterful juxtaposition of these three categories of liberty (political, economic, and civic, provided for across the dimensions of religious exercise, speech, press, assembly, self-defense, property, due process, etc.).

Markets demand economic liberty. They prefer political and civic liberty, as well. The uniqueness of the American experiment transcended a mere fondness for market arrangements. The uniquely American ideal was the juxtaposition of all three freedom categories.

The embarrassment

Those who have studied history know that the ideals of the founders did not overcome a glaring and reprehensible hypocrisy – the continuation of the institution of slavery. And while it took American seventy more years to rid itself of this globally-present atrocity, those were seventy years too long in a country rooted in the principles I have laid out above. This belongs in the historical record, and while more needs to be said about how the legal, moral, economic, and cultural groundwork was laid to eliminate slavery, there is no whitewashing of the fact that such effort was even necessary at all. Where there are conditions for life, liberty, and the pursuit of happiness, there would never be slavery. Ever.

An economic worldview rooted in the dignity of all human beings not only upholds their status as image-bearers of God (“their” being a reference to all humanity of all races and colors), but defends their status as creative, innovative, productive human beings, not made to be dependent on the productive capacity of others.

Pursuit of Happiness

Civilization went thousands of years without really connecting the pursuit of happiness to economic interest. Aristotle, Augustine, and Aquinas all touched upon it, but the classical school of economics took hold in the 18th century (Adam Smith’s Wealth of Nations began to systematize where self-interest connected to free exchange, and out of that a laissez-faire system of economics). Our founding fathers had a special regard for religious freedom, and they also developed a uniquely favorable view of work, productivity, risk, entrepreneurialism, and investment. It may not have been fully realized until after the Industrial Revolution (let’s face it, it isn’t fully realized now), but the basic idea of work as a blessing, as a means of enhancing calling, purpose, and meaning, was a distinct aspect of the American experiment.

Out of Adam Smith and the American Revolution, the concept of division of labor was fully borne. A specialization in our economic activities that recognizes individual talents, interests, appetites, dreams, skills, and passions was completely unknown prior to this. A market economy that emphasized liberty like ours did open up the floodgates of specialization.

And today the Dow is over 30,000.

There’s No Free Lunch

When I write about the economic principles that matter to our understanding of the field or lecture about such to students, I focus on first things – first principles – that drive a coherent understanding of free enterprise. The American experiment was not merely a political declaration of freedom (though it was surely that, too). It was an economic assertion of mutually beneficial free exchange, of the division of labor, of the law of comparative advantage, of the reality of trade-offs, of the primacy of incentives, and of the case for an economic system that promotes human achievement.

Politically unfree systems that were unconcerned with economic growth had, at their core, the betterment of an aristocratic class as their priority. Aristocracy, feudalism, monarchy, and other such pre-modern failures were not aspirational.

The American dream was aspirational. It still is. It declared that in our pursuit of happiness, and with a presupposition of rule of law, private property, and political freedom, anyone could achieve what their God-created capacity would allow for. It set into motion a cycle of mobility that many still fail to understand today. No one has to stay stationary any longer. Rich people can become poor with bad decisions. Poor people can become rich with hard work and good decisions. Dynamism and mobility are the norm, and no one has to be handcuffed to their birth station. Amen and amen.

Investors, take heed

Where there has been more freedom in the course of human history, there has been more investment opportunity. Where there has been less, there has been less. Freedom is pro-markets and markets are pro-freedom. Evolutions in financial markets are a blessing to the cause of human prosperity. Investors who bite the hand that feeds them should proceed with caution.

Each and every day, investors pursue the most rational allocation of capital, that is, the deployment of debt and equity into such uses as would create desirable returns on said capital. This is an investment into human action, not mathematical models. And it is an investment that presupposes liberty. Humans do their best work when free. And investors receive their best returns when free. To that end, we work.

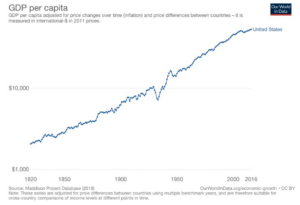

Chart of the Week

Happy Birthday, America.

Quote of the Week

“It is, after all, still the case that nature does not provide enough in the way of resources to meet all human needs at any one moment. Resources have grown enormously, and yet they remain scarce in comparison to human needs and desires. That means that we will always have to face the reality of scarcity – and the problem of the production, creation, and allocation of goods and services to serve human needs. Wealth is not given; it must be created. And there are more successful and less successful ways of achieving that.”

~ Father Robert Sirico

* * *

Clients will receive a pretty comprehensive portfolio report next Wednesday in the Weekly Portfolio Holdings Report. Tuesday’s DC Today will refresh much of what is going on in markets and the economy. And Monday will be a holiday, hopefully, spent outdoors, and hopefully with food, friends, family, and fun.

But no matter what you do Monday, I promise you it is made possible by the liberty that the day is supposed to be celebrating. And I promise you that what I write about every day is nothing more than the application of such. Every day – economic liberty brought to markets, investors, and human activity.

Nature’s God, indeed. Happy Fourth.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet