Dear Valued Clients and Friends –

There are few things people want me to opine on these days more than what I think will happen to the market in light of all the COVID and economic uncertainty, and what I think about big tech in light of its persistent popularity and performance. Both issues are totally legitimate (and not completely unrelated), and both issues are the primary focus of this week’s Dividend Cafe.

Addressing what to make of a steamroller like the big tech-FANG names is as close to a lose-lose proposition as I could think of for someone like me. First of all, we are only lightly exposed to the space – being dividend growth investors – and therefore constantly having to address why we don’t necessarily like expensive assets that keep getting more expensive (fair enough). But secondly, when I am not engaged in the utterly fascinating and enthralling process of studying and evaluating company outlooks (bottom-up), my real love is monetary economics. I believe understanding the inflation/deflation debate of the next 5-10 years will have 100x more of an impact on one’s financial well-being in 2030 than whether or not they own this hot social media company or this internet company crashes and burns, etc. I do a pretty good job and letting my focus be driven by what I know to be primarily important – and not necessarily what may be the most trendy or relatable topic in a given period.

That said, momentum investing is fun, and monetary economics is not. Now, I don’t actually believe either of those things. I truly enjoy monetary theory and monetary policy, and I find momentum investing to lack all the amenities of Las Vegas that I am used to when I gamble. But I am a weirdo, I am comfortable being a weirdo, and frankly, I don’t recall a single period of my life that my interests aligned with the greatest number of people.

But in fairness, this is a little different than when my fourth grade friends wanted to play dodgeball and I wanted to better understand the British/Argentinian fight over the Falklands. I am not just generally focused on things as an investment professional that are more satisfying or interesting to me (and my odd sensibilities); I am focused on what I believe is most important.

Right now, that involves a talk about the market, the economy, COVID, big tech, and all the things … So whether it is interesting to you, important to you, or you really aren’t sure, jump on in to the Dividend Cafe, and let’s see if my priorities might just match what is on your mind this week.

In this week’s Dividend Cafe we will …

- Give a quick summary of the market this week

- Do a deeper dive into all the rage in big tech

- Question if big tech is the only game in town to invest in innovation

- Look at health care spending in Q2 and why it may shock you

- Analyze the dollar’s decline

- Explore the power of the Fed, in very practical terms …

- Wonder out loud what is going on with the Main Street Lending program

- The highlight of the week – What to think about Equities Right Now

- Walk through the full Economic Report Card of the week

- Politics & Money – the Biden VP pick, investor fears, and the fate of a new stimulus deal

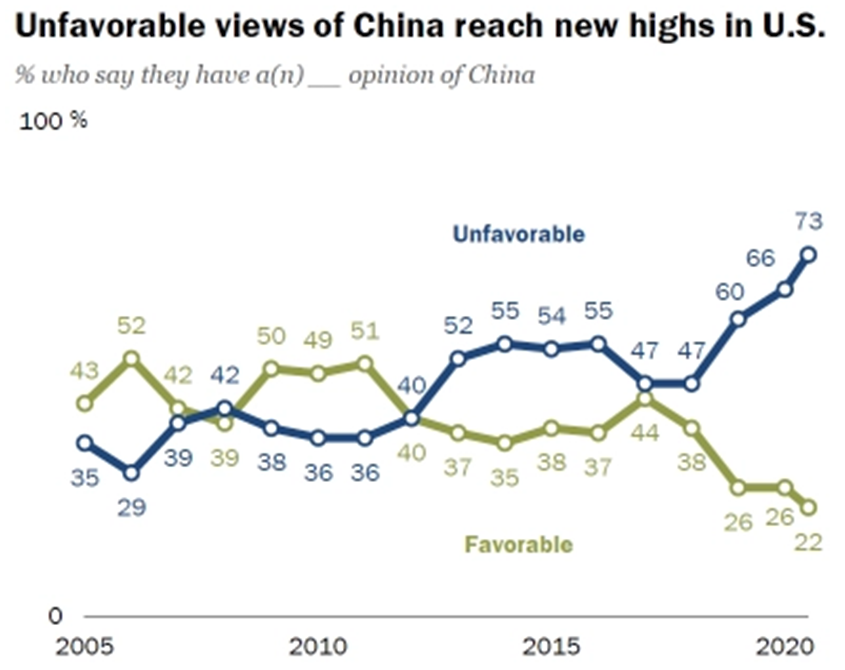

- Chart of the Week – why China tensions are not going anywhere, and most people like that!

- … and much, much more …

So say goodbye to July and hello to August, in this week’s Dividend Cafe …

Market Redux

The market ended the week down just a smidge, having gone up 100 Monday, down 200 Tuesday, up 200 Wednesday, down 200 Thursday, and then up 100 Friday … All that to say, more or less a round trip on the week back to where we started.

Range. Bound. Market.

Movie sequel, this time streaming

The significant momentum for big tech was restored this week after a couple weeks of volatility, and as I type one of the FANG names is getting pounded, and two of them are rallying substantially. But regardless of what name is doing what on one day, the two things I have always been resolute about (and remain so to this day, with even more conviction) is:

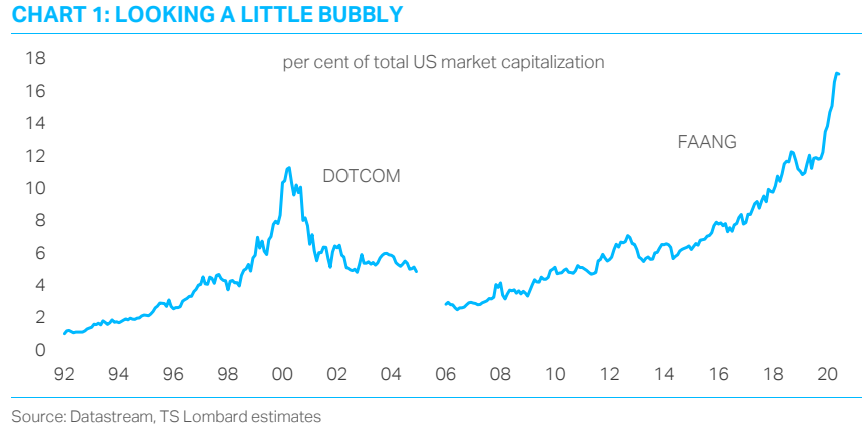

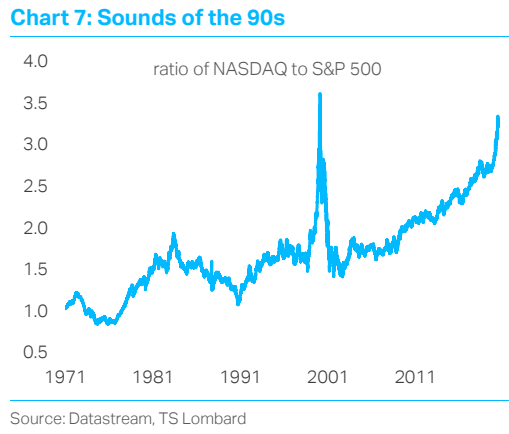

(1) The bulk of the “big tech” names we talk about today are extraordinary companies, with substantial cash flows, and are nothing like the vapor and air that collapsed and blew up coming out of the late 1990’s.

(2) Extraordinary companies notwithstanding, earnings multiples of 35x, 150x, 90x, and 30x (for example) are already reflecting extraordinary, and then some.

It puts a value and risk-sensitive manager like us in a quandary – when excellent companies offer an unattractive risk/reward skew. People frequently confuse believing something to be of that “unattractive risk/reward skew” means you don’t appreciate the upside opportunity, or don’t appreciate the majesty of their companies. Neither is the case.

Big Tech may go up further, but if it does, it will do so against a risk headwind that has to be considered problematic.

I do not believe that 2020 Big Tech and 2000 Dotcom are comparable in this sense – and it is always and forever the only sense – cash flow. These companies today generate a lot of cash flow. The dotcom era was not merely defined by nosebleed valuations, but also revenue-starved companies with no discernible business strategy.

No one can say that about 2020 big tech. But the valuation story persists, and anyone who has lived through a re-pricing of a valuation bubble knows that it is the defining issue of a risk-reward calculation. Companies bought at bubble valuation can take a decade or longer to be restored to purchase price, if they ever do, and that is even if the company is executing brilliantly.

Not the only game in town?

Those looking for octane, growth, and futuristic opportunity in their portfolio may very well find that there are technology names and biotech names not already embedded in trillions of dollars of index funds, not already bid up by the entire population to stratospheric levels, with actually newer and more interesting innovations and invest-ible theses, that can scratch that growth itch.

Health care paradox

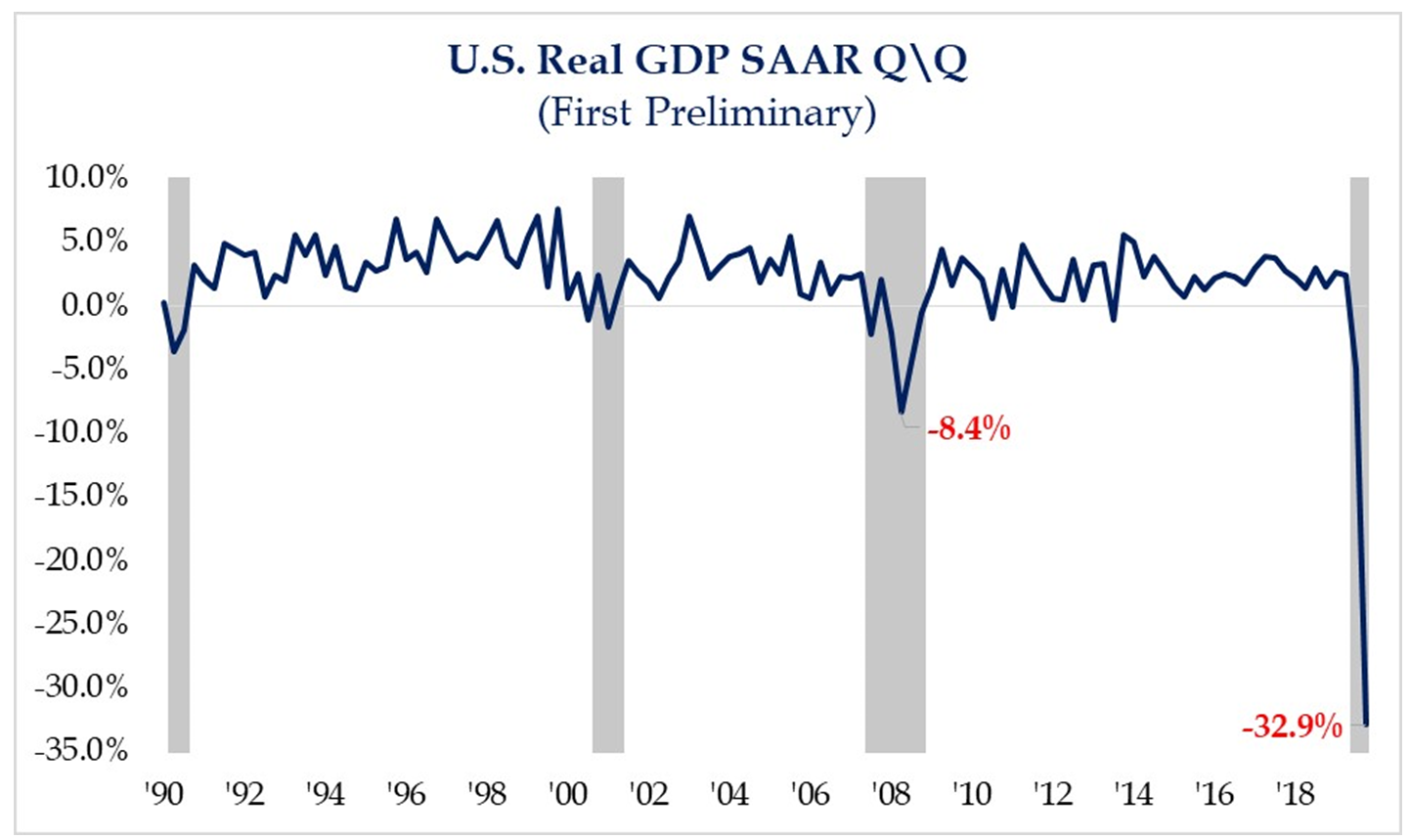

Though the full economic story is unpacked below under the Economic Update for the Week, I’ll end the suspense and say that GDP growth for Q2 was abysmal, declining the most on record as expected. And obviously all of the focus is on the consumer, with consumer spending’s 35% decline being the most dramatic contributor to the Q2 contraction. But one would think that a collapse in consumption because of a health pandemic would mean that health care spending was increasing. But alas, health care spending itself collapsed, taking a full 9.5% off of GDP (health care is 12% of the U.S. economy).

How can that be? The lockdown from elective health care, of course. Don’t let the word “elective” fool you – some of the deferred, delayed, avoided, or missed health care procedures are quite vital, even if non-COVID related. But for GDP purposes, these hospitals are businesses, and health care is an industry, and a comprehensive understanding of current economic distress must transcend our observation that hotel traffic is down. The sizable drop in even health care spending during a health pandemic is a classic example of how penetrating the effects of the lockdown have been.

Dollar woes

How bad of a month was it for the U.S. dollar? Worst in a decade.

Now, on an absolute basis, the dollar is still substantially higher than its 2010-2014 run, and the dollar has only retraced part of the massive dollar rally of 2014-2015. But in the very short term, some re-pricing was needed and inevitable, and is serving as a constructive backdrop for commodity prices and emerging markets.

Commodity craze

I have gone out of my way to show what has happened to commodity prices since the COVID monetary stimulus of 2020, and reiterated the reflation thesis (and attempt at reflation) around copper and lumber prices since then. But we also need to be clear when people use the commodity story and gold prices (two separate things, by the way) to suggest that all this stimulus is creating inflation … whatever has happened to commodity prices since the March/April lows, they aren’t even back to where they were to start the year. And in many cases, they aren’t close! (oil, gas, etc.). Many food agriculture prices remain way off early year highs as well.

Look, I do not doubt that the Fed wants to create inflation. I do doubt that they will be able to, but that is a different story all together. But believing not only that they have already done so evidenced in commodity prices off of their lows, does not stand up to the evidence. Inflation expectations remain non-existent in the TIP market, the interest rate market, and the price indicators we generally use to evaluate. I concur it isn’t for lack of trying, but this issue remains one of the great misunderstandings of our day.

How powerful is the Fed?

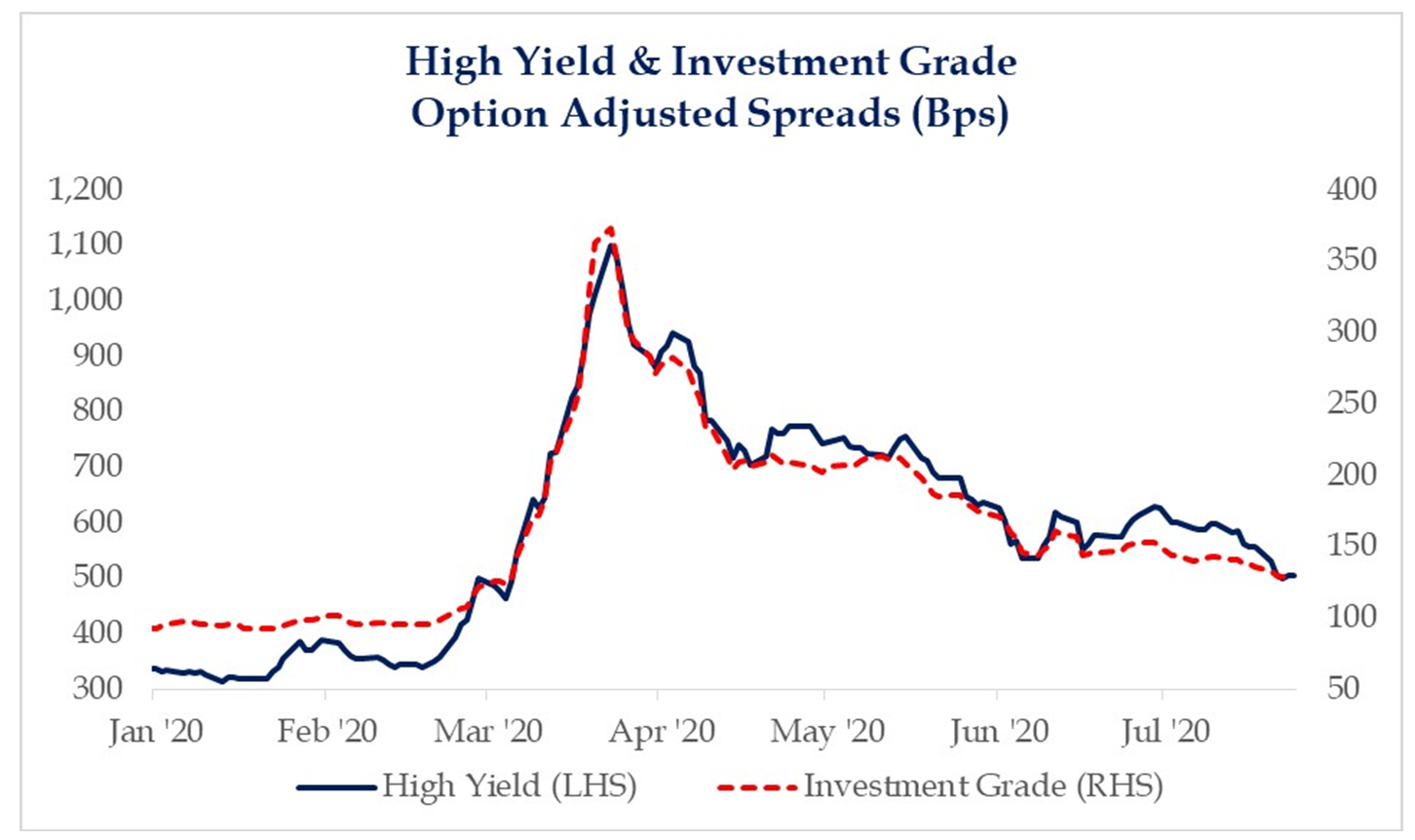

One can believe the Fed shouldn’t do this, and one can believe there is a price to be paid for what they do with interventions (I certainly do), but one is delusional if they deny that the Fed has the power and scope to do this. High yield bond spreads are pretty much back to where they were in early March, not quite February levels, but as tight as spreads were before the real violence of March’s action. Investment Grade bonds had spread to 350 bps at max panic, and currently sit just above 125. What a difference a Fed makes – and most of this was just the gun in the holster, not the gun actually out firing!

* Strategas Research, Daily Macro Brief, July 27, 2020

Is Main Street feeling the love yet?

The Fed’s Main Street Lending program has distributed about $37 billion to date, having allowed banks to look to originate and underwrite loans for about a month now. If there is a normal four-week build-up of pipeline and deal flow, $37 billion is not that bad, but if this represents the bulk of the fruit that will come off the tree, this is not good. The program seeks to have banks hold 5% of the risk of a loan on their books, while the Fed takes on the rest, fueled by an equity injection from the Department of Treasury.

Chairman Powell this week said demand for the lending program was soft because traditional bank lending was healthier than it had been in March (tighter credit spreads, more open markets). Improved confidence and conditions should not be waning demand, it should be facilitating it.

The challenge is either banks not getting on board with the program or afraid to underwrite with even minimal risk, OR it is borrowers just not willing to take on debt in this environment. “Pushing on a string,” my friends, and it is why the great macro challenge of the day (even apart from COVID) is deflationary pressure, not what most are worrying about.

So what to think about equities?

Markets have continued to be choppy, though the severity of day-to-day volatility is way down. Markets moved quite a bit in July (total movement up down) to end up just up 500 points or so in the Dow. But this is where we are – markets are choppy, range-bound, uncertain, and somewhat volatile – and yet most definitely positively biased, having held the 25,000 level or so after testing it a couple times the last two months. Now, markets also haven’t shown much interest in breaking and sustaining a move past 27,000 … But this “holding pattern” reflects (a) The uncertainty of the COVID economic recovery, (b) Fear of fighting the Fed, and (c) A significant impact from the big tech names referred to elsewhere in this commentary.

What do I think now?

More of the same in the broad market. Not a falling apart. Not Dow 30,000 any time soon. But macro risks (economic recovery, election, etc.) persist. And the bullish realities exist (sorry, but dismissing the multi-trillion dollar efforts of the Fed is just as naive as dismissing the headwinds of the economy).

I do believe a reckoning will come for big tech, and I do believe there will be a shift in market leadership. What I do not believe is that I know when this will come. So I stick to what I do know and do believe, and avoid speculation.

Economic update for the week

The headline story of the week was the 32.9% (annualized) contraction in GDP for Q2 that was announced on Thursday. Believe it or not that number (the worst on record) was actually a little better than had been projected. Continuing jobless claims rose to 17 million (from last week’s 16 million) and initial claims this week were another 1.4 million. The GDP number was, as expected, a bloodbath in all categories as trade, production, and consumption all halted in the government-imposed lock-downs that lasted well into May if not early June.

*Strategas Research, Daily Macro Brief, July 31, 2020

Q3’s number will largely be driven by how the unwinding of partial closing events goes into August and particularly September. July was certainly muted, but not constrained like April/May. August is a mystery. Expectations are that September will be substantial.

My thought has been that the consumer-oriented economic data points were going to please people and business economic data points would sadly disappoint. Lately, the consumer-oriented metrics have started to underwhelm, but, shockingly, the business investment numbers have outperformed expectations. Capital goods order rose +3.4% last month and are now just a tiny 3.7% below pre-COVID levels. Total durable goods orders surged +7.3% in June.

* Pantheon Macroeconomics, U.S. Economic Monitor, July 27, 2020, p. 2

Politics & Money: Beltway Bulls and Bears

- Joe Biden has announced he will make his VP announcement this coming week, and most do believe it will either be Sen. Kamala Harris of California or Ambassador Susan Rice of the Obama administration (the former being in a substantial lead in the betting odds). I do not anticipate the market cares much about Harris vs. Rice – the market only cares that it not be Sen. Warren. But frankly, since Sen. Warren was never really a very serious VP candidate, it may be Warren’s potential placement in Treasury Department or another cabinet position that ought to concern markets more. We shall see.

- Another institutional investor survey I read this week had a Democratic sweep (White House and Senate) as the biggest risk to market for 46% of respondents, with COVID impact being the biggest for just 41%. Strong resilience in the market co-existing with this kind of fear of a Democratic sweep suggests to me that the market does not yet believe that a flip of the Senate is something to price in.

- Let me offer a little forecast on how the “Stimulus 4.0” ends up going … I will continue offering daily updates in the COVID & Markets missives each day, but to just skip over everything, I think we are looking at a mid-August deal, with the White House pushing aside Senate demands and desires, and cutting their own deal with the House Democrats (a deal that will look much more like Pelosi’s June deal than McConnell’s July deal). Therefore we likely (not for sure, but likely) go two more weeks with back and forth staggering and posturing, and in the end see a large deal that will not look like something a Republican White House and Republican Senate would generally have let happen. This is my prediction … Now, could we get a “two week extension of unemployment benefits over the weekend”? Yes, we could – but I doubt it. And could we actually get a comprehensive deal over the weekend? In theory, yes. But I really, really doubt it.

Chart of the Week

U.S. negative opinion of China has reached stratospheric, all-time high levels, further fueling my belief that even political considerations will not avoid some rising tensions with China in the months and likely years to come. This expectation, by the way, does not change if the President changes in the months ahead.

*Pew Research Center Survey, Jones Institutional, July 31, 2020

Quote of the Week

“The only person who gets hurt on a roller coaster is the person who gets off in the middle”

~ Unknown

* * *

I can’t remember the last time my Quote of the Week was from an unknown author, but this one came across my desk this week, and I ran with it. I think it is a truly appropriate quote for this period we are living in, both as investors and human beings.

July is now in the history books and we enter what I suspect will be another volatile month of August. I would encourage all clients of The Bahnsen Group – if you feel unsettled, curious, or in any way vulnerable as it pertains to your portfolio, your strategy, your account positioning, and especially your overall financial planning – talk to us. We are the most communicative and engaged wealth management firm I have ever observed, and we love talking to you.

And if you don’t feel unsettled at all, good on you. Poise and patience are powerful tools for investors. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet

The Bahnsen Group is a team of investment professionals registered with HighTower Securities, LLC, member FINRA, SIPC & HighTower Advisors, LLC a registered investment advisor with the SEC. All securities are offered through HighTower Securities, LLC and advisory services are offered through HighTower Advisors, LLC.

This is not an offer to buy or sell securities. No investment process is free of risk and there is no guarantee that the investment process described herein will be profitable. Investors may lose all of their investments. Past performance is not indicative of current or future performance and is not a guarantee.

This document was created for informational purposes only; the opinions expressed are solely those of the author, and do not represent those of HighTower Advisors, LLC or any of its affiliates.