Dear Valued Clients and Friends,

Once again we find ourselves in the midst of a tumultuous week in the markets, and yet with bigger fish to fry in the Dividend Cafe? What could be bigger than a 1,400 point drop in the market on the week, and a 3,000 point drop in the last two weeks (note: I am hitting “send” on this before the market opens on Friday, and pre-market action Friday does appear to be to the upside right now, but you know how that goes)?

Well, for one thing, I think most of the commentary I have to offer on the specific things taking place this week in markets was well-covered in each edition of The DC Today this week. If day-to-day market distress is distressing you, I hope you will turn to The DC Today as a resource. Reading it cannot make the market go up any more than my act of writing it can, but hopefully, it can provide clarity around where this volatility fits into expectations for investors who have real financial goals in their lives.

So the bigger fish to fry I refer to are not about the specific Fed meeting of this week, or this most recent interest rate hike, or even my broader theme about the carnage in “shiny object” investing … It has to do with discussions around a potential deeper level of concern in financial markets, and what they may look like. I hope after reading this week’s Dividend Cafe you will feel a bit smarter, a bit more informed, and a bit more at peace.

Let’s jump into the Dividend Cafe …

|

Subscribe on |

Quick Review

Last week I explained why I did not believe that European bonds, crypto, municipal bonds, some massive hedge fund, or the broader world of private equity represented the next black swan systemic meltdown in financial markets. Each of these arenas most certainly contains their own isolated risks and embedded potential for loss relative to holders of those asset classes, but as far as the oft-discussed concept of “contagion” risk, I made the argument that the risks in these spaces were not of the contagious variety that most doom and gloomers sit around praying for, I mean, worried about.

Private Equity P.S.

Incidentally, I read a report this week just days after last week’s Dividend Cafe analyzing 21 years of returns in the Private Equity space (2000-2021) reaffirming a 4% annual premium in performance vs. public equity counterparts, maintaining a negative correlation to public equities in down markets, and offering no evidence of convergence between the two asset classes. I do not make the argument that private equity magically eliminates the volatility that public equities “burden” investors with (air-quotes), but rather that the illiquidity benefit of the asset class keeps investors from behaving badly around such inevitable periods of illiquidity.

Shiny Objects as Systemic?

One thoughtful reader wrote after last week’s Dividend Cafe and wondered why the “shiny objects” I have been bemoaning for so long couldn’t qualify as the next systemic hit. After all, consider these returns from their highs to where they are now all in the last several months:

- “Innovation” stocks: down -78%

- Crypto: down -70%

- FAANG: down -46%

- Nasdaq: down -34%

- Consumer Discretionary: down -38%

- “Work from home” stocks: down -74%

- SPACs: down -63%

The value destruction in the crypto space alone is estimated to be nearing $2 trillion. And while we previously have discussed the losses here being limited to the speculators who speculated, lo and behold major crypto players now concede “there may be a lot more leverage than we thought, after all.” But even then, the brilliant lenders against crypto positions are isolated, not systemic, and will deal with their profits and losses on their own accord.

The losses in these spaces are deep and severe, and sadly, painful to the investors who have taken the losses. But much like March of 2000 in dotcom, the losses are not contagious, and if anything, may very well result in a more anti-fragile investing community going forward (human nature won’t change, but maybe some individual people will). Brokerage firms that lent on margin cover their losses. Broad, institutional investors are nowhere near concentrated in these pain zones. And while this is an investing moment for the history books, the isolated losses in “shiny objects” do not give me fear of a contagious event.

But it sure seems like recession and bear market are here?

What we know, in order, is the following:

(1) Over-priced aspects of the market, many of which are in the list above, began dropping nearly a year ago, way, way before Fed tightening was the talk of the town. I credit this to the early innings of a valuation bubble bursting.

(2) As inflationary pressures have picked up, and as the Fed waited forever to lift off of March 2020 COVID actions (I see these two events as mostly unrelated), the need for the Fed to begin tightening picked up steam a few months back.

(3) Still over-priced assets now had to contend with their own over-priceyness, and the increase of the risk-free rate that is used to discount them, meaning, further downward pressure on valuation still

(4) The combination of inflationary pressures, the end of the post-COVID economic recovery, and the early tightening of monetary policy all came together, and so did recession talk

(5) Increased pressure on the Fed has led to increased vigilance in tightening monetary policy. The uncertainty and the math of a tighter Fed combined with economic fears, mostly relevant in insanely high energy prices, have created significant economic angst.

(6) The result has been a bear market in the S&P 500, and a lot more recession talk.

The subject of this writing is whether or not there is another shoe to drop beyond the sequence of events I describe above.

In all thy getting, get this

Bank of America’s economist, Michael Hartnett, said this last week:

“What can turn a shallow recession into a deep one is the great unknown of the shadow banking system.”

I believe with every ounce of breath in my body in the evolution of the American financial markets that we now enjoy. I believe risk coming off of the balance sheets of American commercial banks and onto the balance sheets of risk-taking entities is a good thing. This has been the post-2009 reality of American capital markets … New avenues for direct lending, for middle markets, for business loans in the securitized lending space, in private credit, and for asset-backed securities, in structured credit.

Some of these avenues are not new (structured credit like non-agency residential mortgages and commercial backed mortgages are much smaller than they were pre-crisis, but they are smarter – more nimble – more sophisticated – more underwritten). Some are reasonably new (especially in cash-flow-based lending like we see in middle markets).

But is Hartnett right that there is a “shadow banking” world (i.e. non-bank lenders who do not have to have regulated capital cushions, etc.) that could create a deeper recession upon their own implosion?

The answer may encourage you, and it may horrify you, but the answer is: No one knows for sure. There is an opacity issue here – we may not have understood the Special Purpose Vehicles Citi and Lehman ran away within 2006, but we pretty much knew their own balance sheets (people just apparently didn’t care). But we really don’t know the specific balance sheets of the mass web of non-bank lenders who play in the Structured Credit, private credit, and shadow banking world.

And yet …

I believe some of these investments may face pain in a recession or downturn.

A structured credit lender may see his or her collateral asset value drop, and therefore the loan against such marked down. But there is an underlying assets, and the risk and reward connected to such are still not in the commercial banking world that we saw in 2008. In fact, those boring banks are awash in capital, and in fact, have had onerous conditions for doing anything to get a Return on Equity for years now.

A cash-flow-based lender has a senior secured first lien position on cash flows. Some businesses fail, but they are highly diversified and have significant loss protections in a broad portfolio of loans.

Syndicated loans are levered and possibly apathetic to credit strength (covenant-lite and all that stuff), but again, they are senior in the capital structure, recoveries are strong, and they are broadly diversified in the CLO marketplace.

I wouldn’t say that all of this is going to come up roses. There will be defunct companies in the non-bank lending world, of that I am sure. And there will be wider credit spreads, some markdowns, some issues with mark-to-market, and various stressors in the system.

But the part I am reasonably confident in, despite the fact that this has never been tested, is that a shadow system like this carries less systemic risk than we have seen before. Can the tentacles of it exacerbate a recession if conditions get bad enough? I am sure they can. But we have privatized losses and privatized gains as it should be, and markets have a superior track record in being the arbiter of risk and reward.

Conclusion

I would not be cavalier in how one invests in various aspects of Credit, and that is true whether we were in a recession or not. And I would not assume that on a mark-to-market basis that conditions can not get uncomfortable for various actors in the non-bank lending world.

Furthermore, I freely admit that the many more trillions of dollars on the balance sheets of shadow financial entities relative to past dollar levels makes this unprecedented, by definition.

And yet, I would not say that doom and gloom is assured in this space. Financial markets require both risk, and reward, to work. They require both profit and loss. And at the end of the day, maybe, just maybe, this complex web of hedge funds, private credit extenders, middle-market lenders, and other such “shadow” entities will prove to be not just liquidity providers in a post-crisis world that desperately needed liquidity. But maybe, just maybe, they will prove to be better allocators of capital than their predecessors.

Chart of the Week

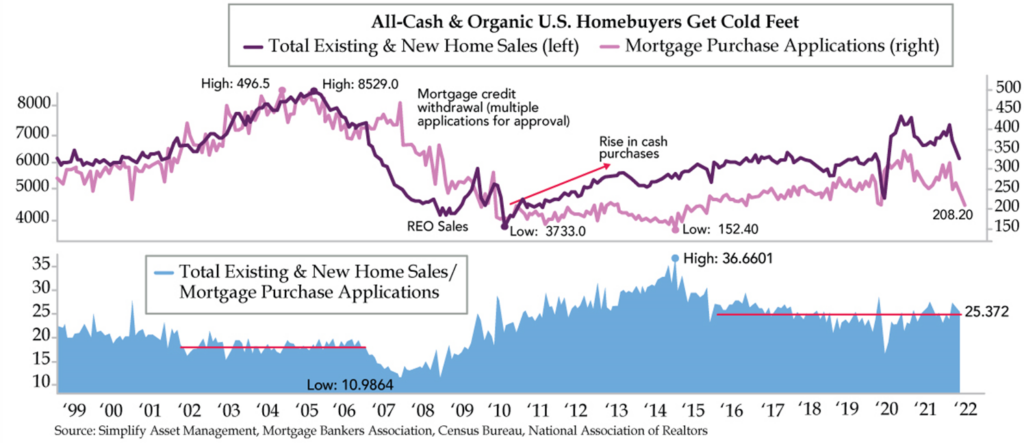

The argument that “cash buyers don’t care about mortgage rates” as a rebut to the notion that higher interest rates are or will push housing prices down has never, ever been a good argument. Cash buyers may not pay the mortgage rate, but the mortgage rate in a market impacts the pricing of the assets in the said market (see: Econ 101).

That said, not only is the argument untrue theoretically, but it is not playing out empirically, either. First of all, cash buyers became ~25% of the residential purchase market since the financial crisis, and that ratio has held exactly in place with the recent collapse in volume. Secondly, much of that “cash buyer” phenomena has been institutional investor purchases, and they are clearly stepping back as well.

Quote of the Week

“Example is the school of mankind, and they will learn at no other.”

~ Edmund Burke

* * *

I head off to a symposium next week where I will be working all week and speaking twice. I love this time of year, no matter what markets are doing, and hope you do, too.

I also would be remiss to not recognize all the Fathers reading this Dividend Cafe as we head into Father’s Day weekend. My own dad is not here to read this, but if any of you were blessed and impacted by your dad the way I was mine, you know how special it is to have such a presence in your life.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet