Dear Valued Clients and Friends,

The fundamental tension in the economy today, and less directly so, in markets themselves, is really simple: Is a recession coming that slows down price inflation? That question is simple to identify as the economic tension point of the moment, but it is not simple to answer.

One reason for this complexity is that some of the premises brought to the question are not to be taken for granted. And this is the subject of today’s Dividend Cafe – what do we know about current economic conditions, potential economic developments, and eventual economic results? What do some think they know that could be wrong? And what is an investor to do through all of this?

I have some thoughts to share that can hopefully bring clarity to much of this, and some of those thoughts are merely clarifying, while others may be non-consensus views. Either way, convictions run deep at The Bahnsen Group, as does humility. That is another “tension” that we hold gladly.

Let’s jump into the Dividend Cafe …

|

Subscribe on |

Is a recession coming?

Real yields are negative. We have never, ever, ever had a recession with negative real yields (or even when real yields were 1%). Now, one can argue that the rate is going higher and that the inflation level is going lower, and from that math, you get something different. Let’s say you end up at 4% in the fed funds rate, and 3% inflation, both numbers I believe are highly unlikely any time soon (the FF rate will not get to 4%, in my opinion, and the inflation rate will not get to 3% any time soon). EVEN THEN, you have a real yield of 1%. I believe a lot of the present circumstances lack much precedence in history, but regardless, there is just not an easy path for predicting recession here from a yield predictor standpoint.

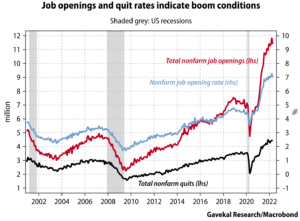

Then there’s the pesky job reality. Not only is unemployment really low, job creation really good (372,000 jobs in June), and wage growth steady, but the bigger economic anomaly remains the opposite, that is, companies unable to fill jobs they are looking to fill.

There are dozens of counterarguments suggesting a recession is coming. But the notion of it as a foregone conclusion in the face of real bond yields and job dynamics is dangerous. If you want to call it 50/50, be my guest. But the point is that driving strong investment decisions on a certain outcome here is not prudent.

Are they praying for recession in Silicon Valley?

Is a recession just what the doctor ordered for growth stocks? Would it hold interest rates around 3% and bring inflation back down to 3%, and further solidify the permanent low rate thesis that growth stocks love? Would it bring back the idea that a 20-25x P/E is a sustainable deal for markets? Would it end cyclical sensitivity and bring back the tech bull?

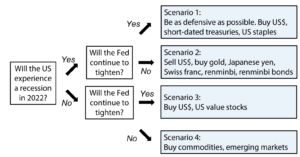

I do not believe so. I believe there are several scenarios in the decision tree of a recession and Fed policy, and none of them suggest a quick comeback for expensive growth assets. Consider the following from Gavekal:

*Gavekal Research, July 2022

The part that fascinates me here is that U.S. growth stocks don’t appear in any path around either recession or the Fed. How can that be? I continue to believe it is valuation and earnings driven – that is, even if there is not a recession, and even if the Fed does slow tightening – earnings momentum has slowed, and valuations are not expanding (or likely to expand) for a long time.

Are we really ready for a tough decision?

What if what we face is a moment where the Fed has to say, “inflation will do what it does but we can’t take a severe recession”?

Right now, basically every country (besides Japan) is aligned with some pretense of saying they want policy biased towards monetary tightening, and some effort at countering inflation as the top headline in their endeavors.

I think a moment will come where that will stop – where some will say, “we must tighten further!” but others will say, “we prefer inflation to recession!” When different countries are fighting for the same thing, you have to guess who will get what they want, and who will be most aggressive and effective in that pursuit. But when they actually have different stated objectives, portfolio alignment becomes easier to create.

At this time, I believe the monetary policy of the Fed is “sound hawkish, move a bit, and then wait for something to happen.” The Fed does not want to resolve the tension between economic pain and inflation, politicians do not want to decide, and I assure you, you do not want to decide (as in, the general public).

Sidebar in Emerging Markets

Why does a strong currency matter? Why does the currency you buy a commodity in matter? The world buys oil in dollars, and it buys a lot of commodities in dollars. When a country is dealing with the price inflation of a commodity AND needing more dollars to do so at the same time their own currency is weakening against the dollar that they must use to buy certain commodities, it is a double whammy of pain. Keeping assets at home strengthens their currency and bids up their own investment assets. The entire world has changed on this front since I began investing in emerging markets. Currency is going to matter in the next phase of this cycle.

Investing on the Inflation/Recession Axis

Two paradigms to consider in Bond and Stock Markets:

More inflation, less recession = More credit, Less duration, More value, Less growth

Less inflation, more recession = Less credit, More duration, Less value, More growth

But of course, one does not know what is going to happen with inflation (I have my theories), and one does not know when (they really don’t). And they do not know what is going to happen with a recession, either.

But … Dividend Growth stabilizes the tension! And so does asset allocation.

Now, dividend growth stocks can go down on either side of this teeter-totter, but in theory, a properly constructed portfolio is long energy and financials that benefit one way, and long other non-cyclicals that benefit another, all focused on the accumulation of growing dividends feeding total return.

For those who suggest asset allocation is broken as stocks and bonds have failed to diversify one another for the last five minutes or so (sorry, I meant six months, but it’s basically the same thing) …

Bonds and Stocks are much more likely to diverge and prove non-correlated from a starting point of 3% than a starting point of 1%. And this is good. The zero-bound policies of the Fed post-COVID caused this. I said it over and over again. Bonds cannot diversify (let alone generate return) at 0% (or 1%). But the ability to offer traditional asset allocation benefits has returned with higher yields.

Sector talk

Over time client returns come from companies generating cash flows, not from our selection of sector weightings at a given point in time. But because I used financials and energy as examples above, I want to make a certain point. Let’s say we get more inflation, OR we get a recession … Note the following about the aforementioned two sectors:

Energy – benefits from inflation; already has low P/Es

Financials – banks and insurance companies do better with higher interest rates; low P/Es suggest they have already priced in recession (or mostly so)

What about low-quality tech stocks? You will forgive me if I will avoid in a period of declining valuations and declining fundamentals, those companies that could not make money in a period of absolutely perfect, ideal conditions for their business model. No path to profits, no pricing power, no basis for valuation premium. And now things get hard? No thank you!

Would a Ukraine/Russia negotiated ending create a short-term shock for energy? Absolutely. Would it change the long-term lesson we have learned from this debacle? Not in the slightest.

But is the Energy Bull Market over?

Allow me to present four potential catalysts for a potential reversal of sentiment and narrative around Energy … Note, I do not believe it would take all four of these to change the narrative, but rather just one. A combination of factors (which is my baseline expectation) just adds more seasoning to the sauce.

- China re-opening. Their insane and anti-scientific COVID policies may keep delaying and depressing this, but AT SOME POINT, Chinese demand reaches normal levels, and AT SOME POINT, full capacity is hit in production, meaning, more energy demand than is presently seen or expected.

- European supply constraints are not remotely over. They can try to make up with Putin, they can embrace the environmentalist wrath in coal, and they can pay the Saudis through the nose, but one way or the other, they will have less supply than demand.

- Geopolitics have hardly stabilized. Russia remains a rogue actor on the world stage. Actions against Russia or by Russia are all asymmetrically more likely to push energy prices higher than lower.

- Policies in treating high energy prices have been some form of subsidy (that is, direct payments or tax cuts) – and not at all supply-driven (more production) or demand-driven (that is, trying to erode demand).

What if it is not inflation or recession we have to fear, but de-globalization?

I am hearing increasing noise that one thing stock investors have to fear is increased capital expenditures. Their argument is not merely the old (and silly) adage that higher capex means less free cash flow and, therefore less profits to investors. More legitimately, there is a newer argument that much of the need for accelerated capex will be tied to on-shoring and re-shoring – that is, the investments that will need to be made to bring more manufacturing and supply chain processes back onshore. In that context, the argument is not merely that the expenses for onshoring will be substantial, but that production costs post-onshoring will be higher than they were offshore. “De-globalization” is said to be a threat to liquidity and even productivity.

All I can say here is that I do not accept the thesis that an investment in productivity is bad for productivity. And I certainly do not accept the thesis that better productivity is bad for profits. You can’t have it both ways. If more capex is good for productivity, it is ultimately good for profits (and markets are discounting mechanisms). If capex is bad for productivity, someone has to explain to me how investing in productivity is bad for productivity.

A friend and brilliant economist wrote this week how increased capex may put downward pressure on stock buybacks. I can buy that argument, as long as it is meant to be a bullish one, not a bearish one. Stock buybacks are what one does with after-tax profits; they do not create after-tax profits. Productivity does. And if capex creates more productivity, it creates more profits, period. Oh – not to mention the pro-cyclical benefits of overall economic growth that business investment represents.

Conclusion

A recession may be coming, and it may not. The Fed may chicken out soon, and they may chicken out later. Some other countries may stay on the side of the Fed for a while longer, while others may soon pursue their own path. But what is not happening is a wholesale change of the principles that have governed financial life for millennia. Dividend Growth cuts through the Value/Growth noise, and Asset Allocation cuts through the Stock/Bond noise.

My advice? Invest in a way that if you end up being wrong in some of these decision tree moments, you are only wrong temporarily. Be invested in mean reversion. Only those excessively sure of outcomes they can’t be sure of, cut themselves off from the eventuality of their thesis. Think about that for a bit.

Quote of the Week

“Desire clouds the equation. If we want something enough, our tolerance for risk goes up fast.”

~ Professor Scott Galloway

* * *

I hope this analysis of current economic tension was useful. If it created more questions than answers, I encourage you to send us those questions. We answer them. But in the meantime, I also encourage you with this: There are uncertainties in the present moment, and that is okay. Attempting to resolve something that is unresolvable creates more problems and risks than the mere unknowability of something. I promise you this is true.

A humble and vigorous quest for prudent and wise decisions is the need of the hour. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet